The Hotel Investor , $1.5 billion + Hotel AUM 🚀 | CEO of DoveHill - Own, Develop, Manage | Masters of Moments Podcast | YPO’er

How to get URL link on X (Twitter) App

1/ The idea is simple, yet powerful: Cut out the middle man, and unlock the deals that big players enjoy.

1/ The idea is simple, yet powerful: Cut out the middle man, and unlock the deals that big players enjoy.

The global luxury hospitality industry is undergoing a transformation. Once considered a relative niche portion of the broader lodging industry, luxury hotels have exploded in tandem with rising global wealth and consumers’ increased prioritization on immersive travel.

The global luxury hospitality industry is undergoing a transformation. Once considered a relative niche portion of the broader lodging industry, luxury hotels have exploded in tandem with rising global wealth and consumers’ increased prioritization on immersive travel.

1/ The idea is simple, yet powerful: Cut out the middle man, and unlock the deals that big players enjoy.

1/ The idea is simple, yet powerful: Cut out the middle man, and unlock the deals that big players enjoy.

Prioritize Experience Over Price

Prioritize Experience Over Price

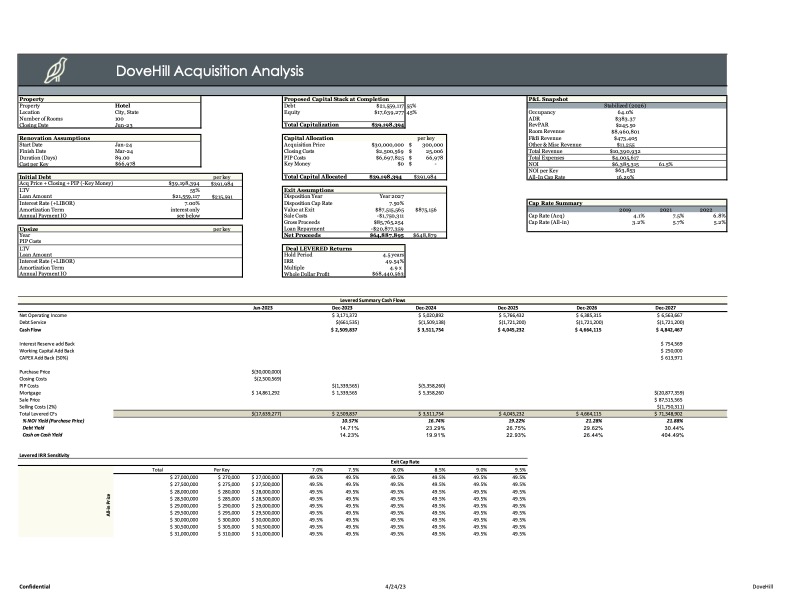

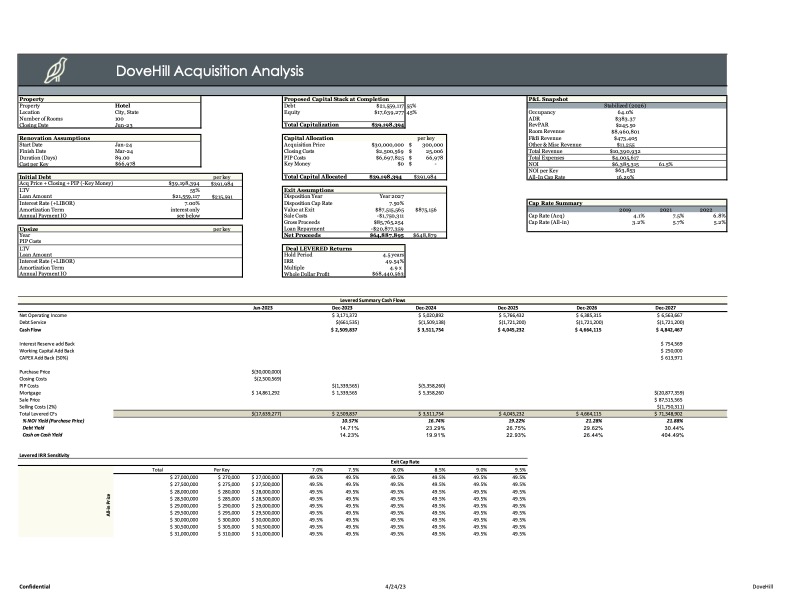

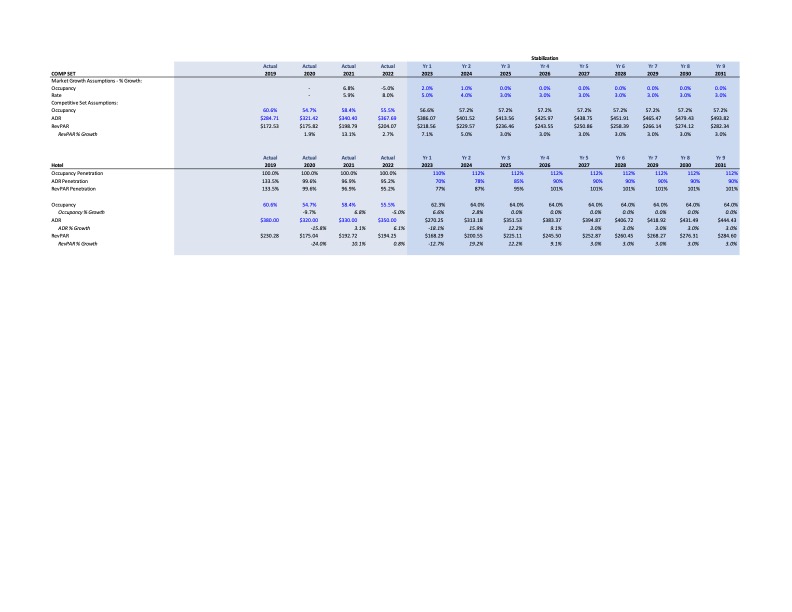

Remember, this is a detailed modeled designed to help us focus on deals we're genuinely interested in and streamline the decision-making process.

Remember, this is a detailed modeled designed to help us focus on deals we're genuinely interested in and streamline the decision-making process.

1/ The idea is simple, yet powerful: Cut out the middle man, and unlock the deals that big players enjoy.

1/ The idea is simple, yet powerful: Cut out the middle man, and unlock the deals that big players enjoy.

Mix and match styles: Don't be afraid to mix and match furniture styles, textures, and materials to create an eclectic and interesting look. Consider combining modern and vintage pieces, metal and wood accents, and various fabrics and patterns to add depth and interest.

Mix and match styles: Don't be afraid to mix and match furniture styles, textures, and materials to create an eclectic and interesting look. Consider combining modern and vintage pieces, metal and wood accents, and various fabrics and patterns to add depth and interest.