How to get URL link on X (Twitter) App

Local brands dominate the NEV market, taking 85%+ of the market share (vs. 50% for PV).

Local brands dominate the NEV market, taking 85%+ of the market share (vs. 50% for PV).

(For 2023)

(For 2023)

Sales Credit (to consumer)

Sales Credit (to consumer)

US containerized imports from China accounted for 42% of total US imports in 2020, according to PIERS. The % further increased in 2021.

US containerized imports from China accounted for 42% of total US imports in 2020, according to PIERS. The % further increased in 2021.

- How the de-listing news got circulated was VERY odd...

- How the de-listing news got circulated was VERY odd...

When a BNPL platform earns the bulk of rev from customers, it is essentially a credit card!

When a BNPL platform earns the bulk of rev from customers, it is essentially a credit card!

2/

2/

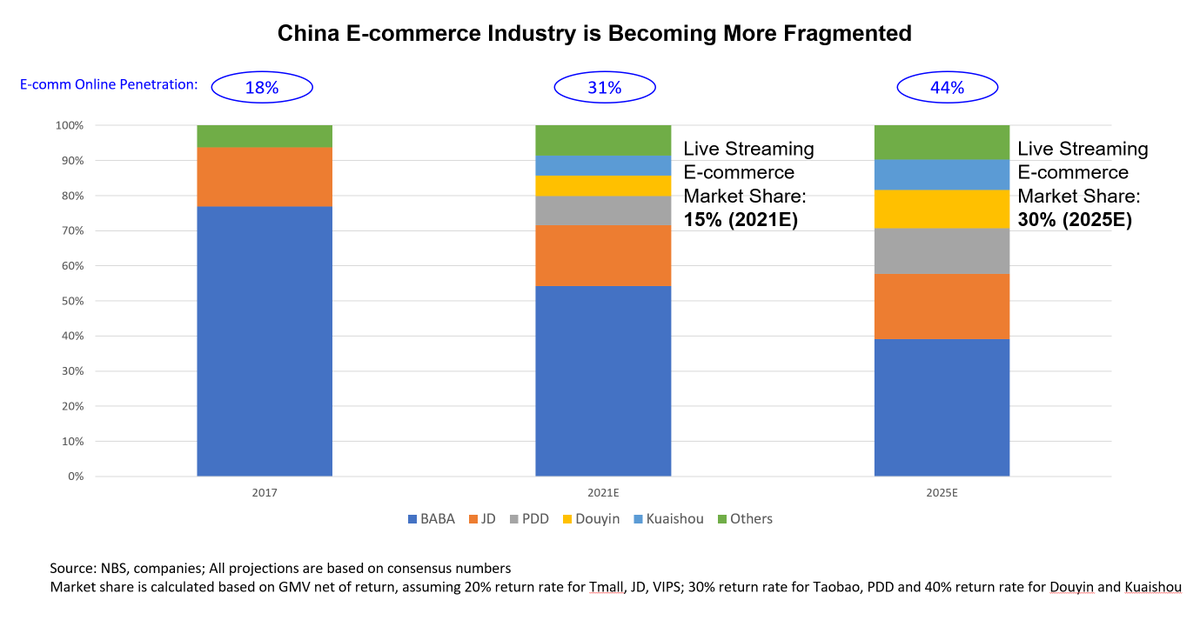

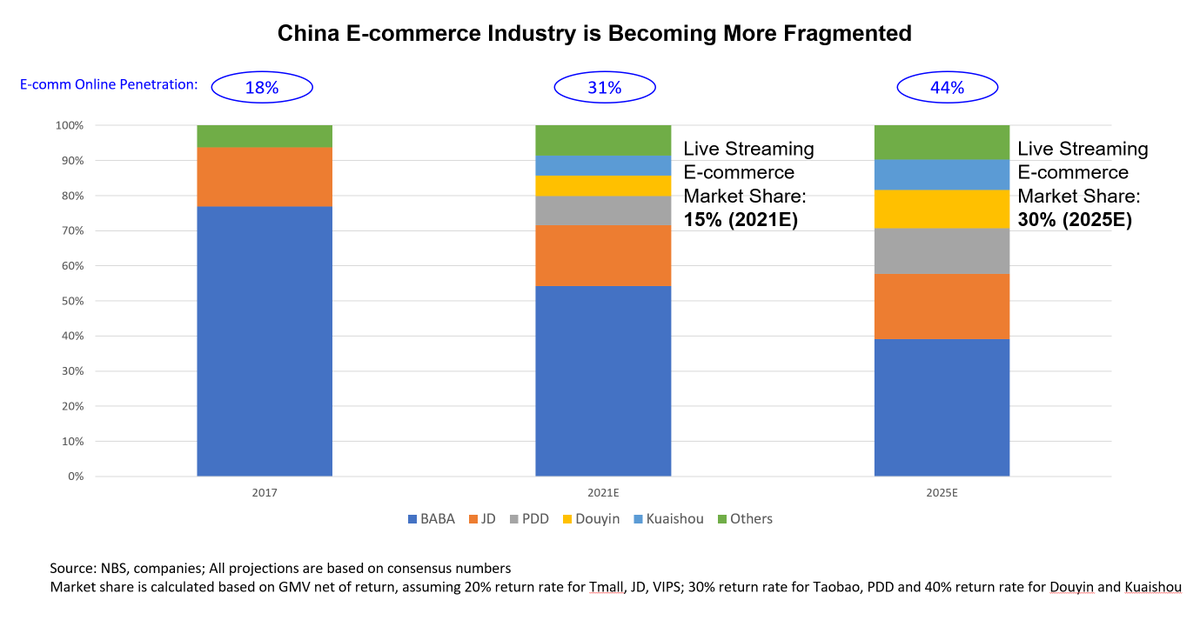

2/ Taobao/Tmall: a more mature, lower growth business going forward

2/ Taobao/Tmall: a more mature, lower growth business going forward

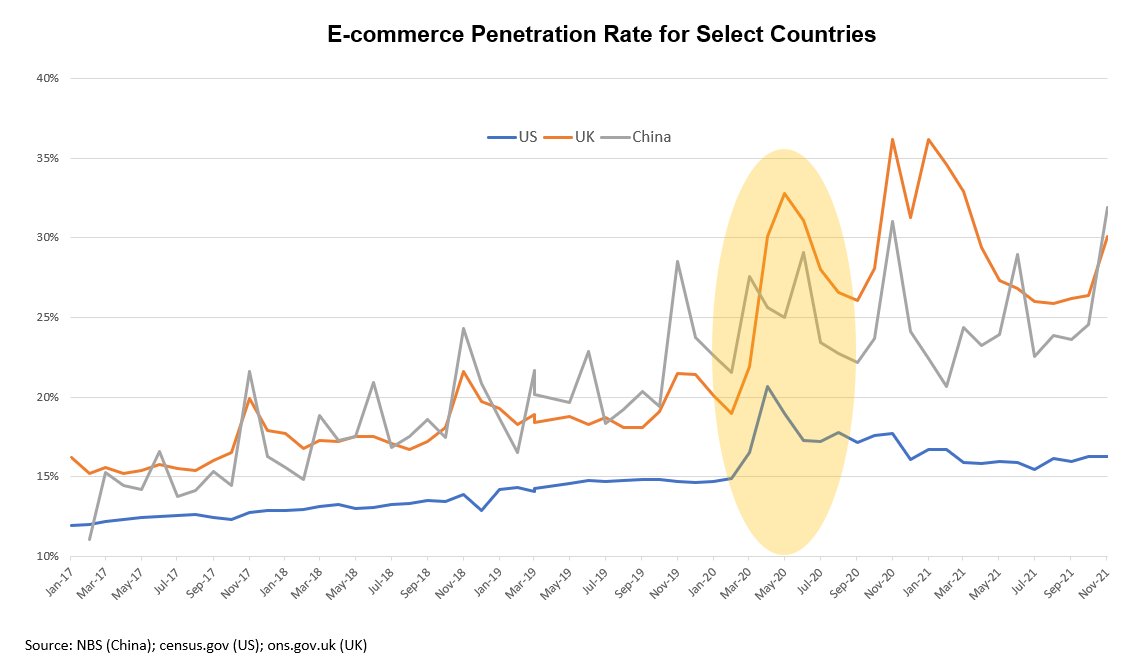

2/ Where’s the rest of the world following China’s playbook:

2/ Where’s the rest of the world following China’s playbook: