Self-Made Multi-Billionaire, Global Investor, Father of P/S Ratio, NYT Bestseller, Market Guru, Financial Columnist and Tree Nut.

How to get URL link on X (Twitter) App

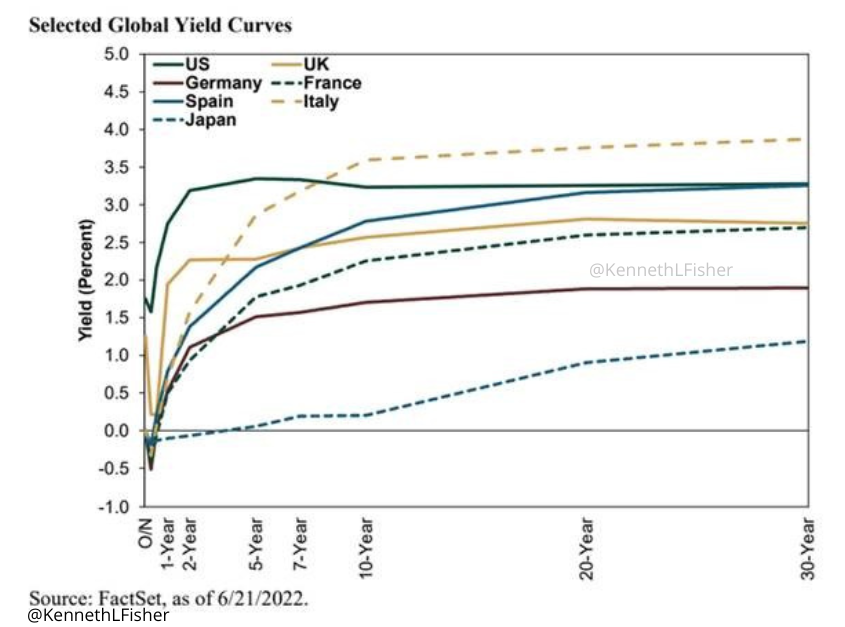

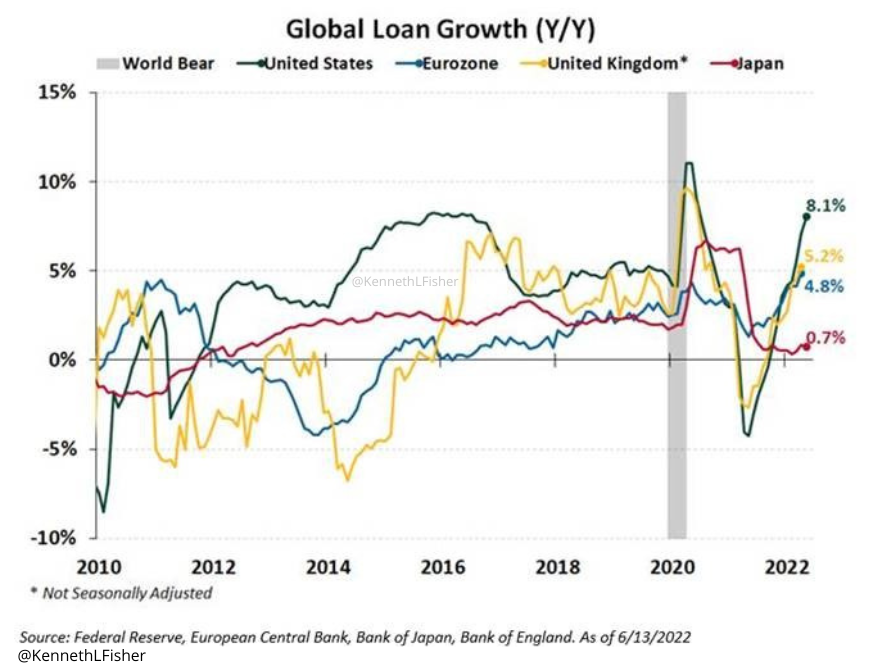

Historically, recessions are rare when long-term rates exceed short-term and banks have profit motive to lend. Loan growth among most developed markets remains healthy. (2/4)

