Postdoc at @Columbia_Biz & @Rooseveltinst. Next: @CornellEcon & @cornellilr, '23. Macro, labor, inequality. "Bloesch" rhymes with "mesh".

How to get URL link on X (Twitter) App

https://twitter.com/paulkrugman/status/1620778846462283776At this point, downward nominal rigidity of wages is pretty well established.

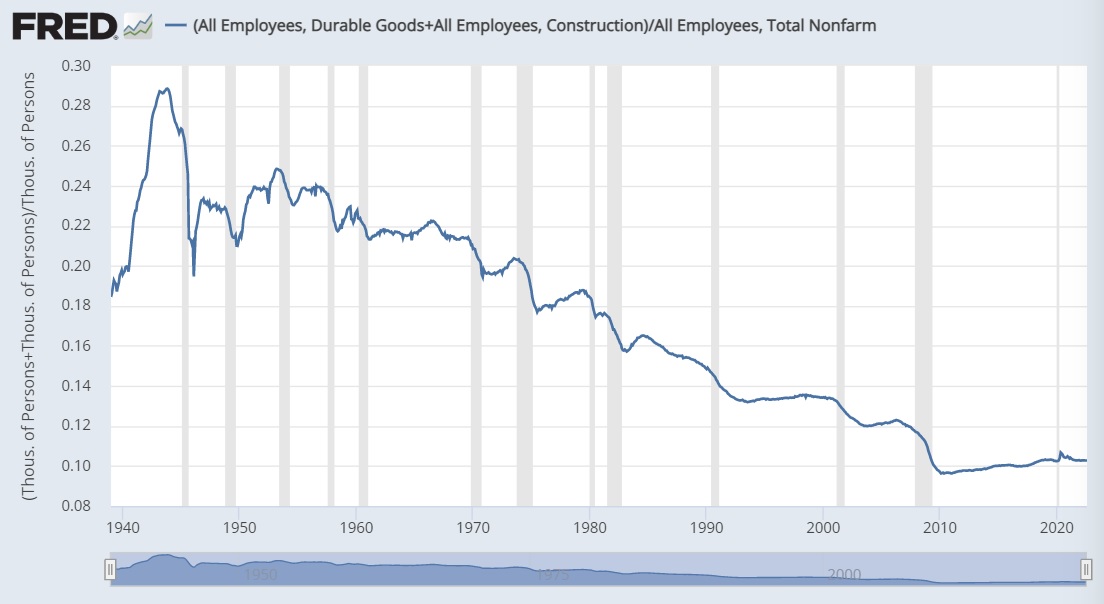

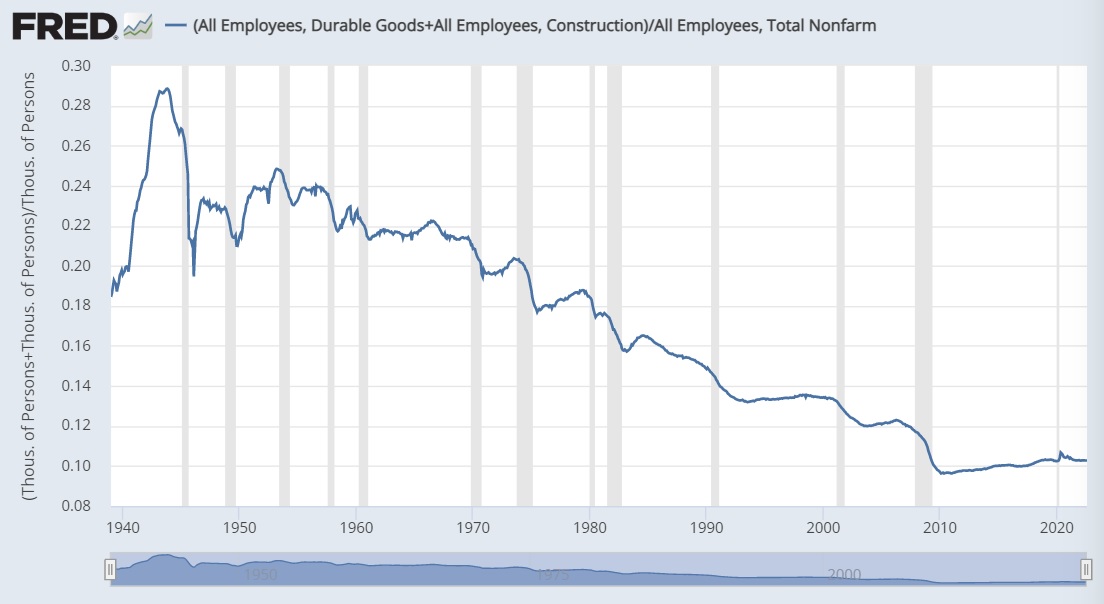

https://twitter.com/conorsen/status/1575463017646620675Fewer people work in interest-sensitive sectors.

Most likely reason: firms pass wage costs into services prices.

Most likely reason: firms pass wage costs into services prices.