How to get URL link on X (Twitter) App

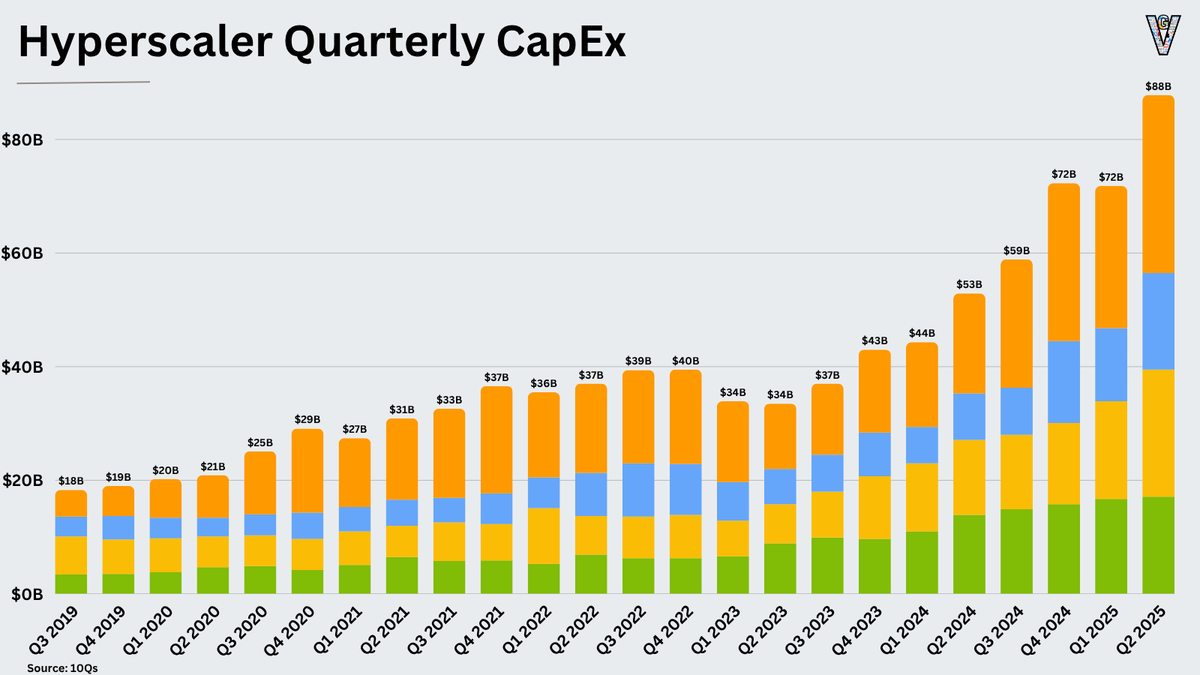

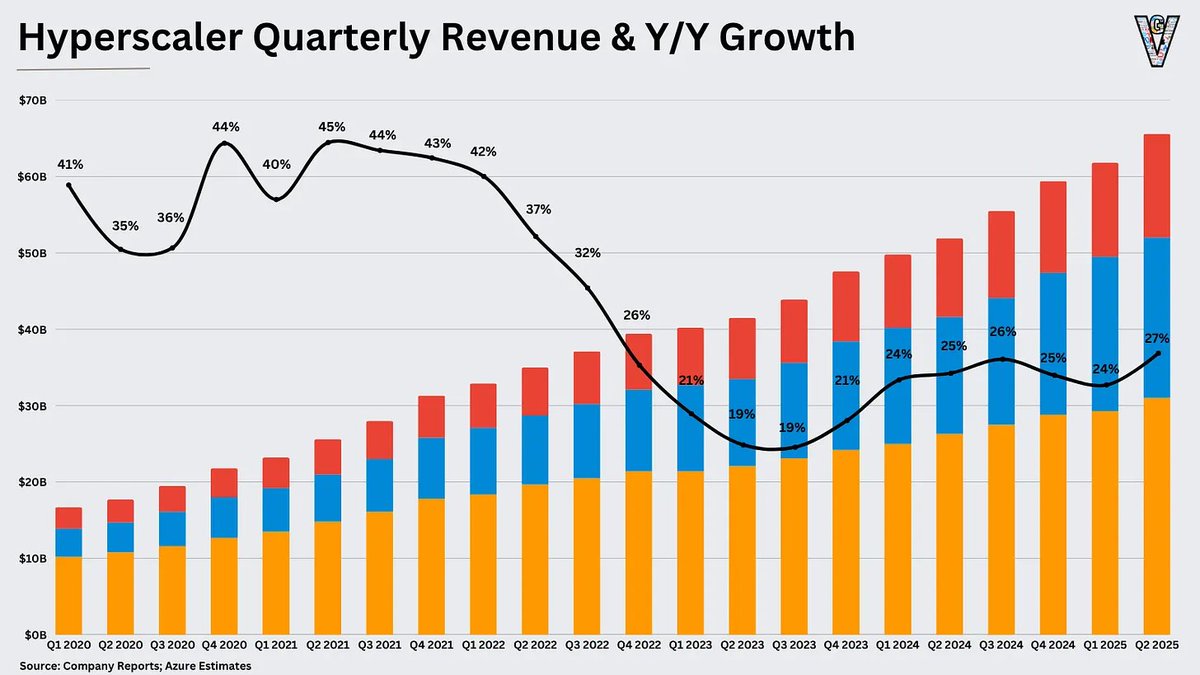

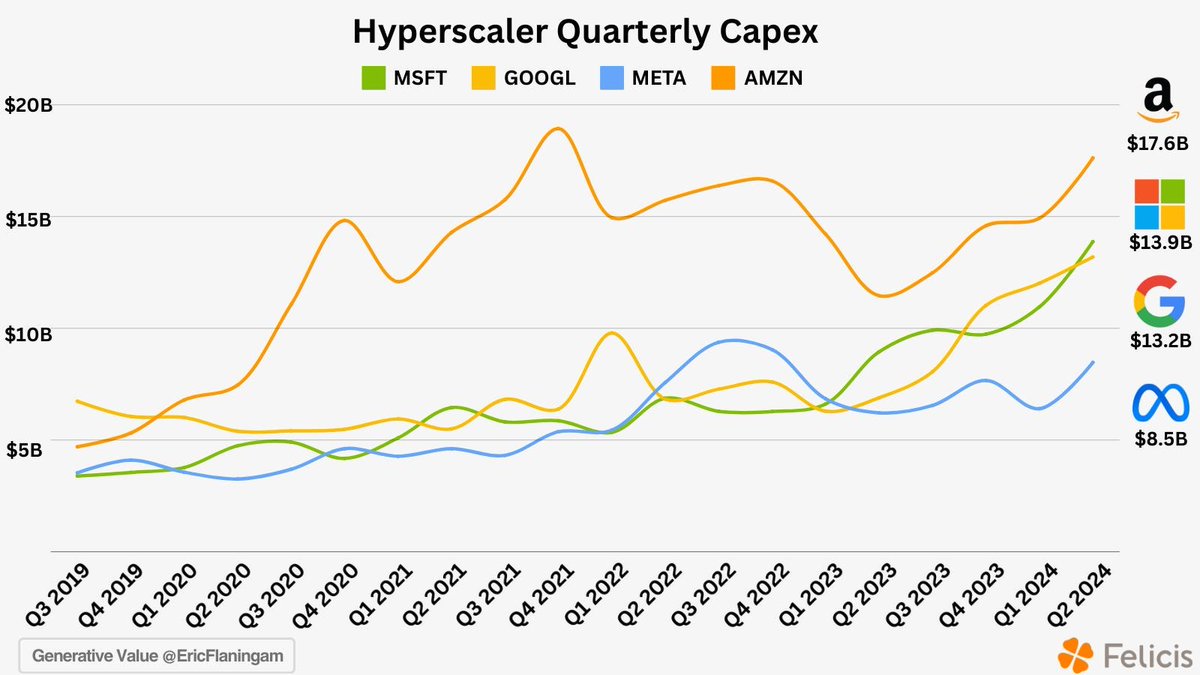

