CEO/CIO at @LuptonCapital and @FirstWaveFund — https://t.co/BgU67oTYtX and https://t.co/SQEowKnaPB

20 subscribers

How to get URL link on X (Twitter) App

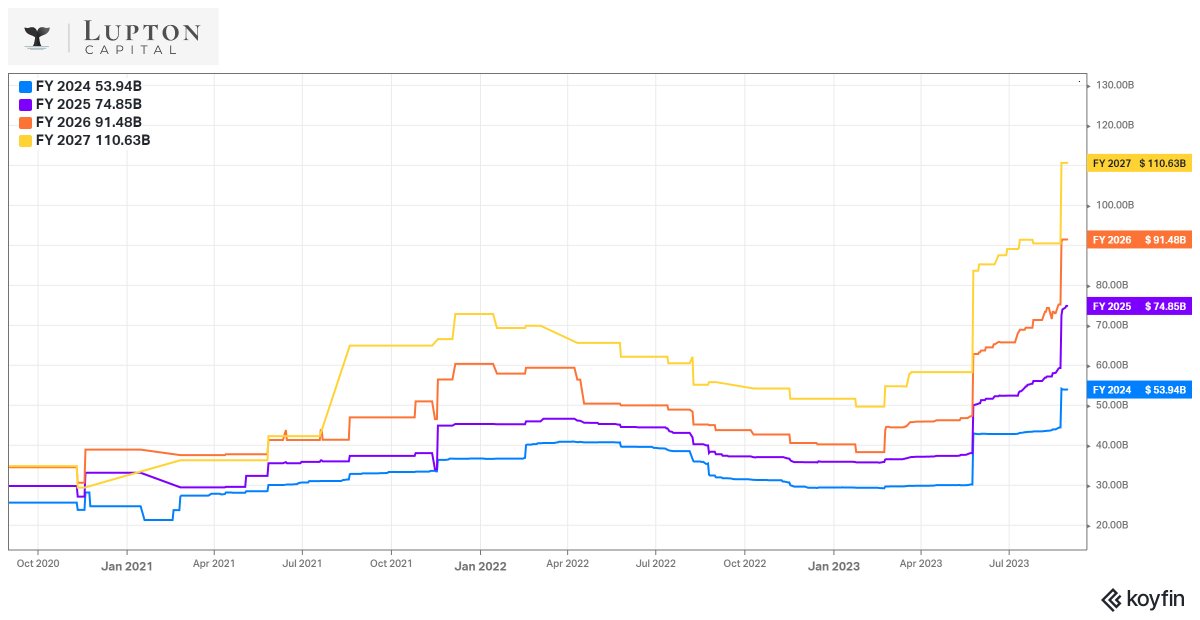

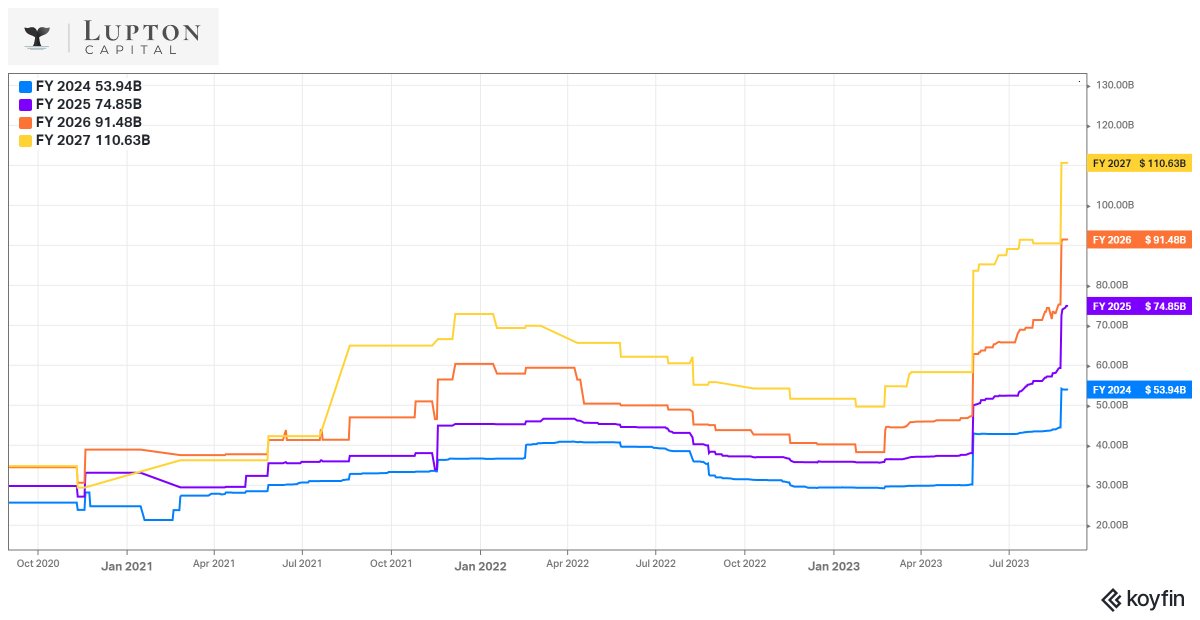

These higher estimate trends for $ELF are also very impressive...

