Ex-IB / PE / Crypto Hedge Fund. Now independent trader & investor. Thoughts are my own. Vibe coding Purrfolio

How to get URL link on X (Twitter) App

(2/8) Unified Platform

(2/8) Unified Platform

https://twitter.com/Keisan_Crypto/status/1881510915813564451

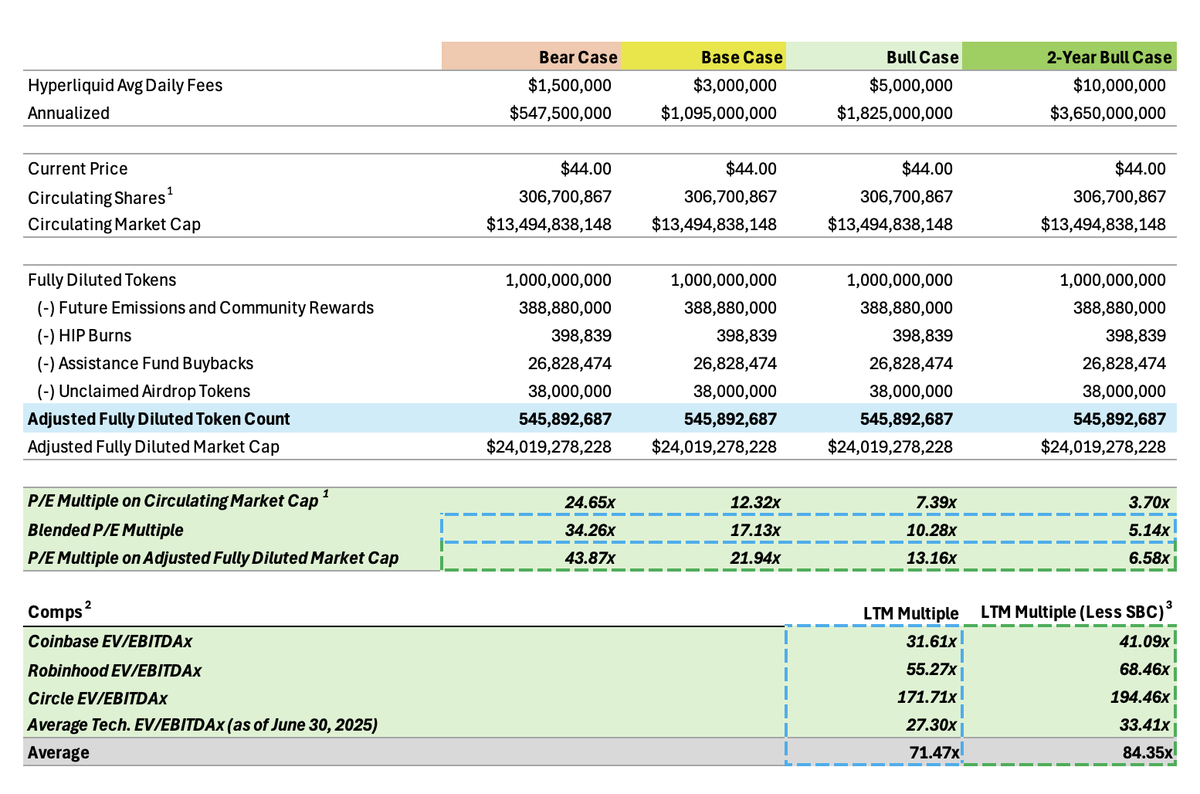

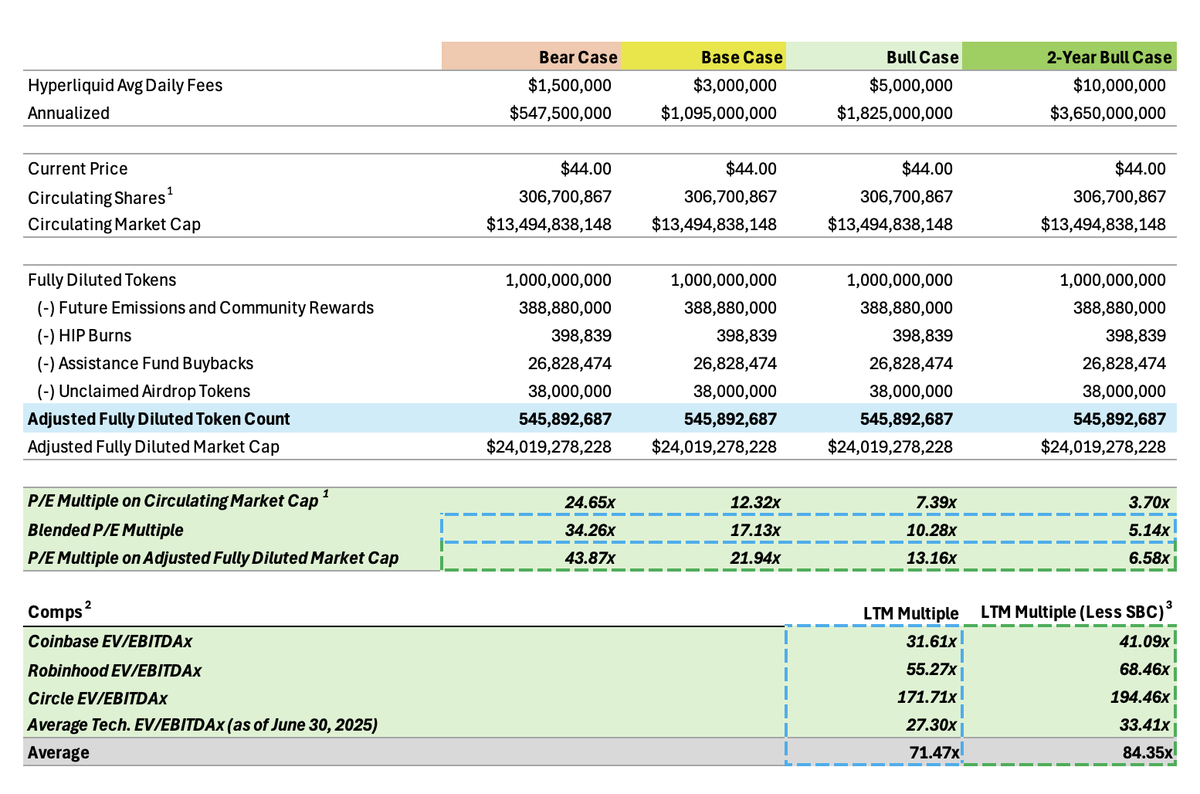

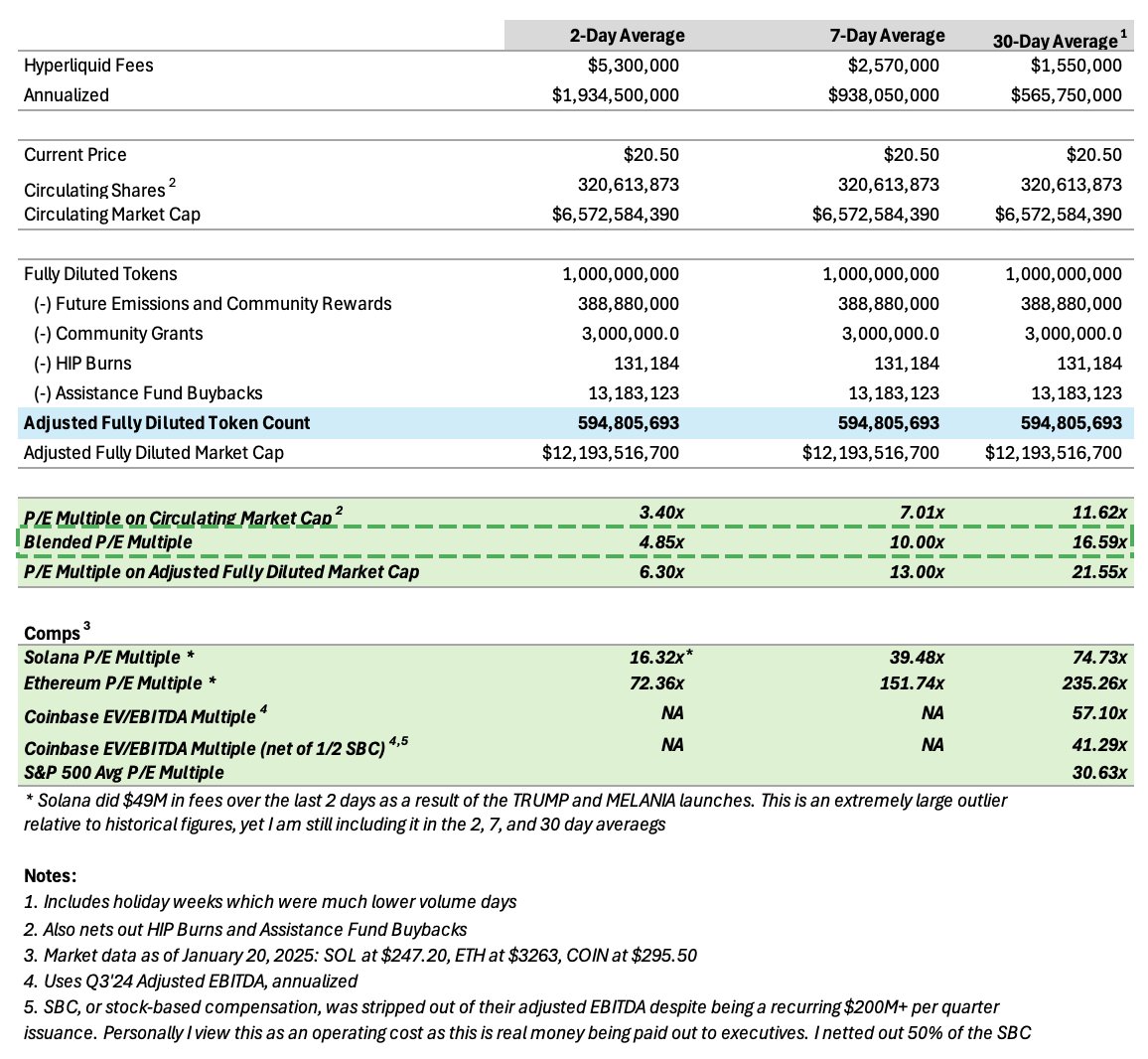