Historically, recessions are rare when long-term rates exceed short-term and banks have profit motive to lend. Loan growth among most developed markets remains healthy. (2/4)

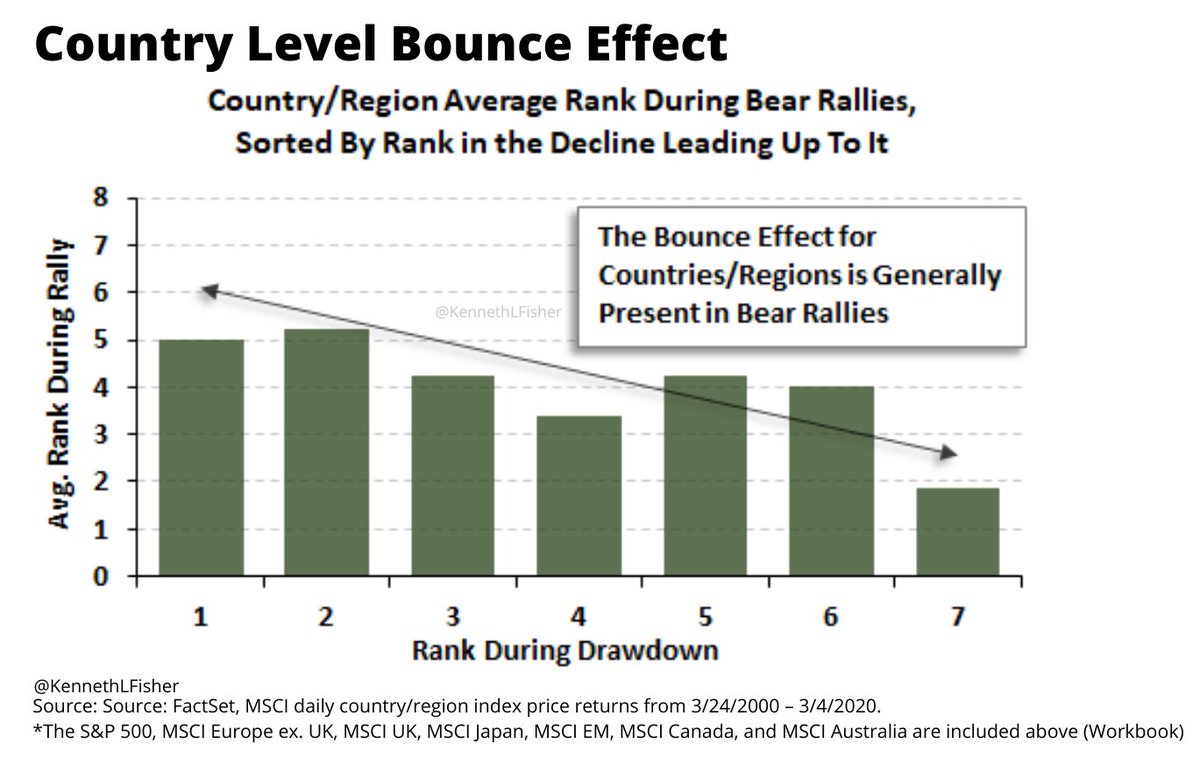

