PNW Based 🌲- Investing To Earn My Time Back- Options, Stocks, Dividends, Value- Financial Nerd- Fundamentals - Brick by Brick 🧱 - $TSLA investor . ⚡️

How to get URL link on X (Twitter) App

2. $TSLA - In 2026, Tesla plans to launch the Cybercab and expand their Robotaxi business to more cities across the U.S. and potentially beyond the U.S.

2. $TSLA - In 2026, Tesla plans to launch the Cybercab and expand their Robotaxi business to more cities across the U.S. and potentially beyond the U.S.

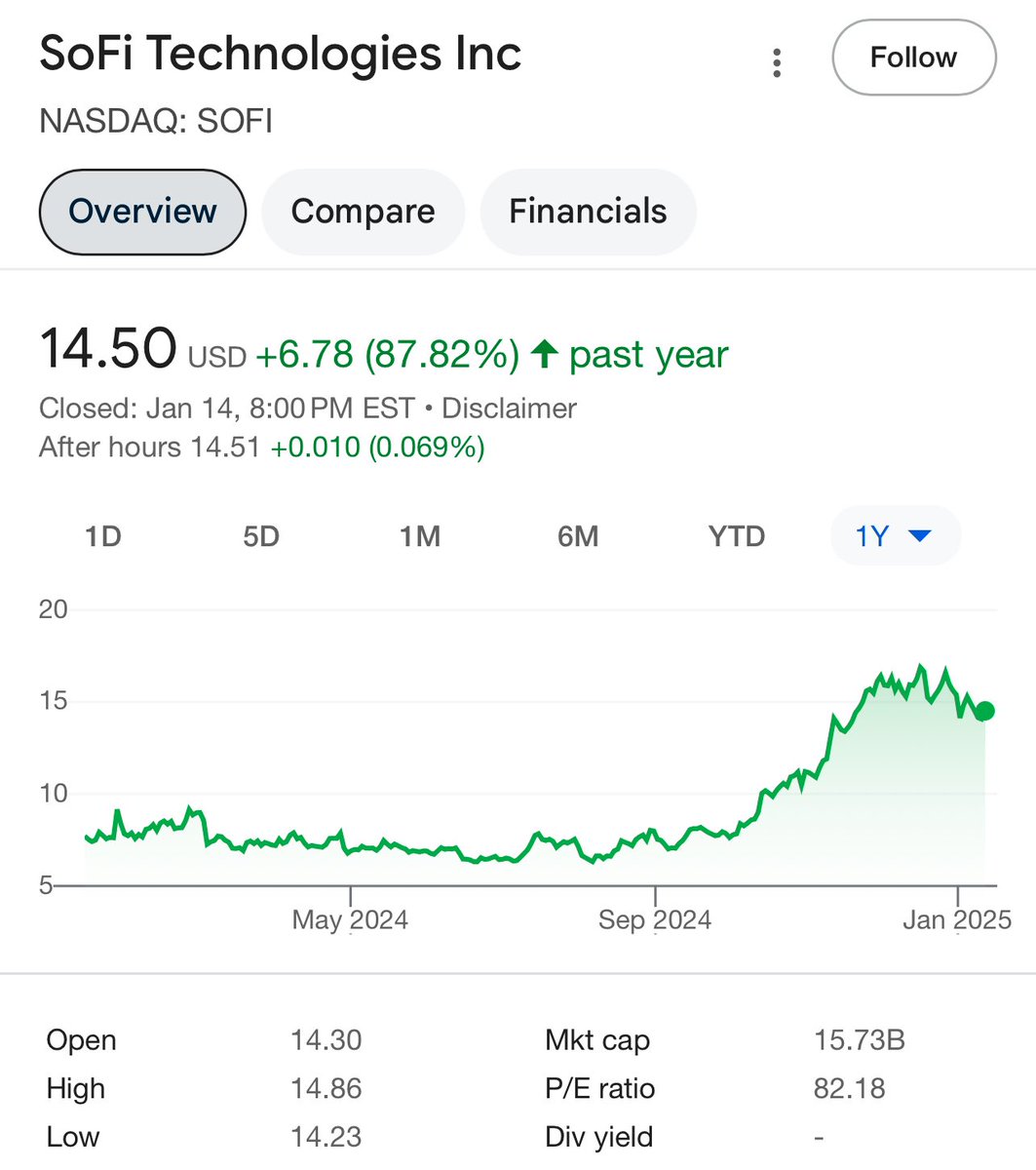

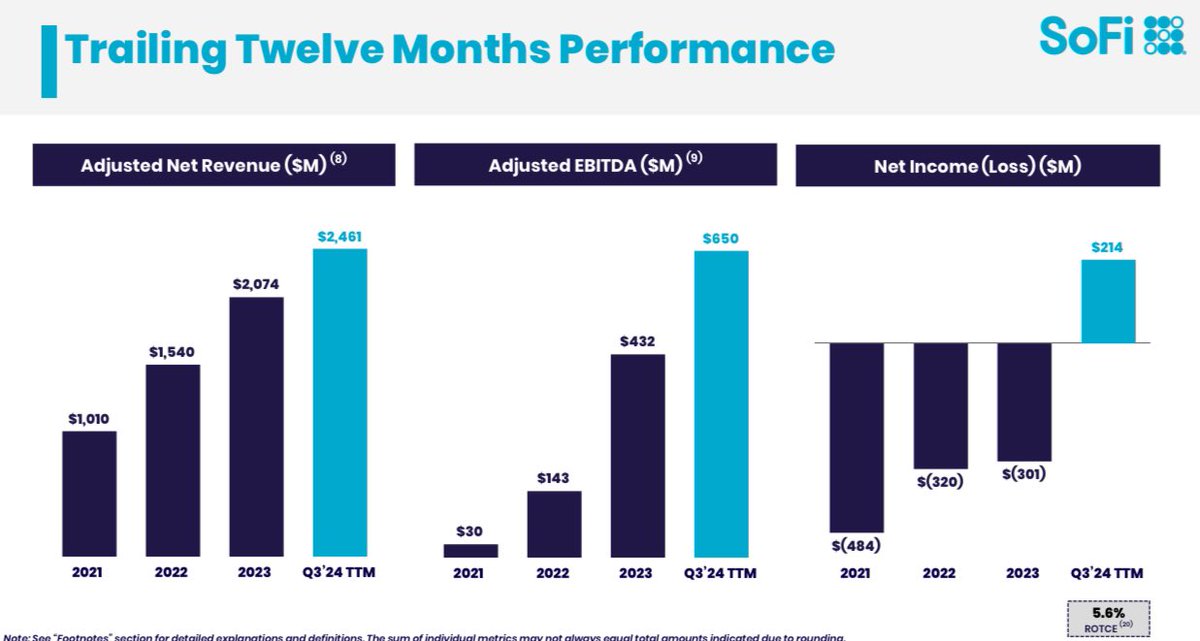

2. It’s a profitable business and has been over the past 4 consecutive quarters and soon to be 5 consecutive quarters at the end of this month.

2. It’s a profitable business and has been over the past 4 consecutive quarters and soon to be 5 consecutive quarters at the end of this month.

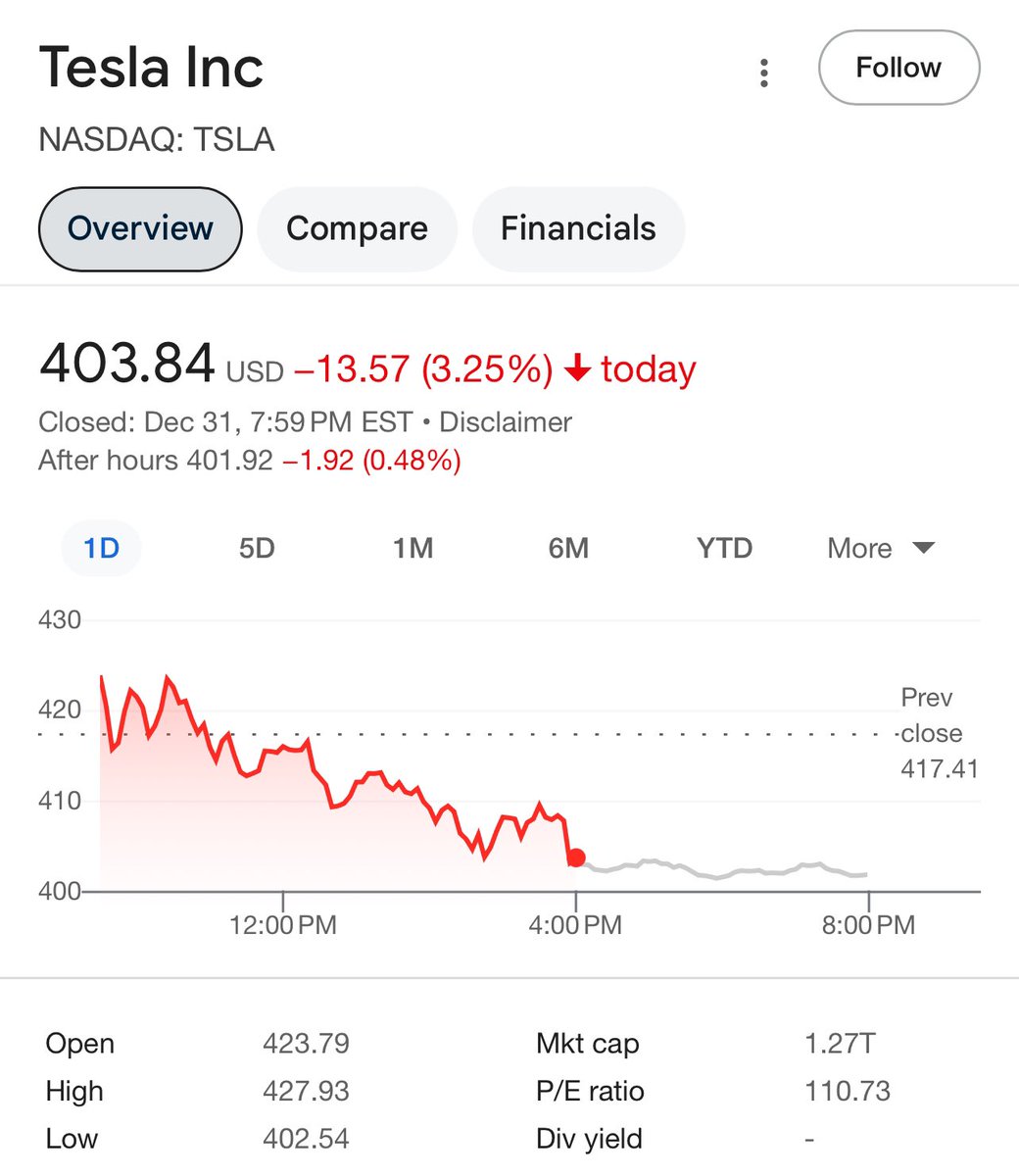

2. $TSLA

2. $TSLA