EconProf @UMass | "cost-shock queen" FT | Robinson, Keynes, Meiksins Wood, Rothschild & Matthöfer Prize | Harvard Associate in Research | 2023 TIME100 Next

3 subscribers

How to get URL link on X (Twitter) App

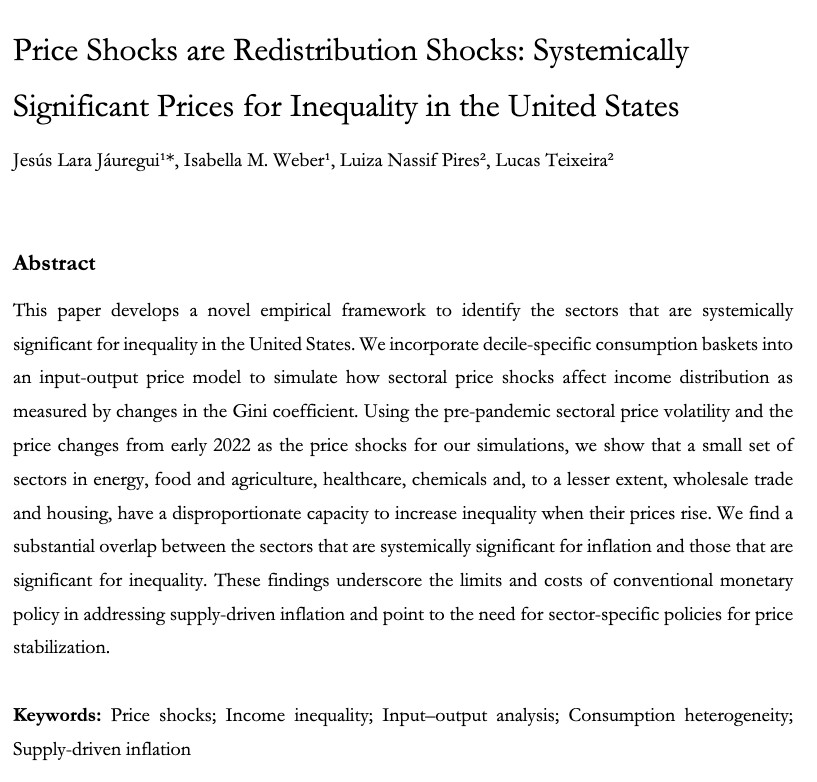

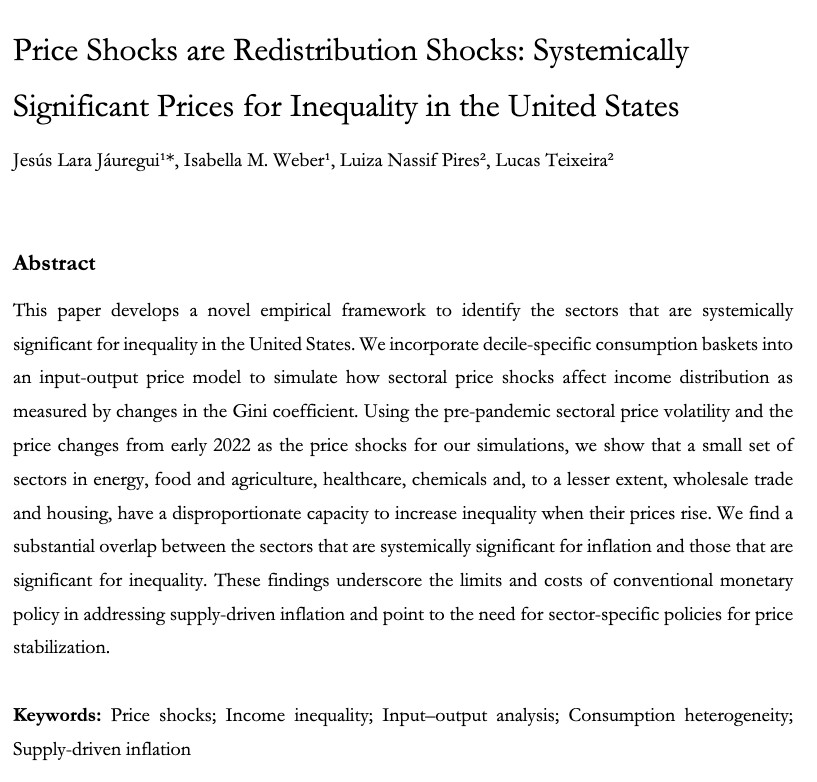

Standard inflation analysis reduces inflation to a single aggregate index. This conceals that inflation is often triggered by price shocks and that consumption baskets differ systematically across income groups, producing unequal inflation burdens. 2/16

Standard inflation analysis reduces inflation to a single aggregate index. This conceals that inflation is often triggered by price shocks and that consumption baskets differ systematically across income groups, producing unequal inflation burdens. 2/16

His program puts affordability first: a rent freeze on stabilized apartments, construction of 200,000 affordable homes, free buses, universal childcare from 6 weeks to 5 years, & city-run grocery stores in food deserts, funded through higher taxes on millionaires & corporations.

