How to get URL link on X (Twitter) App

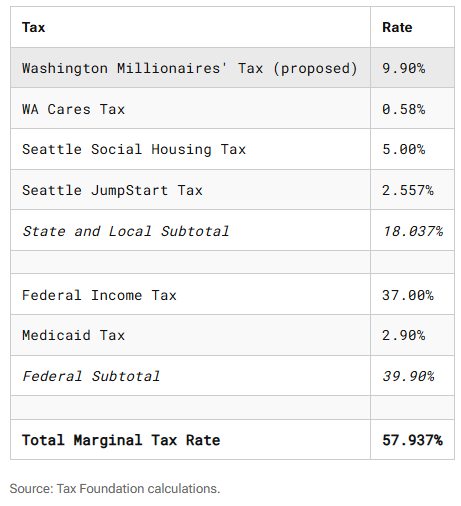

Seattle tech workers could face a nearly 60% marginal rate across federal, state, and local income taxes when their RSUs vest.

Seattle tech workers could face a nearly 60% marginal rate across federal, state, and local income taxes when their RSUs vest.

In 2020, Biden won 81 million votes to Trump's 74 million, with 158.4 million total votes cast.

In 2020, Biden won 81 million votes to Trump's 74 million, with 158.4 million total votes cast.

The amount a taxpayer owes has nothing to do with the number of transactions, the number of shares, or anything other than the *aggregate net income gains* from these assets. If it were levied on the sale or exchange, surely it would involve the transactions in some way!

The amount a taxpayer owes has nothing to do with the number of transactions, the number of shares, or anything other than the *aggregate net income gains* from these assets. If it were levied on the sale or exchange, surely it would involve the transactions in some way!

@wallethub WalletHub calculated overall effective tax rates (taking income, sales and excise, real property, and vehicle taxes into account) for a roughly median household in each state. Actually they ran it twice: the *national* median household placed in each state, then the state median.

@wallethub WalletHub calculated overall effective tax rates (taking income, sales and excise, real property, and vehicle taxes into account) for a roughly median household in each state. Actually they ran it twice: the *national* median household placed in each state, then the state median.

https://twitter.com/CalTax/status/1479152853591543810

The California LAO's current forecast is $51 billion above the biennial budget's numbers. And there are lawmakers who want another $163 billion a year on top of this?

The California LAO's current forecast is $51 billion above the biennial budget's numbers. And there are lawmakers who want another $163 billion a year on top of this?

https://twitter.com/ylanmui/status/1367870111781097478(1) Many people have already filed and will have to file amended returns. Making benefits available as long as needed seems way more important than this complicated retroactive provision, which requires changing tax forms or instructions.

Almost half the states saw revenue increases during the pandemic. Typically not as high as projected, but sometimes exceeding projections. Losses frequently way less than aid. So what do you spend it on if you didn't lose much revenue? Lots and lots of rural broadband? 2/

Almost half the states saw revenue increases during the pandemic. Typically not as high as projected, but sometimes exceeding projections. Losses frequently way less than aid. So what do you spend it on if you didn't lose much revenue? Lots and lots of rural broadband? 2/