These higher estimate trends for $ELF are also very impressive...

A couple years ago BANG ditched their Anheuser Busch distributors after they struck a deal with Pepsi which required that Pepsi buyout Rockstar to get out of that exclusive distribution agreement (what a mess for Pepsi, they just keep compounding their mistakes).

A couple years ago BANG ditched their Anheuser Busch distributors after they struck a deal with Pepsi which required that Pepsi buyout Rockstar to get out of that exclusive distribution agreement (what a mess for Pepsi, they just keep compounding their mistakes).

We also have a great group of sponsors:

We also have a great group of sponsors:

Let’s say you are Microsoft or Netflix or Salesforce and want to sell your products and services across the globe but don’t want to deal with dozens of different payment methods, currencies and tax reporting requirements — $DLO does all of this for them.

Let’s say you are Microsoft or Netflix or Salesforce and want to sell your products and services across the globe but don’t want to deal with dozens of different payment methods, currencies and tax reporting requirements — $DLO does all of this for them.

For the next 20 days we're doing an early bird special:

For the next 20 days we're doing an early bird special:

After hours, $FB basically bounced off the VWAP from the December 2018 lows which is $245.85

After hours, $FB basically bounced off the VWAP from the December 2018 lows which is $245.85

Last year $SI announced a partnership with $FB's Diem project (formerly Libra) diem.com/en-us/updates/…

Last year $SI announced a partnership with $FB's Diem project (formerly Libra) diem.com/en-us/updates/…

