Active Trader. Lifelong Investor. Founder of Cerlogic Markets Research.

Sharing real positions and trend alerts in equities, metals, energy, FX & agriculture.

2 subscribers

How to get URL link on X (Twitter) App

Tin Deep Dive - Part 2 🧵

Tin Deep Dive - Part 2 🧵

🧵(2/13) Platinum – $PL / $PPLT

🧵(2/13) Platinum – $PL / $PPLT

Offshore Drilling Deep Dive - Part 2 🧵

Offshore Drilling Deep Dive - Part 2 🧵

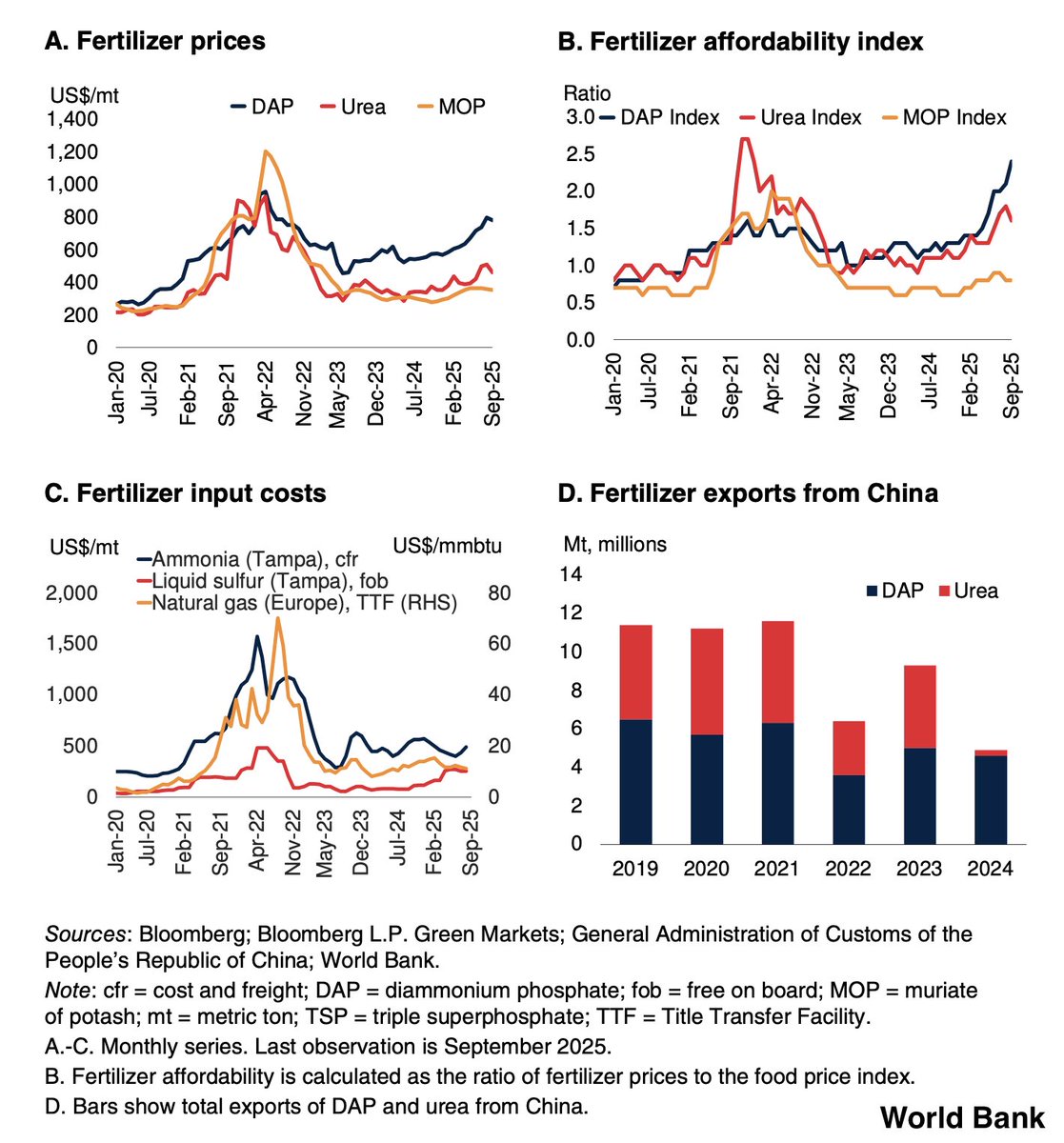

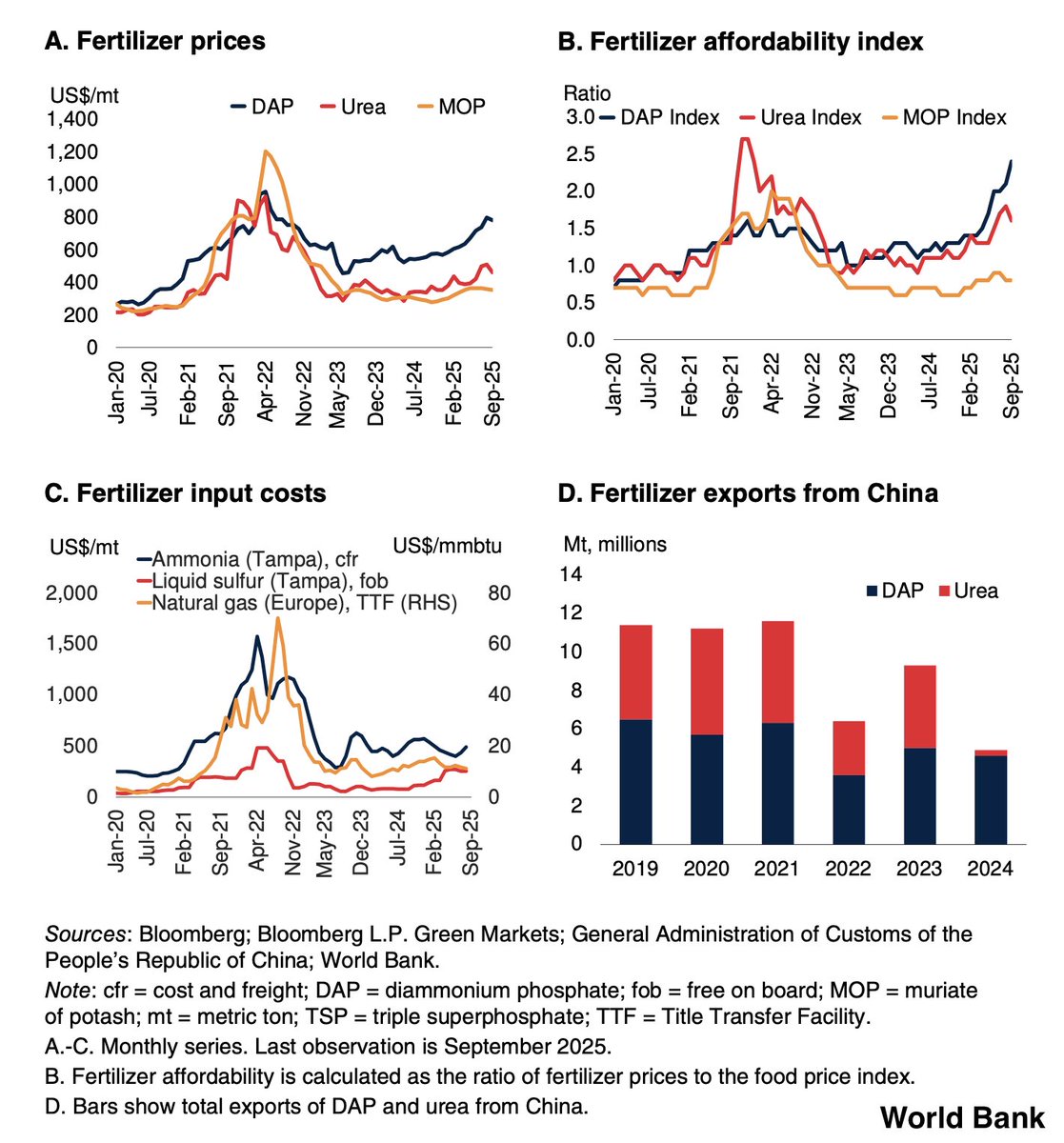

Agriculture Deep Dive | Fertilizers - Part 2 🧵

Agriculture Deep Dive | Fertilizers - Part 2 🧵

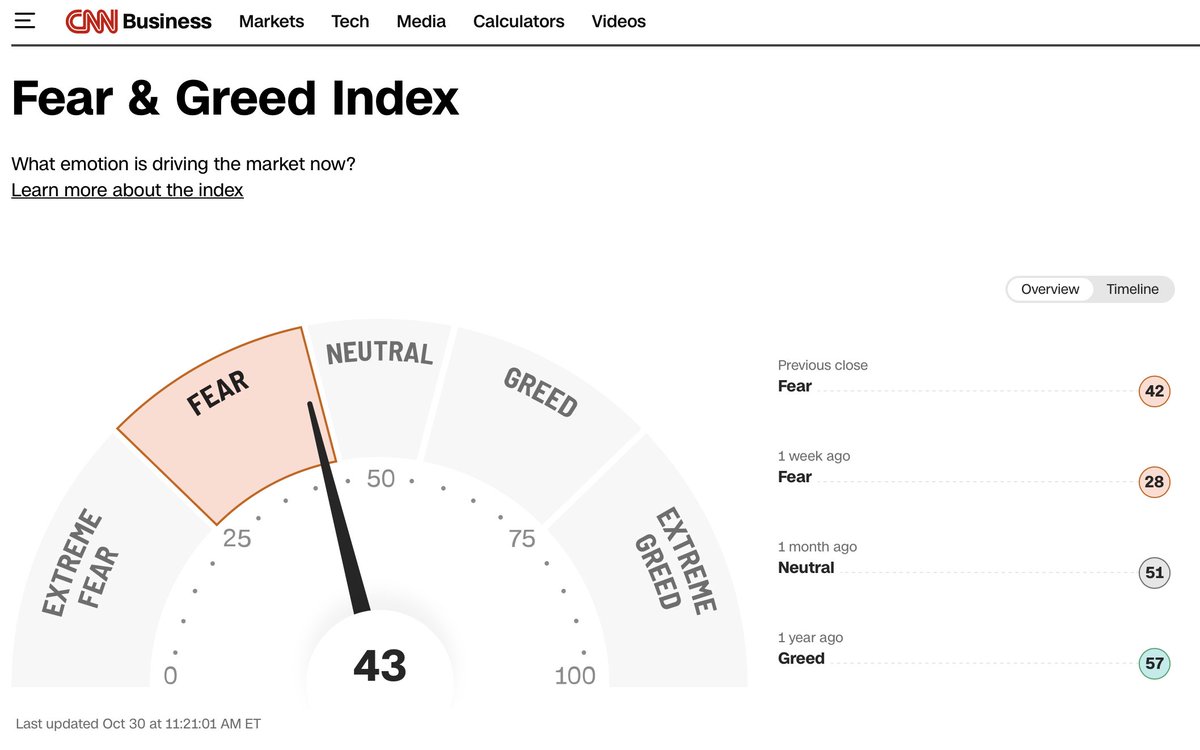

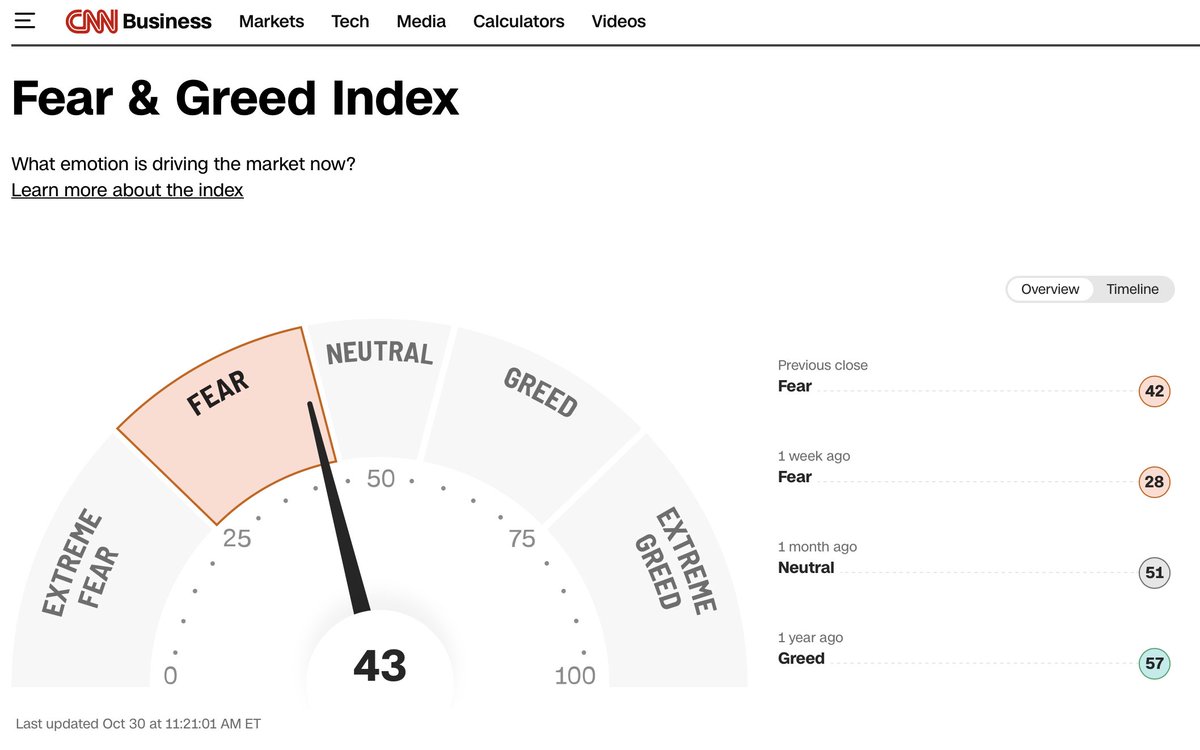

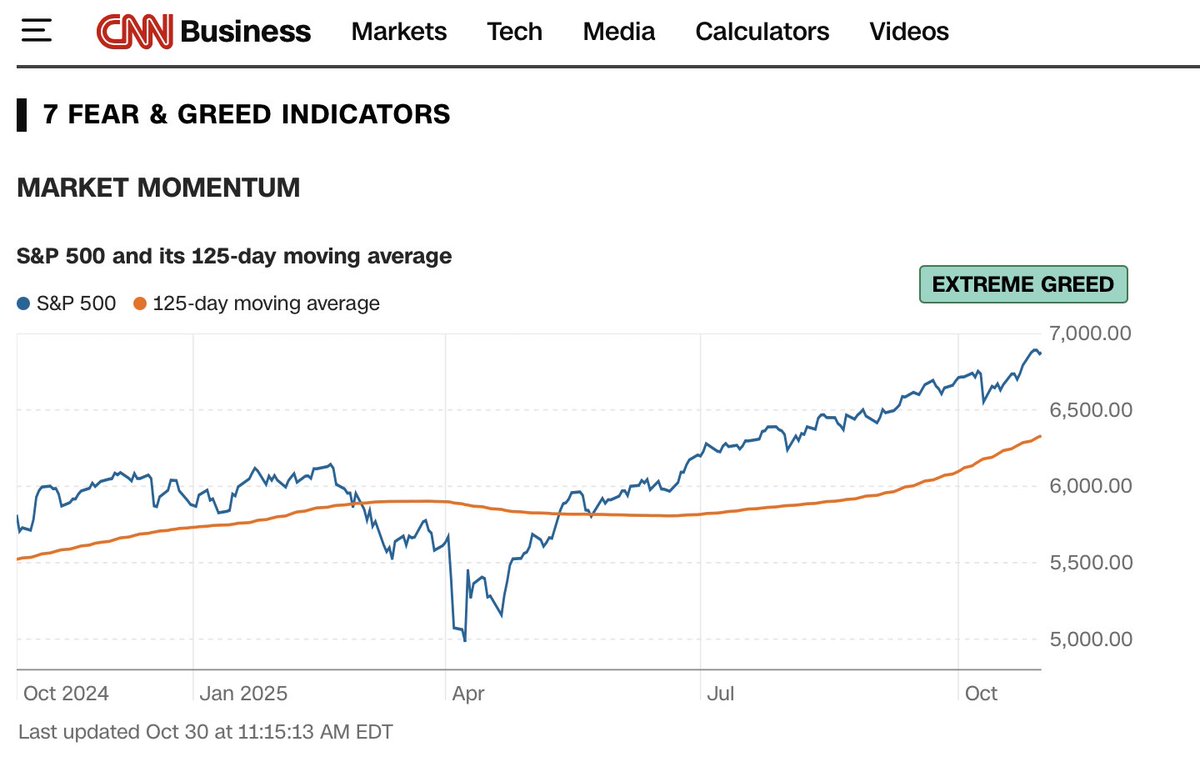

Fear & Greed Index Thread 🧵(1/7)

Fear & Greed Index Thread 🧵(1/7)

Nickel – the quiet setup update - Thread 🧵 p.2

Nickel – the quiet setup update - Thread 🧵 p.2

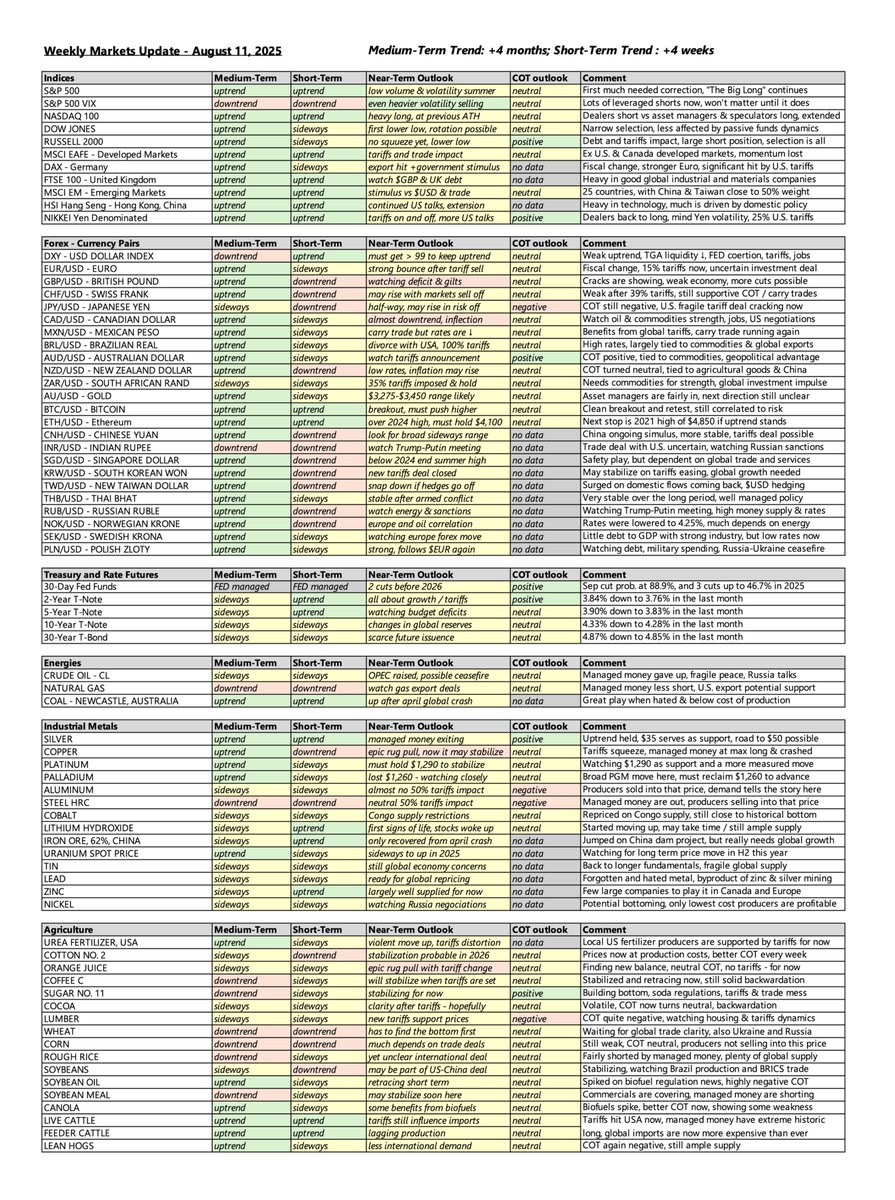