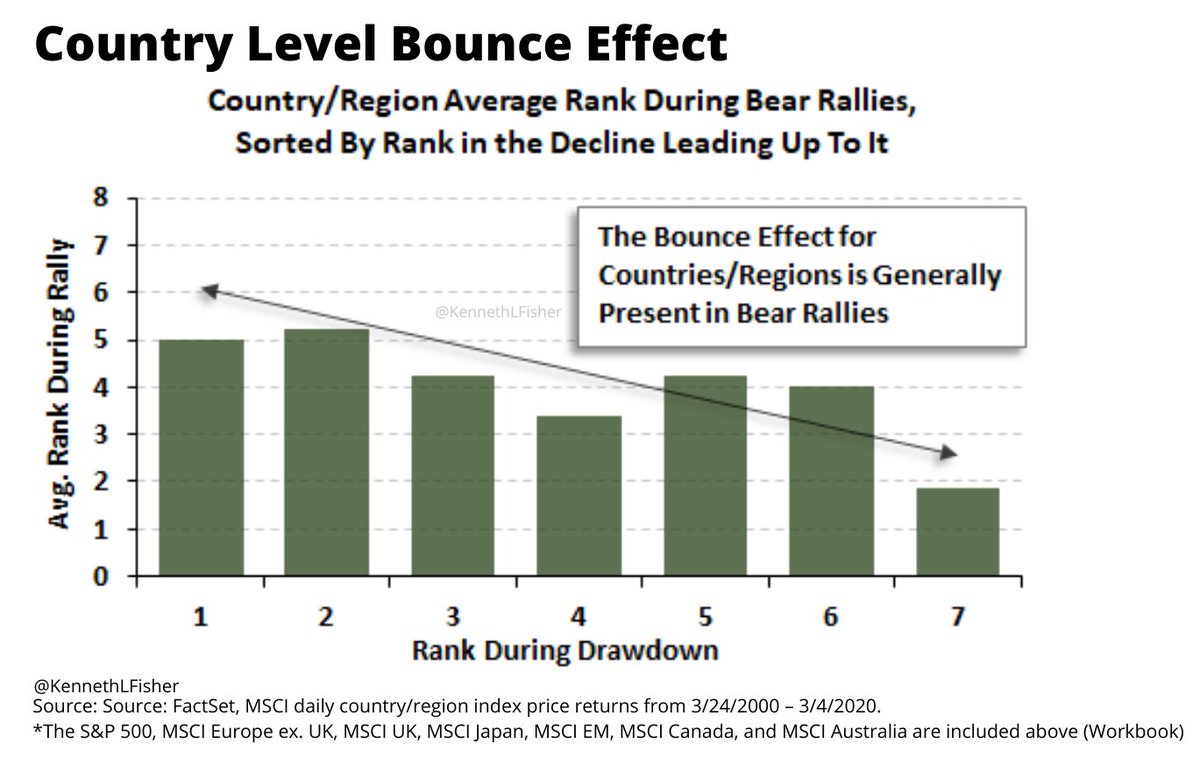

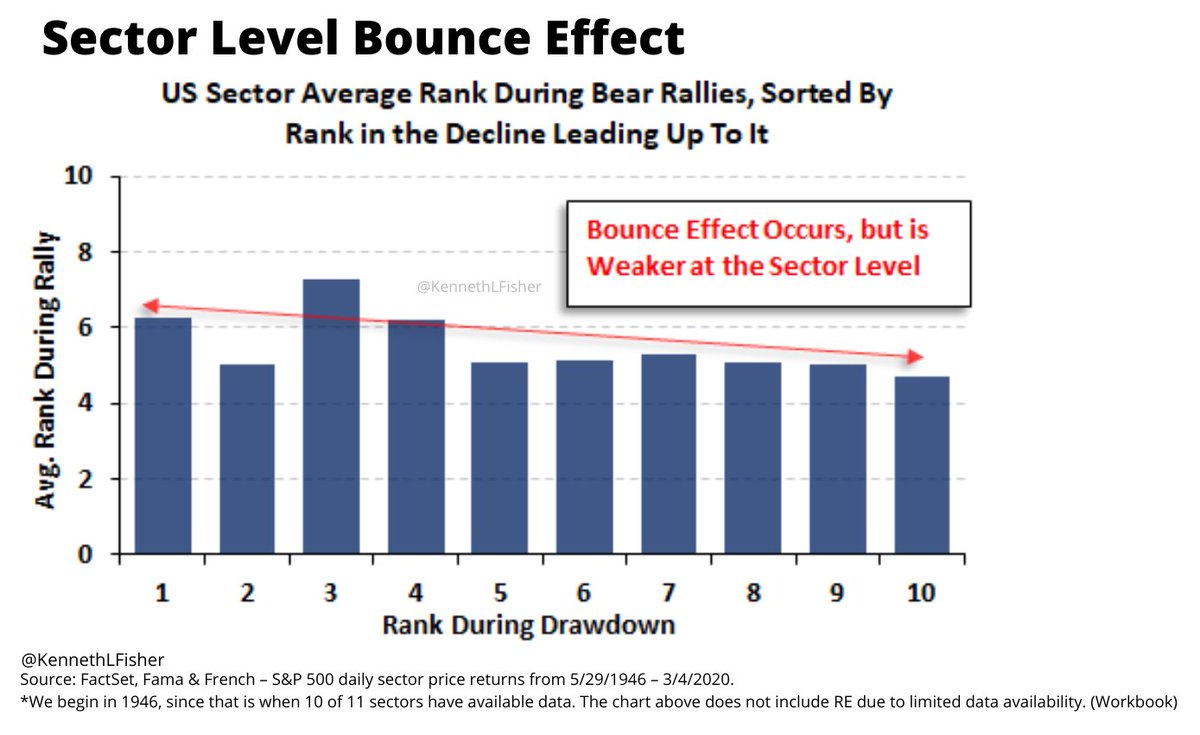

It is a weaker effect by sector but still there.

It is a weaker effect by sector but still there.

