How to get URL link on X (Twitter) App

The company has 17+ years of experience in solar PV mfg industry.

The company has 17+ years of experience in solar PV mfg industry.

The company has approx. 100 Cr in Cash & Liquid Investments while the market cap is 541 Cr and debt of 6 Cr ~ implying an EV of 450 Cr.

The company has approx. 100 Cr in Cash & Liquid Investments while the market cap is 541 Cr and debt of 6 Cr ~ implying an EV of 450 Cr.

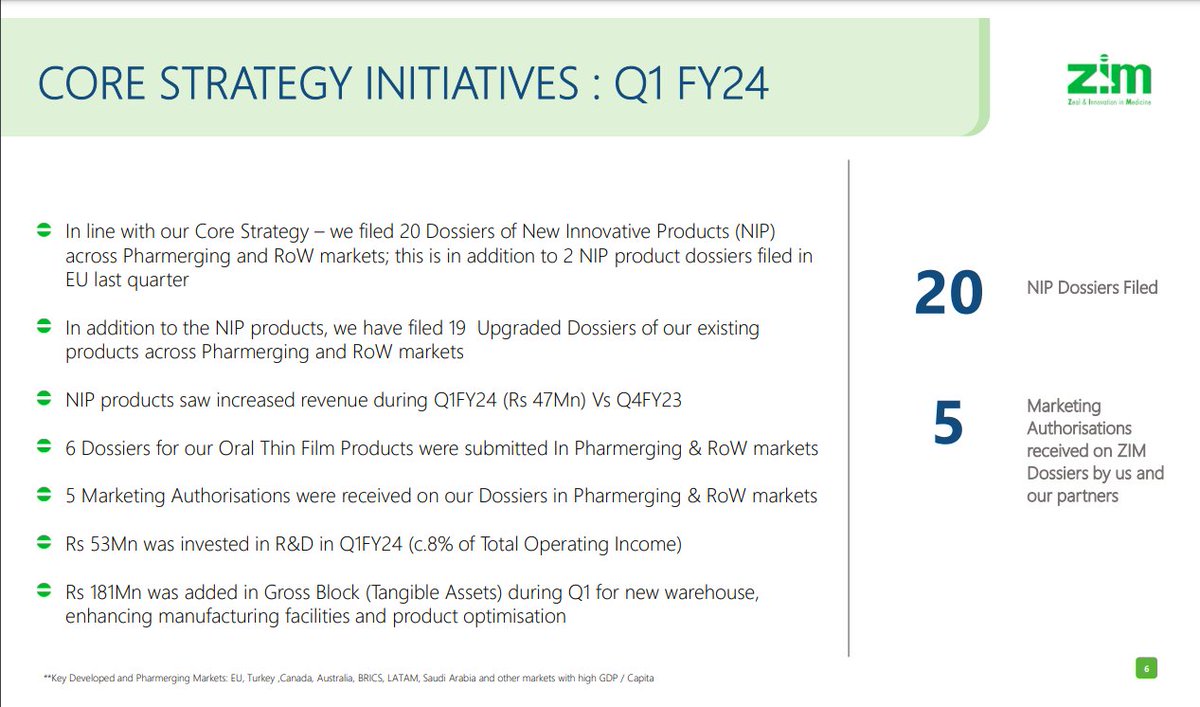

20 NIP Dossiers filed + 19 upgraded dossiers of existing products.

20 NIP Dossiers filed + 19 upgraded dossiers of existing products.

Peer comparison :

Peer comparison :

Balance Sheet :

Balance Sheet :

Current business : 77% from Pharma & 23% from Nutraceuticals

Current business : 77% from Pharma & 23% from Nutraceuticals

Consolidated Numbers :

Consolidated Numbers :

Annual Performance

Annual Performance

With new product launches such as Urbania, Gurkha 5-door variant - these numbers should sustain and improve.

With new product launches such as Urbania, Gurkha 5-door variant - these numbers should sustain and improve.

Auto sector was coming out of a very lean patch of growth due to various reasons :

Auto sector was coming out of a very lean patch of growth due to various reasons :

• Valiant has a very diversified product profile and it is engaged into various processes/chemistries such as :

• Valiant has a very diversified product profile and it is engaged into various processes/chemistries such as :

GDS Business :

GDS Business :