His program puts affordability first: a rent freeze on stabilized apartments, construction of 200,000 affordable homes, free buses, universal childcare from 6 weeks to 5 years, & city-run grocery stores in food deserts, funded through higher taxes on millionaires & corporations.

Germany’s economy has stalled. After six years of stagnation, real GDP growth has plateaued and is almost ten percent below where it should be. The 2022 energy shock triggered the largest one-year drop in real wages since World War II. 2/10

Germany’s economy has stalled. After six years of stagnation, real GDP growth has plateaued and is almost ten percent below where it should be. The 2022 energy shock triggered the largest one-year drop in real wages since World War II. 2/10

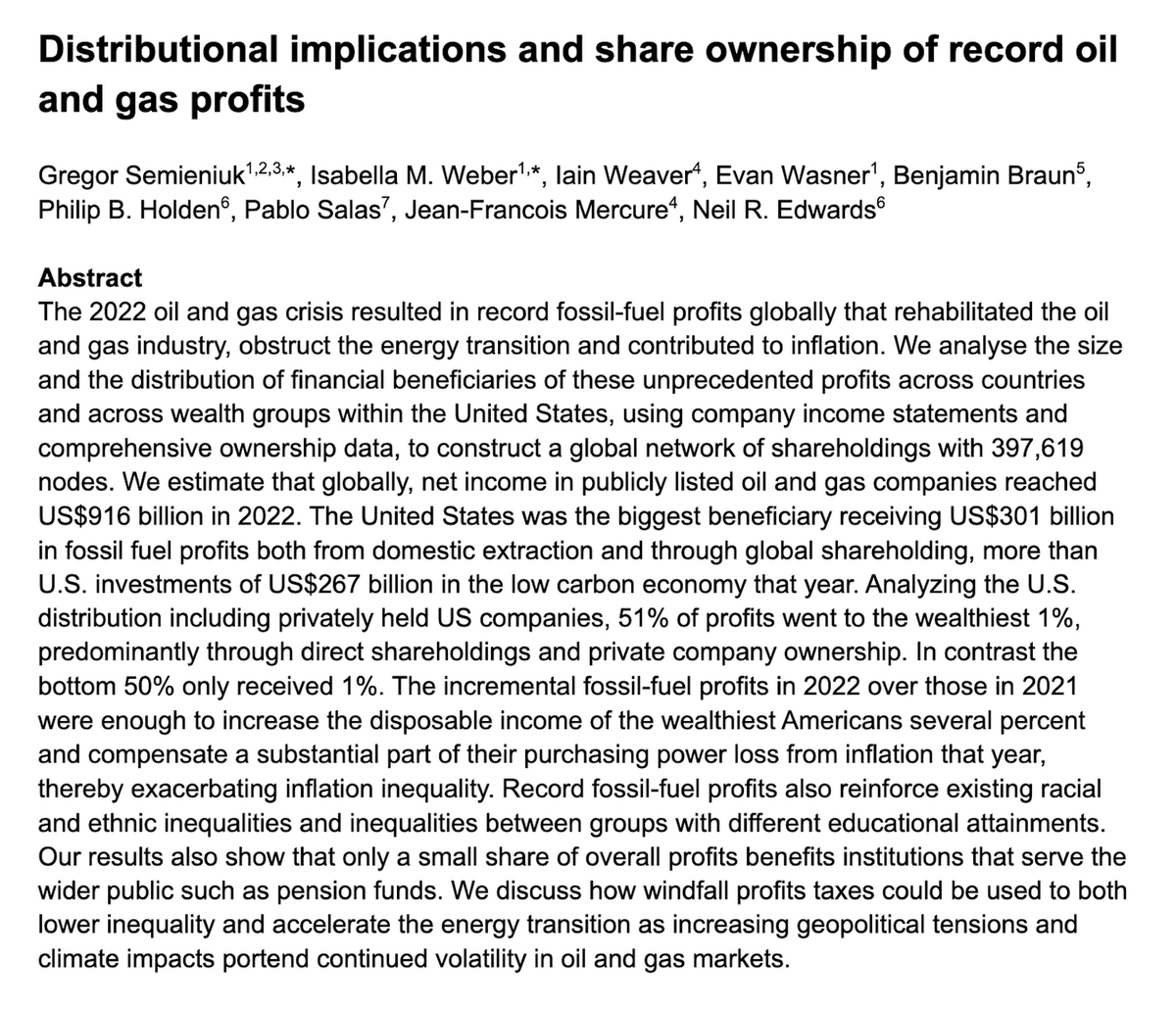

This new working paper has been the outcome of an interdisciplinary collaboration with high powered modelers and wonderful colleagues. @GregorSemieniuk @BJMbraun @JFMercure @PabloSalasB Link:

This new working paper has been the outcome of an interdisciplinary collaboration with high powered modelers and wonderful colleagues. @GregorSemieniuk @BJMbraun @JFMercure @PabloSalasB Link:

In this age of emergencies threats to supply chains are becoming commonplace. Each threat brings the risk of inflation & its power to destabilize governments. If we learned anything from last week’s election, it's that we need new means of protecting our society & democracy. 2/

In this age of emergencies threats to supply chains are becoming commonplace. Each threat brings the risk of inflation & its power to destabilize governments. If we learned anything from last week’s election, it's that we need new means of protecting our society & democracy. 2/

1/ Former President Trump recently called VP Kamala Harris “full communist” for her stance against price gouging. Some economists argue such policies are “not sensible.” This debate isn’t just about politics—it’s about the foundations of economic theory.

1/ Former President Trump recently called VP Kamala Harris “full communist” for her stance against price gouging. Some economists argue such policies are “not sensible.” This debate isn’t just about politics—it’s about the foundations of economic theory.

In search of a post-neoliberal stabilization paradigm, we return to the crossroads of the 1970s: inflation triggered by oil & food price shocks set the stage for international negotiations over commodity price stabilization as part of a New International Economic Order (NIEO). 2/

In search of a post-neoliberal stabilization paradigm, we return to the crossroads of the 1970s: inflation triggered by oil & food price shocks set the stage for international negotiations over commodity price stabilization as part of a New International Economic Order (NIEO). 2/