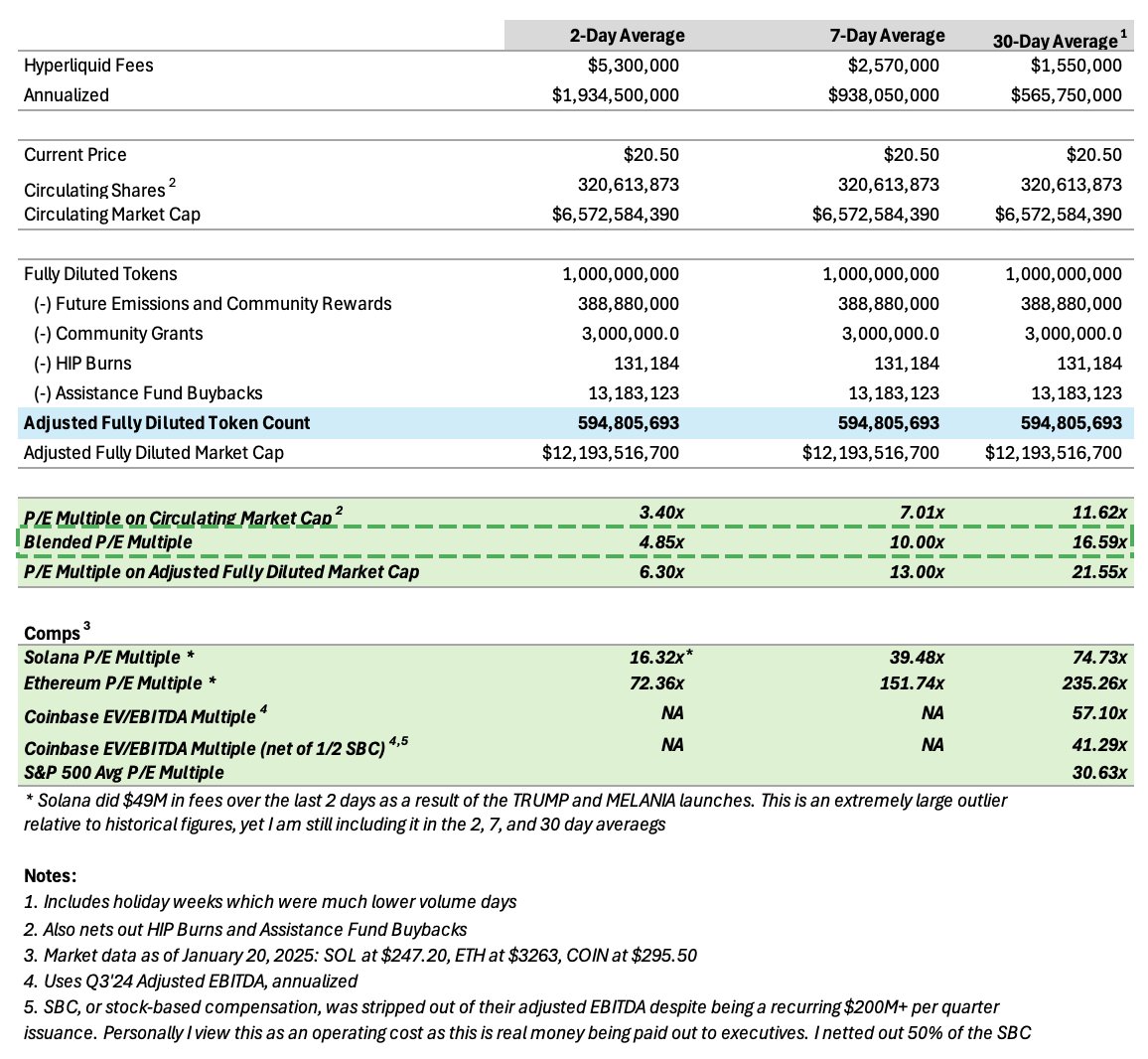

(2/11) Revenue Underwriting --

(2/11) Revenue Underwriting --

1. Retail / normies

1. Retail / normies

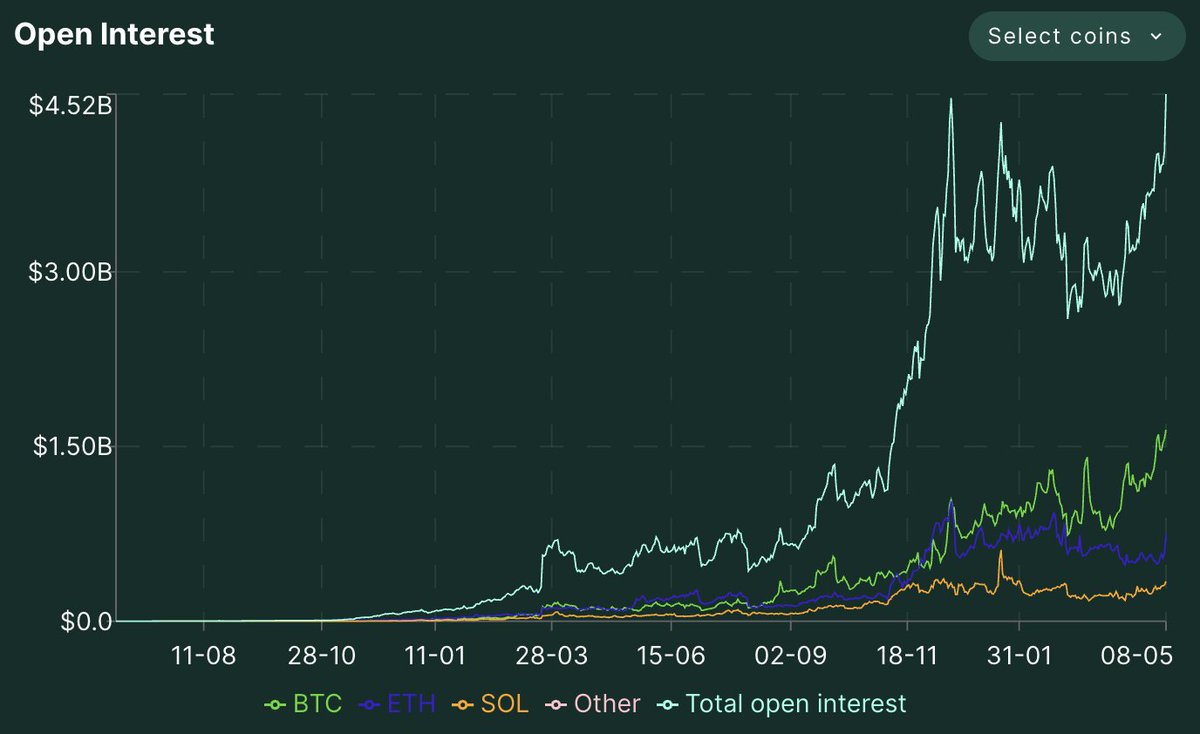

