Macro/Labor/Finance; @HooverInst Policy Fellow @Stanford Econ PhD(c) @UT_Civitas @FREOPP @Mercatus @MLInstitute @CapAndFreedom @EconClubofMiami

How to get URL link on X (Twitter) App

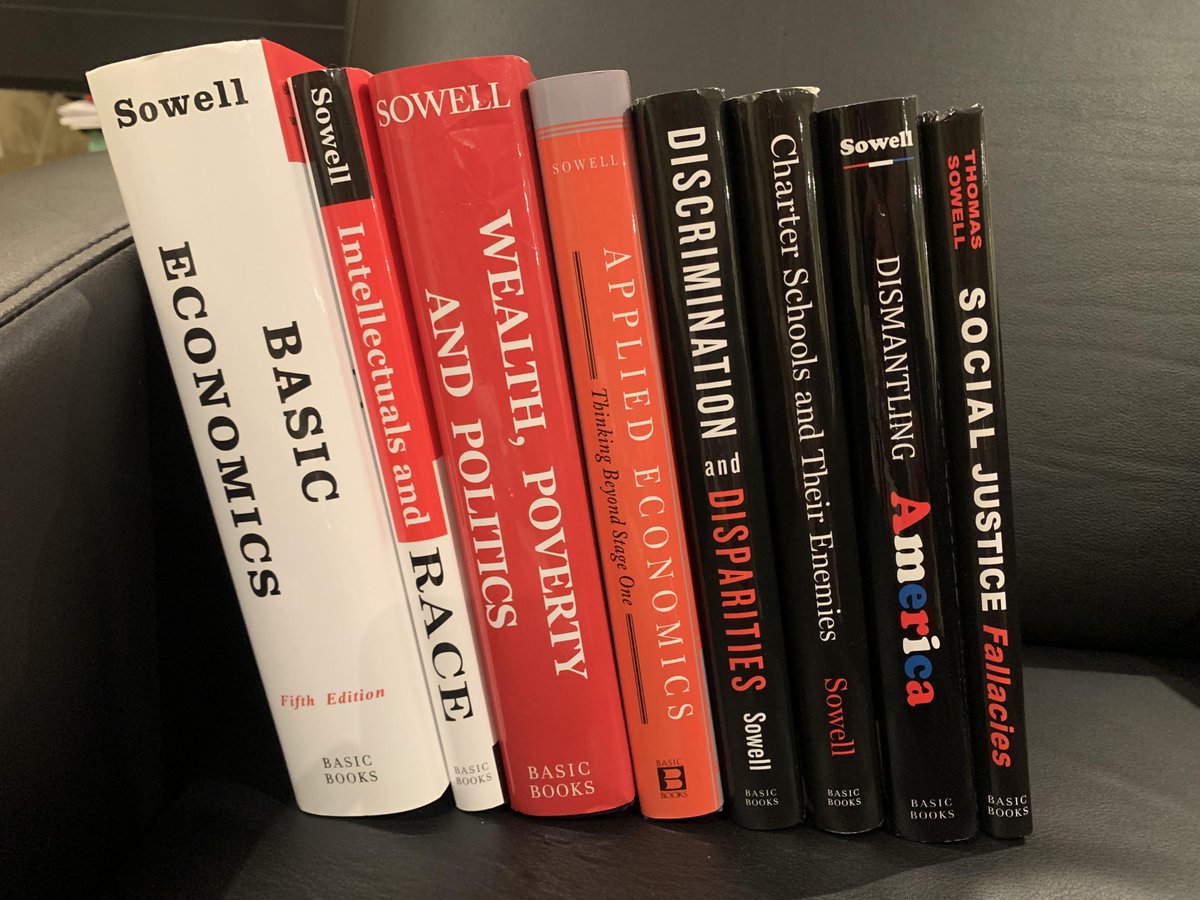

1: Say’s Law: An Historical Analysis (1972)

1: Say’s Law: An Historical Analysis (1972)

https://twitter.com/Jon_Hartley_/status/1890217725110415782

Google search data from Google Trends suggests that searches for "ChatGPT" both in the US and Worldwide have roughly doubled in 2025.

