Analysis Manager at @Jrf_UK

Tweeting about housing, work, benefits and poverty.

Northern Irish. Views are my own.

How to get URL link on X (Twitter) App

And as above map shows - a much higher share of households are housed in temporary accommodation across certain types of geography, typically larger cities and costal cities in particular.

And as above map shows - a much higher share of households are housed in temporary accommodation across certain types of geography, typically larger cities and costal cities in particular.

This isn't constrained to seafronts, we also see disproportionately high private rental housing benefit claims in:

This isn't constrained to seafronts, we also see disproportionately high private rental housing benefit claims in:

Primarily second homes are used as holiday homes or seen as a long-term investment.

Primarily second homes are used as holiday homes or seen as a long-term investment.

*Current benefit levels are the result of a historical sequence of successive rate changes, each based on a range of considerations (previous years rate, inflation, welfare reforms, political assessment of affordability) - but never an objective measure based on need.

*Current benefit levels are the result of a historical sequence of successive rate changes, each based on a range of considerations (previous years rate, inflation, welfare reforms, political assessment of affordability) - but never an objective measure based on need.

Universal Credit and its predecessors (JSA, tax credits) are passporting benefits that grant access to cost-of-living support payments.

Universal Credit and its predecessors (JSA, tax credits) are passporting benefits that grant access to cost-of-living support payments.

There's a consensus that we have a rental affordability crisis, with rents swallowing up 3x more of renters income than it did in 1979.

There's a consensus that we have a rental affordability crisis, with rents swallowing up 3x more of renters income than it did in 1979.

In every region in the UK, the share of households who own their home has fallen substantially, while the numbers who rent privately have more than doubled.

In every region in the UK, the share of households who own their home has fallen substantially, while the numbers who rent privately have more than doubled.

New analysis we’ve carried out (above graph) finds that a mortgage interest rate increasing from 2.1% to 6% means a family buying with a mortgage could see their monthly mortgage payments increase:

New analysis we’ve carried out (above graph) finds that a mortgage interest rate increasing from 2.1% to 6% means a family buying with a mortgage could see their monthly mortgage payments increase:

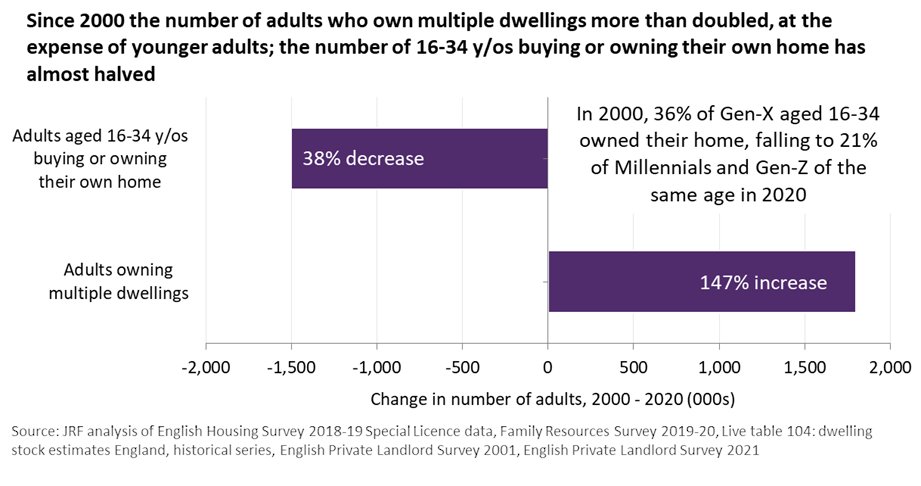

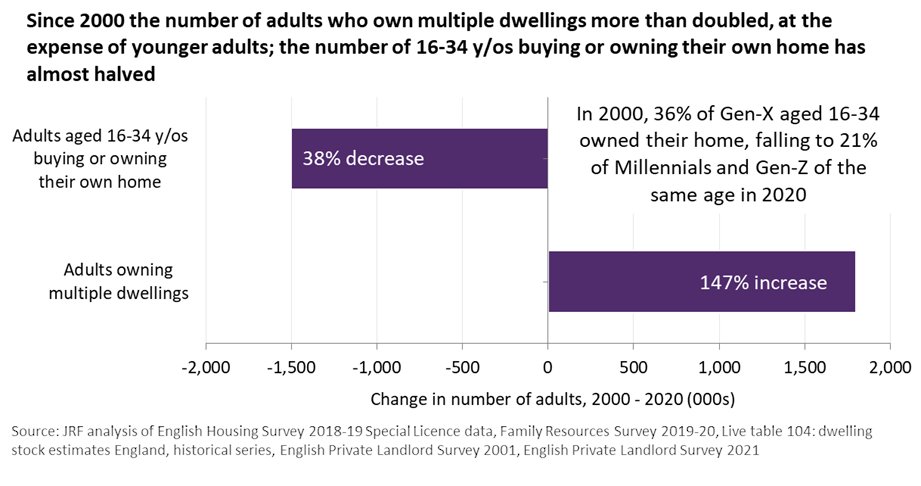

Fixing the housing crisis requires not only a focus on new supply of homes, but a focus who owns them.

Fixing the housing crisis requires not only a focus on new supply of homes, but a focus who owns them.