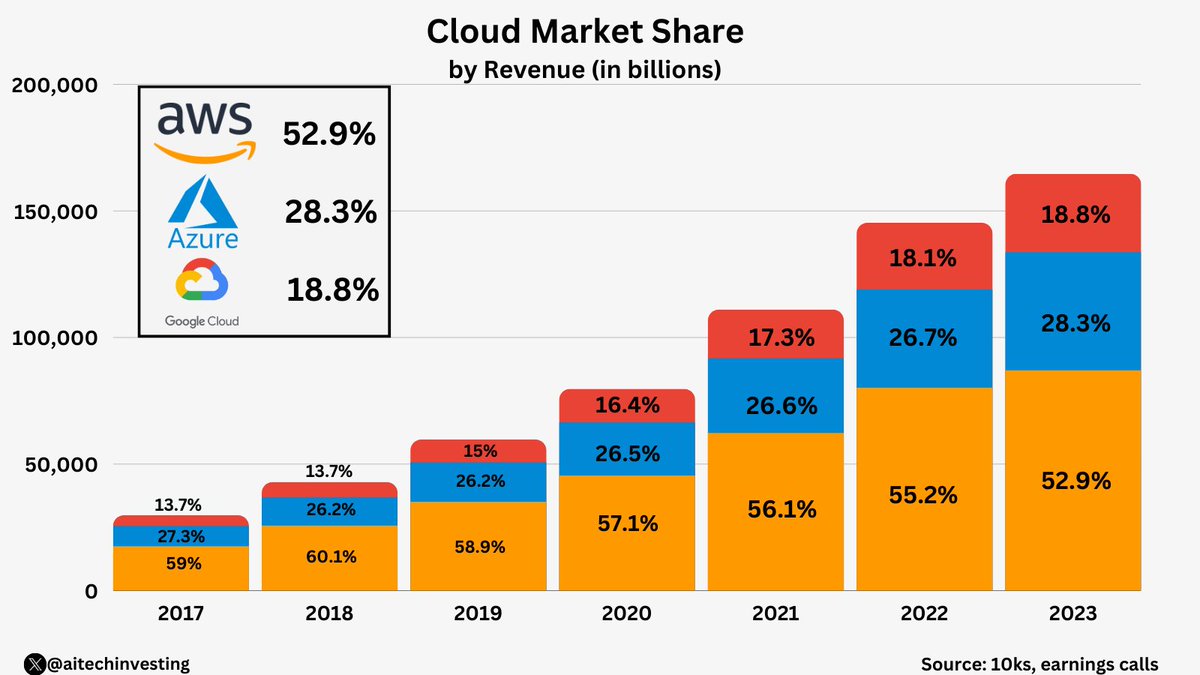

2/ Combined the three big clouds are at a $262B run rate growing 27% Y/Y (wild)

2/ Combined the three big clouds are at a $262B run rate growing 27% Y/Y (wild)