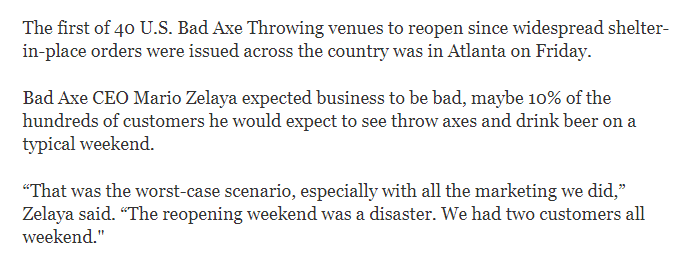

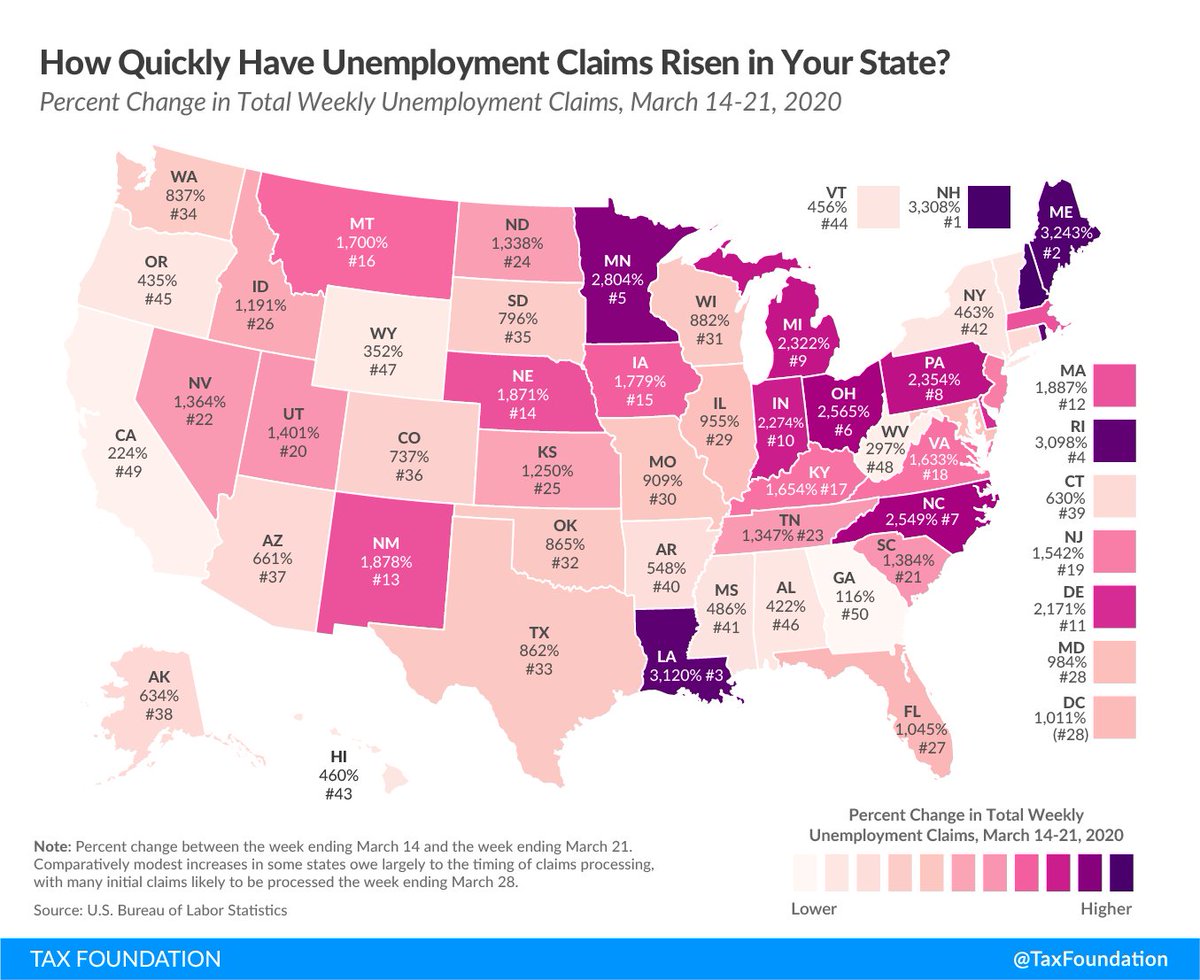

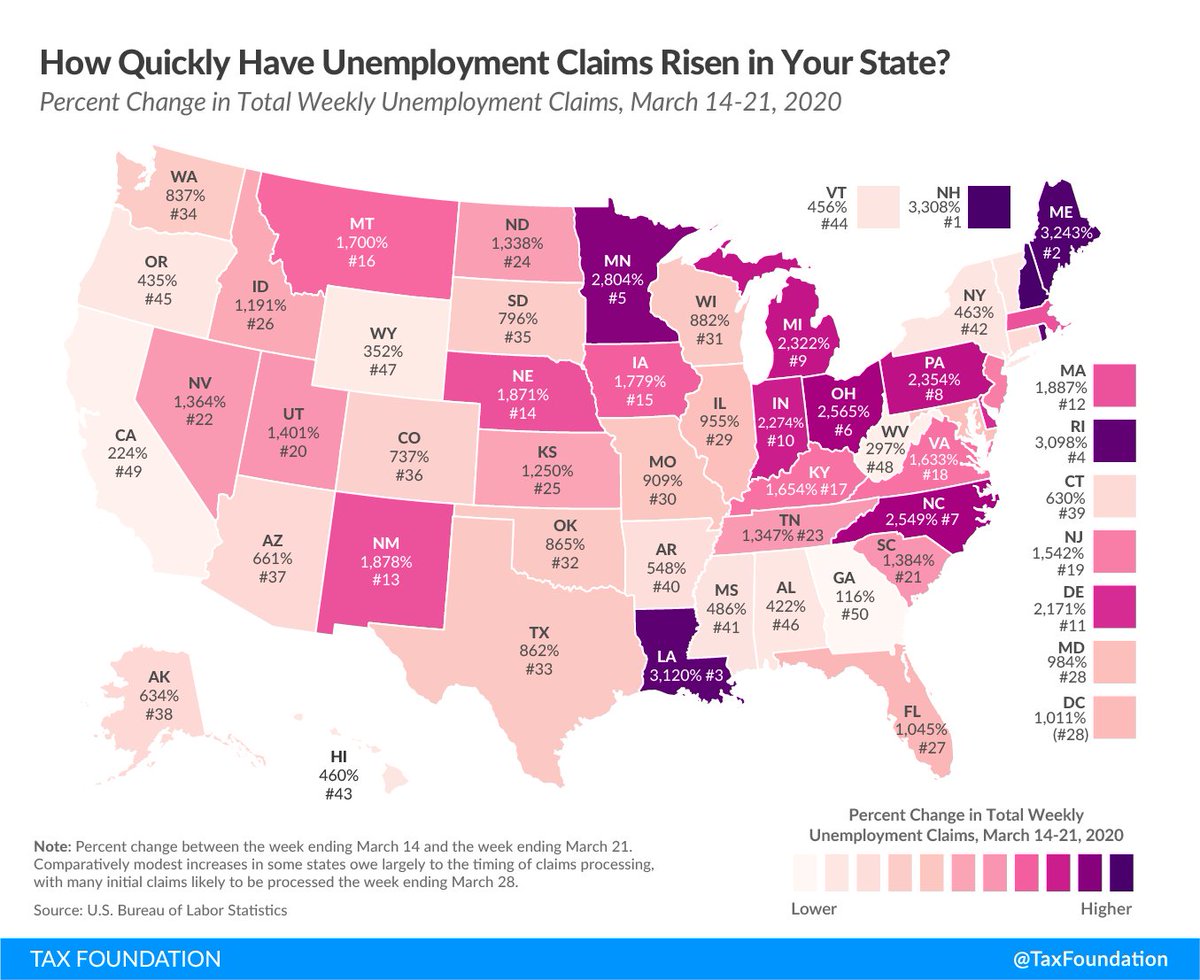

When and how to lift business restrictions is a really complicated issue, and I don't have the answer. Georgia's doing it faster than seems advisable to me, but lots of other states are starting phased re-openings. A few notes:

When and how to lift business restrictions is a really complicated issue, and I don't have the answer. Georgia's doing it faster than seems advisable to me, but lots of other states are starting phased re-openings. A few notes:

Timing matters a lot. It will take at least another 1-2 weeks to have a strong sense of which states are facing the worst crisis. Right now there are challenges in disentangling timing of closure orders, pace of processing UI claims, reporting lags, from larger considerations. 2/

Timing matters a lot. It will take at least another 1-2 weeks to have a strong sense of which states are facing the worst crisis. Right now there are challenges in disentangling timing of closure orders, pace of processing UI claims, reporting lags, from larger considerations. 2/