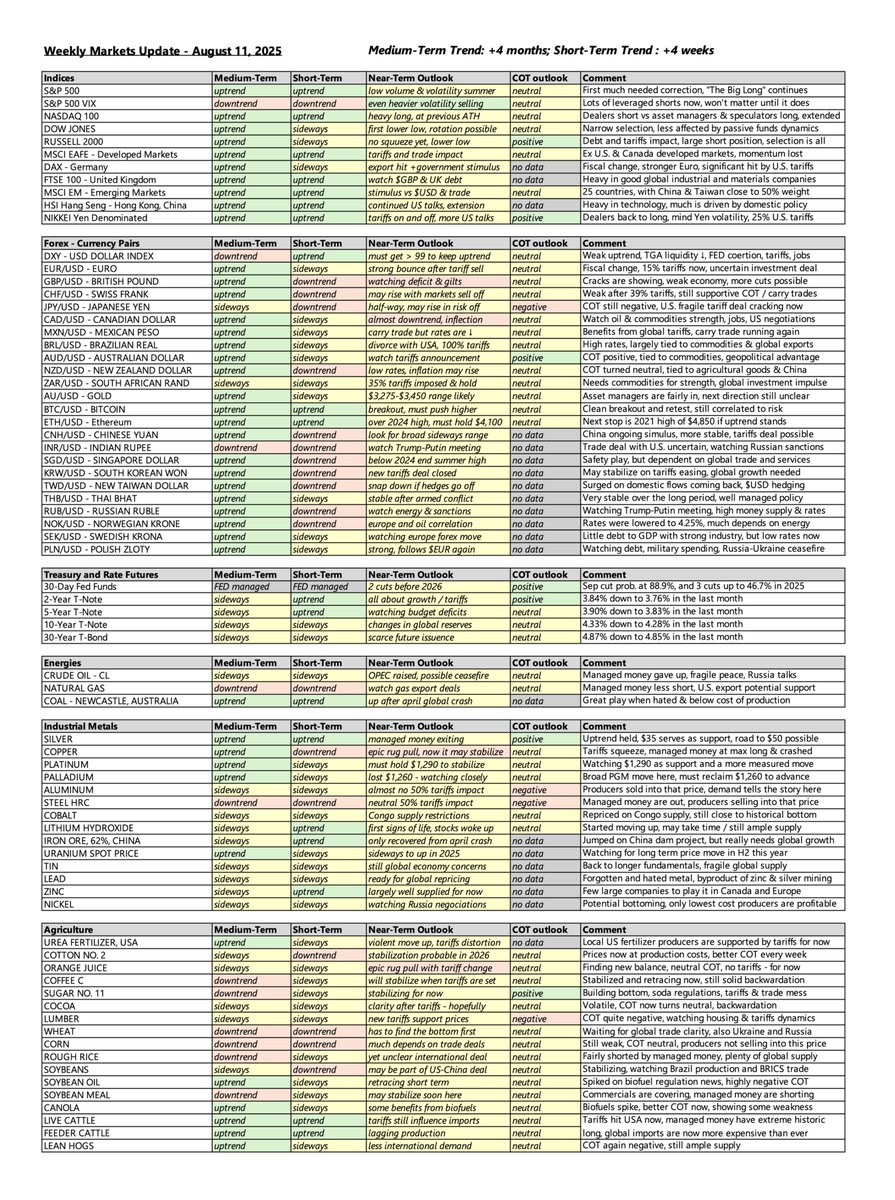

Weekly Markets Update – August 11, 2025 – Part 2

Weekly Markets Update – August 11, 2025 – Part 2