Day trade microcaps. Short long traps, long short traps. US-based. Trying not to lose money every day. Discord access - https://t.co/F3mS3BmxNN

8 subscribers

How to get URL link on X (Twitter) App

Blows my mind how most short sellers couldn't even point out what an ideal flag looks like. Or how many longs couldn't anticipate a clearout/fbo to save their lives. Forever stuck in the same framework while ignoring the other side of the trade.

Blows my mind how most short sellers couldn't even point out what an ideal flag looks like. Or how many longs couldn't anticipate a clearout/fbo to save their lives. Forever stuck in the same framework while ignoring the other side of the trade.

Ok but for real the thinking behind this long is:

Ok but for real the thinking behind this long is:

https://twitter.com/crossbordercap/status/1623257381600649216Liquidity drives our market. And liquidity determines pattern. There's a reason why I've been posting more longs lately. While large gapping % produces good short opportunities, it's also a sign of strength in the market and will also give you the best long opportunities.

And I mentioned before, on the SUPER strong plays the IDEAL shorts are not things like clearouts. They are BIG AGGRESSIVE PUSHES that stall BELOW HoD. $BIAF, $GNS, $LYT, $DCFC

And I mentioned before, on the SUPER strong plays the IDEAL shorts are not things like clearouts. They are BIG AGGRESSIVE PUSHES that stall BELOW HoD. $BIAF, $GNS, $LYT, $DCFC

But think, do you think anyone is legit trying to sell 900k shares and showing it on the lvl 2 for everyone to see? Fuck no, especially on clearly rigged/strong stocks. They are just trying to build enough short stop losses and shake out enough scared longs before the squeeze.

But think, do you think anyone is legit trying to sell 900k shares and showing it on the lvl 2 for everyone to see? Fuck no, especially on clearly rigged/strong stocks. They are just trying to build enough short stop losses and shake out enough scared longs before the squeeze.

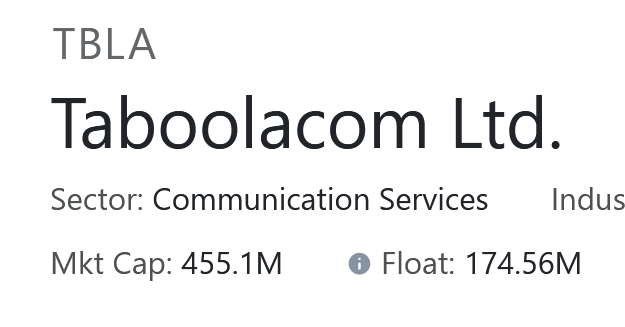

$TBLA Should mention, never said you couldn't short this. I'm just saying it's not microcap trash. High IO gappers can give good short patterns like clearouts and props, they just tend to fade less. Rarely get an institutional dump like $RIDE on 11/8/2022, but possible.

$TBLA Should mention, never said you couldn't short this. I'm just saying it's not microcap trash. High IO gappers can give good short patterns like clearouts and props, they just tend to fade less. Rarely get an institutional dump like $RIDE on 11/8/2022, but possible.

How to short parabolic moves

How to short parabolic moves https://twitter.com/team3dstocks/status/1261415228274692096?s=20&t=MgbECRJCLht8Ig9qX9Ca4g

Should mention there there is a behavior change in the afternoon where, after a strong, manipulated stock has faded far enough, it sets it's lower lows, then starts grinding up with higher lows midday/afternoon for the big squeeze. Usually bounces of a key moving average.

Should mention there there is a behavior change in the afternoon where, after a strong, manipulated stock has faded far enough, it sets it's lower lows, then starts grinding up with higher lows midday/afternoon for the big squeeze. Usually bounces of a key moving average.

Btw a lot of these rules exist because of my trading personality. I'm the type of person who has risk too tight and takes profits too early. I need to create hard rules to follow to make up for my bad habits formed by my personality.

Btw a lot of these rules exist because of my trading personality. I'm the type of person who has risk too tight and takes profits too early. I need to create hard rules to follow to make up for my bad habits formed by my personality.

$MOTS nice prop - as I said before. The longer a long takes the less likely it is to work. Also said in some notes somewhere, in strong markets tickers set short traps that push. In weak markets, tickers set long traps that fade. Soaky boy tho but hoping it breaks this floor.

$MOTS nice prop - as I said before. The longer a long takes the less likely it is to work. Also said in some notes somewhere, in strong markets tickers set short traps that push. In weak markets, tickers set long traps that fade. Soaky boy tho but hoping it breaks this floor.

$VRAX helpful to know what support levels are and why they're support levels. 5 minute EMAs were very clean on this manip and the 50ema tends to be decent "final" support. It's also helpful that intraday LoD was right above it, making a wash and reclaim quite strong.

$VRAX helpful to know what support levels are and why they're support levels. 5 minute EMAs were very clean on this manip and the 50ema tends to be decent "final" support. It's also helpful that intraday LoD was right above it, making a wash and reclaim quite strong.

$BEAT lol guess not

$BEAT lol guess not