Chris Marsh. Global macro and finance; ex. IMF. London based. Personal views, @ExanteData. Exante sub-stack: https://t.co/IJIjSGzIzZ

3 subscribers

How to get URL link on X (Twitter) App

And it lines up favourably compared with gas prices in Europe today. Admittedly, European Gas has moderated since August.

And it lines up favourably compared with gas prices in Europe today. Admittedly, European Gas has moderated since August.

The problem is that the ECB staff's quarterly star-gazing exercises, also known as their macroeconomic projections, are are often stale within weeks of publication—or maybe even before they are published.

The problem is that the ECB staff's quarterly star-gazing exercises, also known as their macroeconomic projections, are are often stale within weeks of publication—or maybe even before they are published.

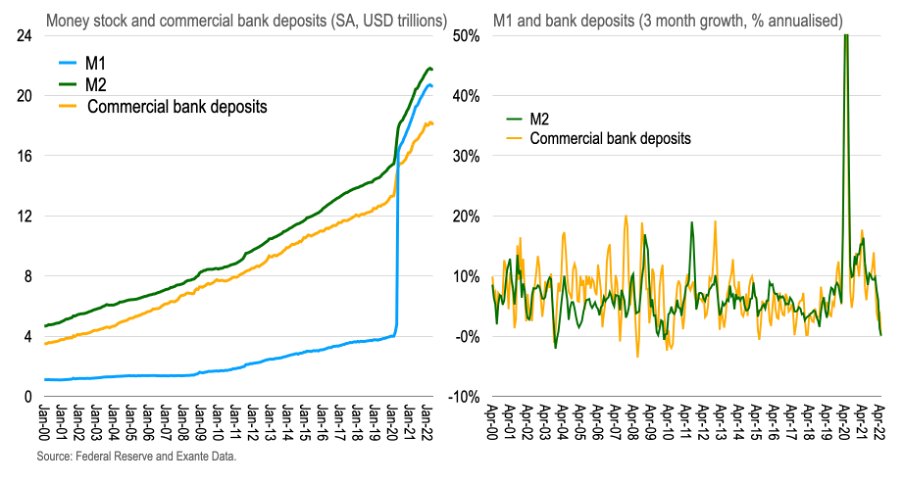

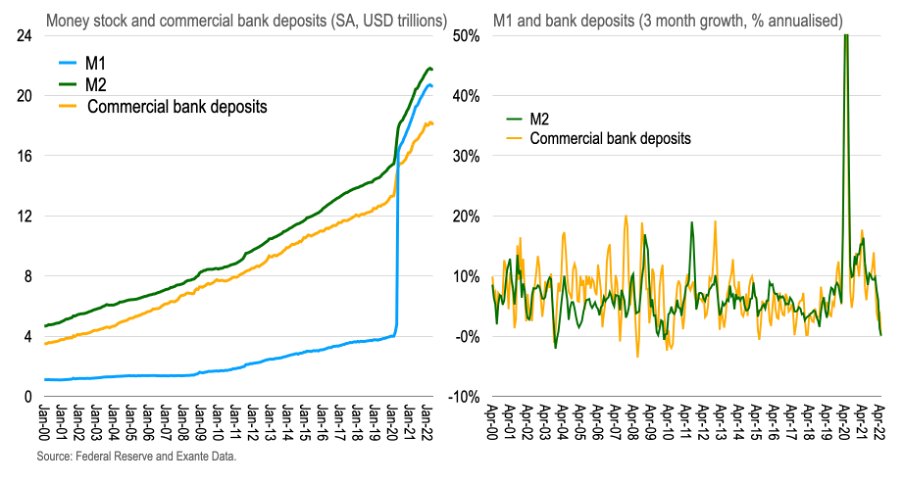

The additional items to make up M2 being small denomination time deposits (<$100k ex. retirement balances) and retail money market funds.

The additional items to make up M2 being small denomination time deposits (<$100k ex. retirement balances) and retail money market funds.

https://twitter.com/MacroAlf/status/1541686839806935042In this case, if (say) Germany were to sell Bunds to recycle into BTPs, given the sharp move in yields in recent months, they would make mark-to-market losses on their portfolio.