Google search data from Google Trends suggests that searches for "ChatGPT" both in the US and Worldwide have roughly doubled in 2025.

https://twitter.com/Jon_Hartley_/status/19368760022292318912. Wendy Kopp (Princeton University, 1989) "An Argument and Plan for the Creation of the Teachers Corps". Founded Teach For America, placing thousands in public schools.

Full "Elastic Markets Hypothesis" Paper is here: papers.ssrn.com/sol3/papers.cf…

Full "Elastic Markets Hypothesis" Paper is here: papers.ssrn.com/sol3/papers.cf…

https://twitter.com/Jon_Hartley_/status/1890217725110415782

Our U.S. survey evidence has found significant increases in Gemini and ChatGPT use during this period of time. ChatGPT and Gemini remain the most widely used tools.

Our U.S. survey evidence has found significant increases in Gemini and ChatGPT use during this period of time. ChatGPT and Gemini remain the most widely used tools.

Model-based estimates of r-star have been divergent since the pandemic. Laubach-Williams has been falling while Lubik-Matthes moving upward. How do we know what we can trust when both have massive standard errors? Turning to surveys and median-survey estimates can meaningfully help.

Model-based estimates of r-star have been divergent since the pandemic. Laubach-Williams has been falling while Lubik-Matthes moving upward. How do we know what we can trust when both have massive standard errors? Turning to surveys and median-survey estimates can meaningfully help.

Our headline takeaway: 30.1% of survey respondents above 18 have used Generative AI at work since Generative AI tools became public, consistent with other survey estimates such as those of Pew and Bick, Blandin, and Deming (2024) (which instead uses Qualtrics; we use IncQuery).

Our headline takeaway: 30.1% of survey respondents above 18 have used Generative AI at work since Generative AI tools became public, consistent with other survey estimates such as those of Pew and Bick, Blandin, and Deming (2024) (which instead uses Qualtrics; we use IncQuery).

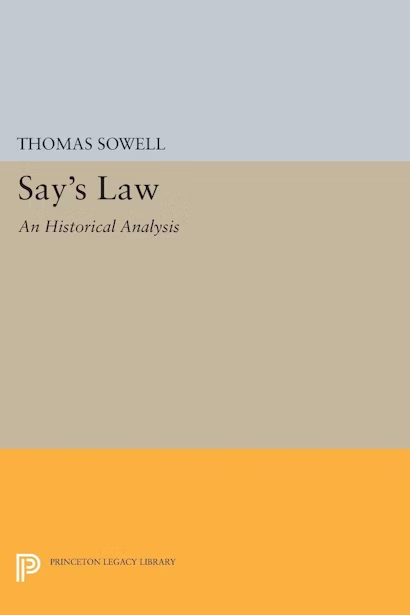

Government debt management is a classic question in macroeconomics and finance: if the government has to issue X in debt, how much should it issue at different tenors/maturities? (2/N)

Government debt management is a classic question in macroeconomics and finance: if the government has to issue X in debt, how much should it issue at different tenors/maturities? (2/N)

French Presidents past and present: Macron, Sarkozy and Hollande

French Presidents past and present: Macron, Sarkozy and Hollande

In 2007, Wes Edens and Fortress Investment Group, LLC used private equity funds to purchase Florida East Coast Industries (FECI), Florida's oldest & largest rail/infrastructure company for $3.5 billion. It was originally founded by South Florida pioneer Henry M. Flagler.

In 2007, Wes Edens and Fortress Investment Group, LLC used private equity funds to purchase Florida East Coast Industries (FECI), Florida's oldest & largest rail/infrastructure company for $3.5 billion. It was originally founded by South Florida pioneer Henry M. Flagler.

2: Some history: Ralph Nader's Critical Mass Energy Project formed in 1974 became the largest U.S. anti-nuclear group created false claims, convincing many Americans that nuclear energy from nuclear power plants had extreme far reaching negative health and environmental effects.

