3rd gen Oklahoman. Board member $FGNX / $GFP.TO. Co-founder @childrensnoco w/ my amazing wife. All views are mine. Always do your own work.

3 subscribers

How to get URL link on X (Twitter) App

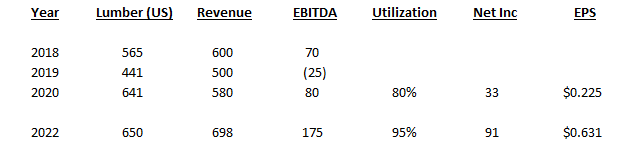

https://twitter.com/IgnoreNarrative/status/1382665576322113536First, and I cannot stress this enough

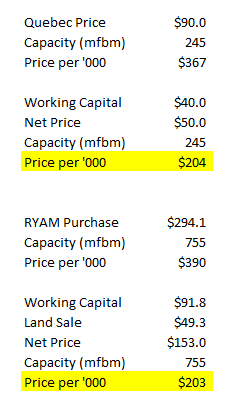

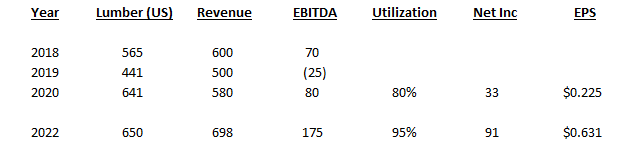

https://twitter.com/IgnoreNarrative/status/1381598329709199361Sounds like there is room to improve the mills