Indeed, there are signs that the traded goods inflation cycle has peaked, that non-energy industrial goods/durables are rolling over. But at about 9%YoY, such traded good inflation is still at a very high level (driven by the US in particular).

Indeed, there are signs that the traded goods inflation cycle has peaked, that non-energy industrial goods/durables are rolling over. But at about 9%YoY, such traded good inflation is still at a very high level (driven by the US in particular).

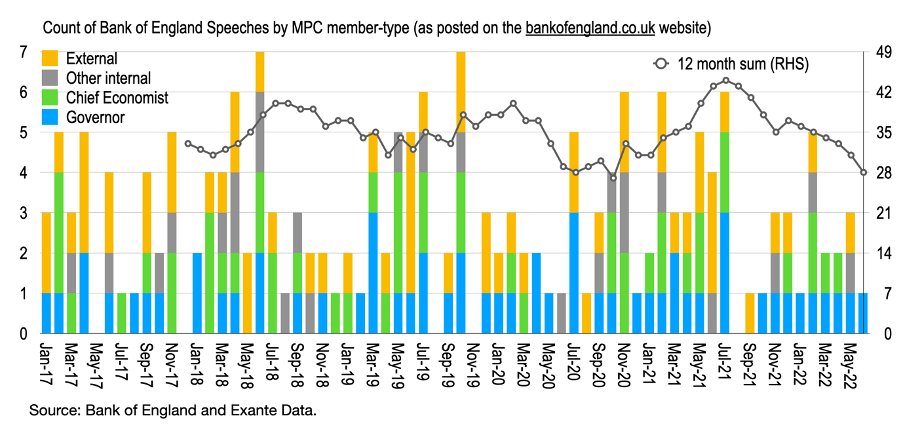

https://twitter.com/notayesmansecon/status/1539162062521352192?s=20&t=ESW4JzXuhg_kSlyDaj7cDgBut there is something more going on. Communication in general is lacking of late. Let’s count the speeches published on the Bank website by MPC members since 2017. What do we find?

While the chart is admittedly carefully constructed, on only five occasions since the end of Bretton Woods has the dollar real exchange rate deviated from the changing fortunes of HH net worth.

While the chart is admittedly carefully constructed, on only five occasions since the end of Bretton Woods has the dollar real exchange rate deviated from the changing fortunes of HH net worth.

...and strength against JPY in particular. Indeed, the USD value of JGBs held by the Bank of Japan (BOJ) fell from USD4.6 trillion in February to about USD4.2 trillion today despite continued net purchases. As such, BOJ accounts for most of the overall balance sheet adjustment.

...and strength against JPY in particular. Indeed, the USD value of JGBs held by the Bank of Japan (BOJ) fell from USD4.6 trillion in February to about USD4.2 trillion today despite continued net purchases. As such, BOJ accounts for most of the overall balance sheet adjustment.

Indeed, the Taylor and similar rules were dominant in the 1990s and 2000s, until post-GFC when the policy rate was constrained by the ZLB on rates, bringing balance sheet management into play.

Indeed, the Taylor and similar rules were dominant in the 1990s and 2000s, until post-GFC when the policy rate was constrained by the ZLB on rates, bringing balance sheet management into play.

The increase in deposits was coincident with the reported increase in the share of euros on CBR balance sheet, which is at least suggestive that these Treasuries were moved into deposits at European banks or at the Eurosystem...

The increase in deposits was coincident with the reported increase in the share of euros on CBR balance sheet, which is at least suggestive that these Treasuries were moved into deposits at European banks or at the Eurosystem...

https://twitter.com/danielmunevar/status/1473982657465827328?s=20

It is still important for consumption and labour supply choices that in percent of end-2019 net worth some of the most disadvantaged groups made the largest gains.

It is still important for consumption and labour supply choices that in percent of end-2019 net worth some of the most disadvantaged groups made the largest gains.