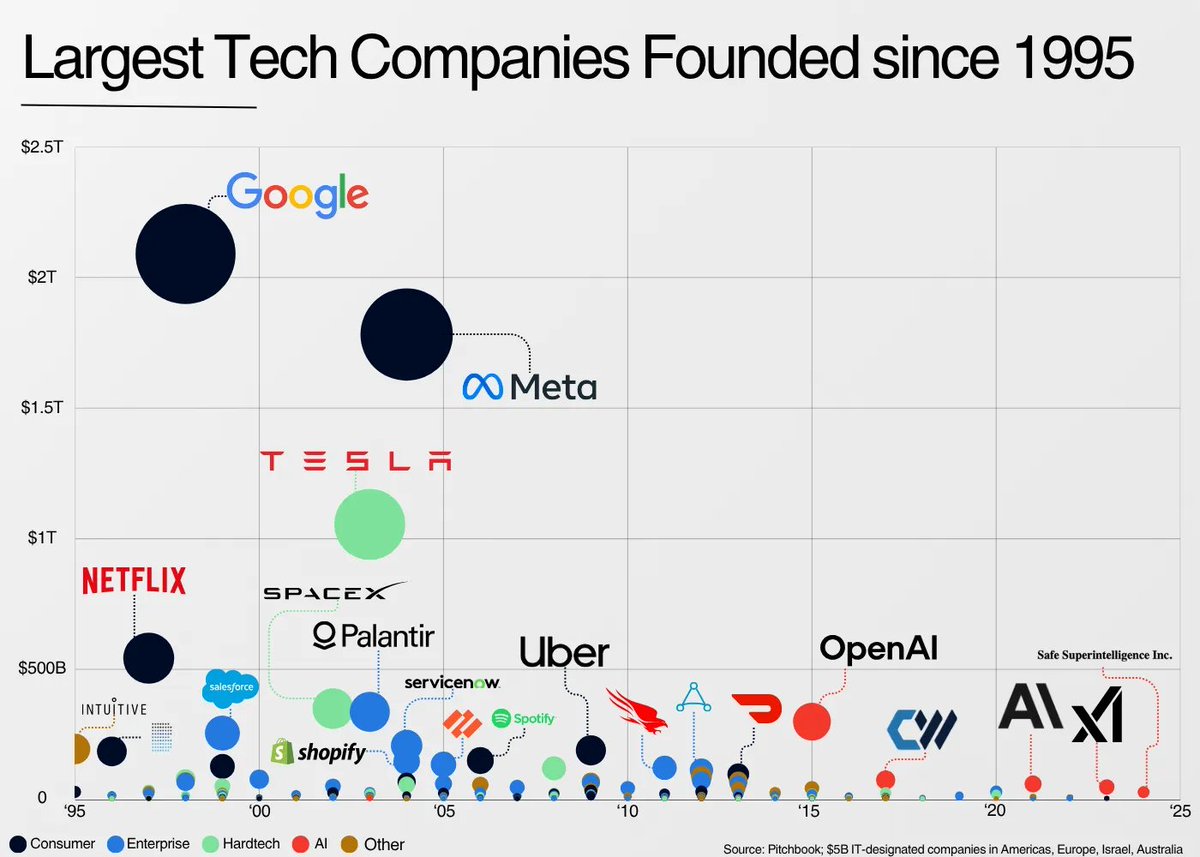

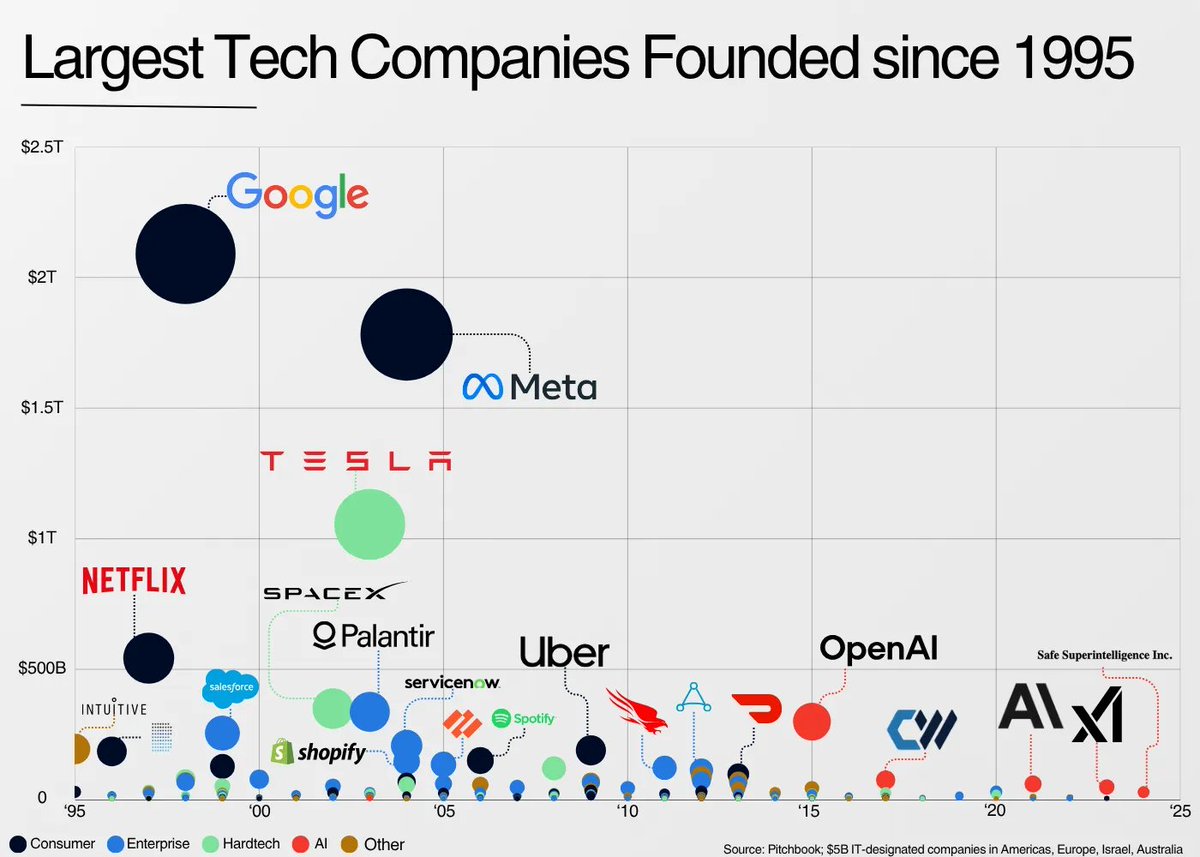

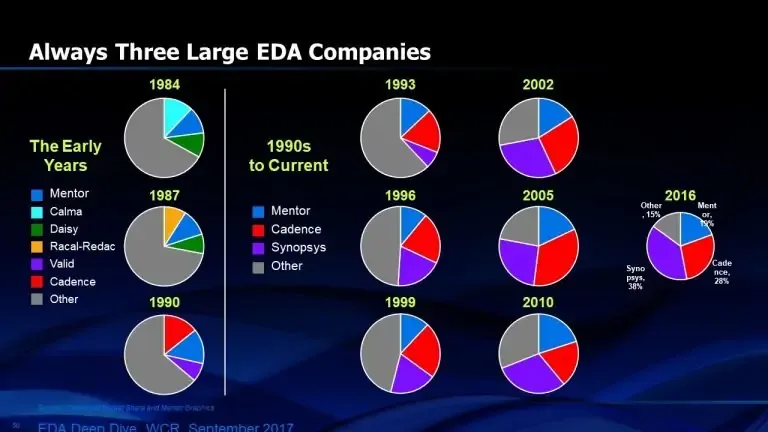