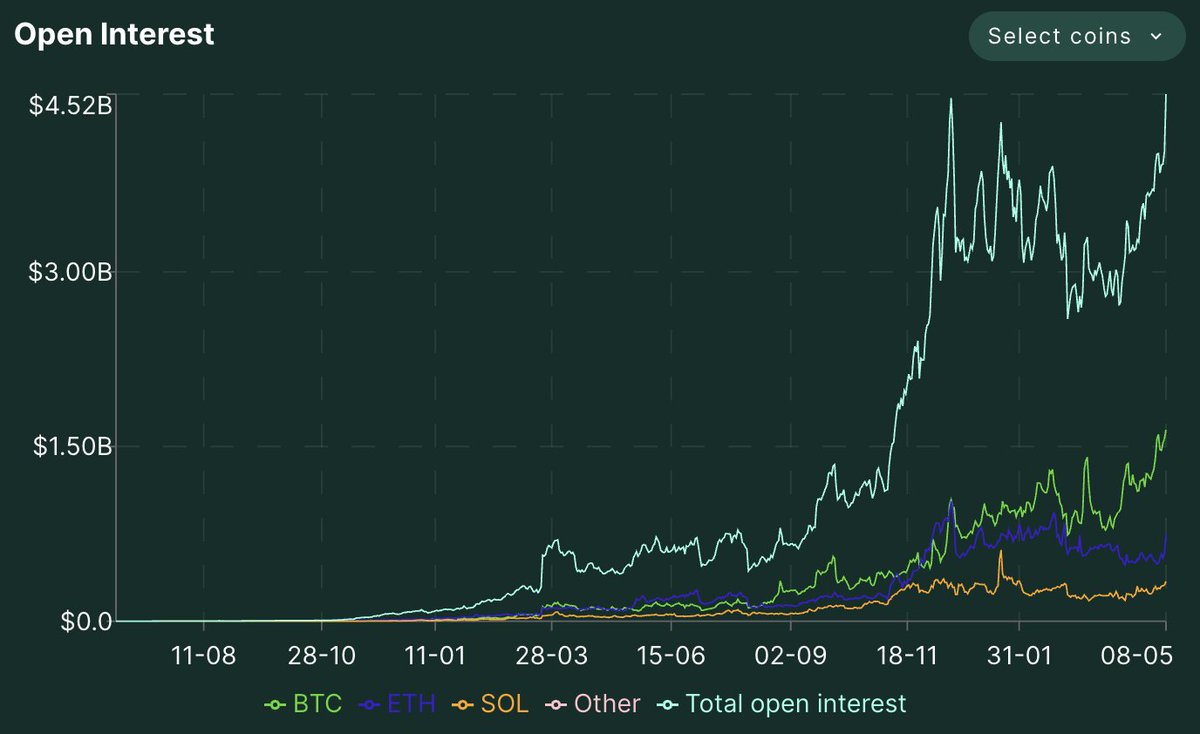

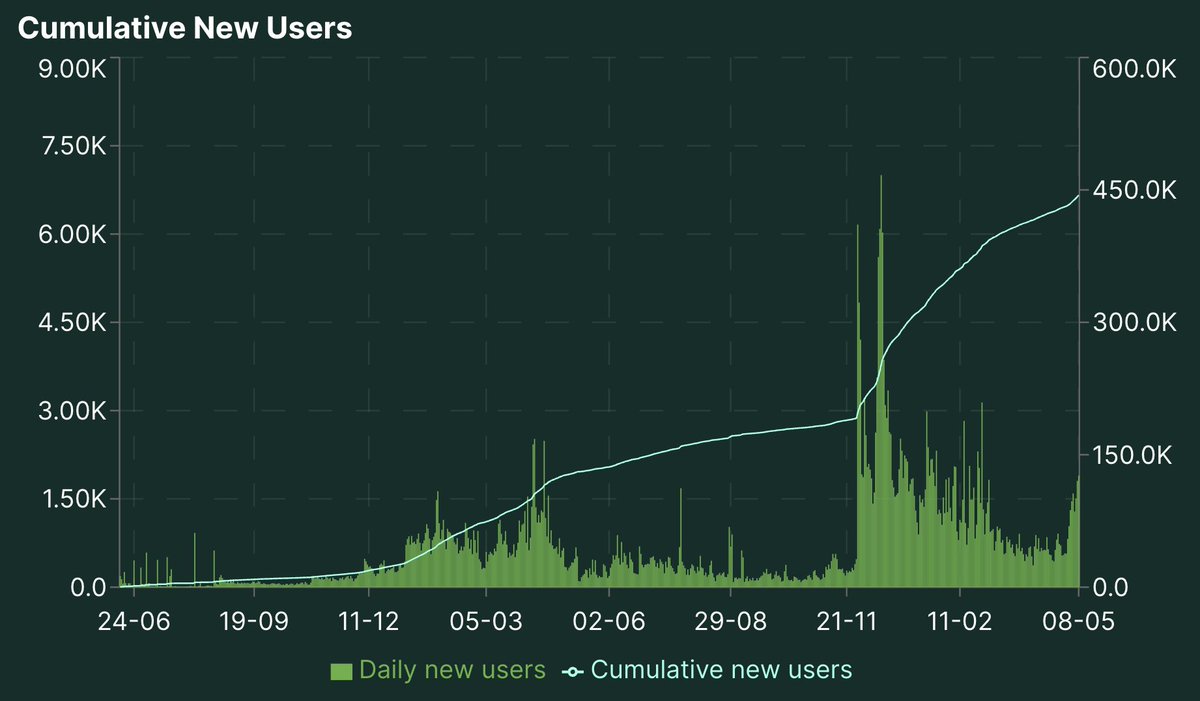

(2/7) User Growth

(2/7) User Growth

(2/6) There are 3 main ways stocks use their earnings: dividends, buybacks, and re-investing in the company (R&D/CapEx)

(2/6) There are 3 main ways stocks use their earnings: dividends, buybacks, and re-investing in the company (R&D/CapEx)

(2/6) Methodology

(2/6) Methodology

(2/10) More users also means more mindshare and free marketing, which turns into even more users.

(2/10) More users also means more mindshare and free marketing, which turns into even more users.