Energy analyst, public policy specialist, amateur historian. Welcome constructive debate. Zero tolerance for trolling

How to get URL link on X (Twitter) App

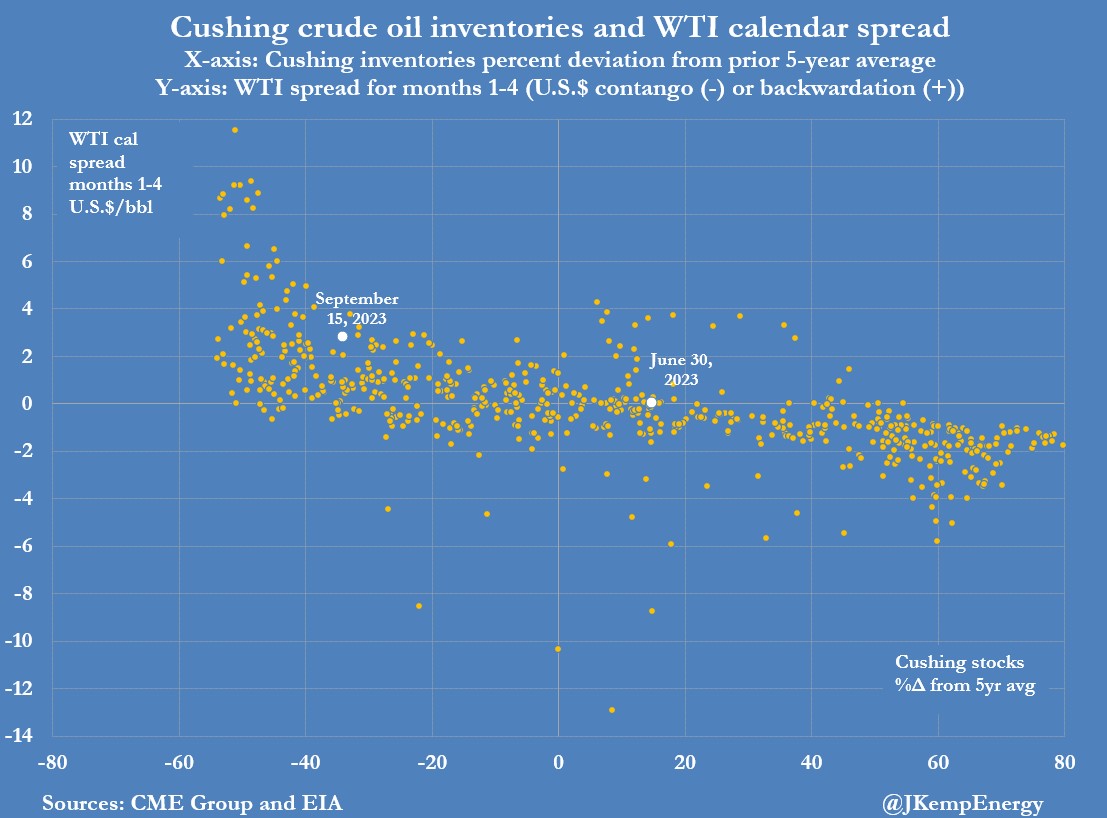

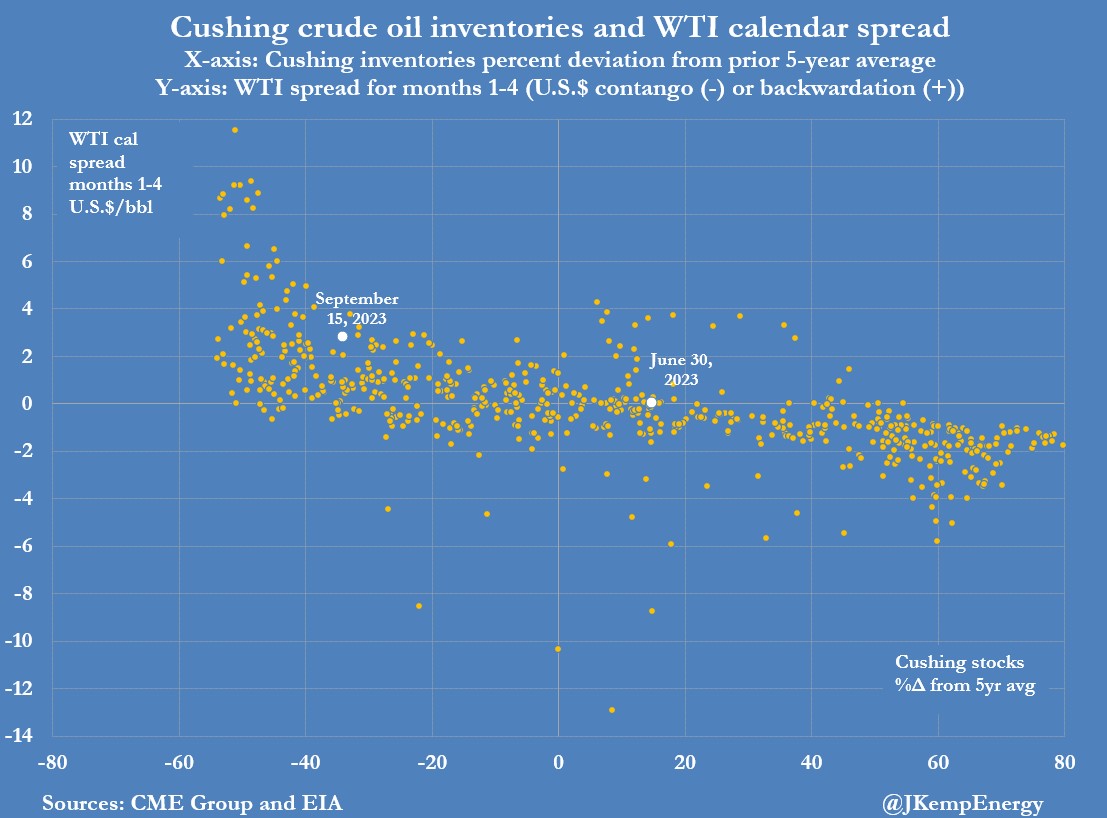

The six month-calendar spread closed in a backwardation of $7.44 (98th percentile for all trading days since 1990) on September 25 having traded briefly in a small contango of 8 cents (47th percentile) three months earlier on June 27:

The six month-calendar spread closed in a backwardation of $7.44 (98th percentile for all trading days since 1990) on September 25 having traded briefly in a small contango of 8 cents (47th percentile) three months earlier on June 27:

