Investment, Equity (on Wall Street), Macro Research background. ~10 years markets experience, supporting investors in succeeding. Join 7000+ FREE subscribers

How to get URL link on X (Twitter) App

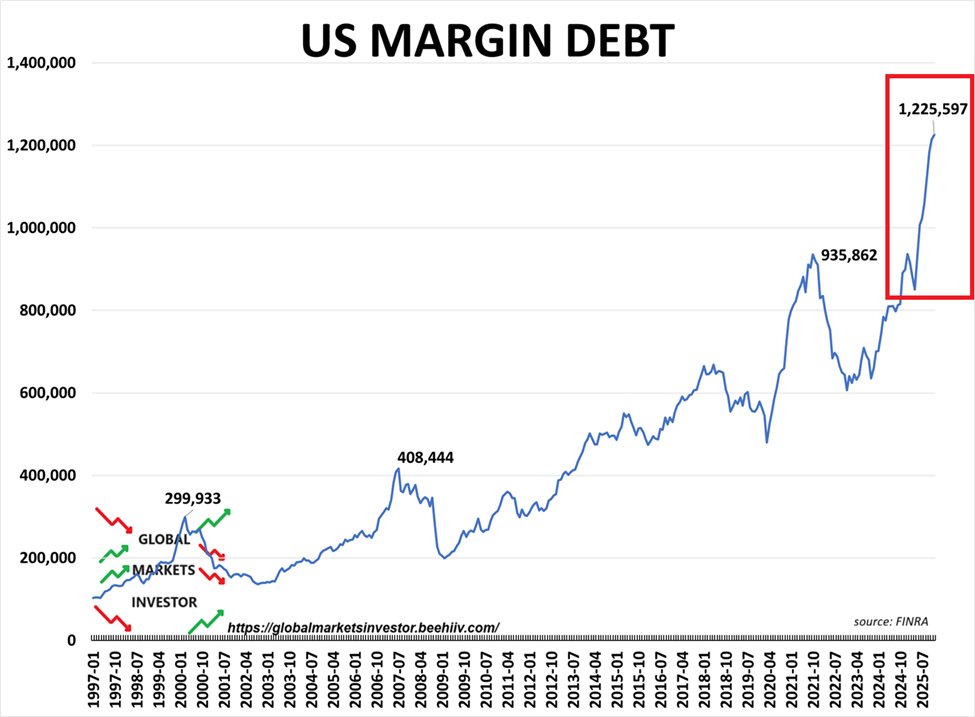

First, US margin debt rose another $11 BILLION in December to a record $1.23 TRILLION.

First, US margin debt rose another $11 BILLION in December to a record $1.23 TRILLION.

