IF U WANT TO WIN 🏆THE GAME ,U HAVE TO BE IN THE GAME ..I LIKE TO PLAY NIFTY 🙏

22 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/ITRADE191/status/1630082496976261120?s=20)

(2/n) Crown can be made only if the IronFly is in profit. If we have Rs 500 profit outside the buy strikes then we can convert that IronFly to crown.

(2/n) Crown can be made only if the IronFly is in profit. If we have Rs 500 profit outside the buy strikes then we can convert that IronFly to crown.

(2/n) Position sizing: Its utmost important to know position sizing. Its even more important than adjustments. Ideally we prefer to start Nifty IronFly with 2 lots per 5Lac capital which use around 20% of capital and provides us flexibility to adjust using remaining 80% capital.

(2/n) Position sizing: Its utmost important to know position sizing. Its even more important than adjustments. Ideally we prefer to start Nifty IronFly with 2 lots per 5Lac capital which use around 20% of capital and provides us flexibility to adjust using remaining 80% capital.

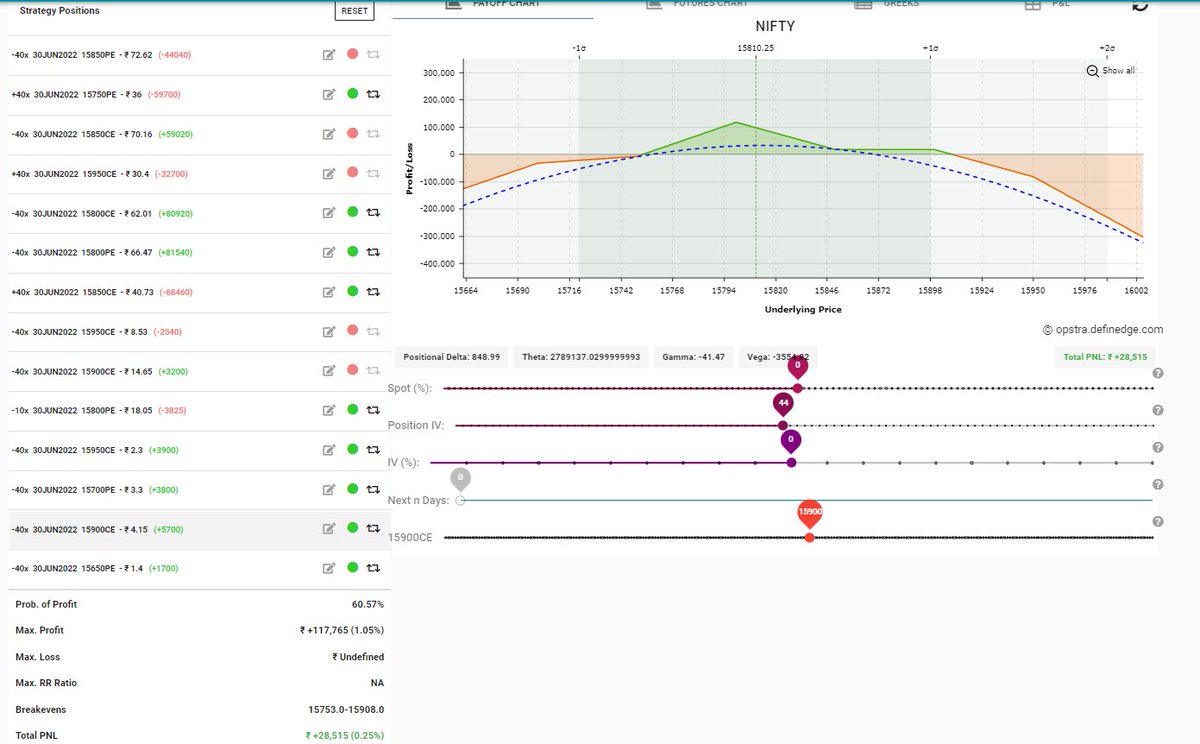

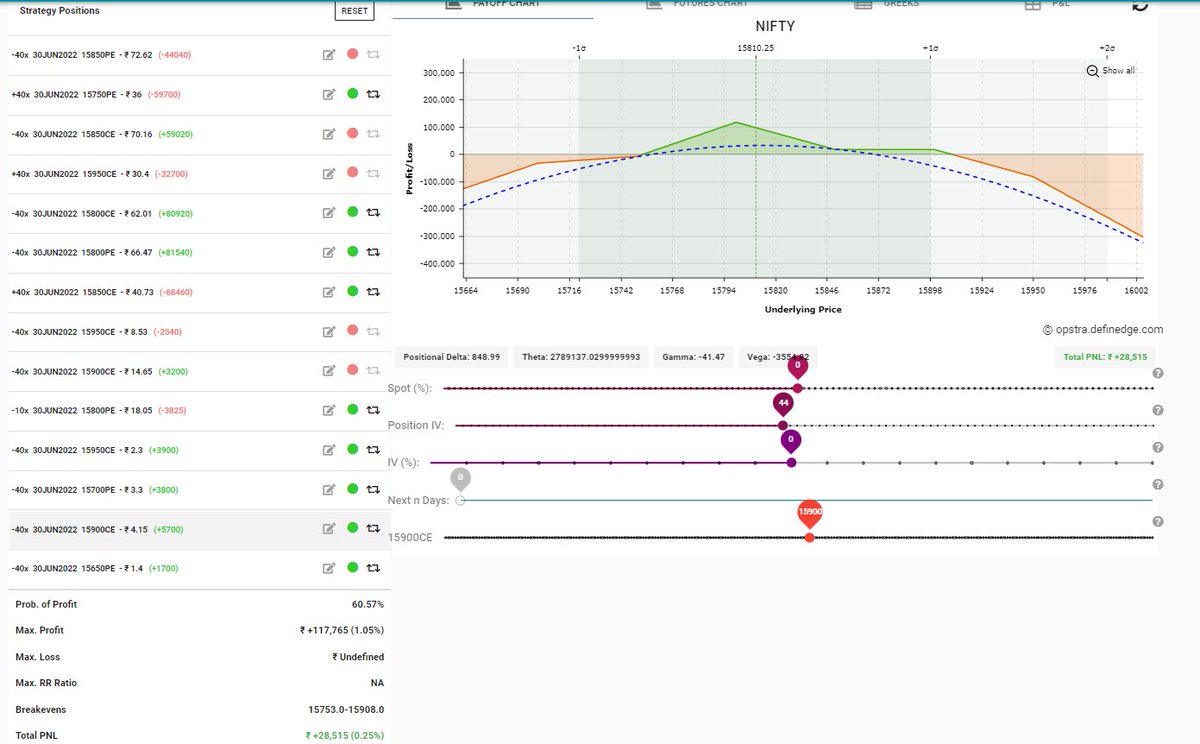

By the time nifty reached to 15820 ,the 15850 straddle was in profit and with the type of volume seen at reversal it looked unlikely for nifty to go to day high again so we shifted our straddle to 15800 with ce buy hedge.

By the time nifty reached to 15820 ,the 15850 straddle was in profit and with the type of volume seen at reversal it looked unlikely for nifty to go to day high again so we shifted our straddle to 15800 with ce buy hedge.