Value investor || Author of a Real-money Investment Newsletter || Value ideas in less researched markets || Subscribe below 👇

6 subscribers

How to get URL link on X (Twitter) App

✅At the same time, Sirius charges more for its monthly subscription than Netflix (avg ARPU is $15 vs $12).

✅At the same time, Sirius charges more for its monthly subscription than Netflix (avg ARPU is $15 vs $12).

3⃣ "A second and more subtle version of expectations revisions happens when companies sustain an ROIC in excess of WACC for longer than the market anticipates. Investors commonly call the stocks of these companies “compounders.” Research shows that these stocks generate higher total shareholder returns, adjusted for risk, than what standard asset-pricing models would suggest."

3⃣ "A second and more subtle version of expectations revisions happens when companies sustain an ROIC in excess of WACC for longer than the market anticipates. Investors commonly call the stocks of these companies “compounders.” Research shows that these stocks generate higher total shareholder returns, adjusted for risk, than what standard asset-pricing models would suggest."

2️⃣ “If your valuation technique has become mainly financial modelling, with extrapolation of past data, AI can do it quicker, and with far fewer errors than you can. If, however, your valuations are built around a business story, enriched with soft data, AI will have a tougher time replicating what you do.”

2️⃣ “If your valuation technique has become mainly financial modelling, with extrapolation of past data, AI can do it quicker, and with far fewer errors than you can. If, however, your valuations are built around a business story, enriched with soft data, AI will have a tougher time replicating what you do.”

✅ “While the timeline of each cycle is highly uncertain, the vast majority have eventually succumbed to new entrants. Some have gone to zero; some are still relevant today but have underperformed the broader market.”

✅ “While the timeline of each cycle is highly uncertain, the vast majority have eventually succumbed to new entrants. Some have gone to zero; some are still relevant today but have underperformed the broader market.”

2️⃣ “The second massively disinflationary force, beginning in 1979, was from China, which faced a similar economic circumstance and was likewise in desperate need of foreign exchange. Lacking commodities to sell, the country could only offer the world market its greatest resource: human capital. That extremely low-cost 1-billion-person labor pool enabled a massive global labor arbitrage.”

2️⃣ “The second massively disinflationary force, beginning in 1979, was from China, which faced a similar economic circumstance and was likewise in desperate need of foreign exchange. Lacking commodities to sell, the country could only offer the world market its greatest resource: human capital. That extremely low-cost 1-billion-person labor pool enabled a massive global labor arbitrage.”

2⃣ $RNR- $11.8B mkt cap, 5.1x P/E, ROE - 25% (Debt/Equity - 0.2). The investment portfolio of $29.6B has a 5.8% yield with a 2.6-year duration. In November, RenRe closed on the purchase of Validus Re, the reinsurance business of AIG. It paid about $2.98B, or 1.14x book. In Q1, Validus was able to raise prices about 8% year over year. In the regular RenRe business, the company raised catastrophe reinsurance prices by about 20%.

2⃣ $RNR- $11.8B mkt cap, 5.1x P/E, ROE - 25% (Debt/Equity - 0.2). The investment portfolio of $29.6B has a 5.8% yield with a 2.6-year duration. In November, RenRe closed on the purchase of Validus Re, the reinsurance business of AIG. It paid about $2.98B, or 1.14x book. In Q1, Validus was able to raise prices about 8% year over year. In the regular RenRe business, the company raised catastrophe reinsurance prices by about 20%.