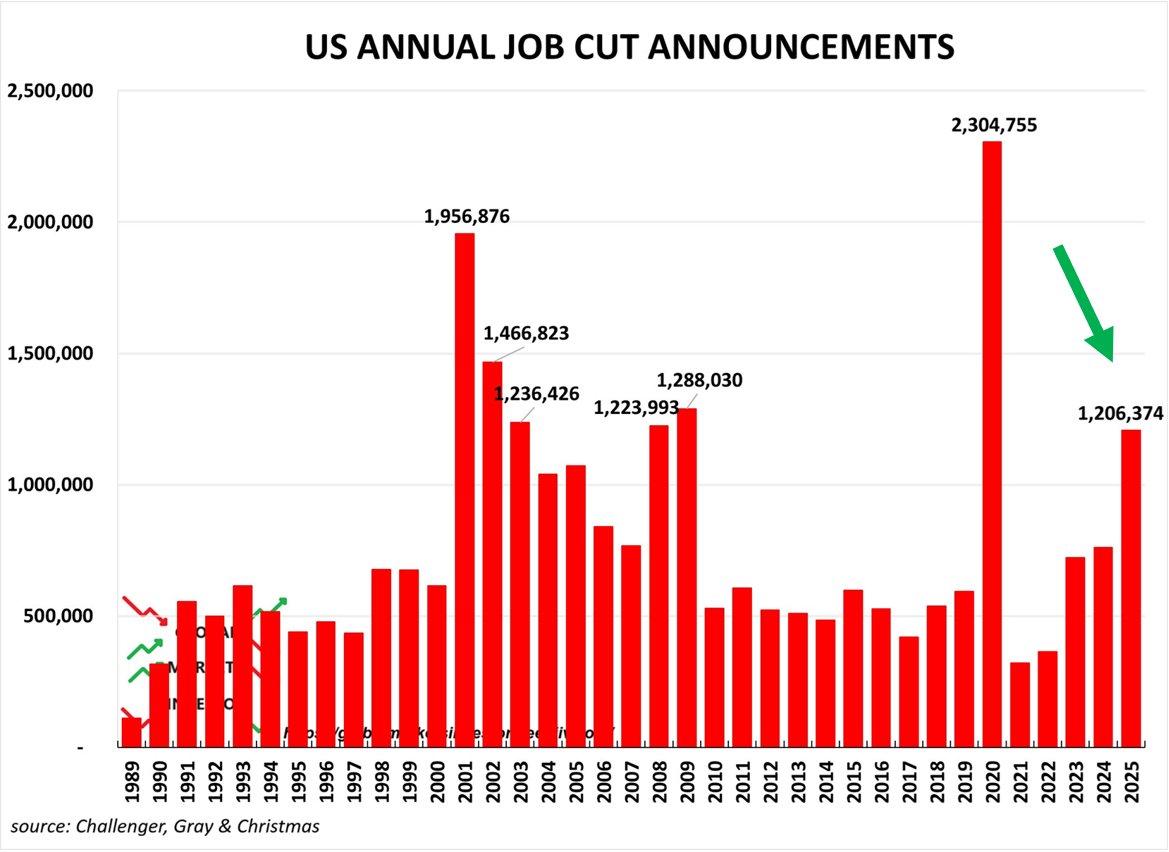

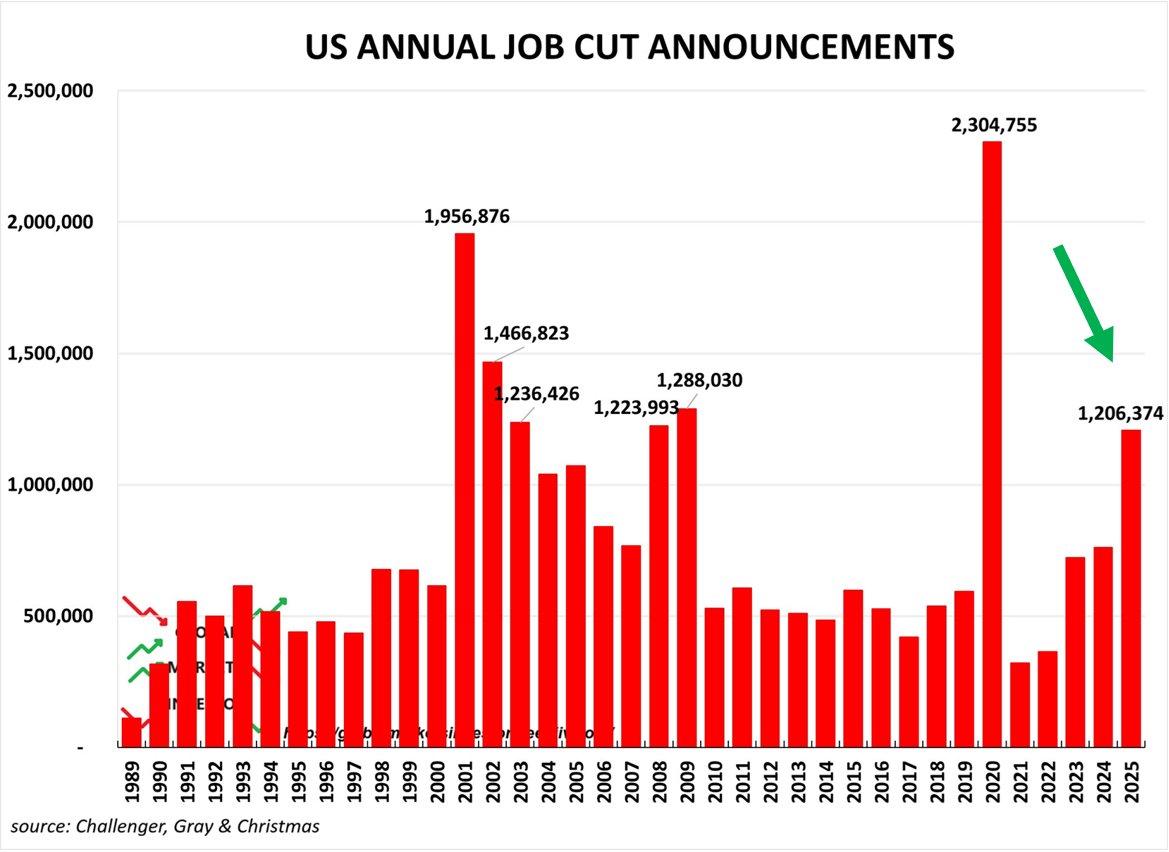

US-based employers' job cut announcements spiked +58% YoY last year, to 1,206,374, the highest since 2020 Crisis.

US-based employers' job cut announcements spiked +58% YoY last year, to 1,206,374, the highest since 2020 Crisis.