2: Some history: Ralph Nader's Critical Mass Energy Project formed in 1974 became the largest U.S. anti-nuclear group created false claims, convincing many Americans that nuclear energy from nuclear power plants had extreme far reaching negative health and environmental effects.

2: Began with a discussion of intervention of the state and socialism. Much discussion of Hayek, Friedman and general equilibrium. Principle of noninterference good. Argues state intervention during COVID-19 pandemic caused 100k additional deaths in Argentina

2: Began with a discussion of intervention of the state and socialism. Much discussion of Hayek, Friedman and general equilibrium. Principle of noninterference good. Argues state intervention during COVID-19 pandemic caused 100k additional deaths in Argentina

Measuring Top 1% income shares is difficult. Auten-Splitner using unreported earnings find after-tax top 1% income shares have been essentially flat since the 1960s unlike the Piketty-Saez-Zucman who find shows substantial increases. Capital21 didn't show after-tax Top 1% shares

Measuring Top 1% income shares is difficult. Auten-Splitner using unreported earnings find after-tax top 1% income shares have been essentially flat since the 1960s unlike the Piketty-Saez-Zucman who find shows substantial increases. Capital21 didn't show after-tax Top 1% shares

"Do Firms Maximize? Evidence from Professional Football" (2006 JPE) by David Romer (2/4) journals.uchicago.edu/doi/full/10.10…

"Do Firms Maximize? Evidence from Professional Football" (2006 JPE) by David Romer (2/4) journals.uchicago.edu/doi/full/10.10…

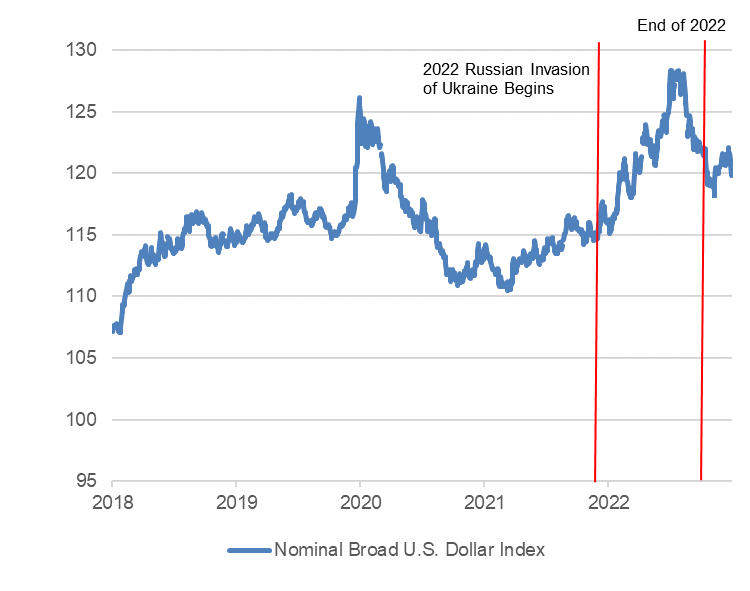

Much short-run variation reflect changes in the USD FX spot price and FX reserve managers being slow to rebalance. USD massively sold off in 4Q2022, nonetheless, US dollar indices finished the end of 2022 MUCH HIGHER than at start of Russia invasion; dollar share now LOWER.

Much short-run variation reflect changes in the USD FX spot price and FX reserve managers being slow to rebalance. USD massively sold off in 4Q2022, nonetheless, US dollar indices finished the end of 2022 MUCH HIGHER than at start of Russia invasion; dollar share now LOWER.

Not the result I was expecting. To be sure there are a lot of concurrent events happening including the worst global inflationary spiral since the 1970s; however, dollar share of reserves usually decreases during inflationary spirals like in the 1970s/1980s per Eichengreen (2014)

Not the result I was expecting. To be sure there are a lot of concurrent events happening including the worst global inflationary spiral since the 1970s; however, dollar share of reserves usually decreases during inflationary spirals like in the 1970s/1980s per Eichengreen (2014)