How to get URL link on X (Twitter) App

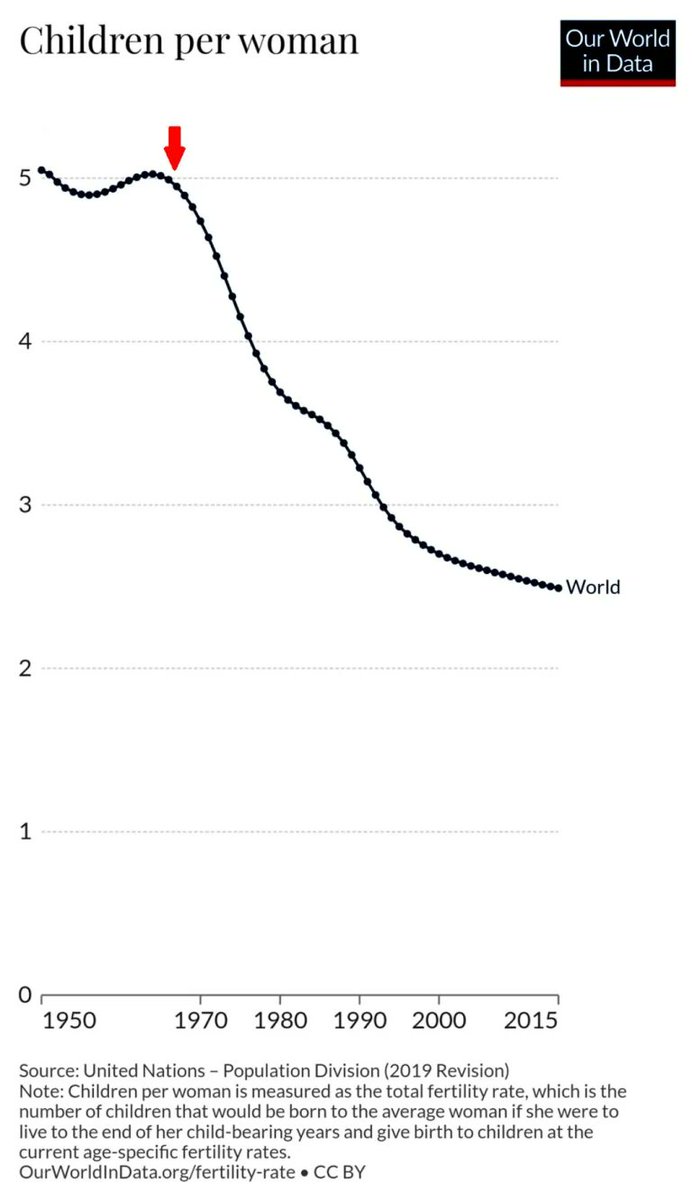

In 1971 the US abandoned the Gold Standard and assigned itself as the world reserve currency issuer.

In 1971 the US abandoned the Gold Standard and assigned itself as the world reserve currency issuer.

https://twitter.com/unusual_whales/status/1635069268663603201In 2008, bank portfolios were riddled with bad credit.

https://twitter.com/Strike/status/1557828743925727234The Strike Card makes Strike the first banking app that allows users to use dollars on the ACH network, a card network, and the Lightning network.

https://twitter.com/jackmallers/status/1484597104349749249The first game is up for grabs.

https://twitter.com/jackmallers/status/1441089090628177933The Strike API enables free, instant, global payments of any size, from anywhere, by anyone.

Drop a comment on what a singular, global, open monetary network with instant and free cash finality means to you along with a Lightning invoice.

Drop a comment on what a singular, global, open monetary network with instant and free cash finality means to you along with a Lightning invoice.

@namcios @ln_strike @chibitdevs Strike allows you to make and receive #Bitcoin and Lightning payments with dollars.

@namcios @ln_strike @chibitdevs Strike allows you to make and receive #Bitcoin and Lightning payments with dollars.