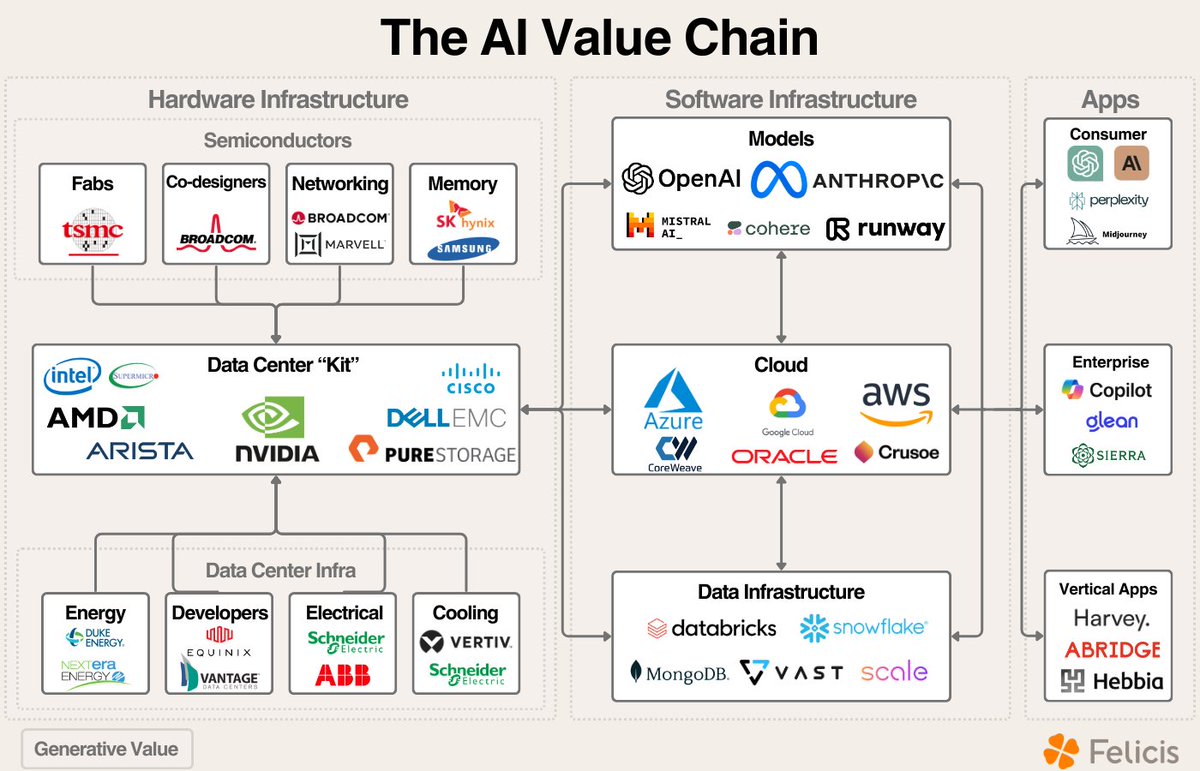

1/ The next $100B company will not look like the last