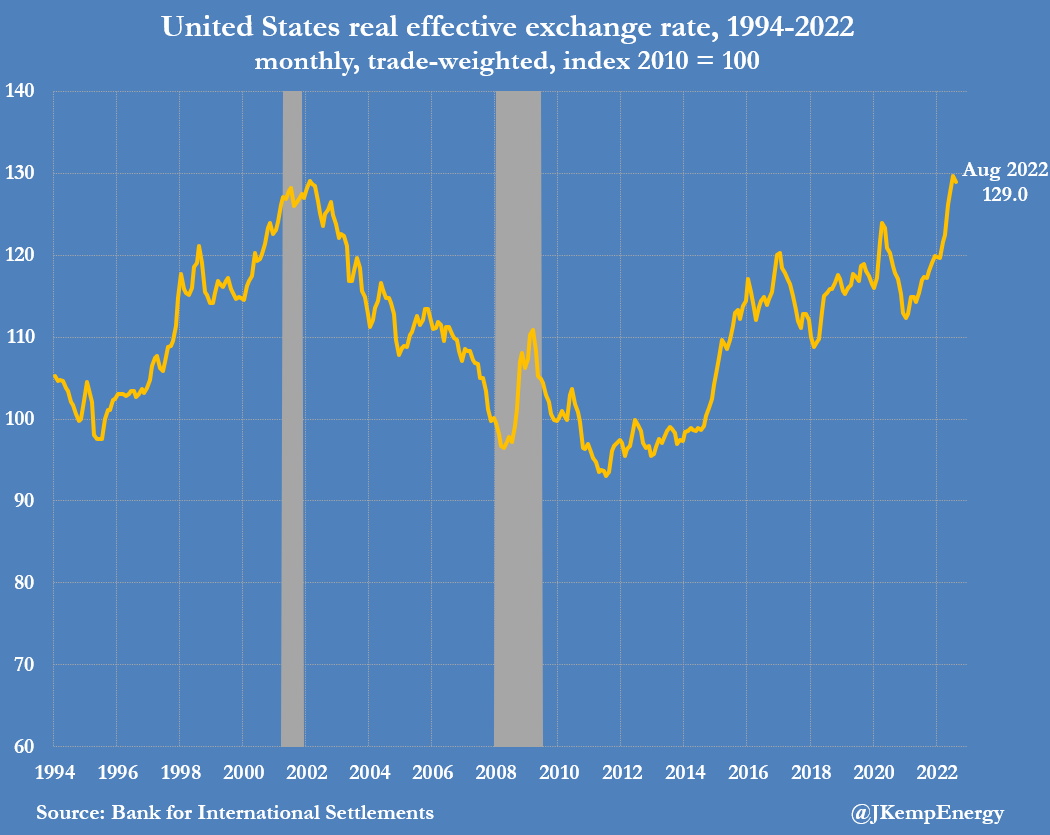

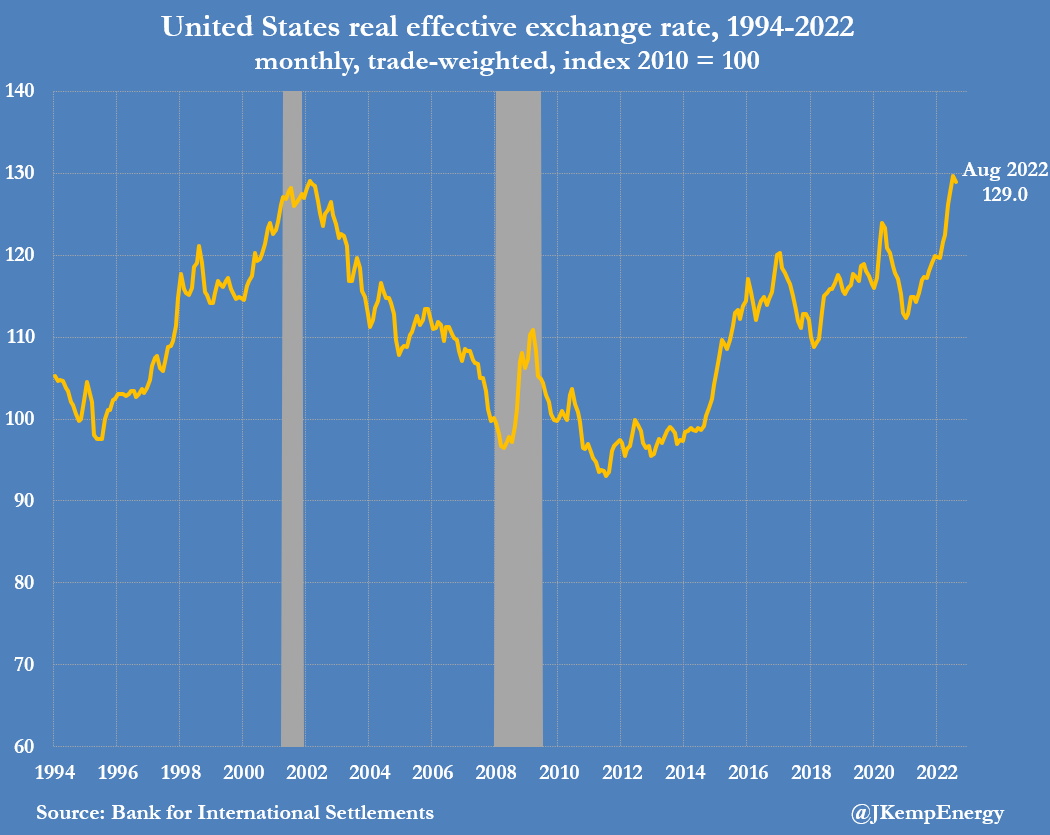

RAPIDLY rising U.S. interest rates have been one of the primary triggers of international financial instability in 1982 (Latin America debt crisis), dollar crisis (1984/85), 1994 (Mexico's tequila crisis), 1997/98 (Asian debt crisis and Russia default) and now 2022:

RAPIDLY rising U.S. interest rates have been one of the primary triggers of international financial instability in 1982 (Latin America debt crisis), dollar crisis (1984/85), 1994 (Mexico's tequila crisis), 1997/98 (Asian debt crisis and Russia default) and now 2022:

https://twitter.com/M_C_Klein/status/1557770196168757253We (journalists, analysts, policymakers, commentators) too often use the language of levels (up, down, high, low) when we are really talking about rates of change (faster, slower, accelerating, decelerating). It sounds simpler but is actually wrong and seriously misleading.

