How to get URL link on X (Twitter) App

https://twitter.com/HalfersPower/status/1476554362663145474

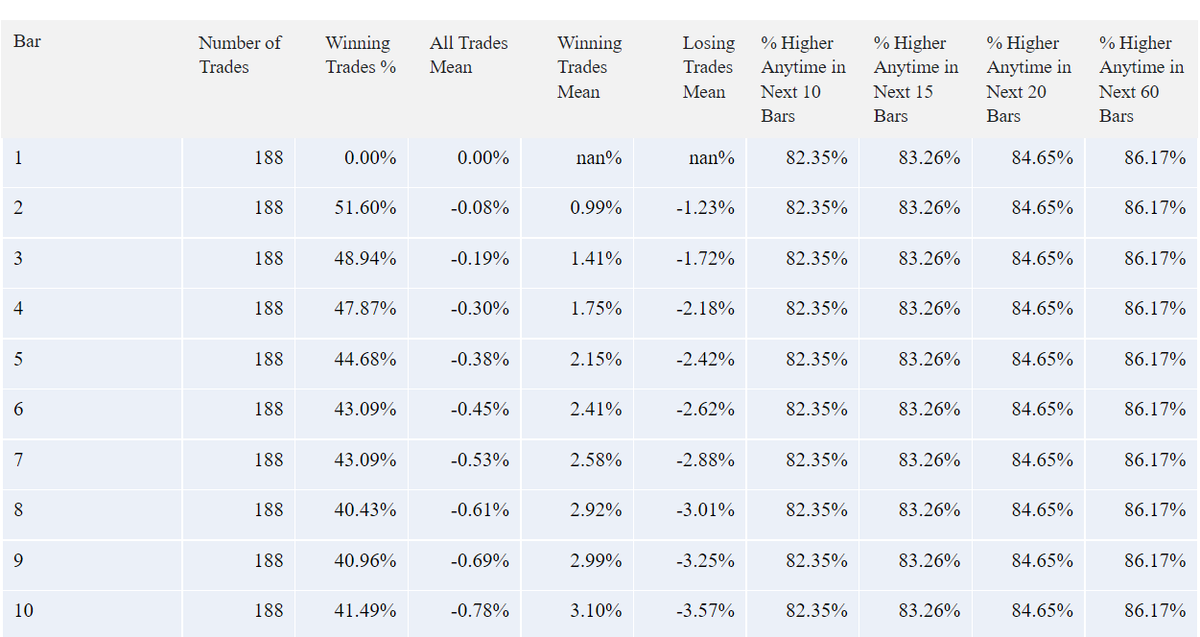

In 2001, each overlapping 10-day period saw the $SPY end higher on day 10 ~41.5% of the time with a mean return of -.78%. During each 10-day period it closed higher at least once 82.35% of the time.

In 2001, each overlapping 10-day period saw the $SPY end higher on day 10 ~41.5% of the time with a mean return of -.78%. During each 10-day period it closed higher at least once 82.35% of the time.

https://twitter.com/bennpeifert/status/1519129080481738753

In our historical dataset.. since about later 2007, backwardation has had stronger relative mean returns, especially about 60 days out, but that relationship is not that strong...

In our historical dataset.. since about later 2007, backwardation has had stronger relative mean returns, especially about 60 days out, but that relationship is not that strong...

https://twitter.com/SqueezeMetrics/status/1516417660292145158?s=20&t=hTpmx8HsHgY6rHTUr8Djbg(1/10) ⬇️ If you aren't familiar with $DIX from ~11'-20', a high print( >.45+) subsequently had strong 60-day mean relative returns on $SPY. The chart below shows the $DIX indicator broken up into deciles. The strongest relative mean returns occurred in the 10th dec. at ~3.5%. (2/10)

Conversely volatility term structure for individual stocks in the S&P500 is mostly in deep contango as measured by the ratio of 30/60 day IV (more blue = more likely in contango and vice-versa)

Conversely volatility term structure for individual stocks in the S&P500 is mostly in deep contango as measured by the ratio of 30/60 day IV (more blue = more likely in contango and vice-versa)

The Y axis is composed of each S&P500 component. The darker the red, the more likely term structured is backwardated for that component, and the darker the blue, more likely in deep contango. Zooming in to recent data looks like this.