1/ The next $100B company will not look like the last

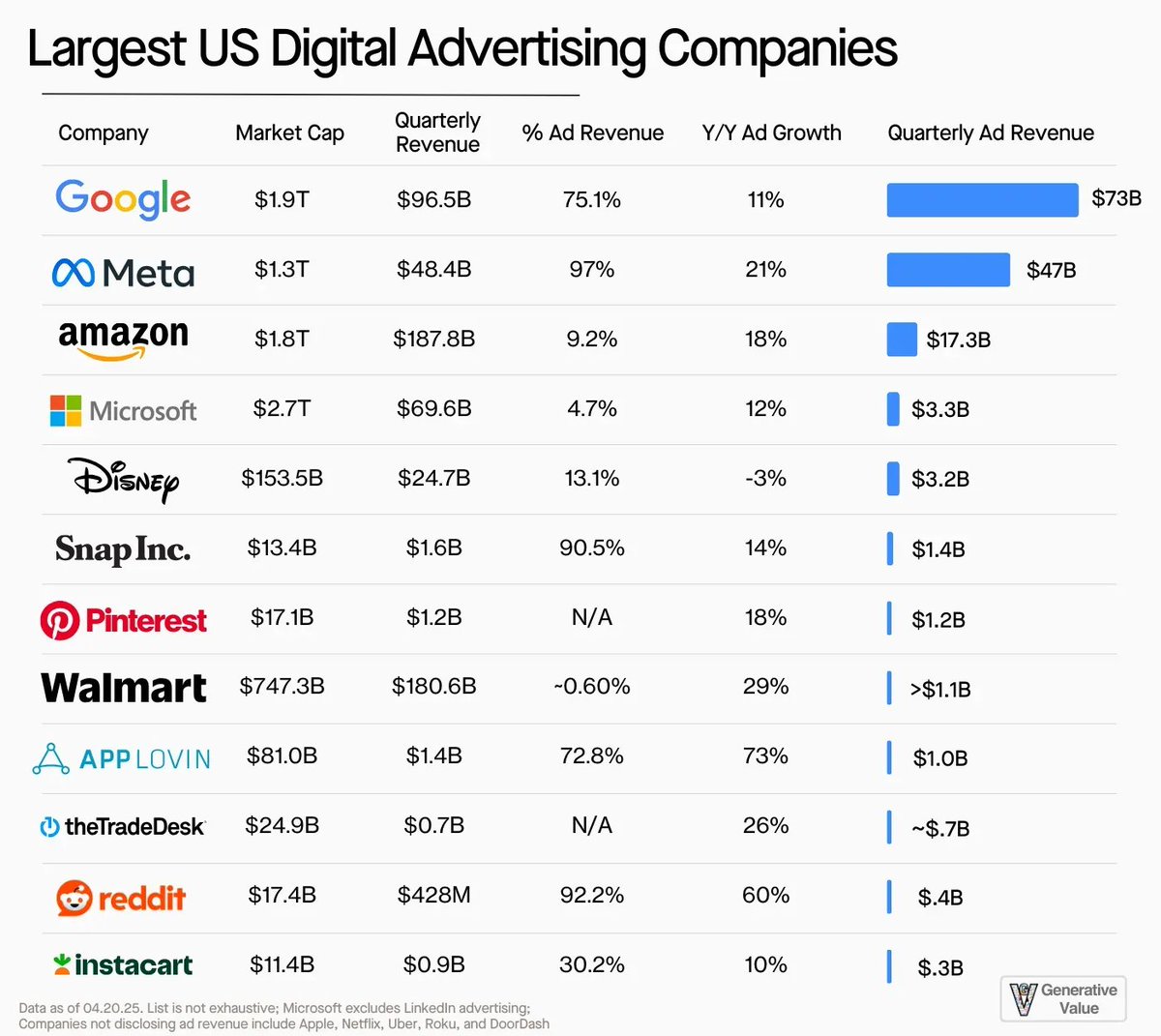

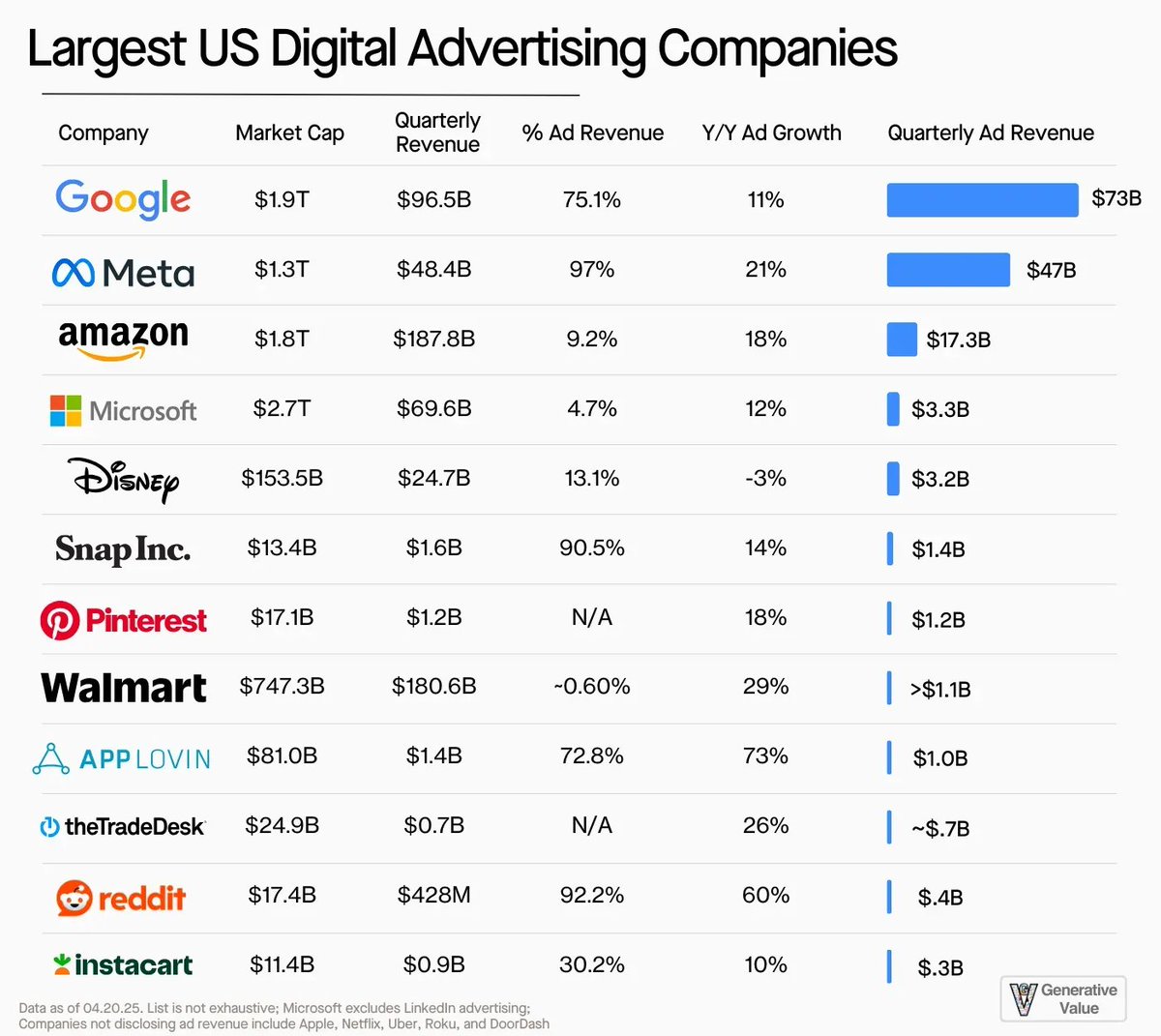