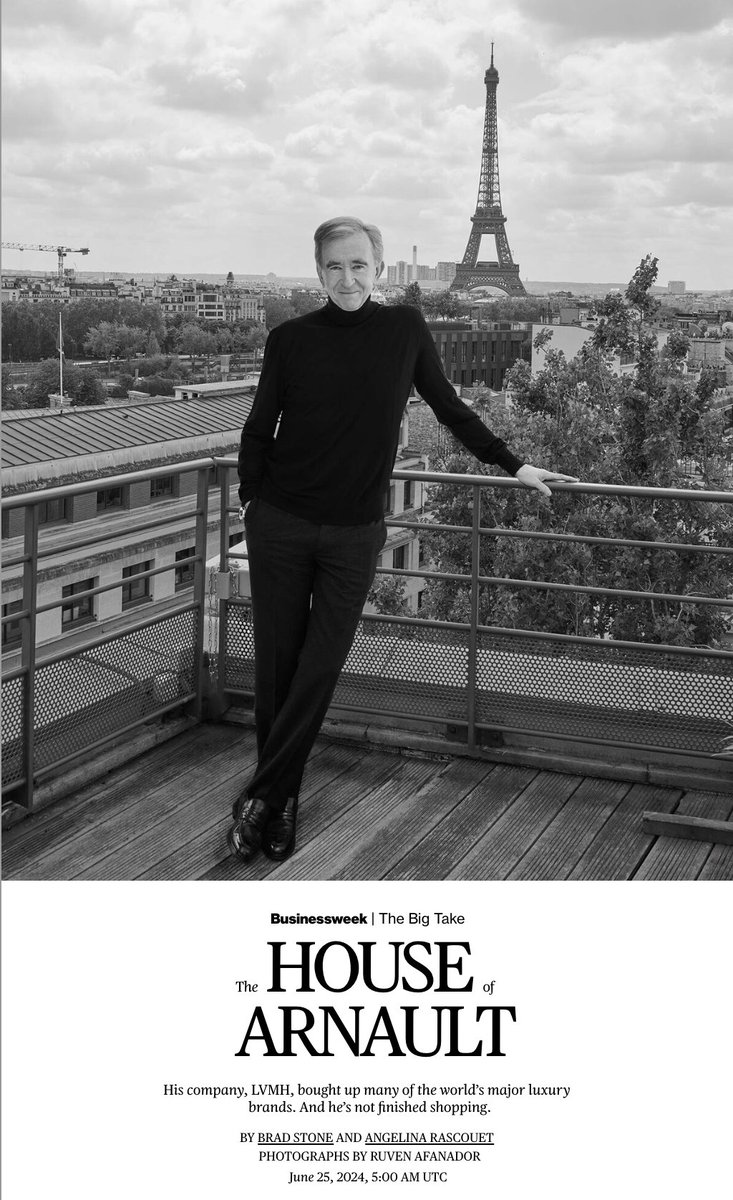

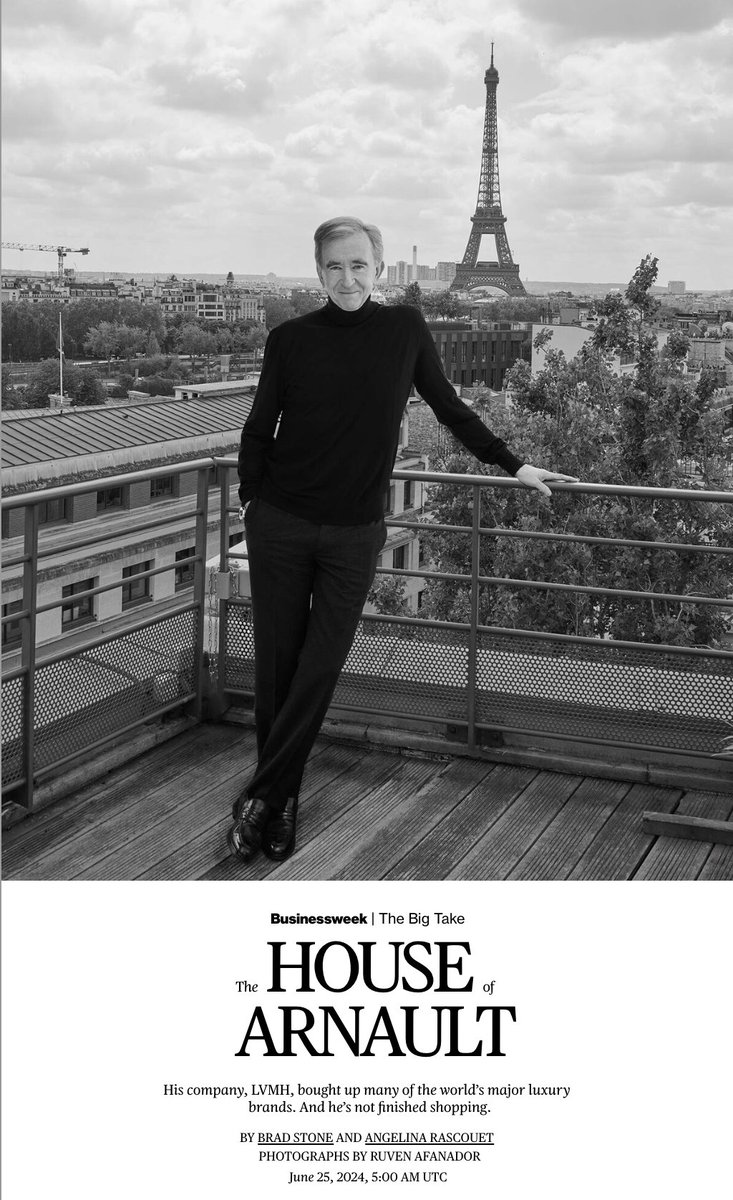

✅Arnault has dressed royals and presidents, supermodels and celebrities. Perhaps more than anyone else, he’s made the clothes and accessories that signify status among the global elite—and project a bit of their insecurity, too.

