Senior ETF Analyst for @Bloomberg. Dad. Rutgers grad. Gen X-er. Author of "The Institutional ETF Toolbox" & "The Bogle Effect.” Co-host of Trillions & ETF IQ.

5 subscribers

How to get URL link on X (Twitter) App

Note: Is it poss GBTC outflows are more bc of accounting? Yes, and even probably but we can only go w the data they send us and this is the latest. Imp thing is that in order for an ETF category to grow you need volume and low fees. These have both in spades = great foundation for long term growth. I've no effing idea what drives btc price day to day but what I do know is if something had an 80% run in 6mo I'd EXPECT a correction and wouldn't cry about it.

Note: Is it poss GBTC outflows are more bc of accounting? Yes, and even probably but we can only go w the data they send us and this is the latest. Imp thing is that in order for an ETF category to grow you need volume and low fees. These have both in spades = great foundation for long term growth. I've no effing idea what drives btc price day to day but what I do know is if something had an 80% run in 6mo I'd EXPECT a correction and wouldn't cry about it.

Judges are now double teaming the SEC with q variations of this main point: how can you guys argue that manipulation in spot wouldn't effect the futures, thus the surveling sharing agreement of futures isn't really meaningful, which is ur whole point in disaproving spot etf.

Judges are now double teaming the SEC with q variations of this main point: how can you guys argue that manipulation in spot wouldn't effect the futures, thus the surveling sharing agreement of futures isn't really meaningful, which is ur whole point in disaproving spot etf.

https://twitter.com/NateGeraci/status/1527095200165797888What's funny is some of the biggest fear mongers and scary headline writers are buy and hold index fund investors. In their defense tho bearishness and fear = clicks. It would be kinda cool if everyone's PAs were public tho. Things would get more optimistic fast.

Will be interesting to see if these succeed. Feel like it could go either way. While I was hoping for some more inspired tickers like $DARK $OWL or $ZZZ these could work better given they ride the brand notoriety of $SPY and $IWM and it makes clear what it does.

Will be interesting to see if these succeed. Feel like it could go either way. While I was hoping for some more inspired tickers like $DARK $OWL or $ZZZ these could work better given they ride the brand notoriety of $SPY and $IWM and it makes clear what it does.

Here's what this looks like zoomed out. You can see this was biggest week since the Glory Days but also note the in and out style of the flows, it's a now bonafide trading tool for many, which is one reason it will hang around long term vs say other high flying MFs of era past.

Here's what this looks like zoomed out. You can see this was biggest week since the Glory Days but also note the in and out style of the flows, it's a now bonafide trading tool for many, which is one reason it will hang around long term vs say other high flying MFs of era past.

This one was pretty interesting, someone put their whole live savings in $GBTC (or at least that's what they saying). Aside, many like this one think the SEC is protecting the rich instead of avg investors.

This one was pretty interesting, someone put their whole live savings in $GBTC (or at least that's what they saying). Aside, many like this one think the SEC is protecting the rich instead of avg investors.

While bond MFs are bigger risk of mass panic IMO bc of redemption halt poss, ETFs are in mix and a good indicator. Check out how wide and deep the bloodbath is. I mean everything is down (nowhere to hide really) and seeing outflows. Extrapolate this out and it gets fugly..

While bond MFs are bigger risk of mass panic IMO bc of redemption halt poss, ETFs are in mix and a good indicator. Check out how wide and deep the bloodbath is. I mean everything is down (nowhere to hide really) and seeing outflows. Extrapolate this out and it gets fugly..

https://twitter.com/CramerTracker/status/1488664287111520260Have a note coming out tmrw predicting that we will see an Inverse Cramer ETF filed soon (likely actively mgd) to exploit his uncanny reverse Midas touch.

1.25x is only diet leverage altho still can suffer from vol drag, altho could make up for roll costs if btc is on nice run. Altho that's not dependable. Either way prob used by traders either way.

1.25x is only diet leverage altho still can suffer from vol drag, altho could make up for roll costs if btc is on nice run. Altho that's not dependable. Either way prob used by traders either way.