1/ The Resistance to Ads

1/ The Resistance to Ads

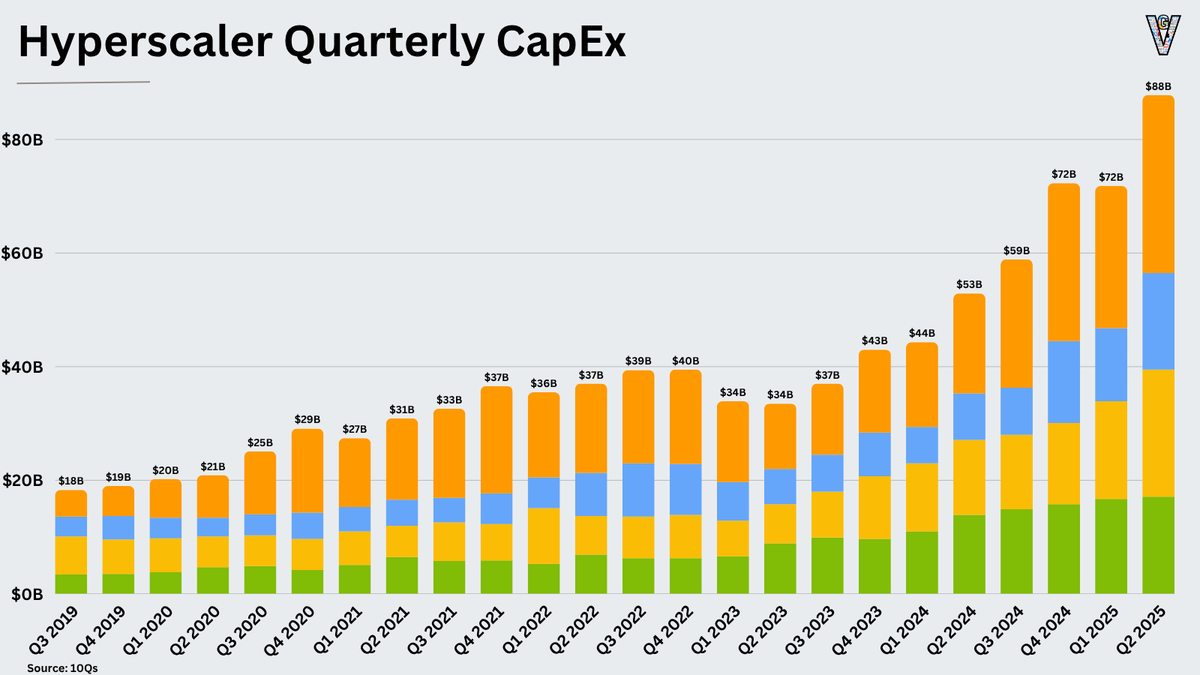

