📉Stock trader & educator. 1.3M subs YouTube

👇🏼 Get my free weekly stock watchlist

How to get URL link on X (Twitter) App

1/ Why I stopped scalping and why everyone's so upset about it

1/ Why I stopped scalping and why everyone's so upset about it

📖 What is swing trading?

📖 What is swing trading?

1️⃣There’s no such thing as income stability

1️⃣There’s no such thing as income stability

1️⃣ VWAP 101: What Is VWAP?

1️⃣ VWAP 101: What Is VWAP?

But first... should you even use indicators? The answer is not so simple.

But first... should you even use indicators? The answer is not so simple.

1️⃣ 5:00 - 9:30 AM: Premarket Prep - NO Trading

1️⃣ 5:00 - 9:30 AM: Premarket Prep - NO Trading

Step 1: Find Large-Cap Stocks Gapping Up Premarket 🚀

Step 1: Find Large-Cap Stocks Gapping Up Premarket 🚀

1/ The golden rule of risk

1/ The golden rule of risk

1️⃣ Charting shouldn't feel like a coloring book

1️⃣ Charting shouldn't feel like a coloring book

2/ First, the harsh truth about day trading.

2/ First, the harsh truth about day trading.

1/ ❌ Reason #1: Jumping From One Strategy to Another (Shiny Object Syndrome)

1/ ❌ Reason #1: Jumping From One Strategy to Another (Shiny Object Syndrome)

1/ The Pros and Cons of Swing Trading

1/ The Pros and Cons of Swing Trading

1️⃣ Master Risk Management on Small Caps 📉

1️⃣ Master Risk Management on Small Caps 📉

1/ My Overall #1 Pick for the Best Trading Broker for US Traders: CenterPoint Securities @CenterPointSec

1/ My Overall #1 Pick for the Best Trading Broker for US Traders: CenterPoint Securities @CenterPointSec

