5+ decades in int’l banking, finance & investments. Began publishing in 1987. Founded https://t.co/Qqr6wD5clr in 2001. @goldmoney Latest book:“Money and Liberty”

How to get URL link on X (Twitter) App

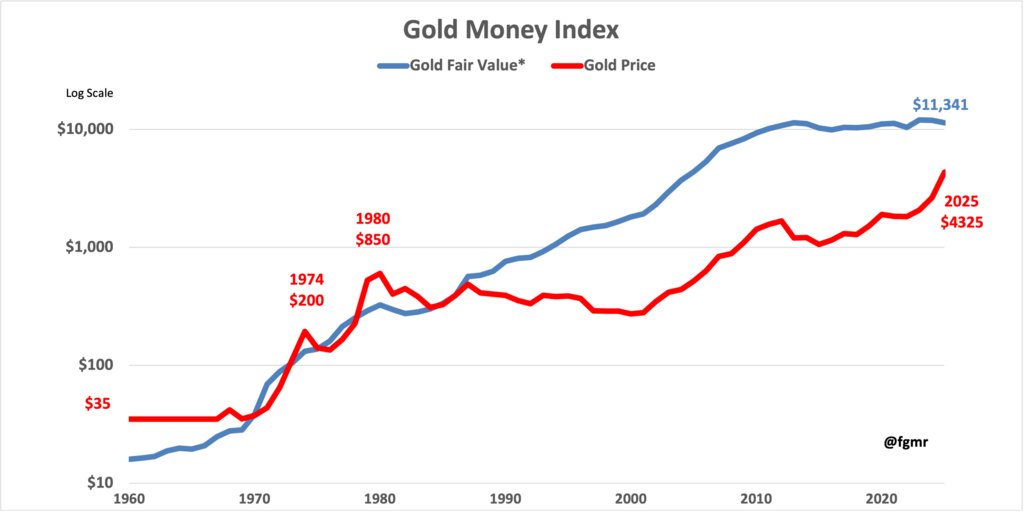

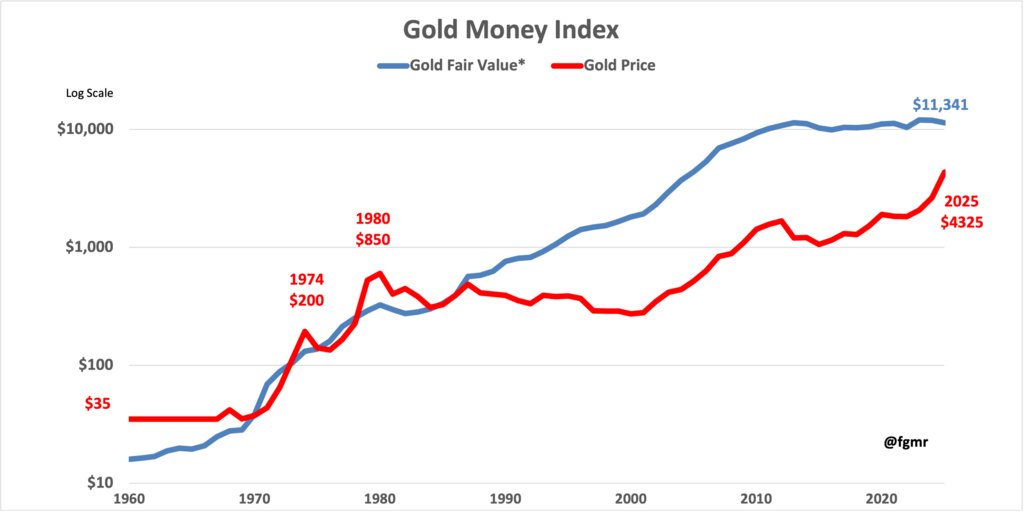

2/6 I use the Fair Value of #gold & the gold/silver ratio (currently 61:1) to calculate the FV of #silver, which has demand as an industrial metal & a gold-substitute. There is about 10X more silver than gold in the earth's crust & roughly 10X more silver than gold mined annually by weight, but their historic ratio is about 16oz silver to 1oz gold, not 10:1 as supply alone would suggest. The 16:1 ratio reflects the demand premium given to gold as a purely #monetary metal. Let's assume the ratio fluctuates in a range between 30 (the ratio at silver's 2011 price peak) & 20 to approach the historic ratio.

2/6 I use the Fair Value of #gold & the gold/silver ratio (currently 61:1) to calculate the FV of #silver, which has demand as an industrial metal & a gold-substitute. There is about 10X more silver than gold in the earth's crust & roughly 10X more silver than gold mined annually by weight, but their historic ratio is about 16oz silver to 1oz gold, not 10:1 as supply alone would suggest. The 16:1 ratio reflects the demand premium given to gold as a purely #monetary metal. Let's assume the ratio fluctuates in a range between 30 (the ratio at silver's 2011 price peak) & 20 to approach the historic ratio.