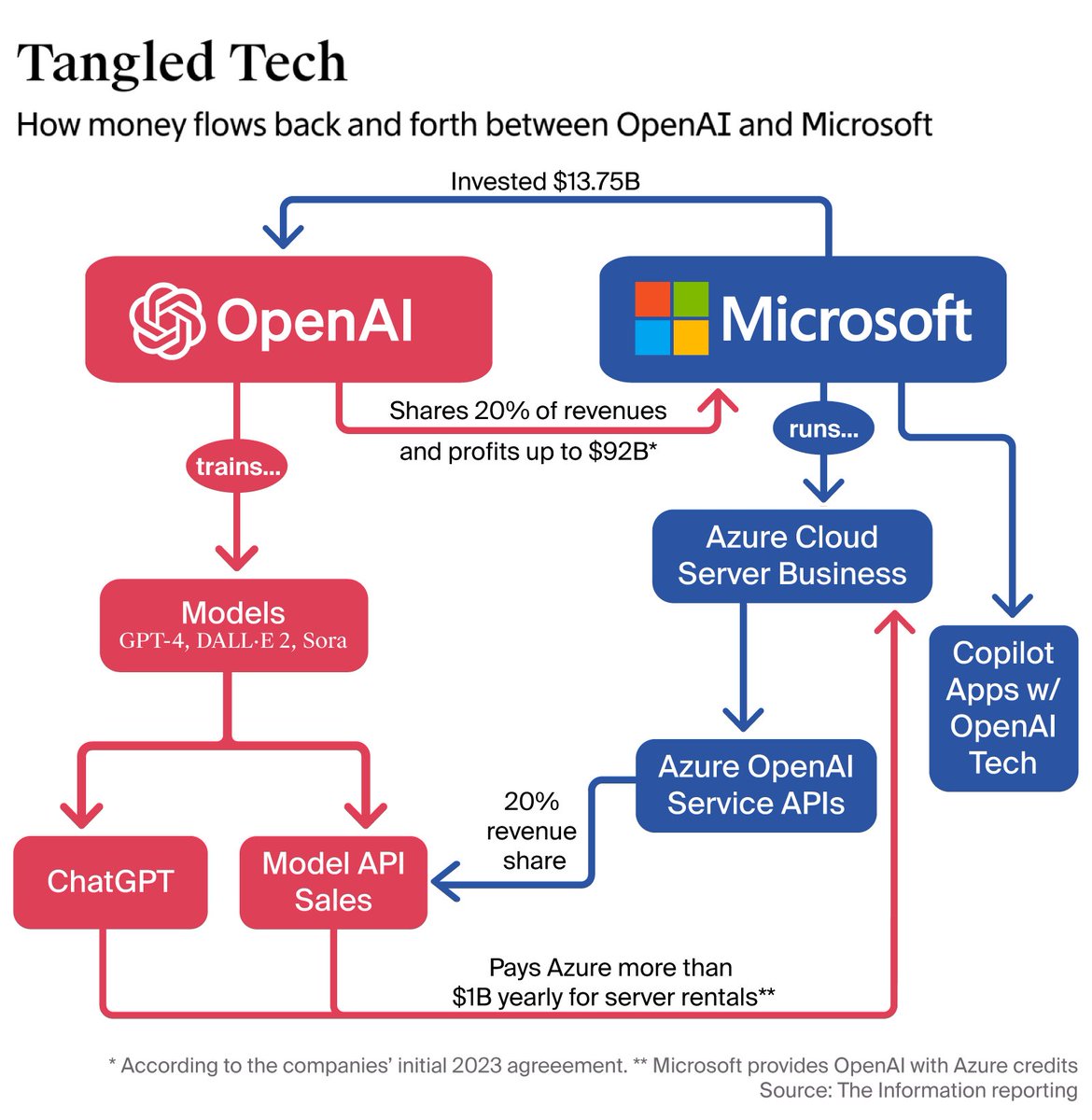

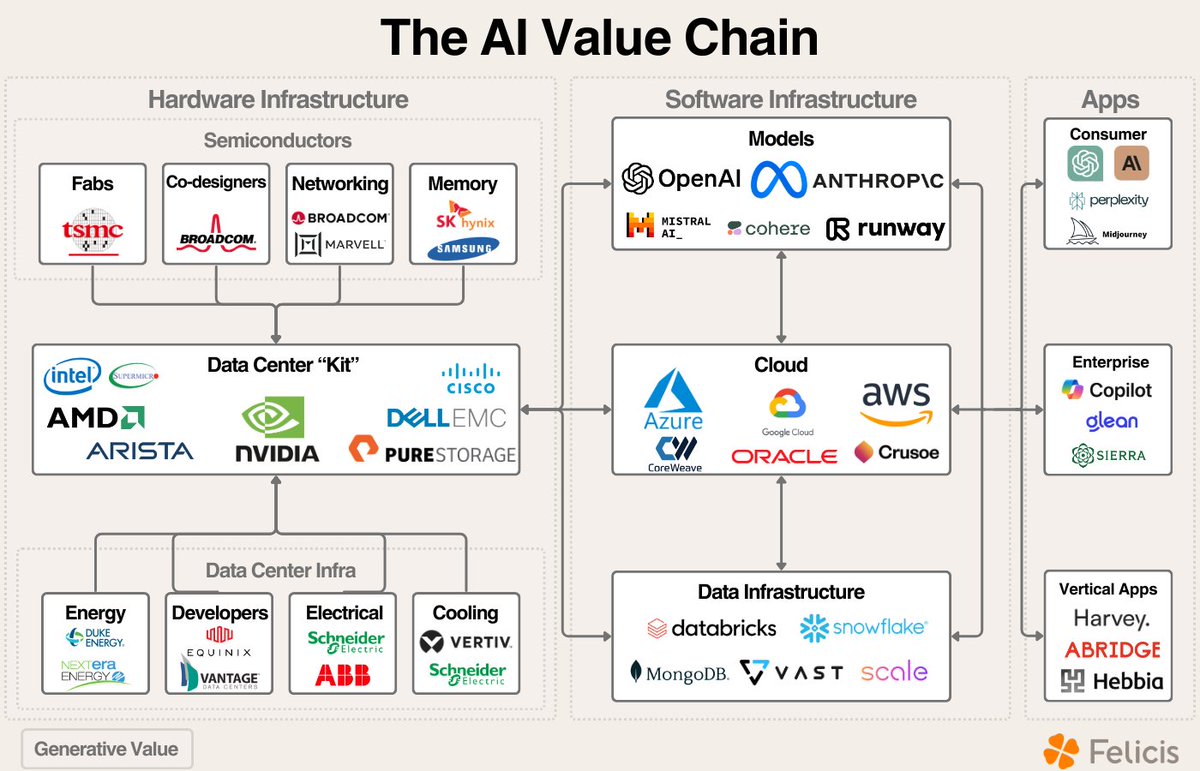

2/ On “AI Demand”:

2/ On “AI Demand”:

