Investing content focusing on $GLXY and AI Robotics the two largest opportunities I see in the world right now. Not affiliated with @thinkingusd.

7 subscribers

How to get URL link on X (Twitter) App

2/ Hyperliquid is averaging around $6.7B in daily volume vs $1.1B in October a mere 6 months ago. This has translated into going from 2% to 9% of Binance's volume! (OI has also exploded from $600M to $3.2B).

2/ Hyperliquid is averaging around $6.7B in daily volume vs $1.1B in October a mere 6 months ago. This has translated into going from 2% to 9% of Binance's volume! (OI has also exploded from $600M to $3.2B).

Let's walk through the reflexive cycle:

Let's walk through the reflexive cycle:

https://twitter.com/hodlKRYPTONITE/status/15971584713127608342/ The second point relates to crypto dropping and traders on the platform being net short.

2/ Firstly lets walk through GMX's oracle pricing model along with its pros and cons so we can fully understand the tradeoffs it makes.

2/ Firstly lets walk through GMX's oracle pricing model along with its pros and cons so we can fully understand the tradeoffs it makes.

https://twitter.com/FloodCapital/status/14020485947655618582/ Back to first principals, lets examine the US fiscal situation.

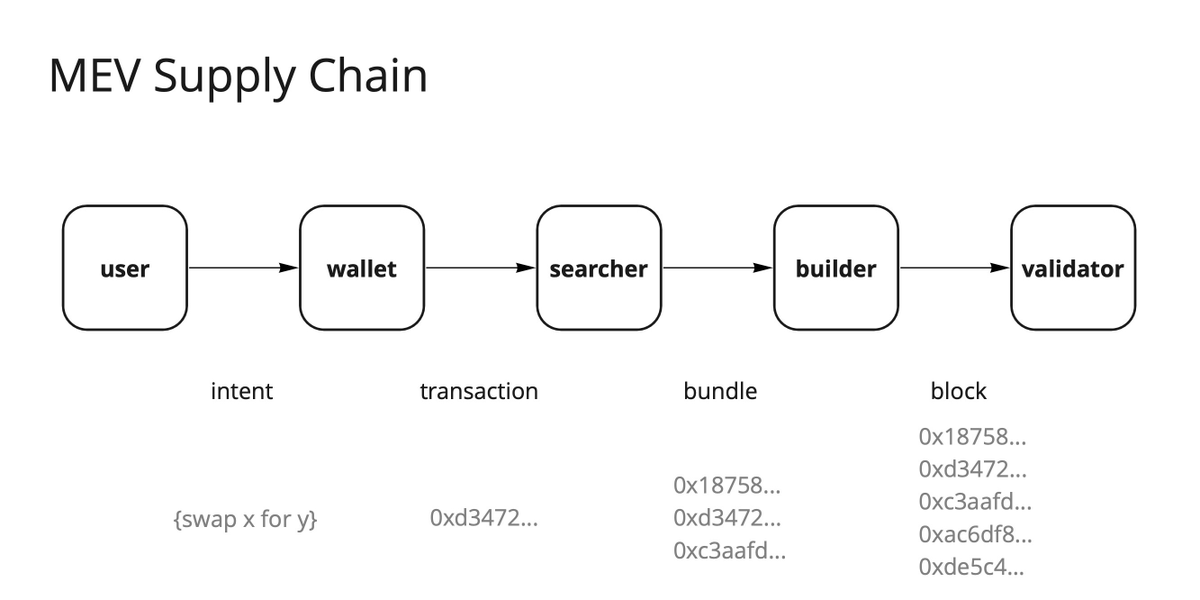

2/ First lets take a look at the effects MEV will have on ETH after the merge.

2/ First lets take a look at the effects MEV will have on ETH after the merge.

2/ Firstly Traders.

2/ Firstly Traders.

2/ The obvious second order effects are for liquid staking providers like @LidoFinance $LDO and @Rocket_Pool $RPL.

2/ The obvious second order effects are for liquid staking providers like @LidoFinance $LDO and @Rocket_Pool $RPL.

2/ Right now stablecoin rates across Aave and Compound are 1-3%.

