Oxford Econ, MBA Stern. Ranked top 15 Twitter technical accounts, Business Insider. Indie film producer (Sundance ’06, LAIFF ’16). 90’s trained, Behavioralist.

3 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/FusionptCapital/status/1487085769441173509

Also to give a sense of how not unusual this is, here is the progression in 2008.

Also to give a sense of how not unusual this is, here is the progression in 2008.

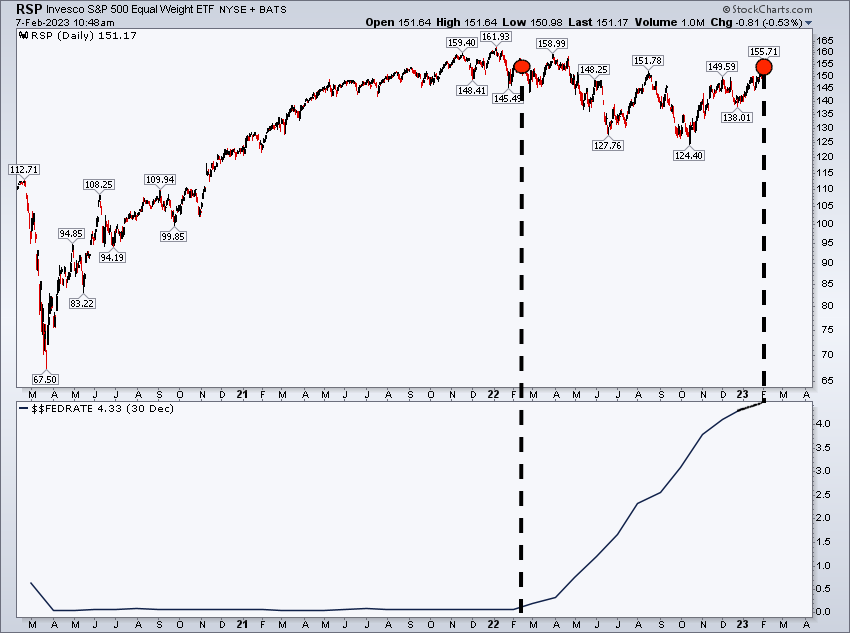

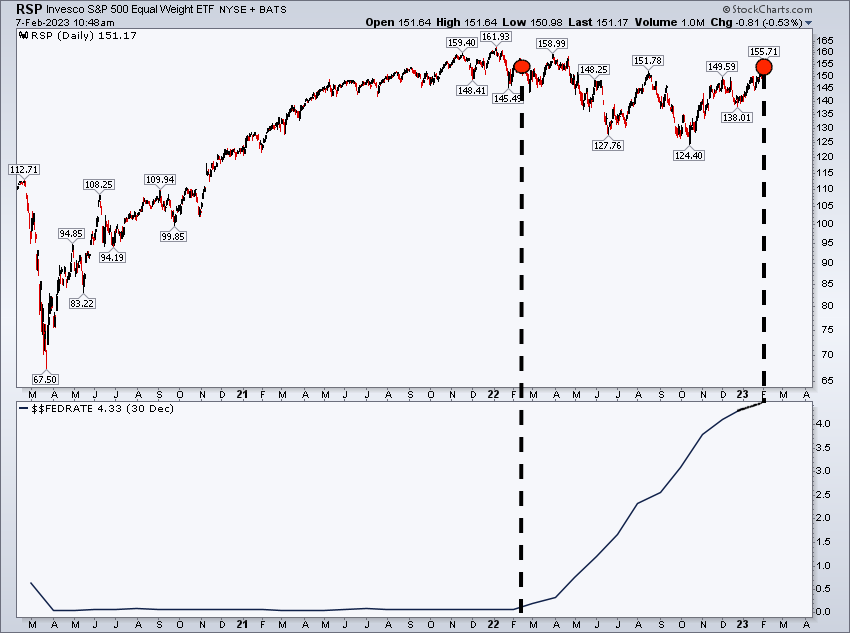

Zoom in here on 06 vs today. The price magically dropped essentially out of the blue then recovered the following year.

Zoom in here on 06 vs today. The price magically dropped essentially out of the blue then recovered the following year.