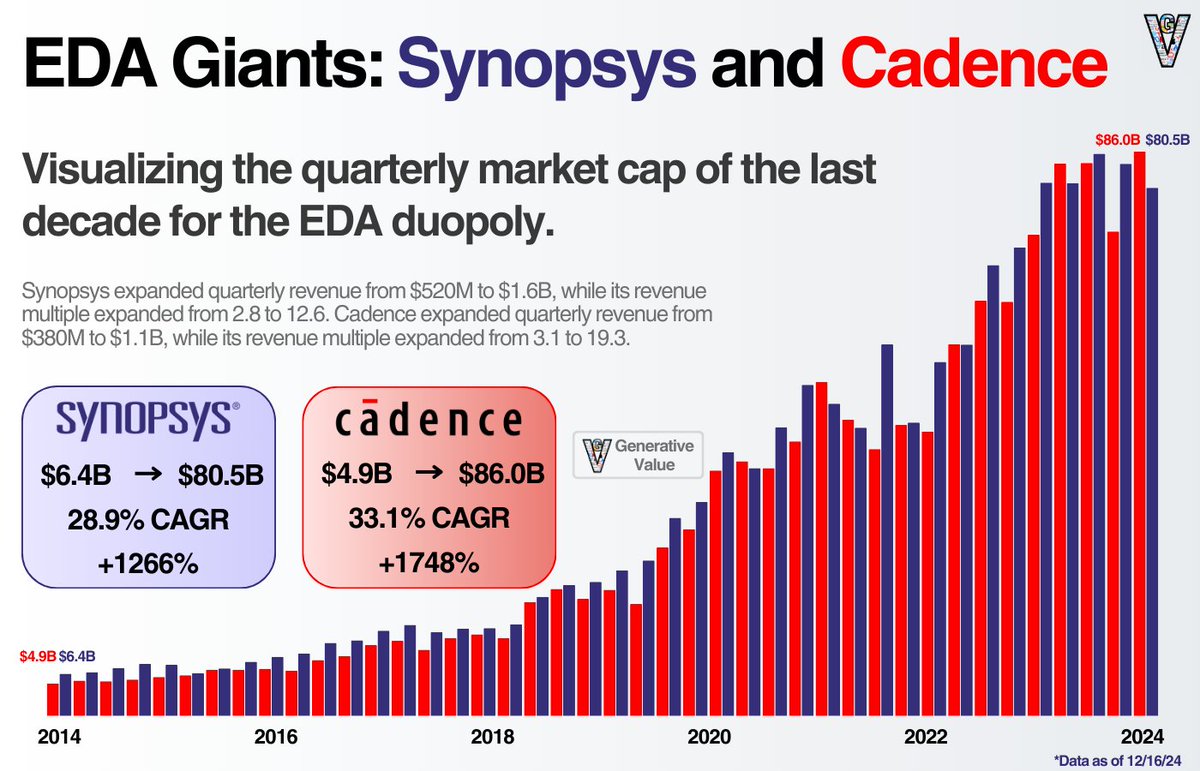

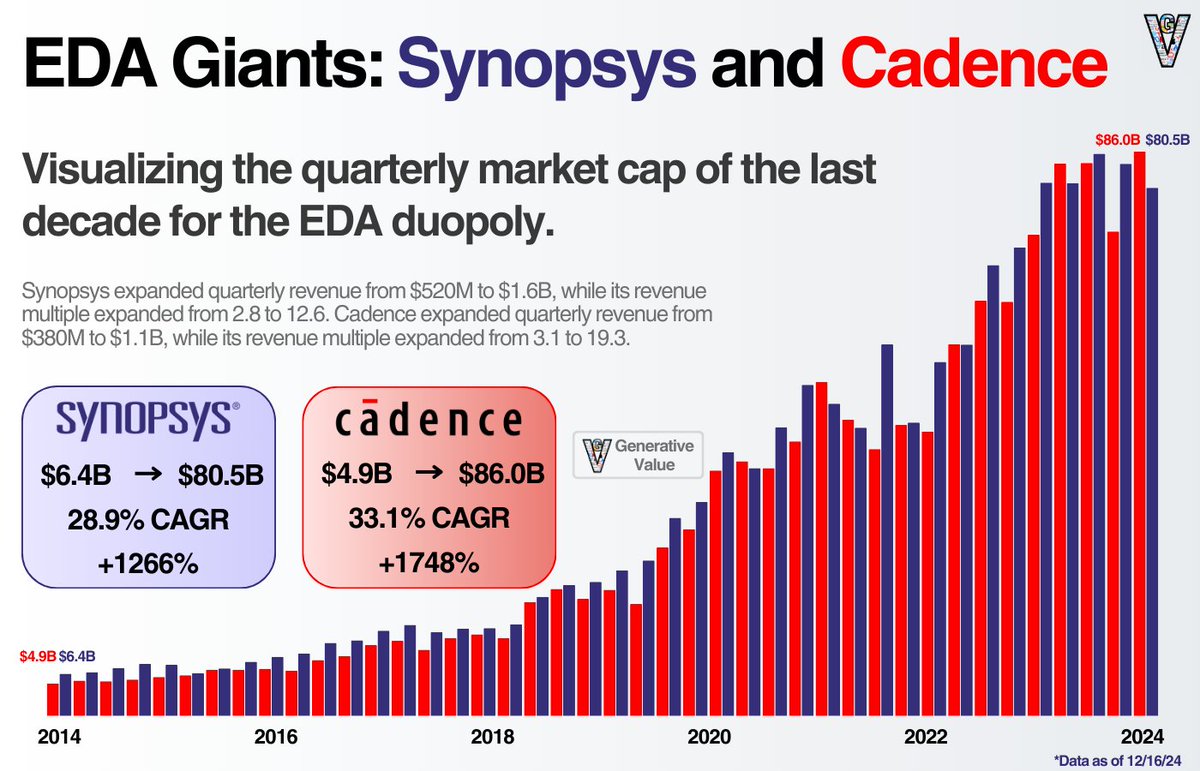

1/ From the 1990s to today, we’ve seen the consolidation of the EDA industry onto three main players in Synopsys, Cadence, and Siemens EDA (Mentor Graphics):

1/ From the 1990s to today, we’ve seen the consolidation of the EDA industry onto three main players in Synopsys, Cadence, and Siemens EDA (Mentor Graphics):

1/ We’re seeing a similar buildout with data centers as we did with the electric grid 100+ years ago.

1/ We’re seeing a similar buildout with data centers as we did with the electric grid 100+ years ago.

The gap between infrastructure spend and application revenue has fueled the recent "AI ROI" debate.

The gap between infrastructure spend and application revenue has fueled the recent "AI ROI" debate.

1/ AWS revenue driver

1/ AWS revenue driver