2/ Right now stablecoin rates across Aave and Compound are 1-3%.

https://twitter.com/0xAppodial/status/15025172021084856322/ You can monitor all of GMX's stats here: stats.gmx.io

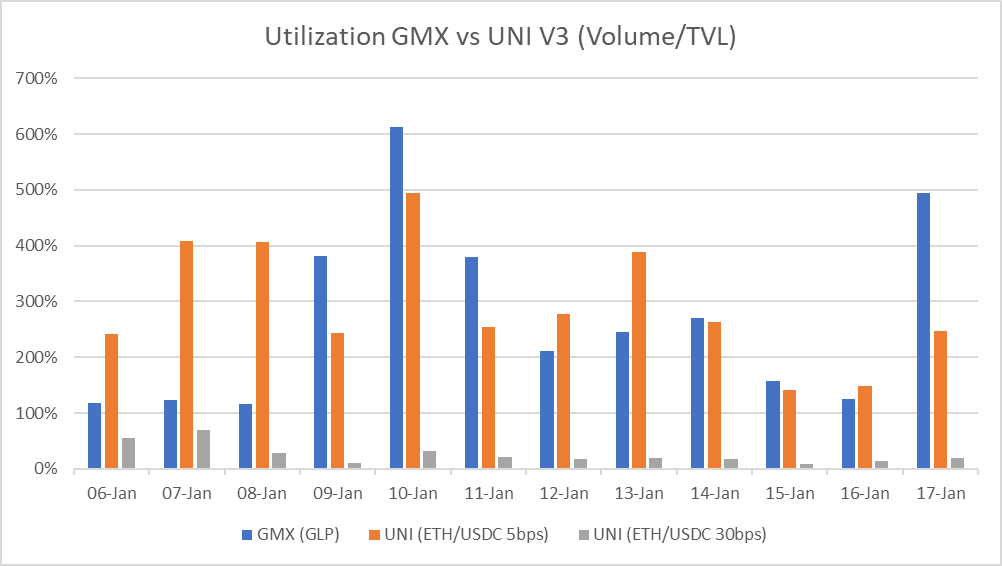

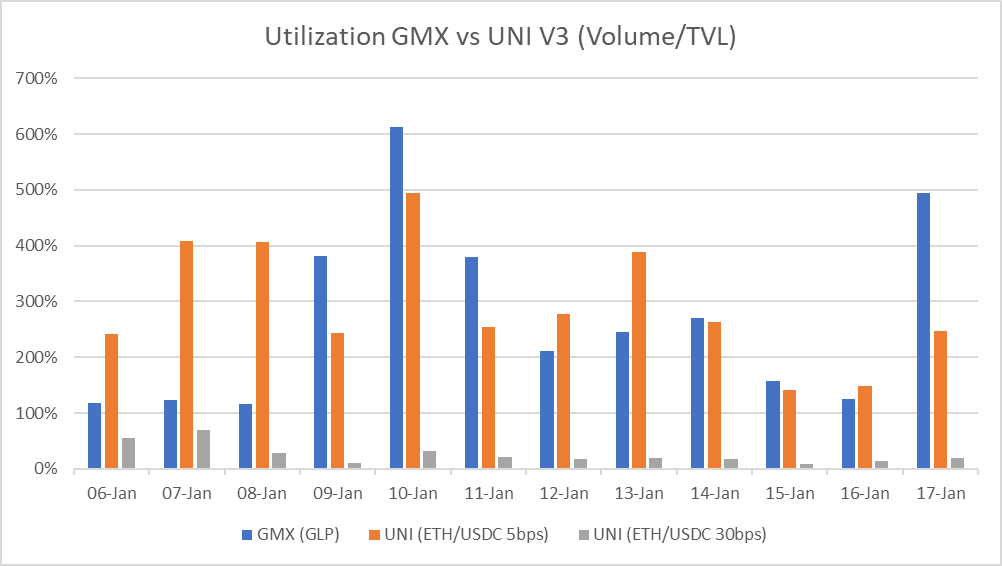

2/ Firstly, before I get into why GLP is so efficient, a quick recap on GLP.

2/ Firstly, before I get into why GLP is so efficient, a quick recap on GLP.

