Investing in IPOs & Stocks | B.E. in I.C. | Ex-IT Engineer |

Financial Advisor |

FIRE |

Follow for IPOs | SME | GMP | Investments | Stocks Updates

How to get URL link on X (Twitter) App

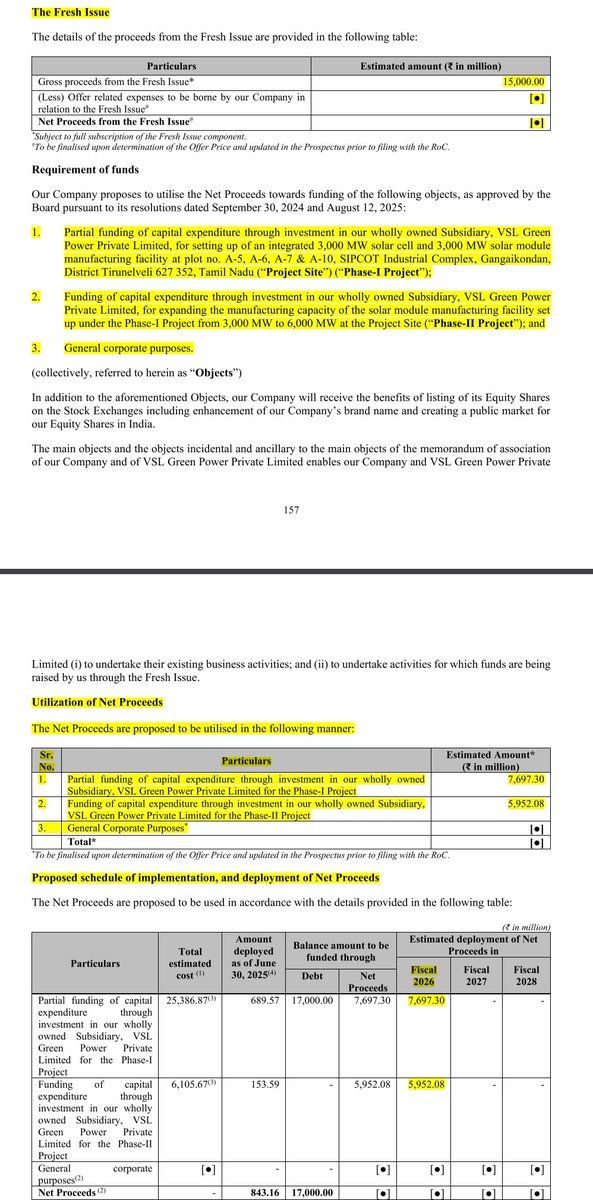

🔷Object of the issue :

🔷Object of the issue :

@waareegroup @Tanmay_31_ @manishlalwani9 @rohiitian @adeshjainj IPO details

@waareegroup @Tanmay_31_ @manishlalwani9 @rohiitian @adeshjainj IPO details

Revenue QoQ inline.

Revenue QoQ inline.