Identifying hated moats | I buy companies when the market panics | Veteran commodity trader turned contrarian investor | Not advice | See my deep dives here 👇

How to get URL link on X (Twitter) App

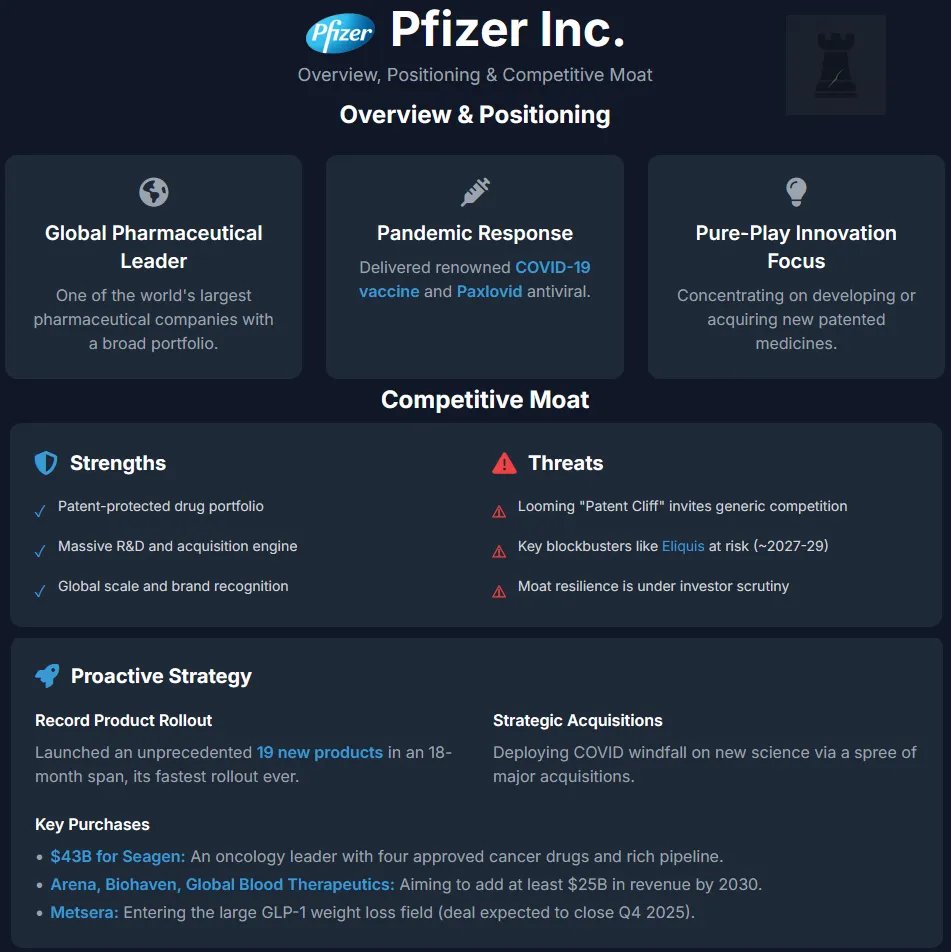

2/ Overview, Positioning and Competitive Moat

2/ Overview, Positioning and Competitive Moat

2/ Overview, Positioning and Competitive Moat

2/ Overview, Positioning and Competitive Moat