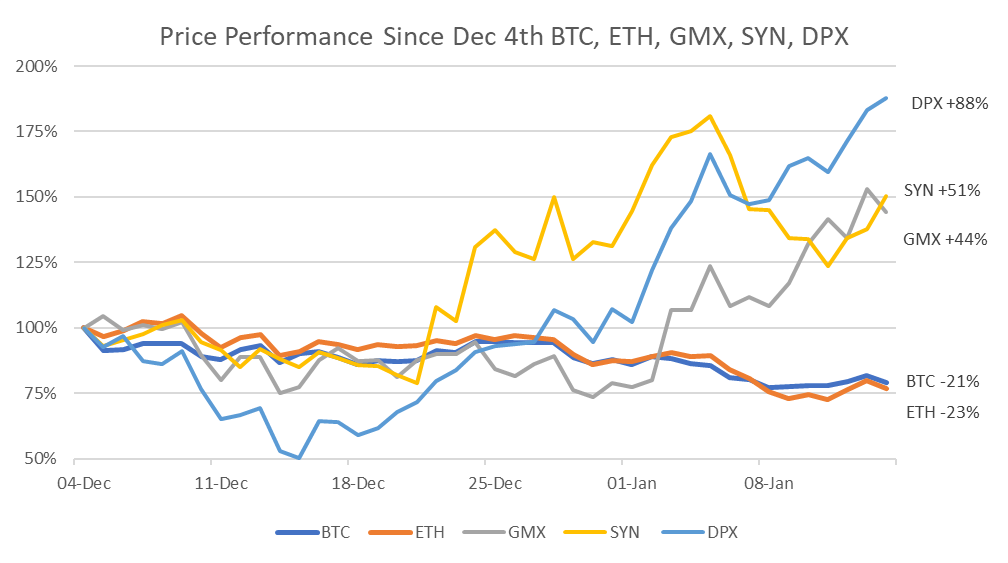

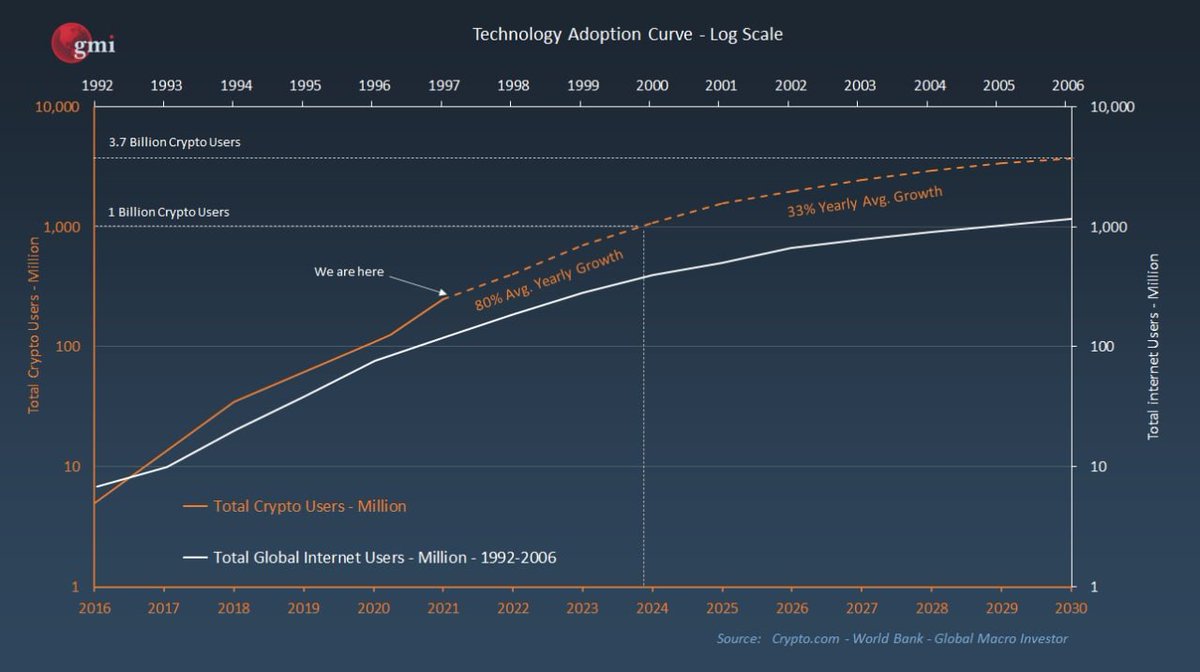

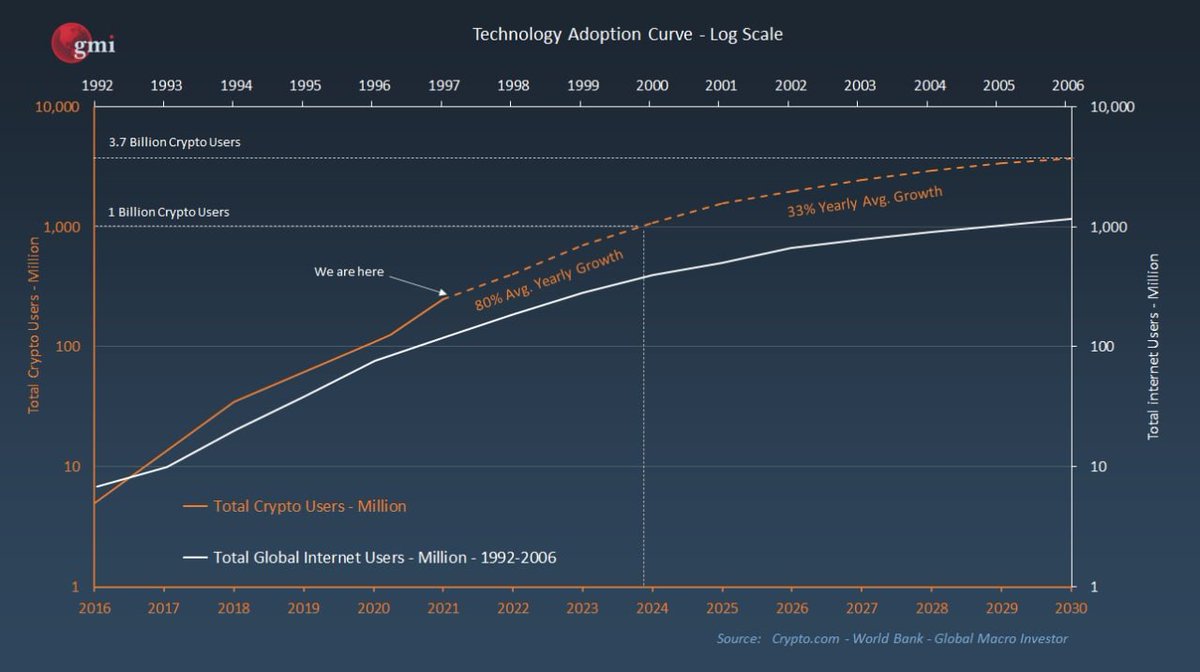

2/ The following thread is meant to hit the highlight reel regarding each of these projects.

2/ The following thread is meant to hit the highlight reel regarding each of these projects.

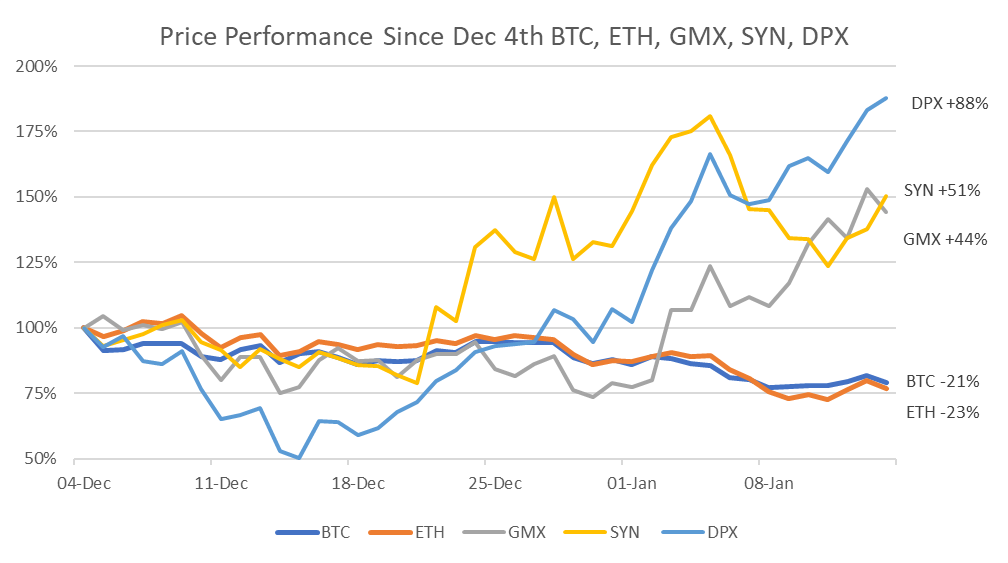

2/ Conviction allows you to hold to 100x, it also allows you to hold through massive drawdowns.

2/ Conviction allows you to hold to 100x, it also allows you to hold through massive drawdowns.

2/ A big hurdle for the growth of DeFi options is capital efficiency.

2/ A big hurdle for the growth of DeFi options is capital efficiency.

2/ Through DeFi the possibilities for different vaults and structured products are endless, you just need to source the liquidity and pricing, this becomes much easier when products are available to everyone.

2/ Through DeFi the possibilities for different vaults and structured products are endless, you just need to source the liquidity and pricing, this becomes much easier when products are available to everyone.

#1 Development of TeFi

#1 Development of TeFi

UST's growth strategy is two pronged:

UST's growth strategy is two pronged:

2/ GMX uses GLP, a basket of ETH, BTC, LINK, UNI, USDC, USDT, and MIM to facilitate margin trading and swaps on the platform.

2/ GMX uses GLP, a basket of ETH, BTC, LINK, UNI, USDC, USDT, and MIM to facilitate margin trading and swaps on the platform.