✅Arnault has dressed royals and presidents, supermodels and celebrities. Perhaps more than anyone else, he’s made the clothes and accessories that signify status among the global elite—and project a bit of their insecurity, too.

➡️On AI:

➡️On AI:

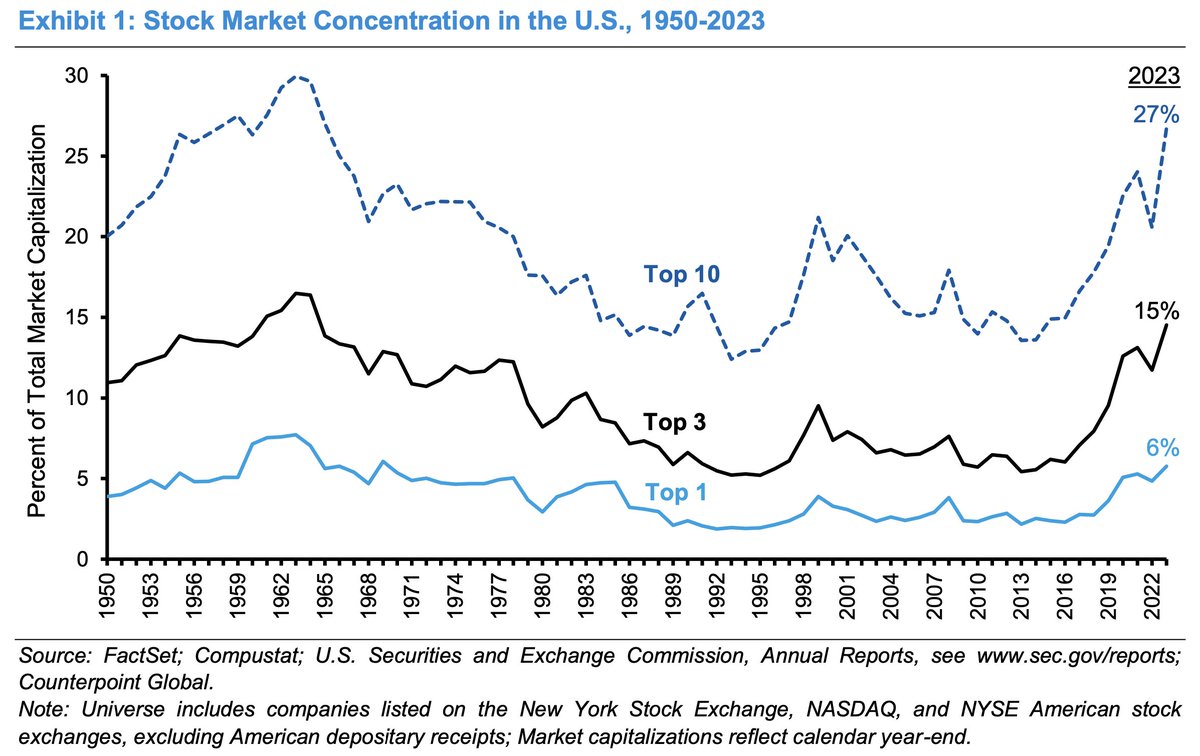

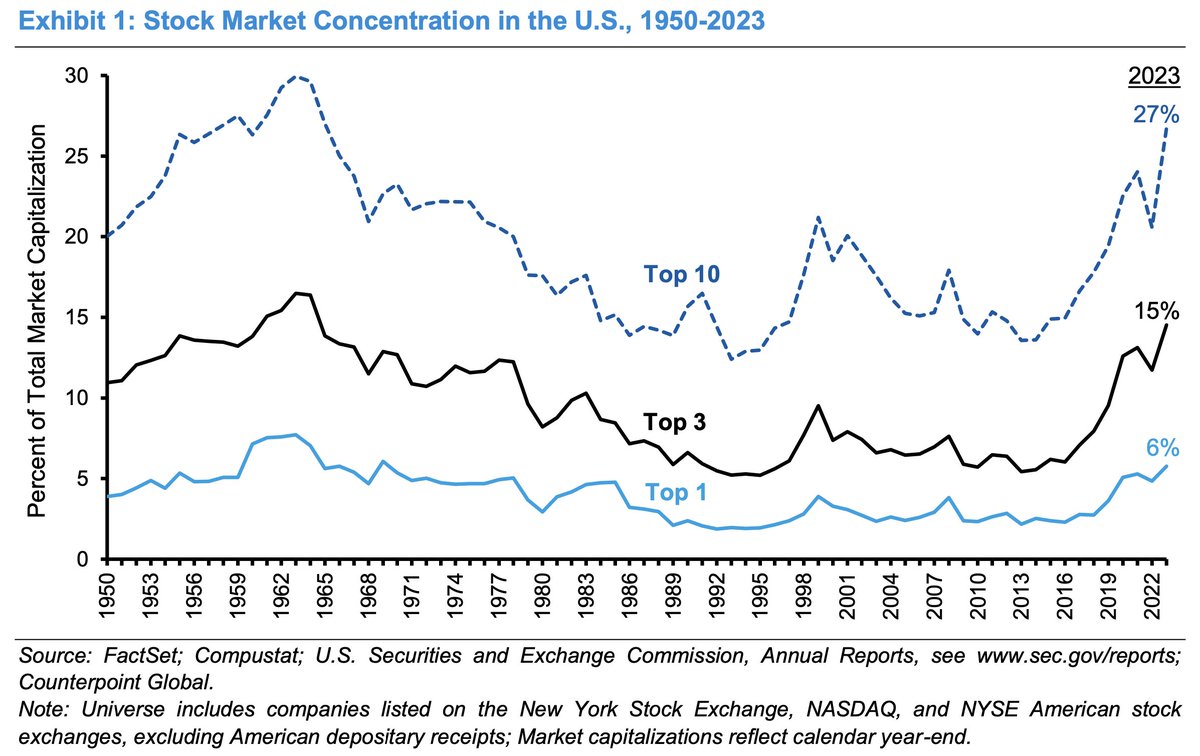

✅"The S&P 500 has delivered returns above the average when concentration was rising and below the average when concentration was falling."

✅"The S&P 500 has delivered returns above the average when concentration was rising and below the average when concentration was falling."

2️⃣ “ Most people are biased towards confirmation, to embrace the positive feedback of a share price going up. Rising prices (and, with the benefit of hindsight, peak valuations) imply successful approaches and quality companies.”

2️⃣ “ Most people are biased towards confirmation, to embrace the positive feedback of a share price going up. Rising prices (and, with the benefit of hindsight, peak valuations) imply successful approaches and quality companies.”

"If we were all sitting here in 1999 talking about the Internet, I don’t think anybody would have estimated it would be as big as it got in 20 years. And yet, if you bought the Nasdaq in ’99, it went down 80% before that all came to fruition. That’s not going to happen with AI. But it could rhyme – AI could rhyme with the Internet as we go through all this capital spending we need to do. The big payoff might be four to five years from now. So AI might be a little overhyped now but under-hyped long term."