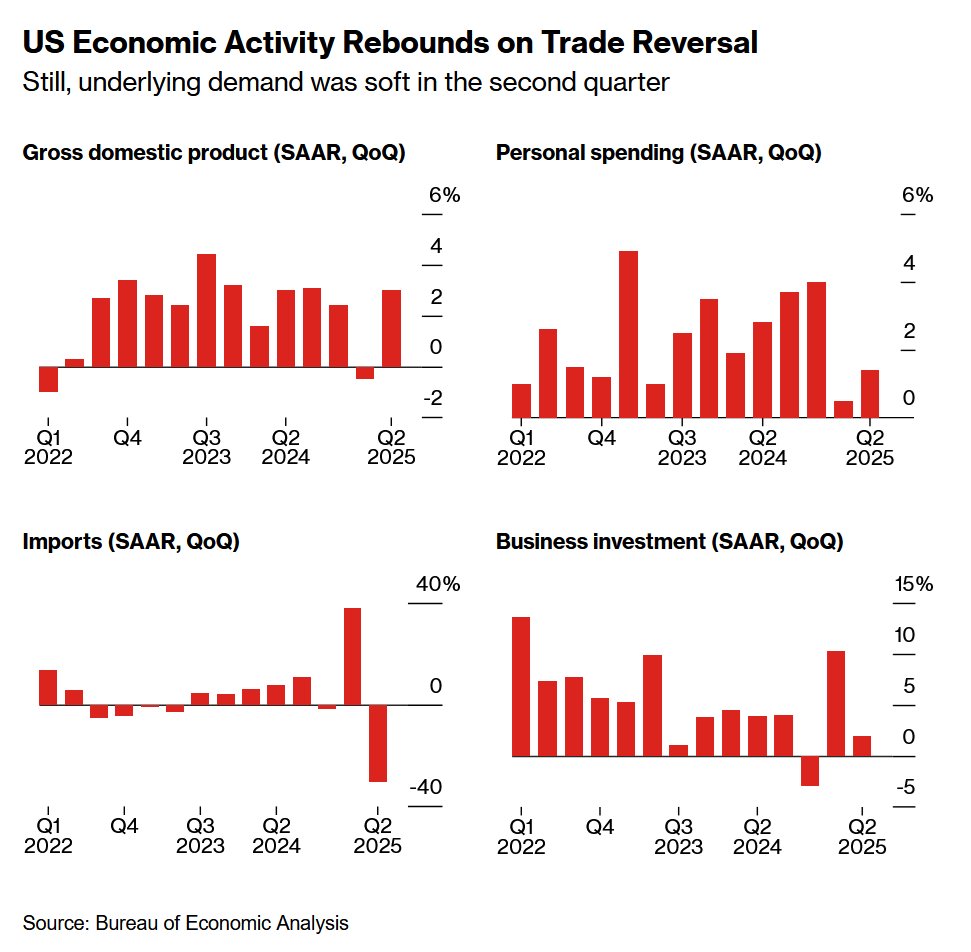

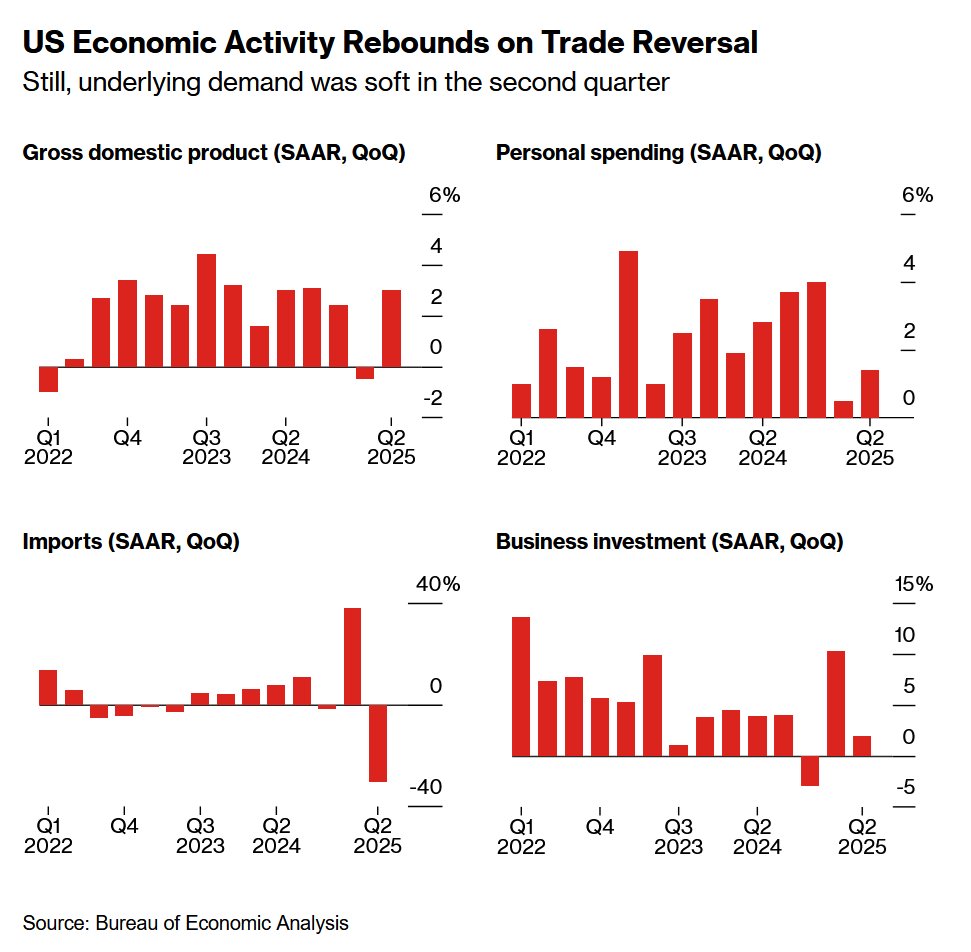

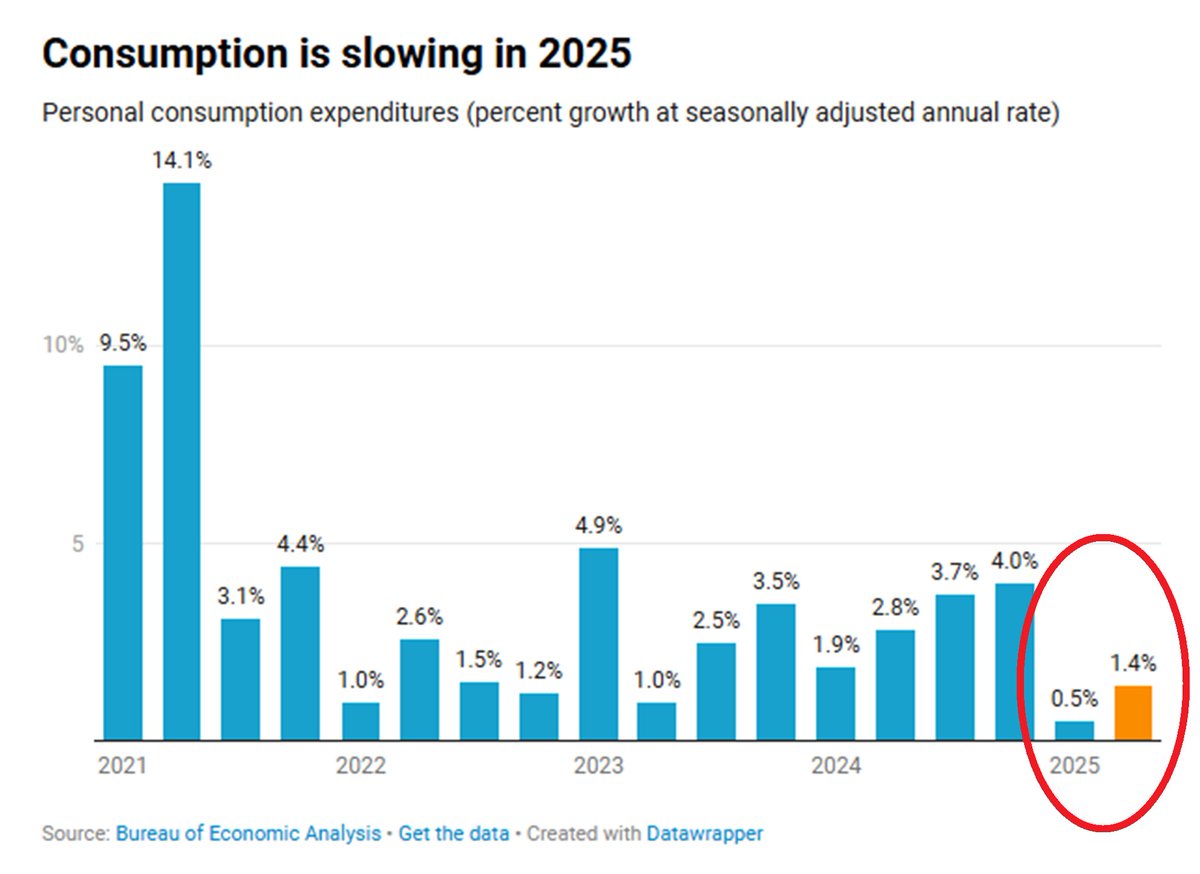

Consumer spending rose at an annualized pace of 1.4% last quarter.

Consumer spending rose at an annualized pace of 1.4% last quarter.

