Watching the markets go up and down for 17 years. Mostly credit and options. Relative value, cap structure arbitrage or simple directional trades via options

How to get URL link on X (Twitter) App

Many traders/investors use Substack to source trading ideas from. This new idea distribution channel is breaking the previously high barrier to entry of private wall street research. There are very clever authors out there putting their everything to produce excellent content.

Many traders/investors use Substack to source trading ideas from. This new idea distribution channel is breaking the previously high barrier to entry of private wall street research. There are very clever authors out there putting their everything to produce excellent content.

@donnelly_brent Under the radar📡:

@donnelly_brent Under the radar📡:

Under the radar📡:

Under the radar📡:

Achieving consistently successful active management has historically proven more difficult within select asset classes, such as among the stocks of large U.S. companies. Active equity managers find it hard to beat their benchmarks

Achieving consistently successful active management has historically proven more difficult within select asset classes, such as among the stocks of large U.S. companies. Active equity managers find it hard to beat their benchmarks

Black swan events (or price shocks) are large changes in price caused by unpredictable and significant events. While most traders don't think about them due to their low probability, they are the most common cause of catastrophic loss.

Black swan events (or price shocks) are large changes in price caused by unpredictable and significant events. While most traders don't think about them due to their low probability, they are the most common cause of catastrophic loss.

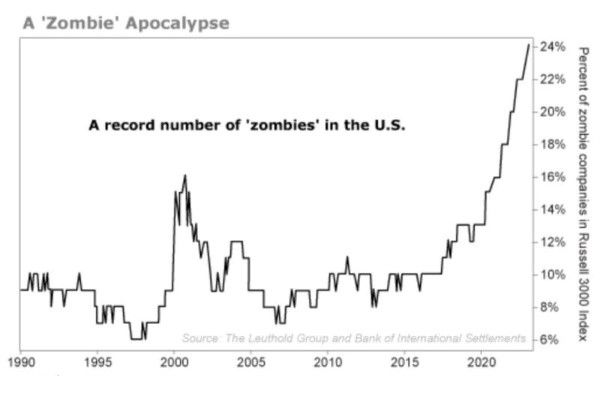

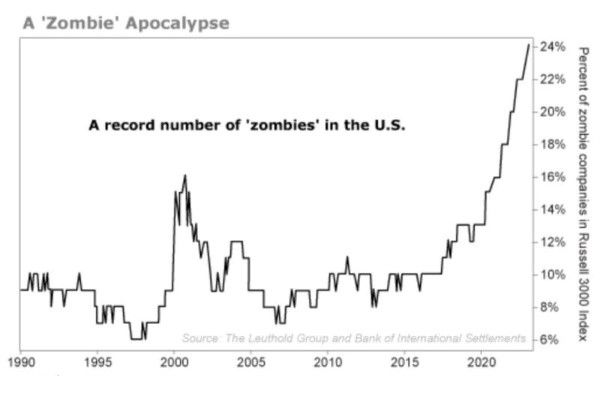

"Zombie" company is defined as one that cannot pay the interest on its debt from operating revenues. The term was applied to Japanese firms supported by Japanese banks during the period known as the Lost Decade

"Zombie" company is defined as one that cannot pay the interest on its debt from operating revenues. The term was applied to Japanese firms supported by Japanese banks during the period known as the Lost Decade