Overlapping emergencies are our new normal. More shocks are likely to come. In Europe, wage earners bore the brunt of the costs last time around: As a result of the 2022 shockflation, real wages were pushed below their 2019 levels for many countries. 2/

Overlapping emergencies are our new normal. More shocks are likely to come. In Europe, wage earners bore the brunt of the costs last time around: As a result of the 2022 shockflation, real wages were pushed below their 2019 levels for many countries. 2/

Arrighi & Silver’s Systemic Cycles of Accumulation (SCA) provide a framework which links hegemonic shifts with dynamics regarding the geographical expansion of trade and production. ‘Systemic chaos’ is the pivotal moment for the hegemonic shift. But what leads to chaos? 2/

Arrighi & Silver’s Systemic Cycles of Accumulation (SCA) provide a framework which links hegemonic shifts with dynamics regarding the geographical expansion of trade and production. ‘Systemic chaos’ is the pivotal moment for the hegemonic shift. But what leads to chaos? 2/

Germany's dependence on Russian gas meant it was hit hard by the Russian invasion of Ukraine. But market fundamentalist economists downplayed the impact of the energy shock & opposed policies to control energy prices. This delayed the government’s intervention. A mistake: 2/

Germany's dependence on Russian gas meant it was hit hard by the Russian invasion of Ukraine. But market fundamentalist economists downplayed the impact of the energy shock & opposed policies to control energy prices. This delayed the government’s intervention. A mistake: 2/

US profit margins have reached levels not seen since the aftermath of WWII when inflation coincided with windfall profits. As @mtkonczal shows, there is again a relation between profits & inflation. But why have the same firms that kept prices stable started price hikes? 2/

US profit margins have reached levels not seen since the aftermath of WWII when inflation coincided with windfall profits. As @mtkonczal shows, there is again a relation between profits & inflation. But why have the same firms that kept prices stable started price hikes? 2/

Inflation used to be thought of as being ‘always and everywhere a macroeconomic phenomenon’ that macro tightening should address. However, the current inflation is the result of sectoral shocks that involve large changes in relative prices & require a micro policy response. 2/

Inflation used to be thought of as being ‘always and everywhere a macroeconomic phenomenon’ that macro tightening should address. However, the current inflation is the result of sectoral shocks that involve large changes in relative prices & require a micro policy response. 2/