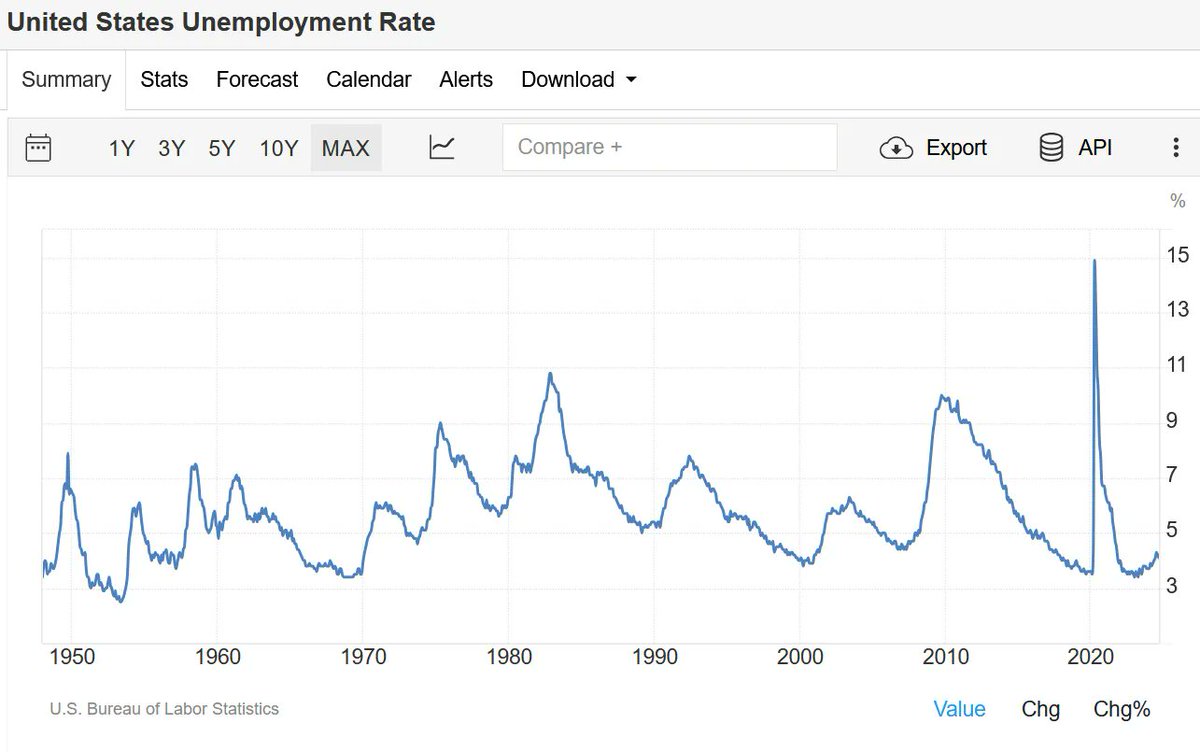

In October, the US economy officially created 12,000 jobs, according to the BLS estimates released Friday, 1st of November.

In October, the US economy officially created 12,000 jobs, according to the BLS estimates released Friday, 1st of November.