2/ Overview, Positioning and Competitive Moat

2/ Overview, Positioning and Competitive Moat

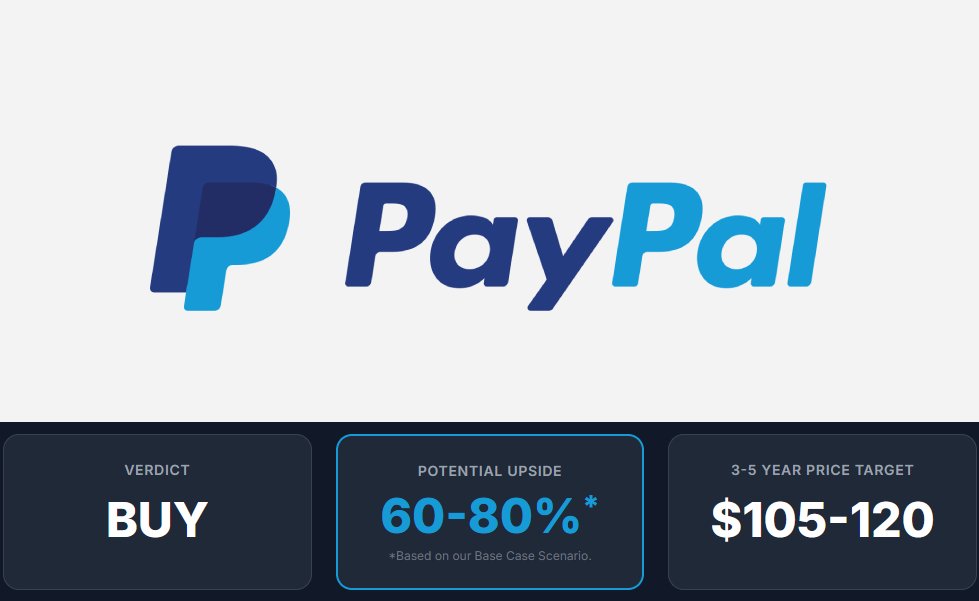

2/ The Deal

2/ The Deal

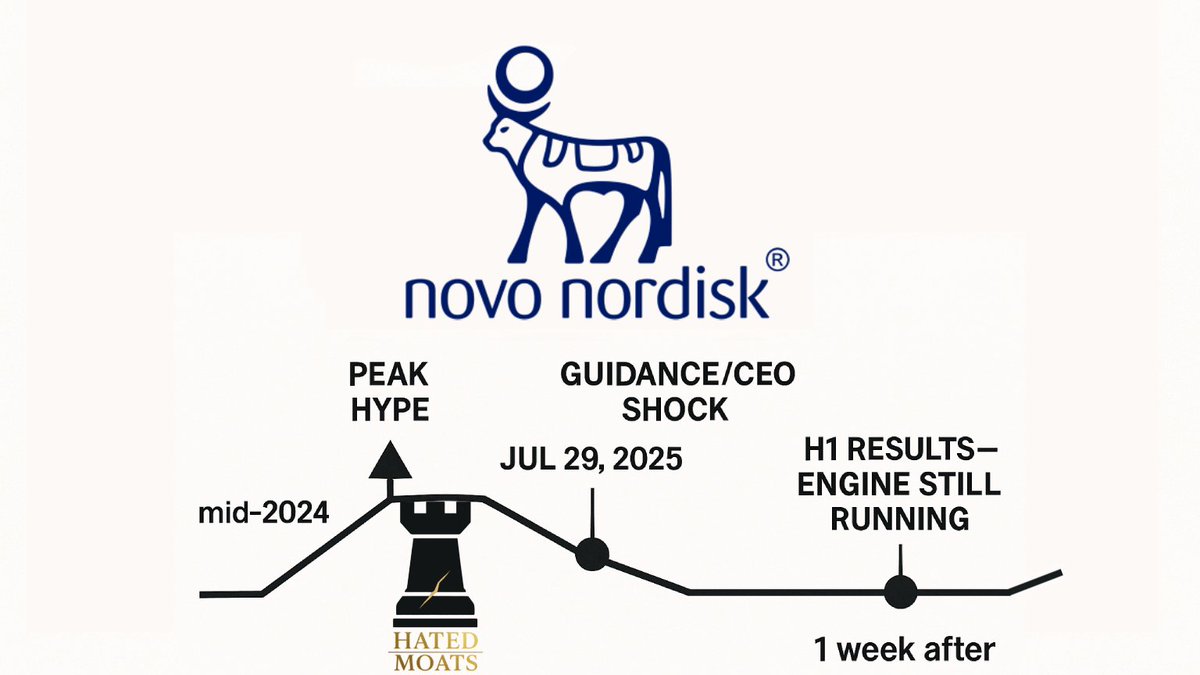

2/ What actually happened?

2/ What actually happened?

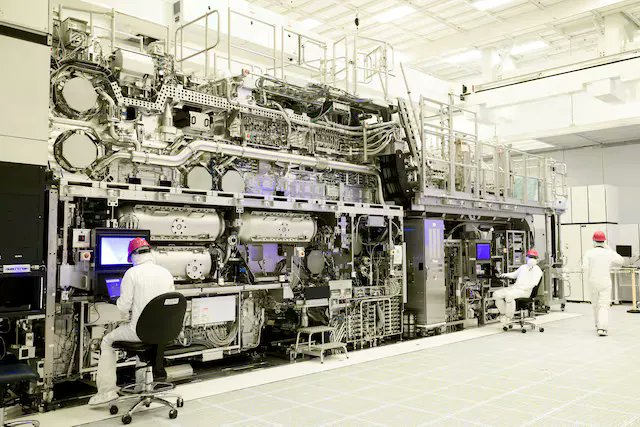

2/ What Is Lithography (in chip-making)?

2/ What Is Lithography (in chip-making)?