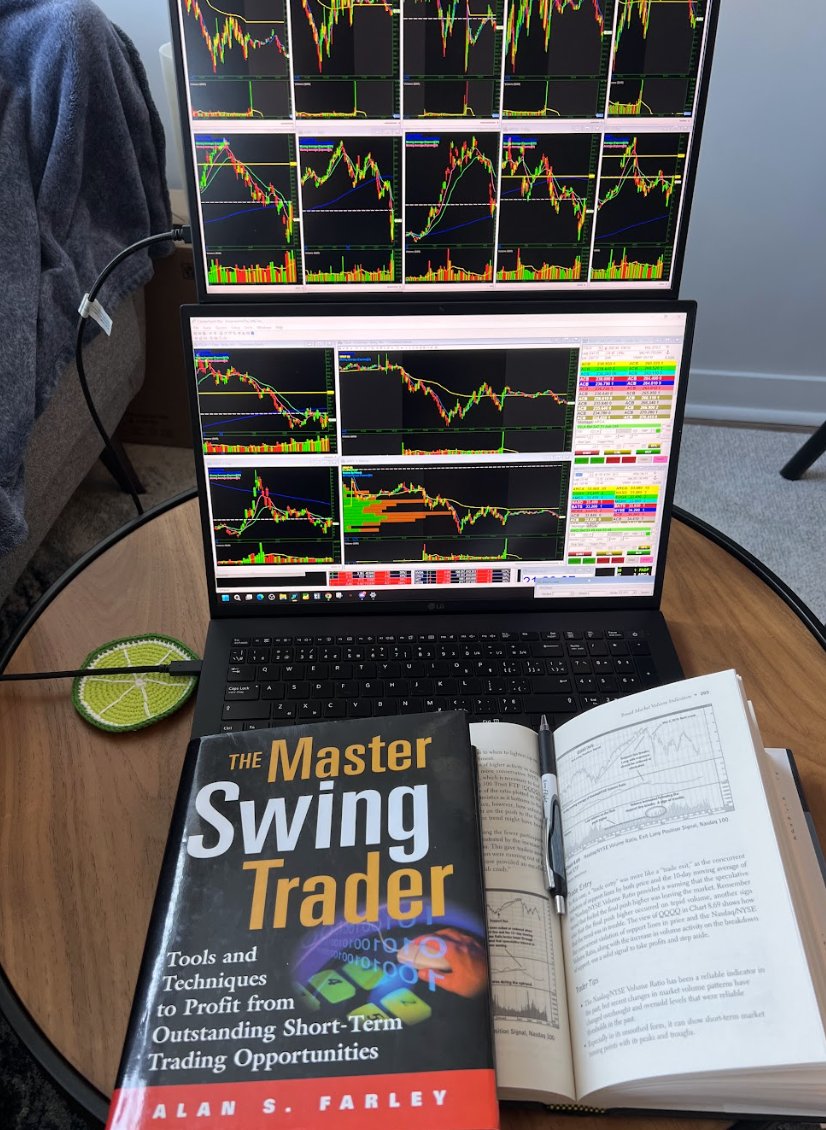

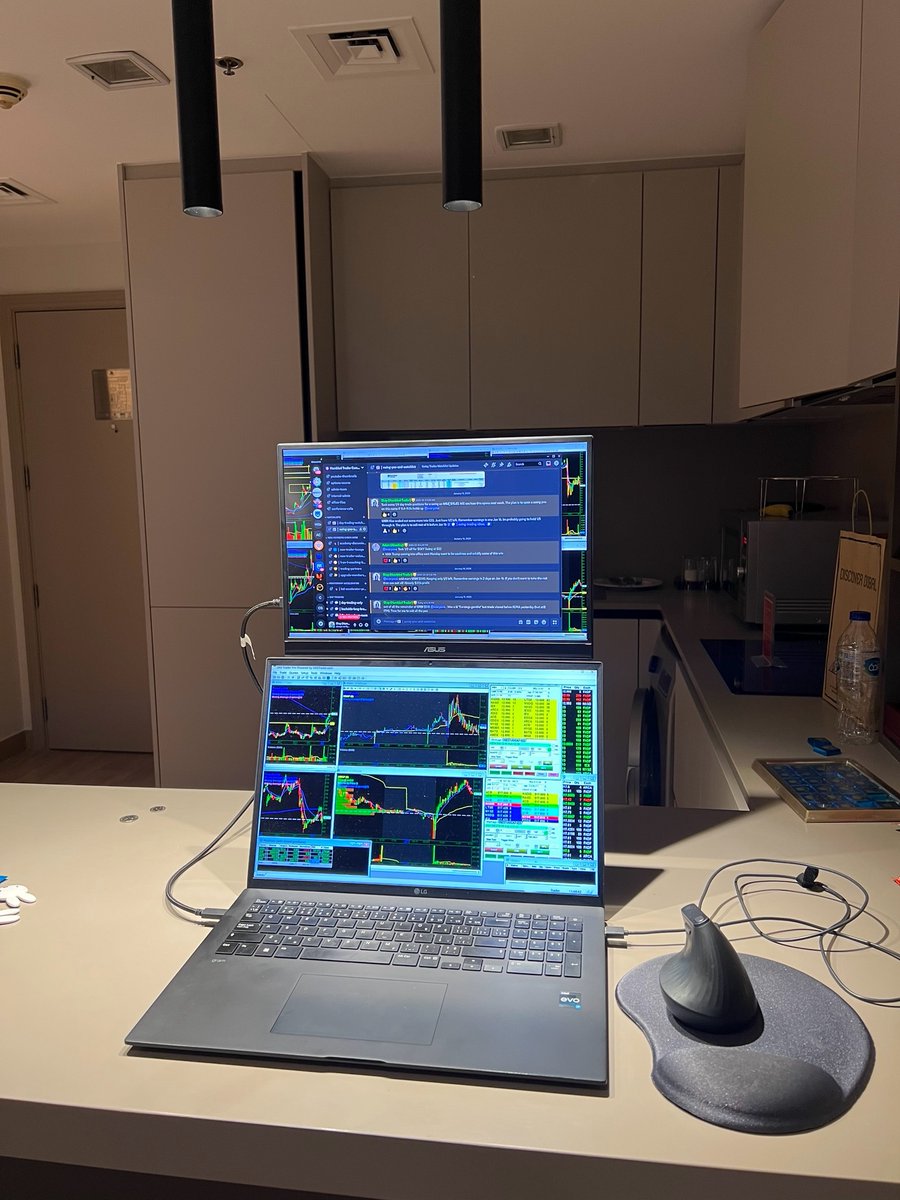

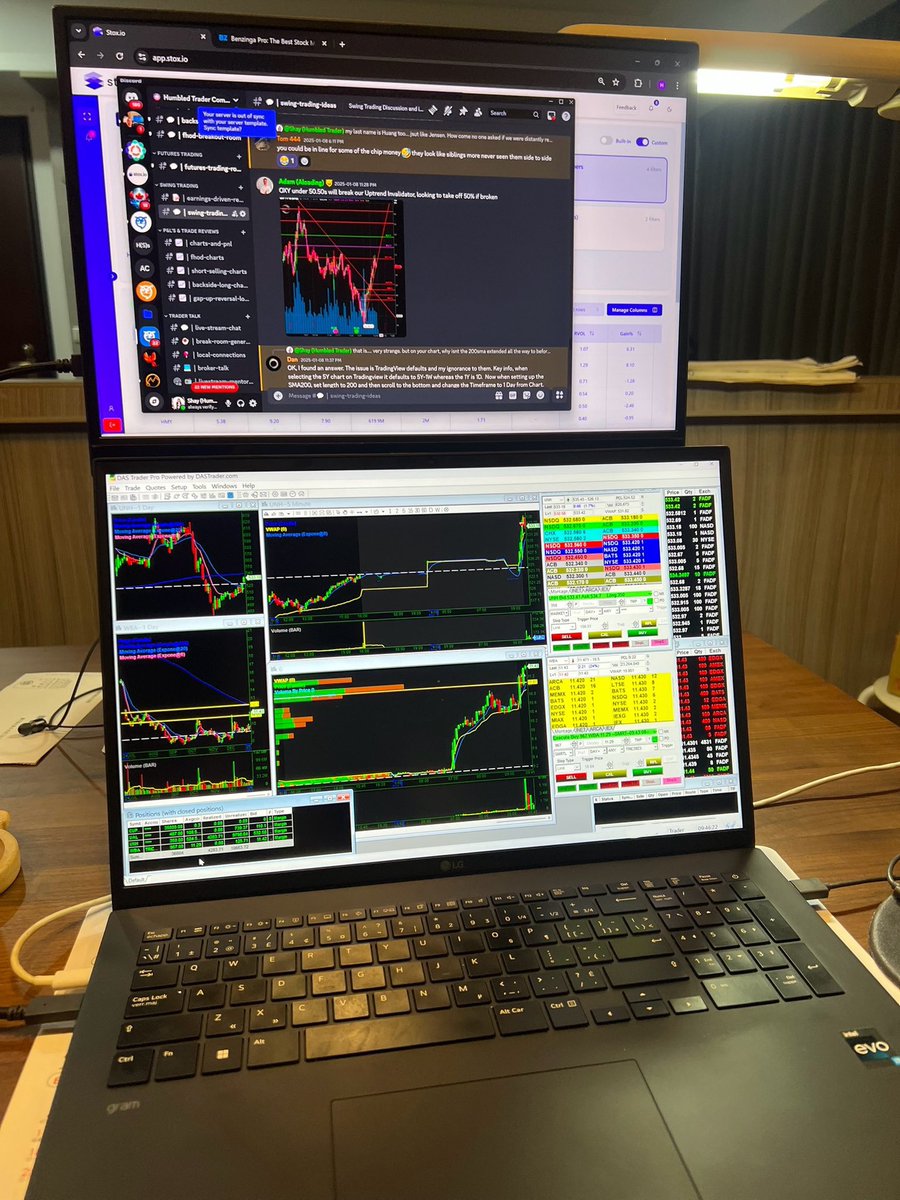

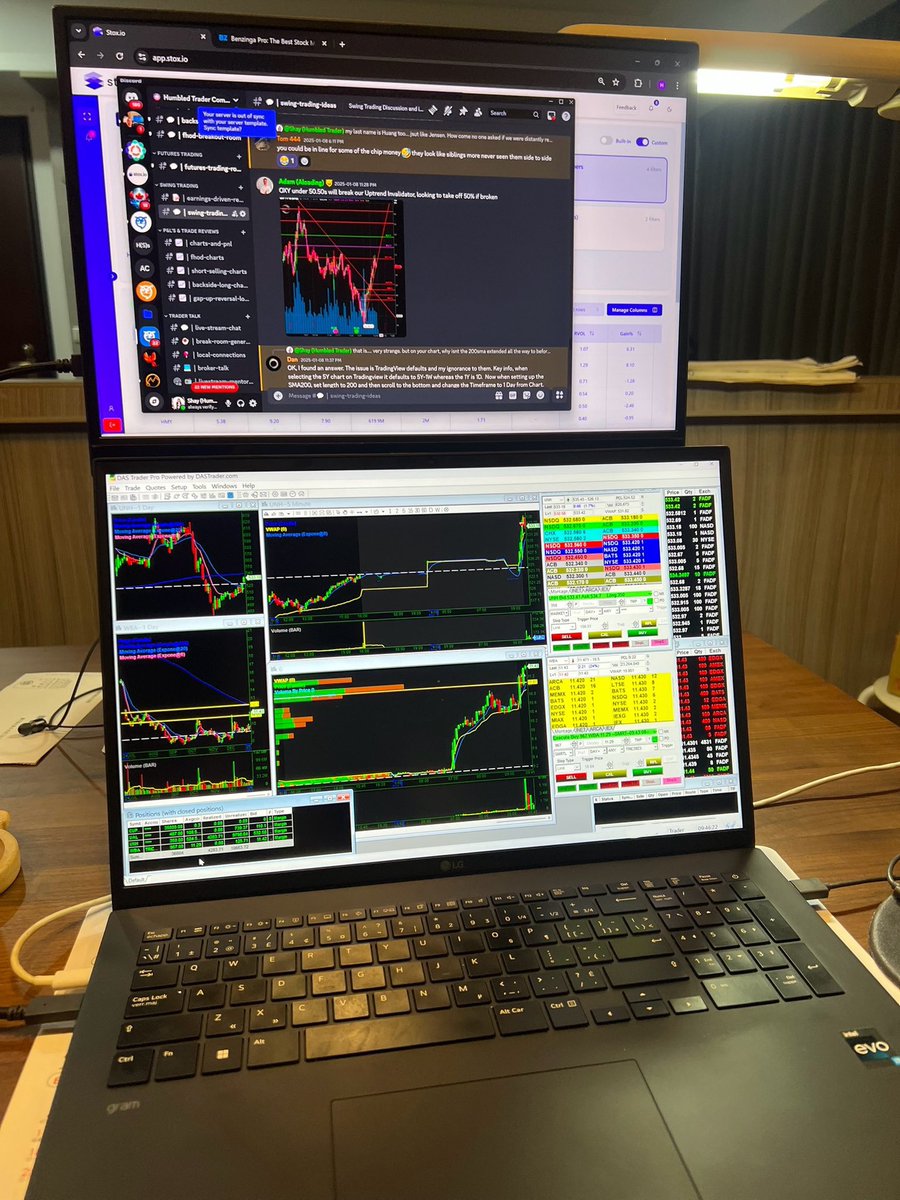

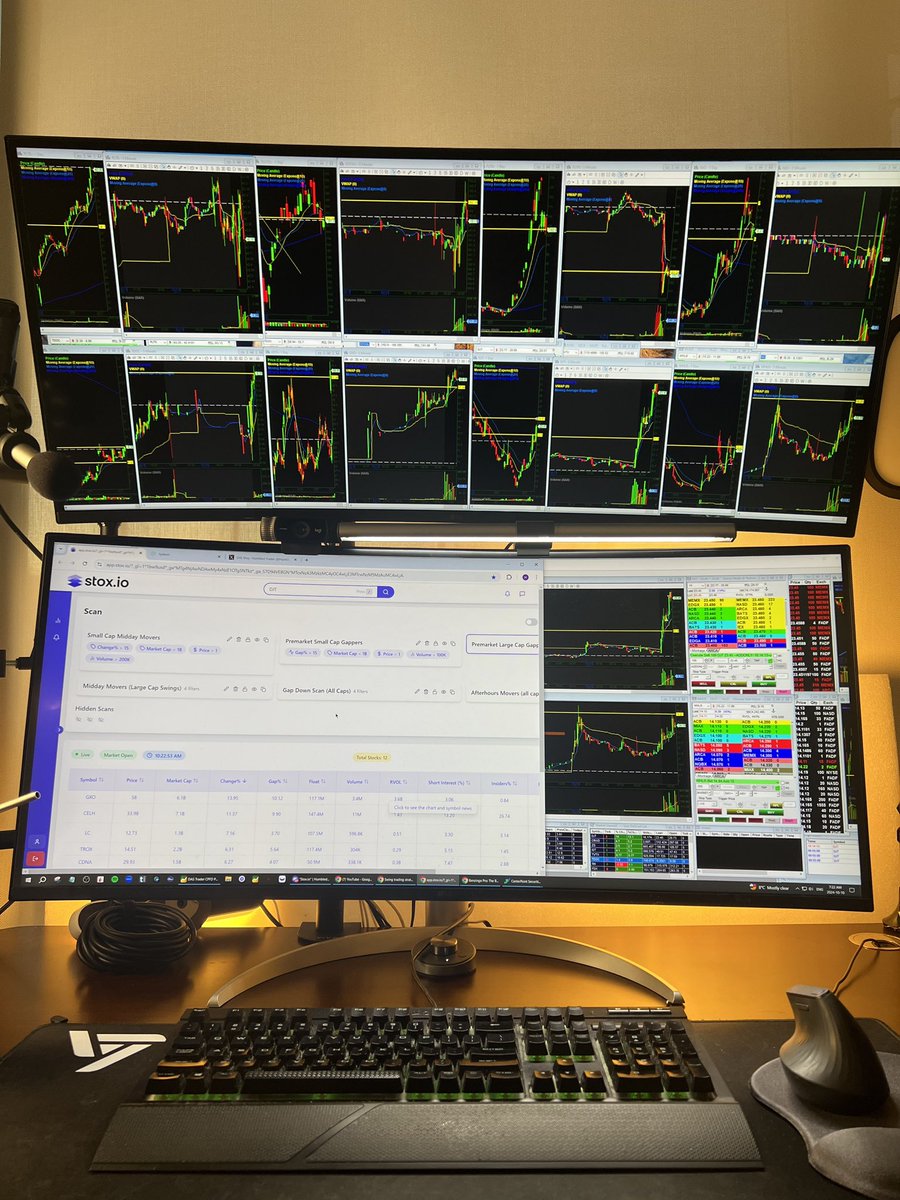