If I were selling against $BITO I'd def point out the roll issues, exp ratio (altho I do think has good value for traders) but it is temporary. Cheap is coming bc this is what ETFs do, check out this track record (and yeah smart-beta not tech not asset class i know)

If I were selling against $BITO I'd def point out the roll issues, exp ratio (altho I do think has good value for traders) but it is temporary. Cheap is coming bc this is what ETFs do, check out this track record (and yeah smart-beta not tech not asset class i know)

Big win for white label issuer @alphaarchitect @RyanPKirlin @jvogs02 @patrickcleary01 to work with @CathieDWood and @OpheliaBSnyder. Strong indie partnership. I'm sure $ARKA will be an instant force to be reckoned with when it launches.

Big win for white label issuer @alphaarchitect @RyanPKirlin @jvogs02 @patrickcleary01 to work with @CathieDWood and @OpheliaBSnyder. Strong indie partnership. I'm sure $ARKA will be an instant force to be reckoned with when it launches.

THAT SAID, the crypto crowd may be overestimating the demand for these ETFs. It's a big step no doubt but we see only $4b in first 12mo (and some think that's too high!) but that's just 5% of crypto fund aum, 3% of bitcoin futures, and 1% of bitcoin mkt cap and 1% of all ETF flow

THAT SAID, the crypto crowd may be overestimating the demand for these ETFs. It's a big step no doubt but we see only $4b in first 12mo (and some think that's too high!) but that's just 5% of crypto fund aum, 3% of bitcoin futures, and 1% of bitcoin mkt cap and 1% of all ETF flow

The lack of interest is also despite the fact that it tracks spot bitcoin really well (which is arguably welcome news for futures etfs). I added $GBTC so you could see the dif. You'd think this would get more looks. I'm a little stunned frankly.

The lack of interest is also despite the fact that it tracks spot bitcoin really well (which is arguably welcome news for futures etfs). I added $GBTC so you could see the dif. You'd think this would get more looks. I'm a little stunned frankly.

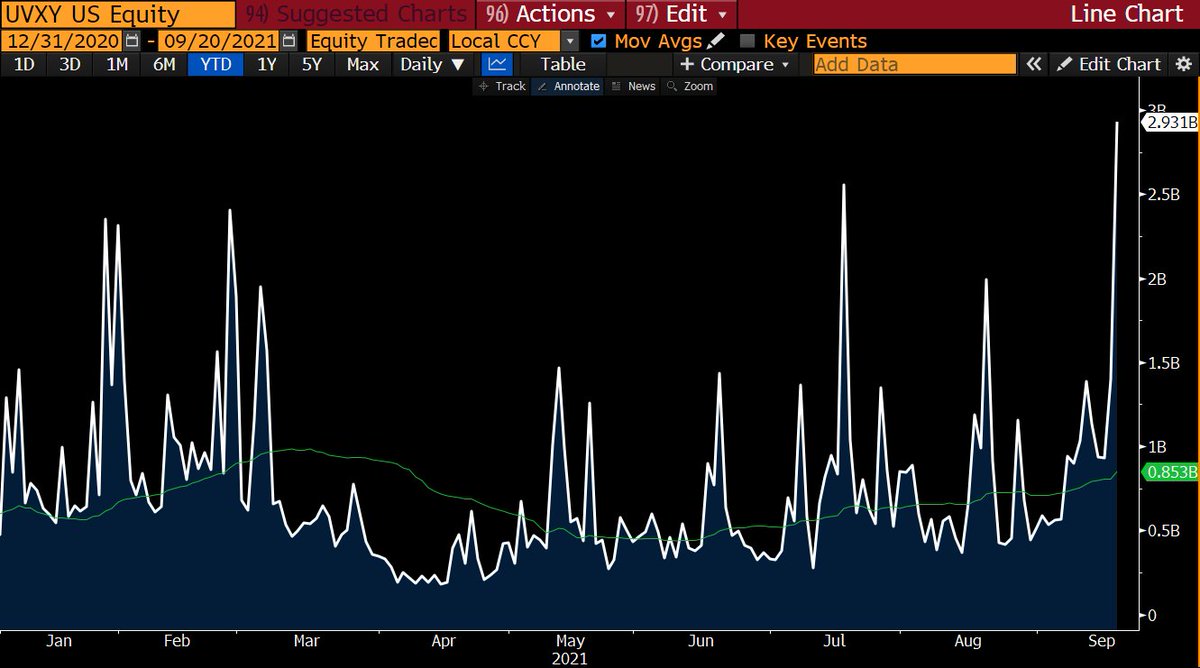

$UVXY traded a ton too, most this year.. about $3b, which is 2x what it has in aum, ha.