"If we were all sitting here in 1999 talking about the Internet, I don’t think anybody would have estimated it would be as big as it got in 20 years. And yet, if you bought the Nasdaq in ’99, it went down 80% before that all came to fruition. That’s not going to happen with AI. But it could rhyme – AI could rhyme with the Internet as we go through all this capital spending we need to do. The big payoff might be four to five years from now. So AI might be a little overhyped now but under-hyped long term."

✅ Almost half of companies have launched buybacks - record high.

✅ Almost half of companies have launched buybacks - record high.

2⃣ $KOS - 5x PE / 20% FCF yield. Additional LNG assets that will start contributing later ($3 a share, 50% of the current price). Plans to reduce debt first, then launch buyback later.

2⃣ $KOS - 5x PE / 20% FCF yield. Additional LNG assets that will start contributing later ($3 a share, 50% of the current price). Plans to reduce debt first, then launch buyback later.

2 | “The internal wealth gap and the resulting conflict over wealth and values are intensifying, which is fear-inducing.”

2 | “The internal wealth gap and the resulting conflict over wealth and values are intensifying, which is fear-inducing.”

➡️How NOT to beat the market

➡️How NOT to beat the market

"Russia was a large market in 1900, accounting for some 6% of world capitalization. Austria-Hungary was also large in 1900 (5% of world capitalization) and, while investors didn’t experience total losses, in real terms, it was the worst-performing equity market and the second worst-performing bond market of our 21 countries with continuous investment histories."

"Russia was a large market in 1900, accounting for some 6% of world capitalization. Austria-Hungary was also large in 1900 (5% of world capitalization) and, while investors didn’t experience total losses, in real terms, it was the worst-performing equity market and the second worst-performing bond market of our 21 countries with continuous investment histories."