2/The Headline

2/The Headline

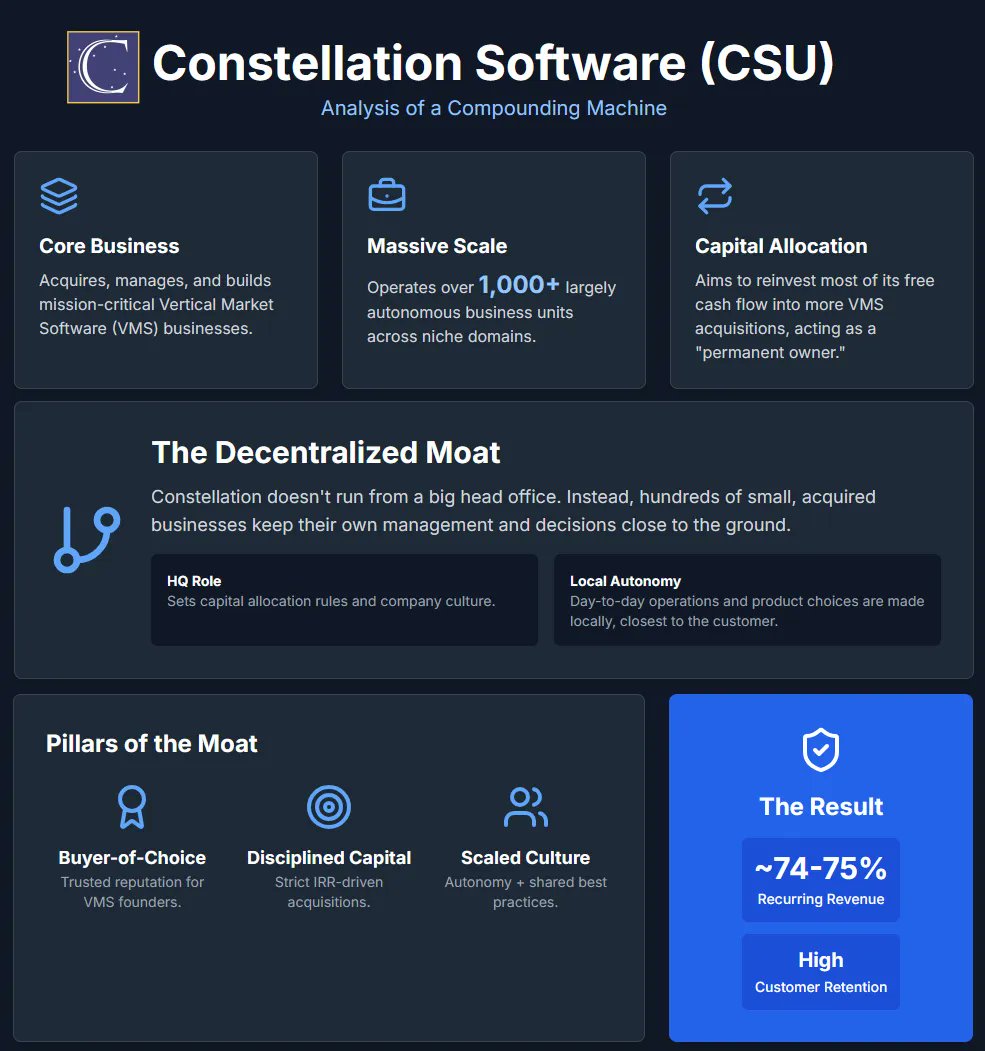

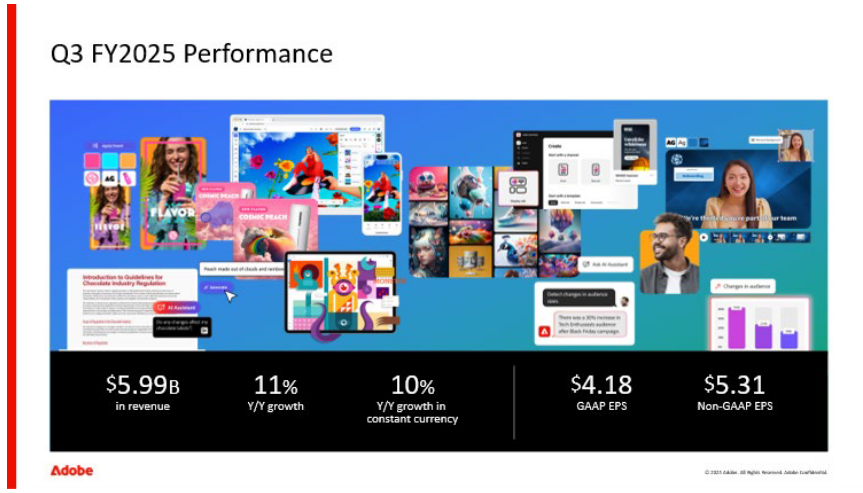

2/ Overview & Competitive Moat

2/ Overview & Competitive Moat

2/ The new STEER study is a real-world evidence (RWE) analysis comparing Wegovy and tirzepatide in patients with obesity and established cardiovascular disease (CVD).

2/ The new STEER study is a real-world evidence (RWE) analysis comparing Wegovy and tirzepatide in patients with obesity and established cardiovascular disease (CVD).

2/ Overview

2/ Overview

The Inception of a Hated Moat

The Inception of a Hated Moat

(2/10)

(2/10)