$UVXY traded a ton too, most this year.. about $3b, which is 2x what it has in aum, ha.

Note: the ProFunds Bitcoin Strategy Mutual Fund was launched 77 Days after filing. So these dates are not exact exact, but prob close IMO (altho I've been wrong handicapping this race before so.. )

Note: the ProFunds Bitcoin Strategy Mutual Fund was launched 77 Days after filing. So these dates are not exact exact, but prob close IMO (altho I've been wrong handicapping this race before so.. )

Not to mention how balking chased away Bruce Bond and Hooten/Fulten who set up PowerShares and Claymore. Not a stretch to say had CEO had better vision, Nuveen could have been bigger than BlackRock. Good case study for all the legacy asset mgrs entering biz.

Not to mention how balking chased away Bruce Bond and Hooten/Fulten who set up PowerShares and Claymore. Not a stretch to say had CEO had better vision, Nuveen could have been bigger than BlackRock. Good case study for all the legacy asset mgrs entering biz.

$VTI has taken a net $100b more than $SPY in past 3yrs.. check out this uptick in flow-age. Plus, its ability to take in cash in down markets (which have to come at some point, right?) will help it gain a lot of that ground when bull mkt subsidy is non-factor.

$VTI has taken a net $100b more than $SPY in past 3yrs.. check out this uptick in flow-age. Plus, its ability to take in cash in down markets (which have to come at some point, right?) will help it gain a lot of that ground when bull mkt subsidy is non-factor.

While semi-shock, kinda makes sense as Cathie is on the board of 21Shares, which is a progressive bitcoin ETP issuer in Europe. They get US penetration and ARK can use own fund in their active ETFs. This pod/thread has good background on 21Shares ICYI:

While semi-shock, kinda makes sense as Cathie is on the board of 21Shares, which is a progressive bitcoin ETP issuer in Europe. They get US penetration and ARK can use own fund in their active ETFs. This pod/thread has good background on 21Shares ICYI: https://twitter.com/EricBalchunas/status/1392808511713824768?s=20

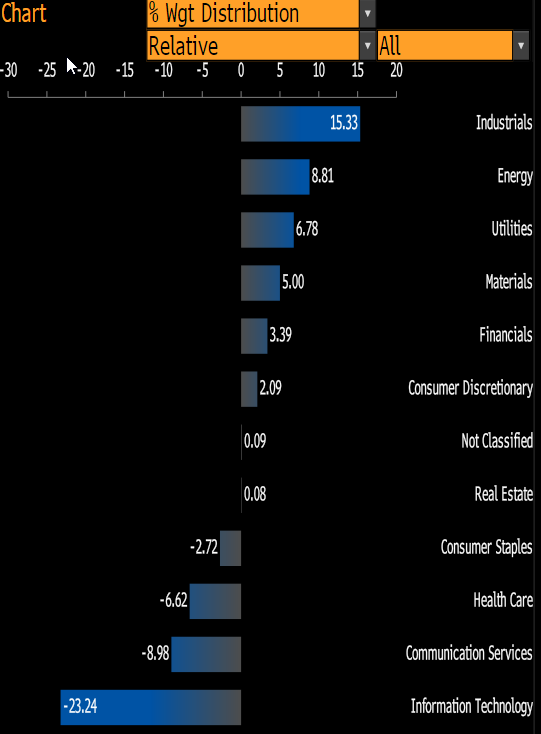

Here's the relative sector differences with the S&P 500, which was poison under Trump but gold under Biden. What a world.

Here's the relative sector differences with the S&P 500, which was poison under Trump but gold under Biden. What a world.

Interesting (and yet kinda predictable) most of the cash is going to the watered down value ETFs even tho the pure stuff is popping WAY MORE. Here's a look at the Top 4 Value ETFs in our "intensity rank" vs $IWD & $VTV which rank near bottom.

Interesting (and yet kinda predictable) most of the cash is going to the watered down value ETFs even tho the pure stuff is popping WAY MORE. Here's a look at the Top 4 Value ETFs in our "intensity rank" vs $IWD & $VTV which rank near bottom.