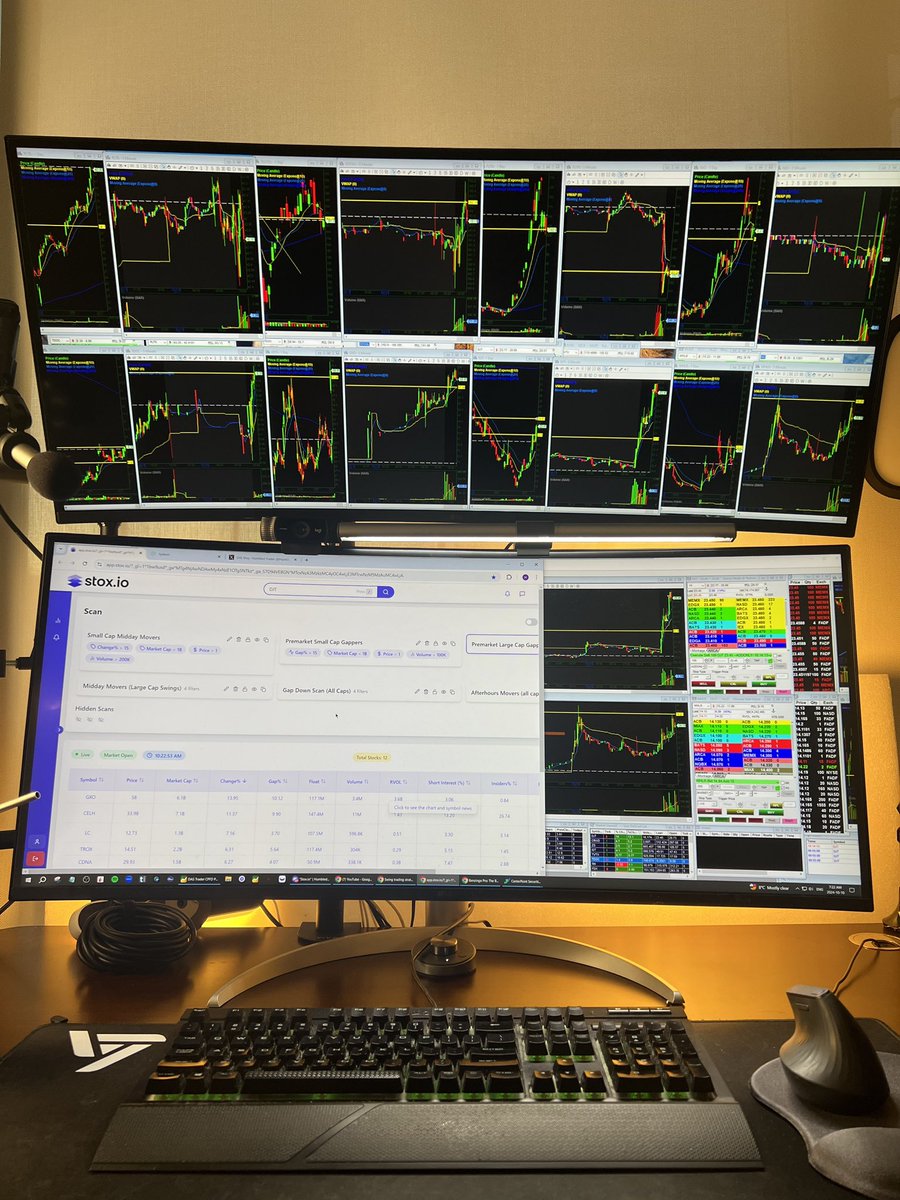

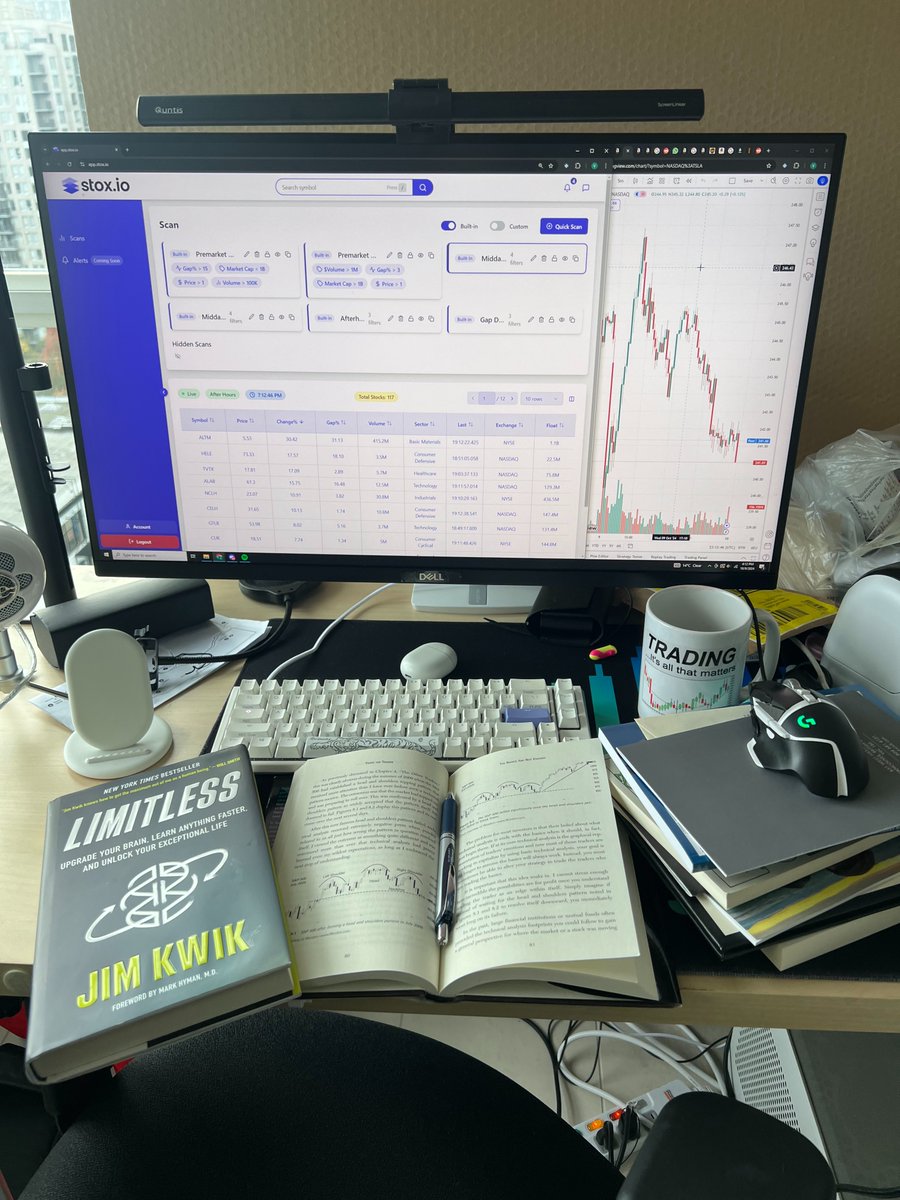

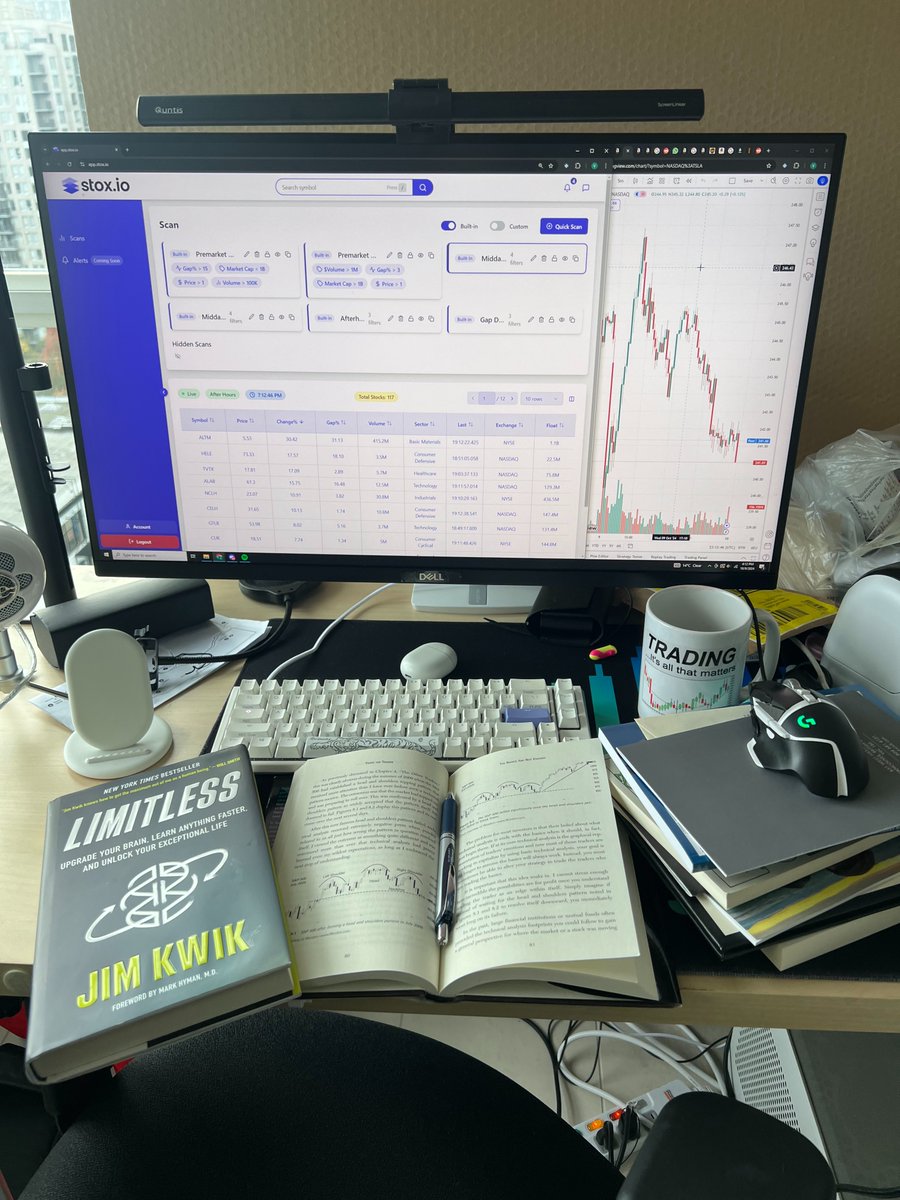

The complete setup I trade with:

The complete setup I trade with:

But first—if you want to save time and simplify your trading, check out my stock scanner, Stox —built for busy traders who want results without the overwhelm.

But first—if you want to save time and simplify your trading, check out my stock scanner, Stox —built for busy traders who want results without the overwhelm.

First things first, the right strategy starts with the right tools. My stock scanner, Stox, is designed to help you find high-quality setups efficiently—especially on a busy schedule.

First things first, the right strategy starts with the right tools. My stock scanner, Stox, is designed to help you find high-quality setups efficiently—especially on a busy schedule.

PS. On my screen is my stock scanner. If you're tired of endlessly stock scanning, use Stox to find profitable trades in seconds stox.io/?utm_source=tw…

PS. On my screen is my stock scanner. If you're tired of endlessly stock scanning, use Stox to find profitable trades in seconds stox.io/?utm_source=tw…

2/ First off, if you've made more profits than me in trading, that's amazing.

2/ First off, if you've made more profits than me in trading, that's amazing.