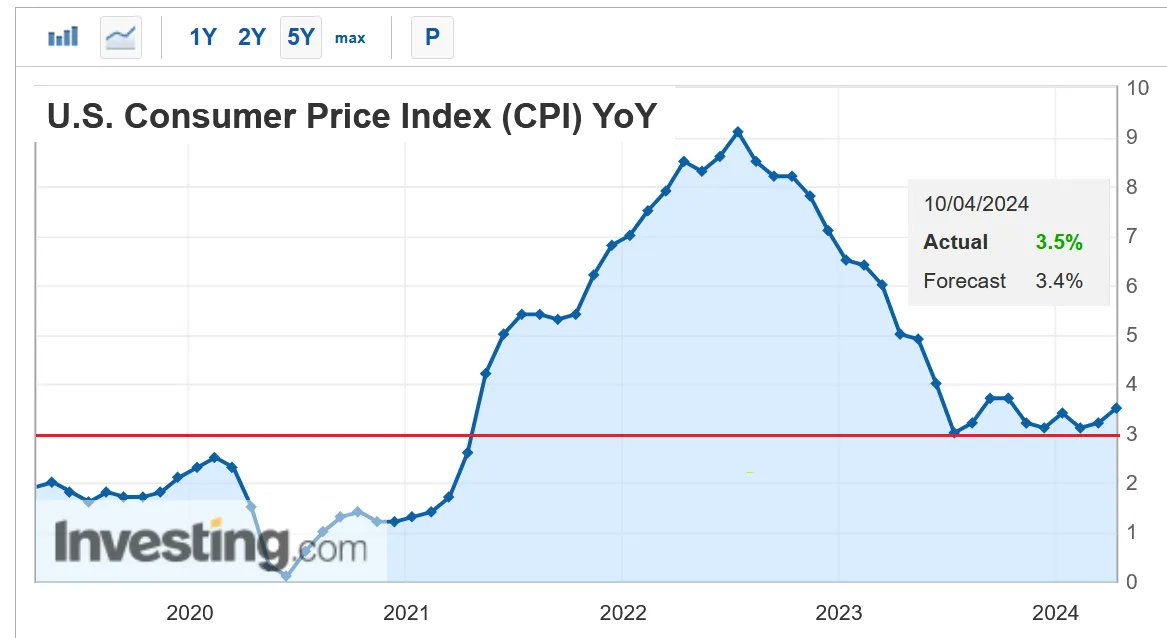

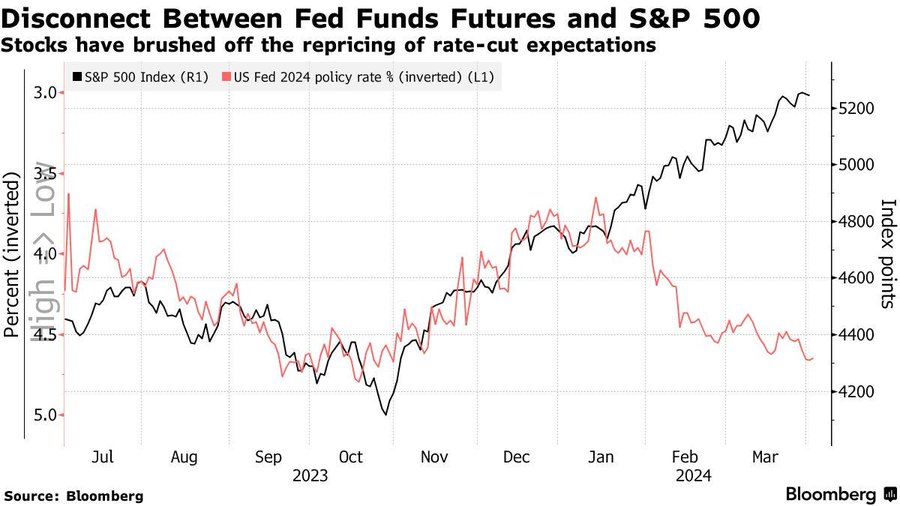

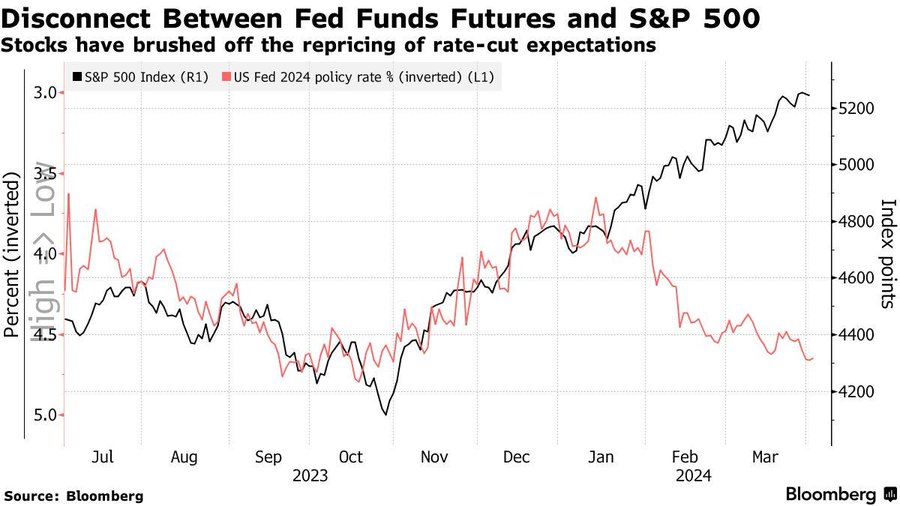

The March headline CPI inflation rate rose to 3.5%, above expectations of 3.4%, from 3.2% in February.

The March headline CPI inflation rate rose to 3.5%, above expectations of 3.4%, from 3.2% in February.