Person of the Year-Bloomberg BW;2xChina’s Most Influential Economist;2xEconomist of the Year-Asia Private Banker;“The man called China’s boom & bust”-Bloomberg

9 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/haohong_cfa/status/15617181676715540482/7)人民币跌破年内前低

https://twitter.com/haohong_cfa/status/1561851074444726272

2/N)西南财大调查显示,中国家庭有房无贷的近50%,近20%有房有贷,30%租房。与大城市里住房拥有率>70%基本一致。

2/N)西南财大调查显示,中国家庭有房无贷的近50%,近20%有房有贷,30%租房。与大城市里住房拥有率>70%基本一致。

https://twitter.com/HAOHONG_CFA/status/15591585429673902082/7)央行意外降息,银行意外破位

https://twitter.com/HAOHONG_CFA/status/1559155723476647940

https://twitter.com/haohong_cfa/status/15569922786227814412/7)中美修昔底德陷阱

https://twitter.com/haohong_cfa/status/1557337815393996801

https://twitter.com/haohong_cfa/status/15544151418229063692/7) July Econ Contraction; Consensus Shocked.

https://twitter.com/haohong_cfa/status/1553713471811981312

https://twitter.com/haohong_cfa/status/15526294671678259222/7 Buying Moutai Is Not Bullish

https://twitter.com/haohong_cfa/status/1552280808194449409

https://twitter.com/HAOHONG_CFA/status/15466322022718218242/7 人民币货币乘数 vs 日元历史性贬值

https://twitter.com/haohong_cfa/status/1546461156692328448?s=21&t=WxD8aqxm3DYRnQgVPkYgJw

https://twitter.com/haohong_cfa/status/15451885890213109772/7 人民币与金铜比预示全球增长放缓,风险上升。美国实时GDP预测-2.1%。美联储会议纪要担心加息负面影响或大于预期。美债期货开始预期明年降息。

https://twitter.com/haohong_cfa/status/1544632954865041409?s=21&t=6i4zPS-MoaRIpGNW-WpX5A

2/🧵 Or we could say China “swapped out” US jobs. Ricardo thought countries gain by trading with respective comparative advantages.

2/🧵 Or we could say China “swapped out” US jobs. Ricardo thought countries gain by trading with respective comparative advantages.