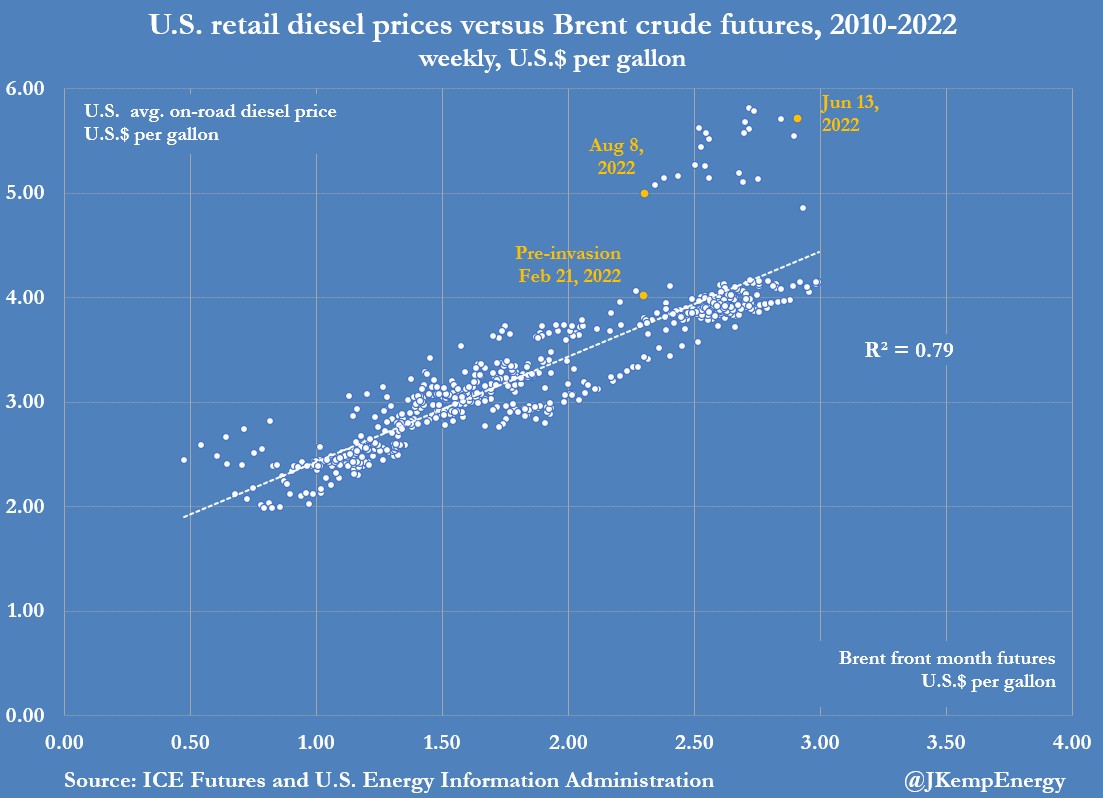

FUEL-PRICE reductions are mostly explained by the decline in international crude prices. Refining margins remain higher than before Russia invaded Ukraine. Diesel prices remain elevated compared with gasoline as a result of the global diesel shortage:

FUEL-PRICE reductions are mostly explained by the decline in international crude prices. Refining margins remain higher than before Russia invaded Ukraine. Diesel prices remain elevated compared with gasoline as a result of the global diesel shortage:

“It is well known the safety lamp did not bring a marked fall in the number of colliery accidents. Its first effect was to encourage working of deeper and more fiery seams and to encourage the removal of pillars from areas which were too dangerous to approach with naked lights …

“It is well known the safety lamp did not bring a marked fall in the number of colliery accidents. Its first effect was to encourage working of deeper and more fiery seams and to encourage the removal of pillars from areas which were too dangerous to approach with naked lights …

In the late 1830s and early 1840s, coal prices were kept artificially high in London by limiting the number of ship loads sold each day (the "limitation of the vend") according to a sliding scale based on market prices

In the late 1830s and early 1840s, coal prices were kept artificially high in London by limiting the number of ship loads sold each day (the "limitation of the vend") according to a sliding scale based on market prices

In case you wondered, later coal price spikes in 1653, 1667, 1673 and 1675 were caused by the Anglo-Dutch wars, with coal shipments along England's east coast disrupted by attacks and the threat of them from the Dutch fleet and privateers, causing shortages in London

In case you wondered, later coal price spikes in 1653, 1667, 1673 and 1675 were caused by the Anglo-Dutch wars, with coal shipments along England's east coast disrupted by attacks and the threat of them from the Dutch fleet and privateers, causing shortages in London

By the summer of 1644, the coal shortage in London had become a crisis. The Venetian ambassador predicted “there will be riots this winter” unless shipments resumed. The crisis was averted when Scottish forces acting at the behest of Parliament captured Newcastle in October 1644

By the summer of 1644, the coal shortage in London had become a crisis. The Venetian ambassador predicted “there will be riots this winter” unless shipments resumed. The crisis was averted when Scottish forces acting at the behest of Parliament captured Newcastle in October 1644

EXTREME short-volatility, price gapping and evaporation in liquidity are classic features of a market nearing an extreme high/low, in terms of time if not price. Recent examples are negative WTI prices in April 2020 and the peak in oil prices in Jun/Jul 2008

EXTREME short-volatility, price gapping and evaporation in liquidity are classic features of a market nearing an extreme high/low, in terms of time if not price. Recent examples are negative WTI prices in April 2020 and the peak in oil prices in Jun/Jul 2008

https://twitter.com/ERCOT_ISO/status/1361215084010352644Forced load-shedding is a sign of a power system under extreme stress, with inadequate firm generation capacity, inadequate capacity to import power from neighbouring areas to support the network, and inadequate flexibility on the consumption side

GLOBAL OIL MARKET - cyclical position:

GLOBAL OIL MARKET - cyclical position: