How to get URL link on X (Twitter) App

https://twitter.com/TheIFS/status/17101808388587766601. Full expensing would cost ~£1-3bn for each year it was in place

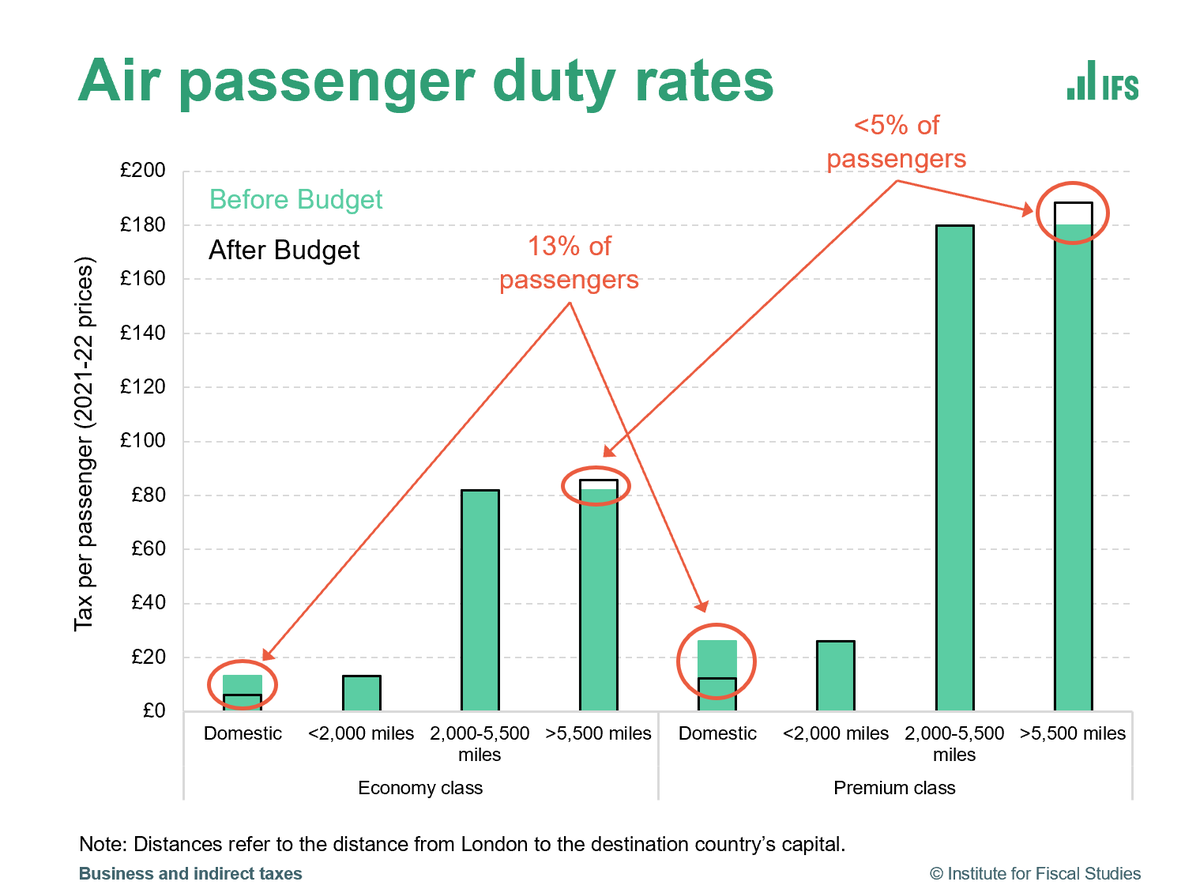

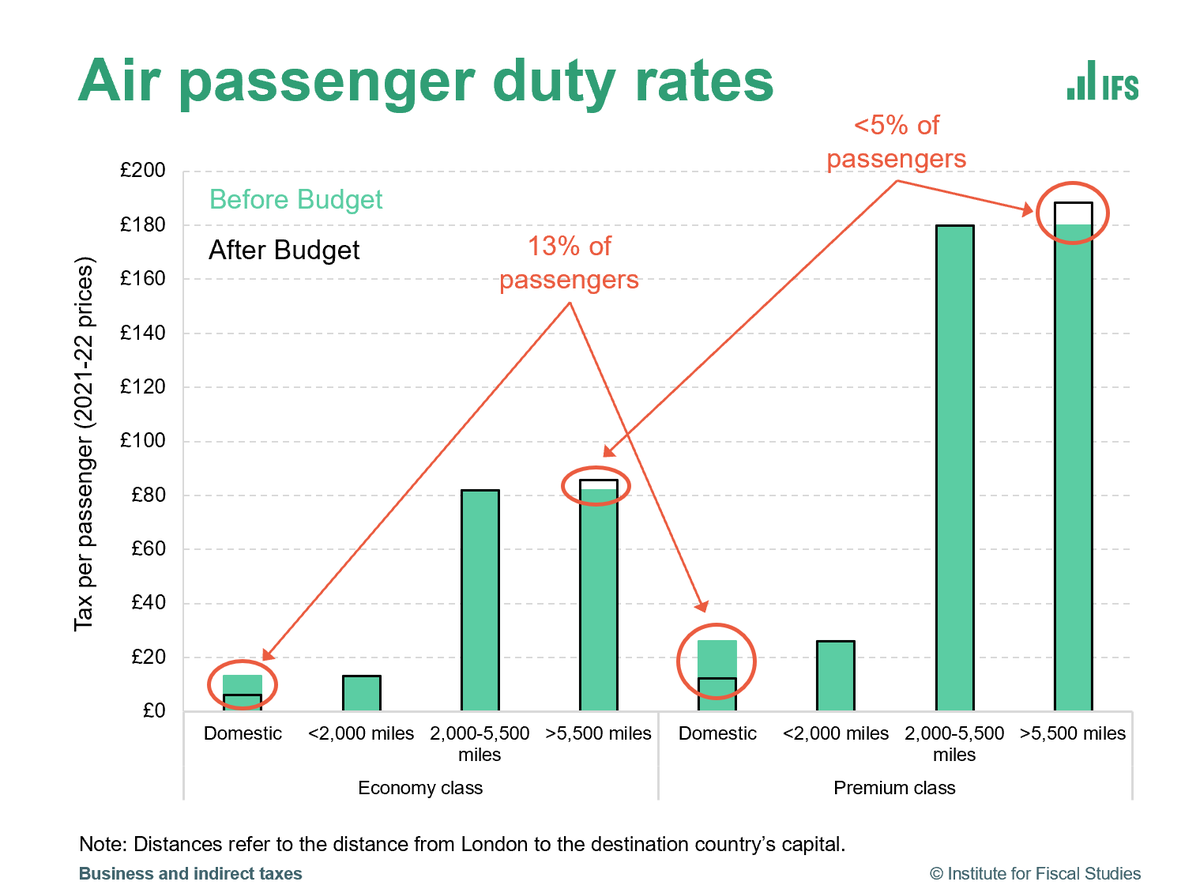

Domestic flights are within UK Emissions Trading Scheme. This puts a cap on emissions from things covered. BROADLY, more emissions from domestic aviation -> more demand for permits -> higher ETS prices -> lower emissions elsewhere. Overall emissions within ETS unchanged. 2/n

Domestic flights are within UK Emissions Trading Scheme. This puts a cap on emissions from things covered. BROADLY, more emissions from domestic aviation -> more demand for permits -> higher ETS prices -> lower emissions elsewhere. Overall emissions within ETS unchanged. 2/n

86% of employees now have at least 80% of their net income replaced when out of work. Was 10% before recent covid measures. Self-employed have seen some increase in the social safety net via increases in generosity of universal credit, but small in comparison 2/n