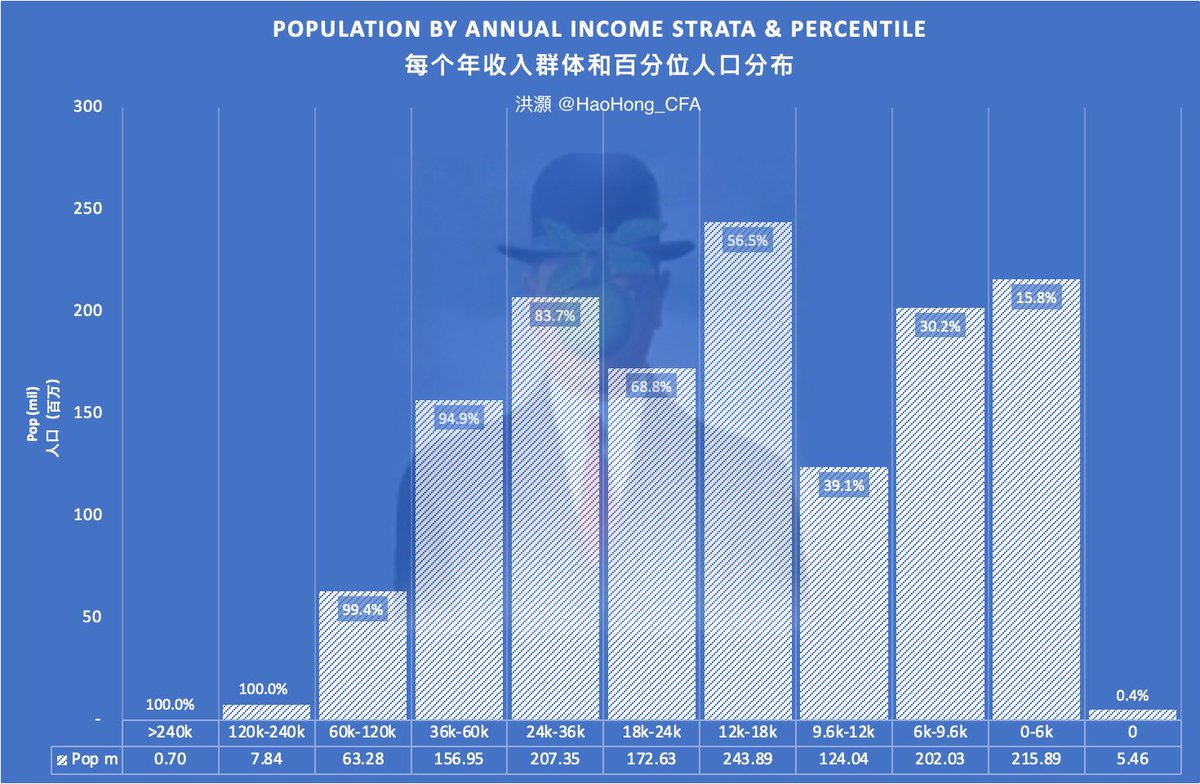

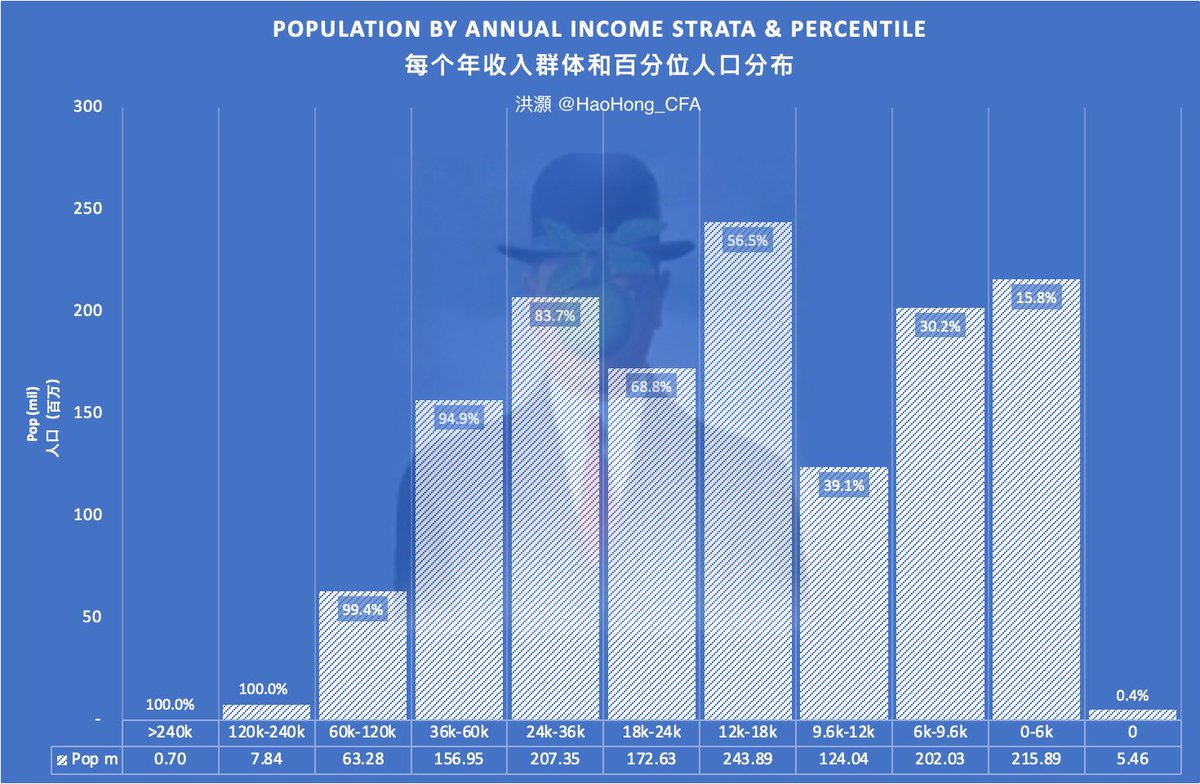

2/🧵 Only 0.7m/1.4bn population at 100th% income earning ¥240k p.a. ($37k) x 2.62pp/HH = $96.7k p.a./HH ~66% US HH income.

2/🧵 Only 0.7m/1.4bn population at 100th% income earning ¥240k p.a. ($37k) x 2.62pp/HH = $96.7k p.a./HH ~66% US HH income.

Foreigners reducing Chinese treasury. Treasury’s leads on/offshore stocks buying by up to 3Q.The Russian central bank may be under sanction pressure to reduce its holdings. Today’s report “The aides of March”: researchreport.bocomgroup.com/Strategy-22031…

Foreigners reducing Chinese treasury. Treasury’s leads on/offshore stocks buying by up to 3Q.The Russian central bank may be under sanction pressure to reduce its holdings. Today’s report “The aides of March”: researchreport.bocomgroup.com/Strategy-22031…

Every oil crisis followed by a U.S. recession. This time unlikely to be different. Today’s report: researchreport.bocomgroup.com/Strategy-22030…

Every oil crisis followed by a U.S. recession. This time unlikely to be different. Today’s report: researchreport.bocomgroup.com/Strategy-22030…

China’s current account peaks and troughs with A-shares. Onshore market has been rising for three years - first time in history. But now under pressure.

China’s current account peaks and troughs with A-shares. Onshore market has been rising for three years - first time in history. But now under pressure.