🇰🇷 crypto MFT/HFT. quant research and quant dev. not financial advice. 🔗 https://t.co/HlaqCGWX4w

16 subscribers

How to get URL link on X (Twitter) App

https://x.com/ScottPh77711570/status/1733690323946414377What model should we begin with? Let’s regress forward returns against bollinger score (z-score of closing prices).

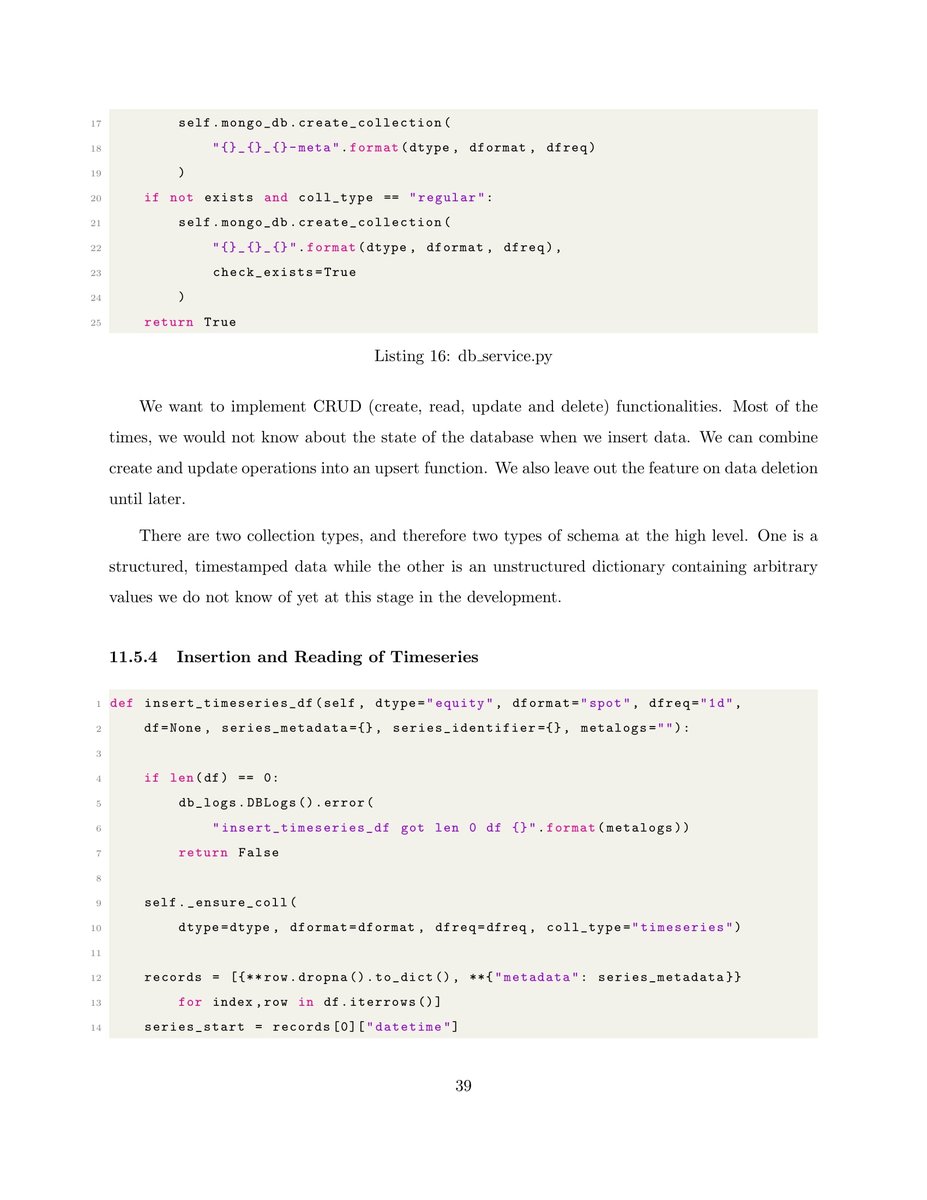

In the next report, we cover topics in asynchronous programming, multi-threading, batch processing, reducing network trips and HTTP handshakes to increase read-write throughput.

In the next report, we cover topics in asynchronous programming, multi-threading, batch processing, reducing network trips and HTTP handshakes to increase read-write throughput.

I would likely show integration with a NoSQL DB (not decided yet). If you like the content and want more free previews of code, please help to share and RT! Love whoring for all the attention I get from strangers :)

I would likely show integration with a NoSQL DB (not decided yet). If you like the content and want more free previews of code, please help to share and RT! Love whoring for all the attention I get from strangers :)