86% of employees now have at least 80% of their net income replaced when out of work. Was 10% before recent covid measures. Self-employed have seen some increase in the social safety net via increases in generosity of universal credit, but small in comparison 2/n

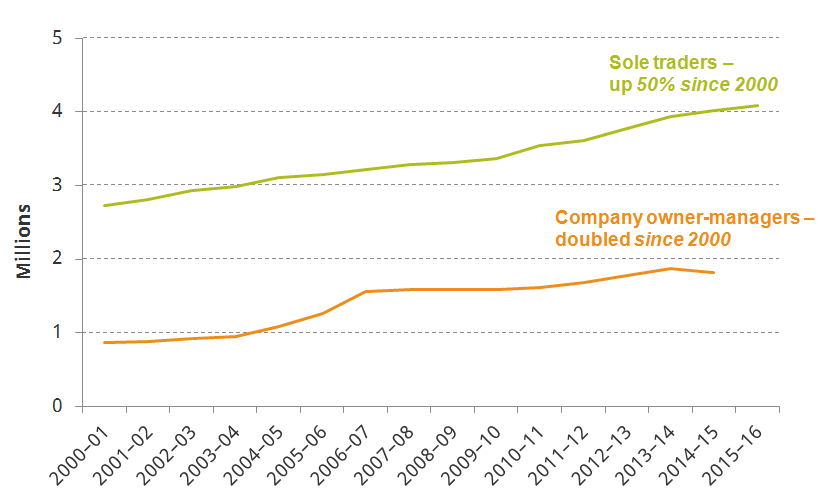

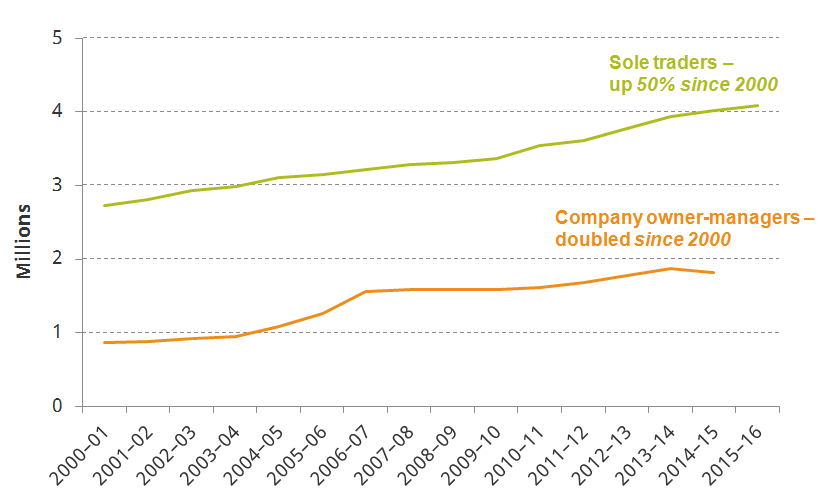

More people try self-employment than aggregate numbers suggest – annual growth in sole traders results from huge entry & exit. Between 2011-2015, ~2.4 million sole traders operated each year but ~6m people tried self-employed at some point. Self employed are not a fixed group 2/n

More people try self-employment than aggregate numbers suggest – annual growth in sole traders results from huge entry & exit. Between 2011-2015, ~2.4 million sole traders operated each year but ~6m people tried self-employed at some point. Self employed are not a fixed group 2/n

Paper uses UK corporate tax records matched to company accounts to ask how much tax MNEs avoid. Great question, cool data. (Can see what's on UK corp tax form here assets.publishing.service.gov.uk/government/upl…) 2/

Paper uses UK corporate tax records matched to company accounts to ask how much tax MNEs avoid. Great question, cool data. (Can see what's on UK corp tax form here assets.publishing.service.gov.uk/government/upl…) 2/