Creator | Time & Price | SnR | Building The Kaizen Principle (TKP) | Consistency Beats Intensity💛 | Telegram: https://t.co/z1juBWlm7I

How to get URL link on X (Twitter) App

Join my telegram community here where I share my trade directional bias :

Join my telegram community here where I share my trade directional bias :

Every move starts in a box.

Every move starts in a box.

Confirmation isn’t “I saw a candle, so I jumped in.”

Confirmation isn’t “I saw a candle, so I jumped in.”

Price moves from Internal Range Liquidity → External Range Liquidity and vice versa.

Price moves from Internal Range Liquidity → External Range Liquidity and vice versa.

What is an engulfing candle?

What is an engulfing candle?

Support and Resistance (SnR) is the first concept most traders learn.

Support and Resistance (SnR) is the first concept most traders learn.

Let’s be honest most traders are frustrated.

Let’s be honest most traders are frustrated.

I used to think I had a strategy problem.

I used to think I had a strategy problem.

First, what is bias?

First, what is bias?

First, let’s be real what’s an engulfing candle?

First, let’s be real what’s an engulfing candle?

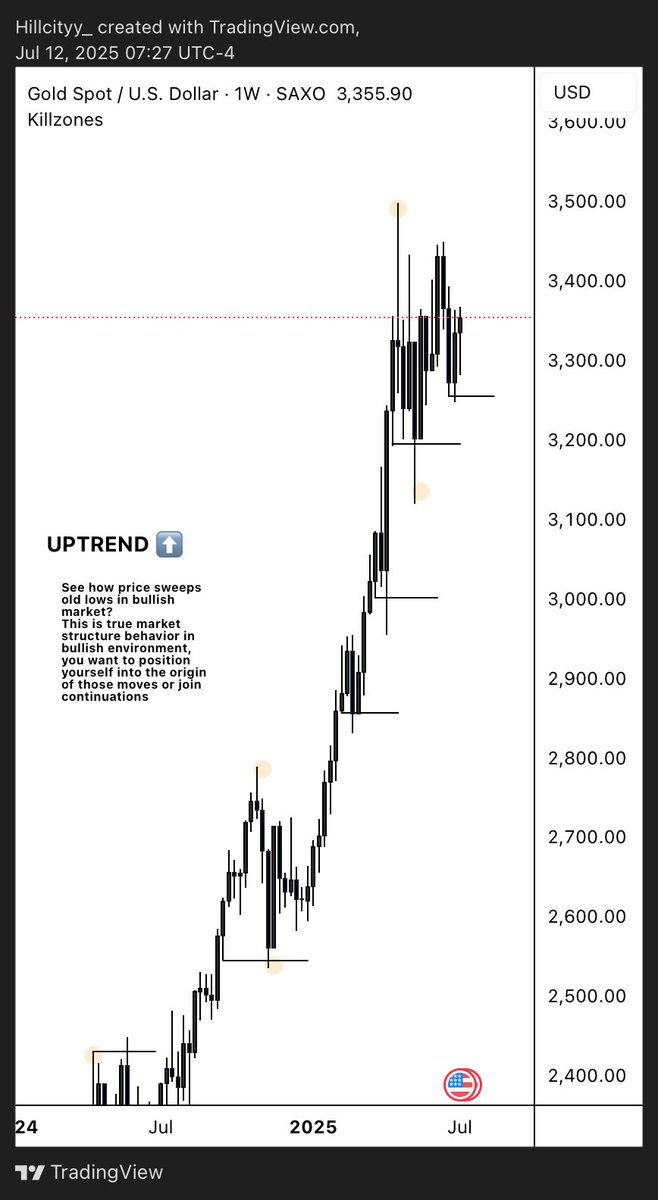

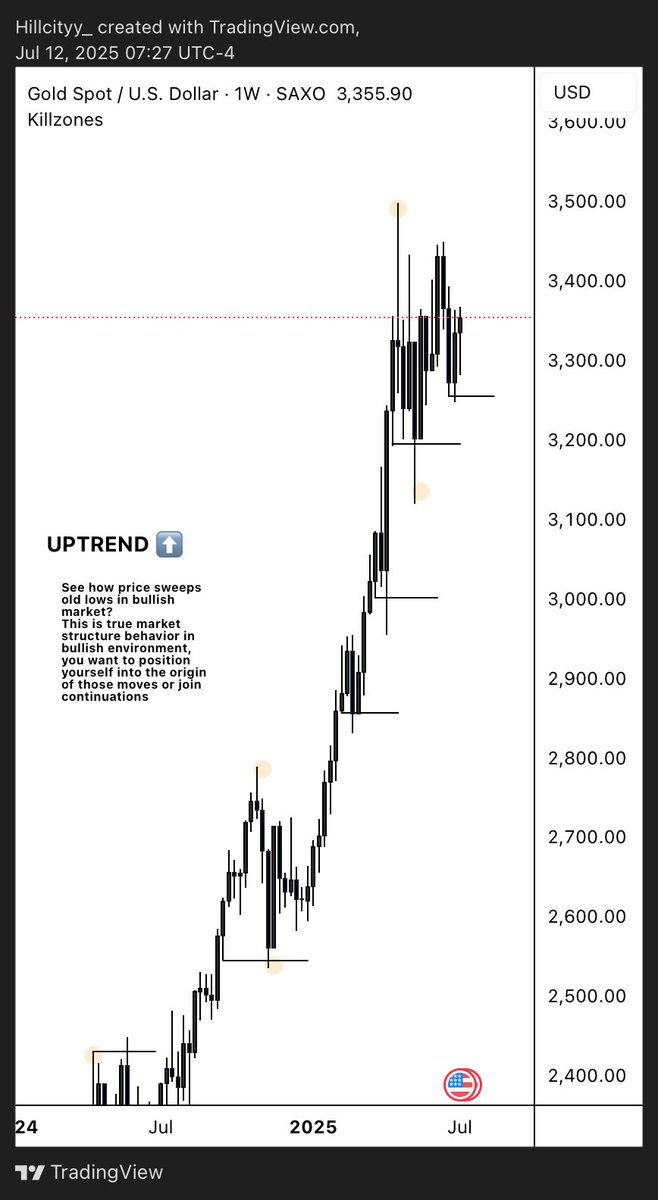

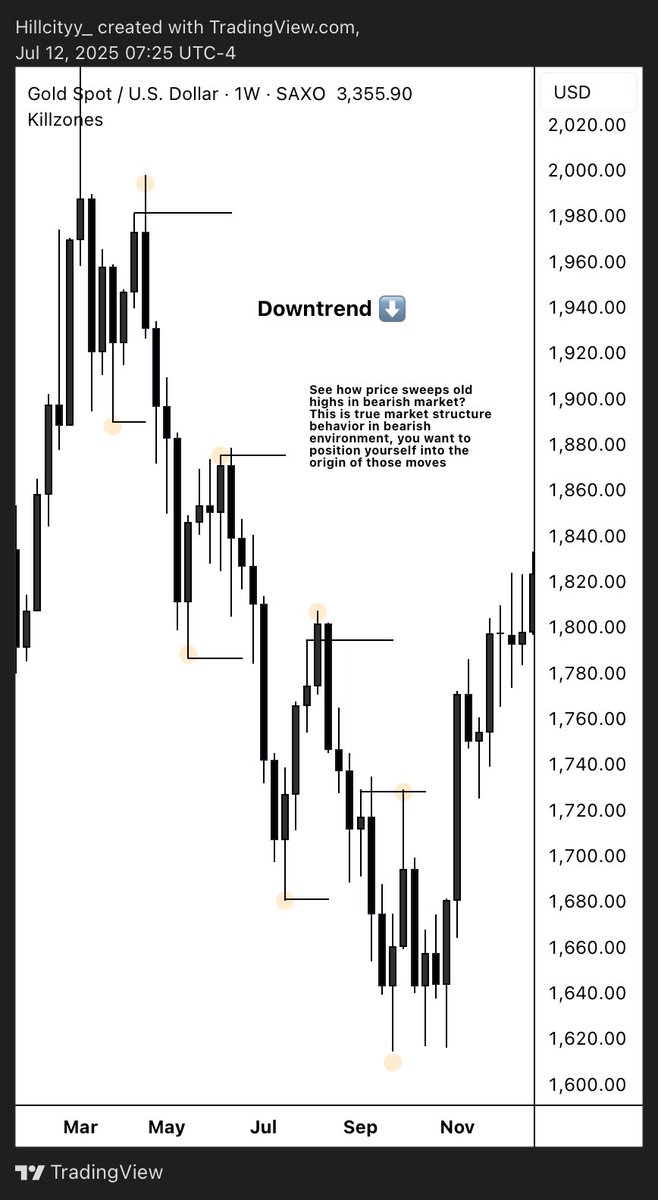

Most traders only look for reversals.

Most traders only look for reversals.

First – kill the noise.

First – kill the noise.

Let’s be honest.

Let’s be honest.

First, let’s clear the confusion.

First, let’s clear the confusion.

Let me tell you a harsh truth.

Let me tell you a harsh truth.

First, let’s get this straight.

First, let’s get this straight.

First, what is a fakeout?

First, what is a fakeout?

1. Stop marking lines.

1. Stop marking lines.