Economics prof @UWEBristol. @PKEconSoc chair. @FMM_macro fellow. @PEF_online council. Blogging intermittently at https://t.co/gjD32qdMbg

How to get URL link on X (Twitter) App

https://twitter.com/t0nyyates/status/1676468465714987008We revive an argument from Gordon that reductions in sales taxes can reduce inflation; this will of course stimulate aggregate demand and require offsetting tax increases elsewhere.

https://twitter.com/jryancollins/status/1529834553329819649There are two related issues:

Note the use of the 'then' when discussing banks. A clear and incorrect statement of temporal ordering.

Note the use of the 'then' when discussing banks. A clear and incorrect statement of temporal ordering.

https://twitter.com/ChrisGiles_/status/1346047029609426947Five years ago saying this kind of thing inevitably meant being denounced as a crank. theguardian.com/politics/2015/…

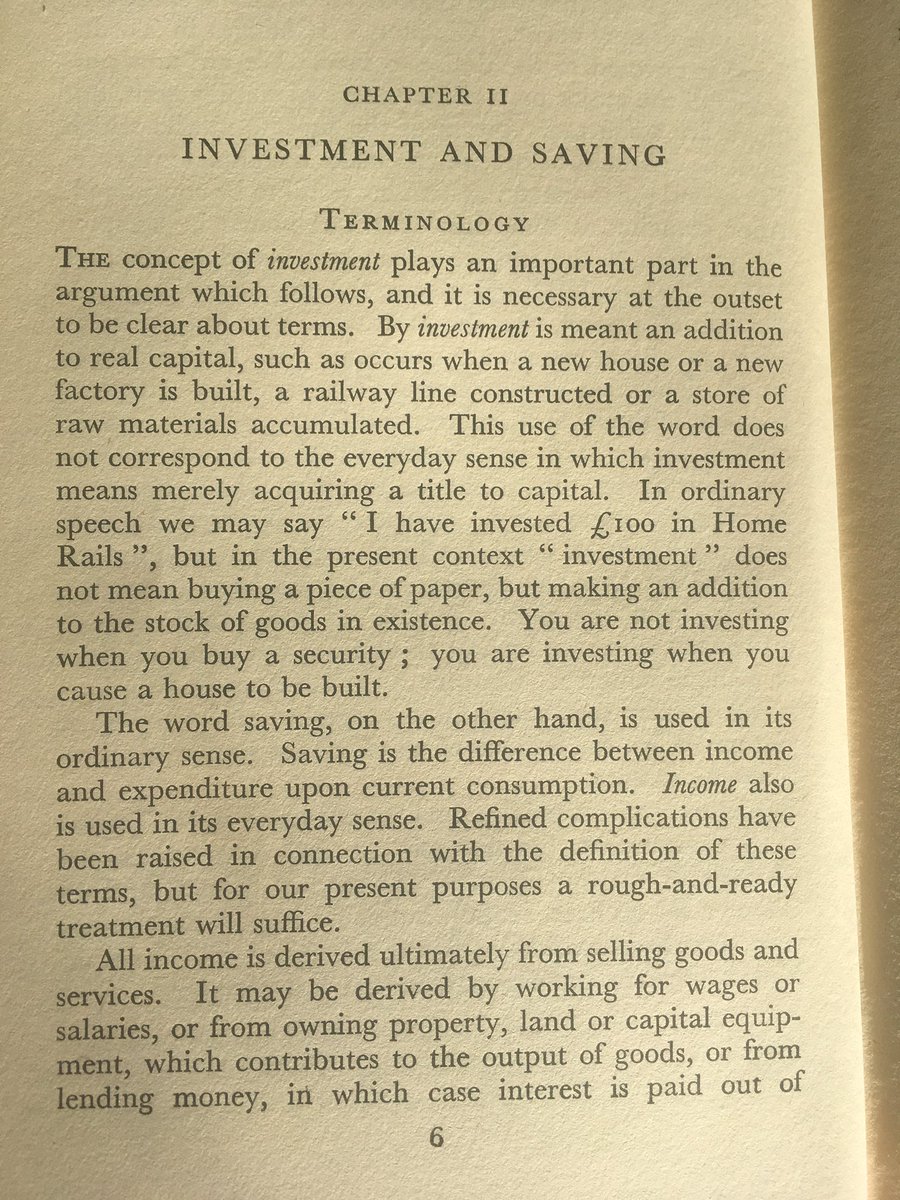

By investment is meant an addition to real capital ... This use of the word does not correspond to the everyday sense in which investment means merely acquiring a title to capital. ... Saving is the difference between income and expenditure on consumption. 2/

By investment is meant an addition to real capital ... This use of the word does not correspond to the everyday sense in which investment means merely acquiring a title to capital. ... Saving is the difference between income and expenditure on consumption. 2/

https://twitter.com/jomicheii/status/1343120447077048322Its time for another ECONOMICS EXPLAINER!

https://twitter.com/RebuildMacro/status/1262752666985230336First interesting point: Kocherlakota seems to be arguing that mainstream econ believes in Say's Law over ~= a 3-year period. Demand can't affect supply. No hysteresis. No Kaldor-Verdoorn.

https://twitter.com/JoMicheII/status/1261598111488753665Harries says that coronavirus prevalence is currently "two or three in a thousand" and that this is "likely to halve" by the time schools open. So lets say the infection rate is one in a thousand when schools open. 2/