The Y axis is composed of each S&P500 component. The darker the red, the more likely term structured is backwardated for that component, and the darker the blue, more likely in deep contango. Zooming in to recent data looks like this.

The chart above shows each component of the S&P500 ranked by it's liquidity score and then sorted from top to bottom each and every day. What is transactional liquidity in the markets and how do we measure it? Pop open the image below

The chart above shows each component of the S&P500 ranked by it's liquidity score and then sorted from top to bottom each and every day. What is transactional liquidity in the markets and how do we measure it? Pop open the image below

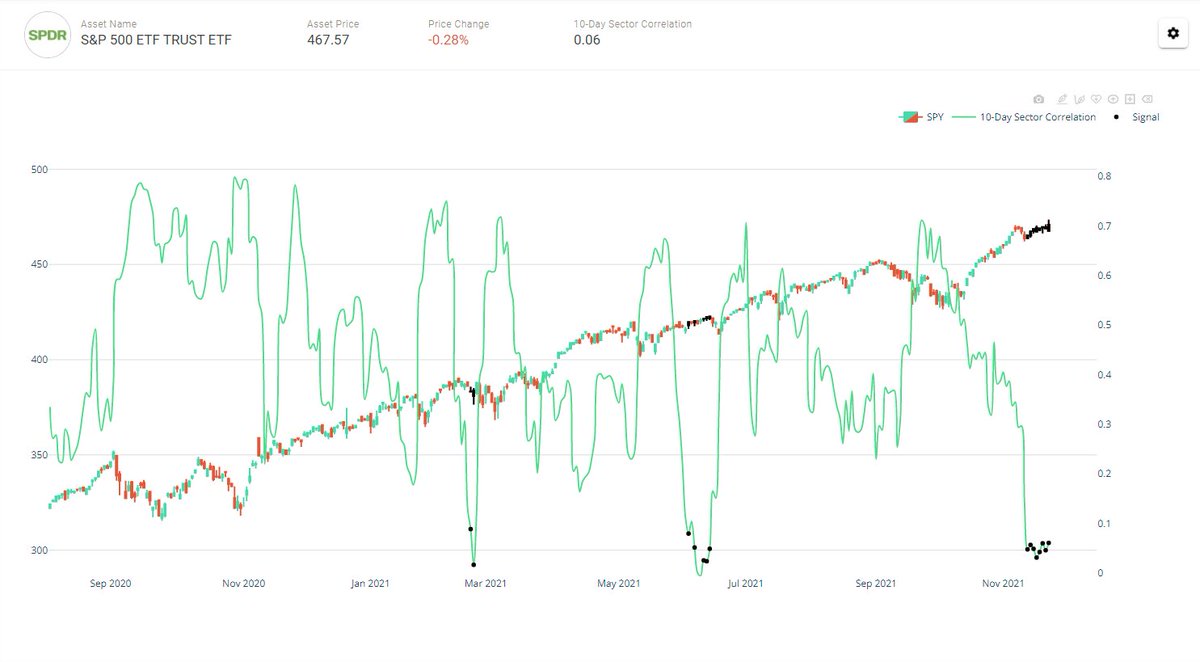

Minor-sell offs that is. Black candles highlight days when the short-term #correlation was between 0 and .1.

Minor-sell offs that is. Black candles highlight days when the short-term #correlation was between 0 and .1.

*Sorry if $VIX % Returns make you mad.

*Sorry if $VIX % Returns make you mad.

https://twitter.com/SqueezeMetrics/status/1438983328850395138?s=20⬇️ Over the next week the S&P500 returned 1.46% on average compared to anytime returns of .31% in the past ~decade. A elevated $DIX did not preclude short term risk capping out at about -5%, historically.