Growth + Value Investor | My Investing journal | NISM Cert. Research Analyst | Equity Markets | Fundamental Analysis | Views are personal | SRCC alum | DMs 🤗 |

How to get URL link on X (Twitter) App

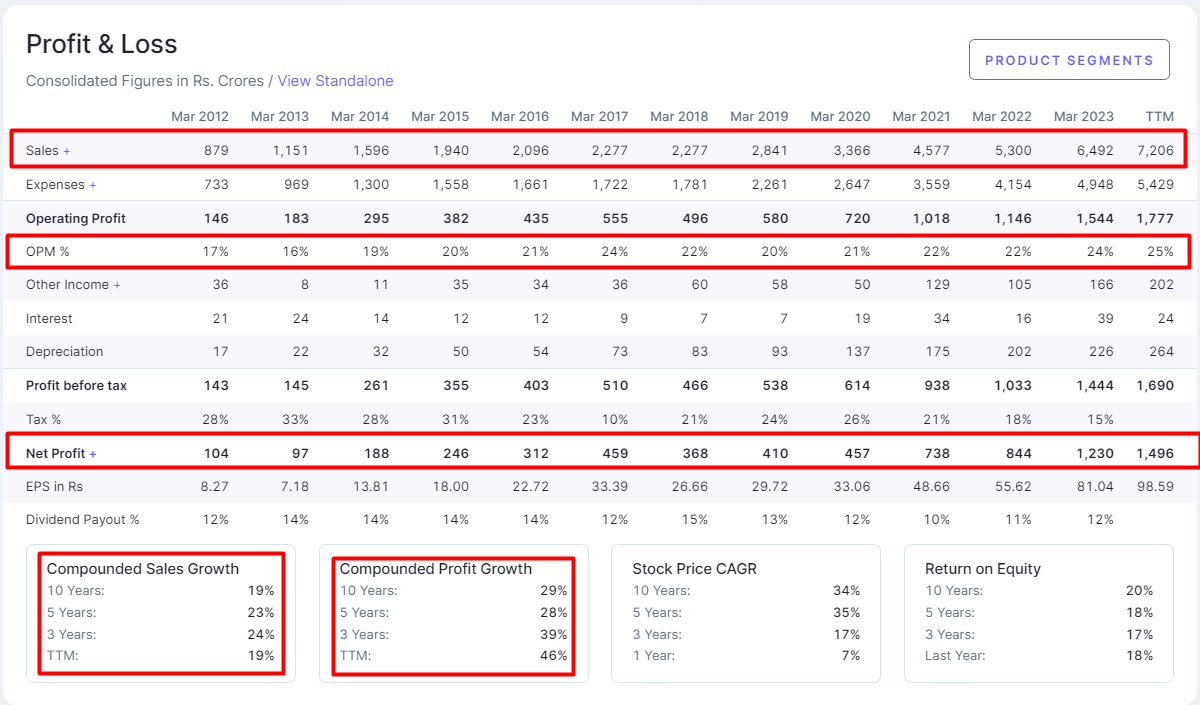

Screener provides a lot of customization & is super helpful in tracking quarterly results and generating new ideas

Screener provides a lot of customization & is super helpful in tracking quarterly results and generating new ideas

Tailwinds in the sector

Tailwinds in the sector

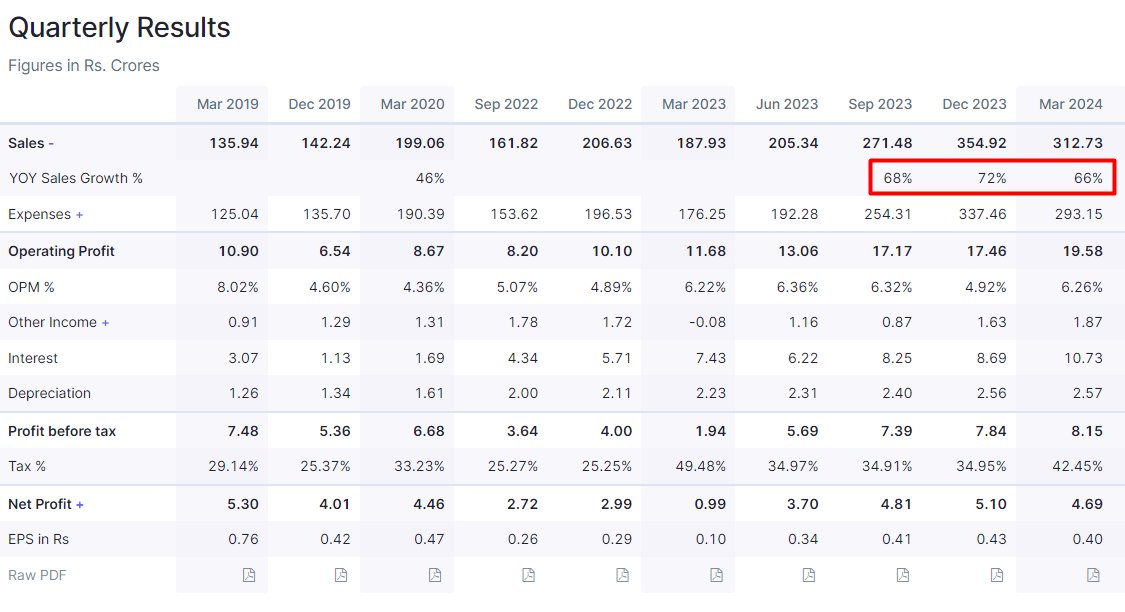

FY25 💹

FY25 💹

Solid Results #Q4FY24🔥

Solid Results #Q4FY24🔥

There are a lot of metrics and ratios we have to see as an Investor

There are a lot of metrics and ratios we have to see as an Investor