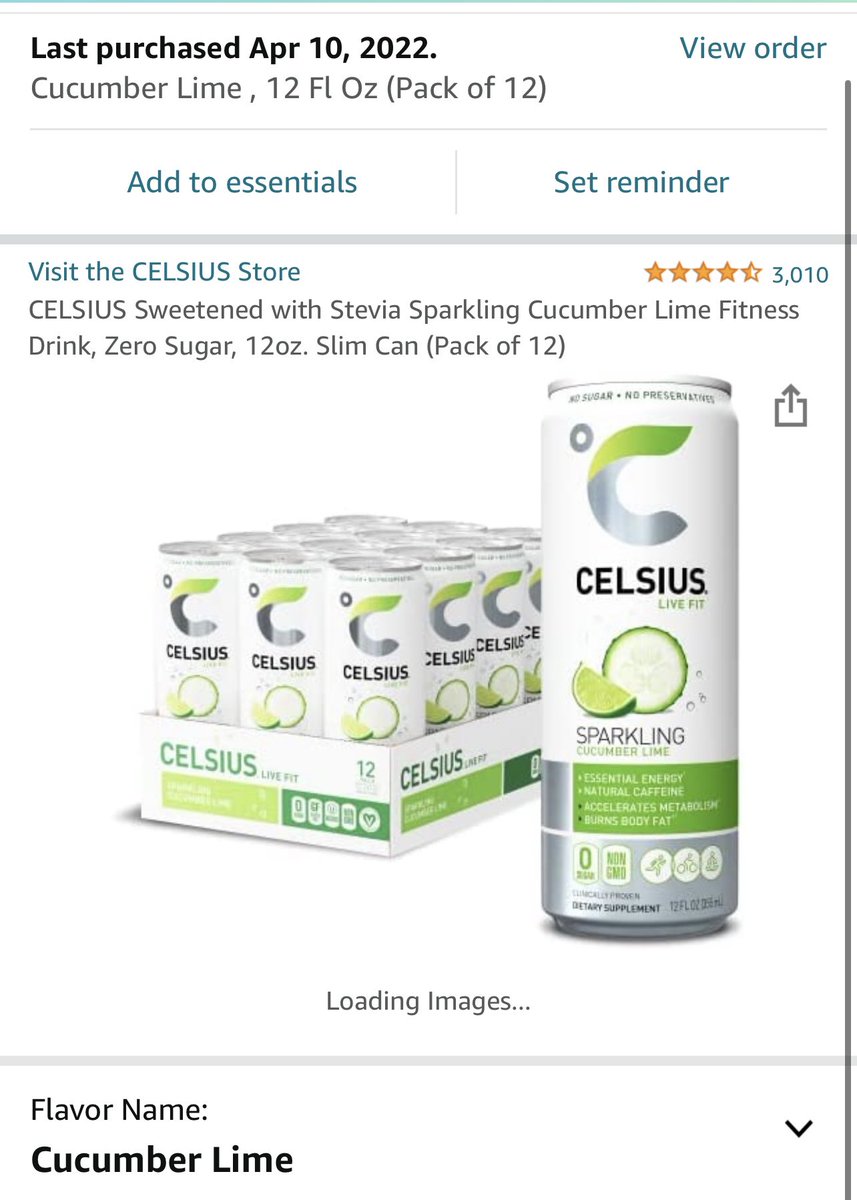

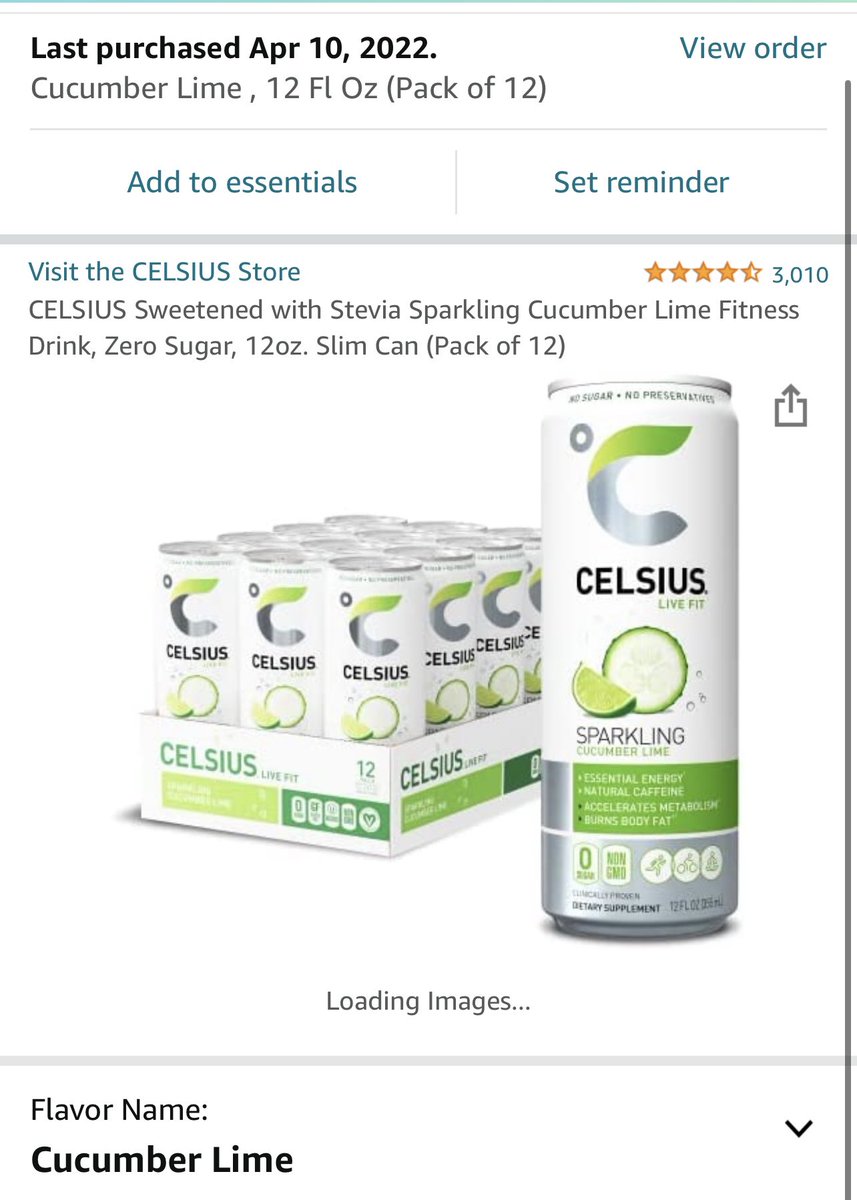

$CELH will get more shelf space and cooler space in 2022 with 120,000+ approved locations doing their resets plus they're still adding more locations, more DSD partners and more branded coolers!!

$CELH will get more shelf space and cooler space in 2022 with 120,000+ approved locations doing their resets plus they're still adding more locations, more DSD partners and more branded coolers!!