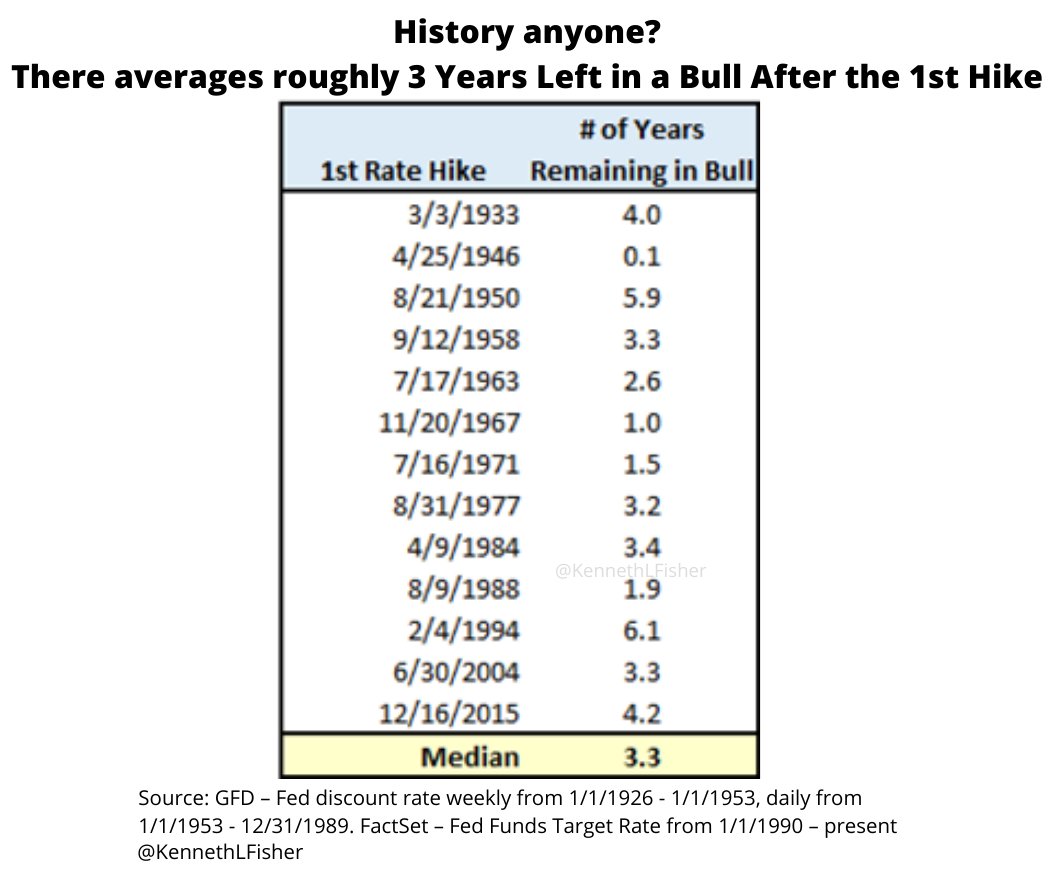

2nd of 4 showing stats that should seriously dissuade the masses now believing 2022 rate hikes should kill stocks. Ridiculous notion. Stocks may or may not thrive, but it won’t be from rate hikes. I remain bullish seeing double digits by yearend.

2nd of 4 showing stats that should seriously dissuade the masses now believing 2022 rate hikes should kill stocks. Ridiculous notion. Stocks may or may not thrive, but it won’t be from rate hikes. I remain bullish seeing double digits by yearend.

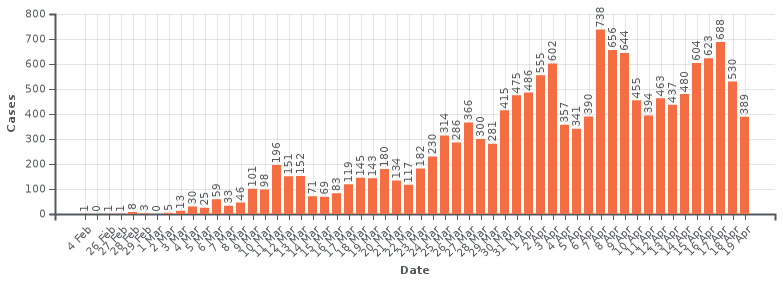

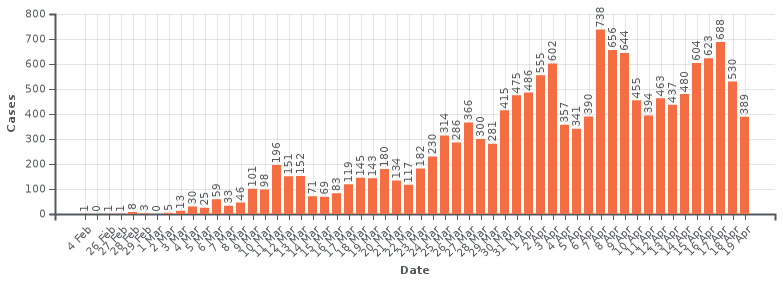

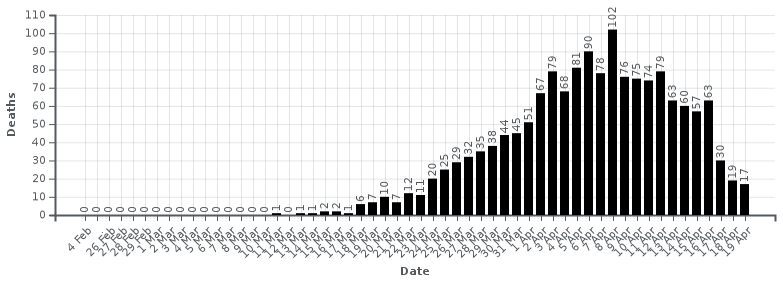

Sweden’s deaths/day peaked 10 days ago & have fallen almost to the floor, which seems one definition of success. Hard to see why more western nations aren’t emulating, experimenting with or studying that. Instead they negatively compare to Finland, Denmark & Norway. Why?

Sweden’s deaths/day peaked 10 days ago & have fallen almost to the floor, which seems one definition of success. Hard to see why more western nations aren’t emulating, experimenting with or studying that. Instead they negatively compare to Finland, Denmark & Norway. Why?

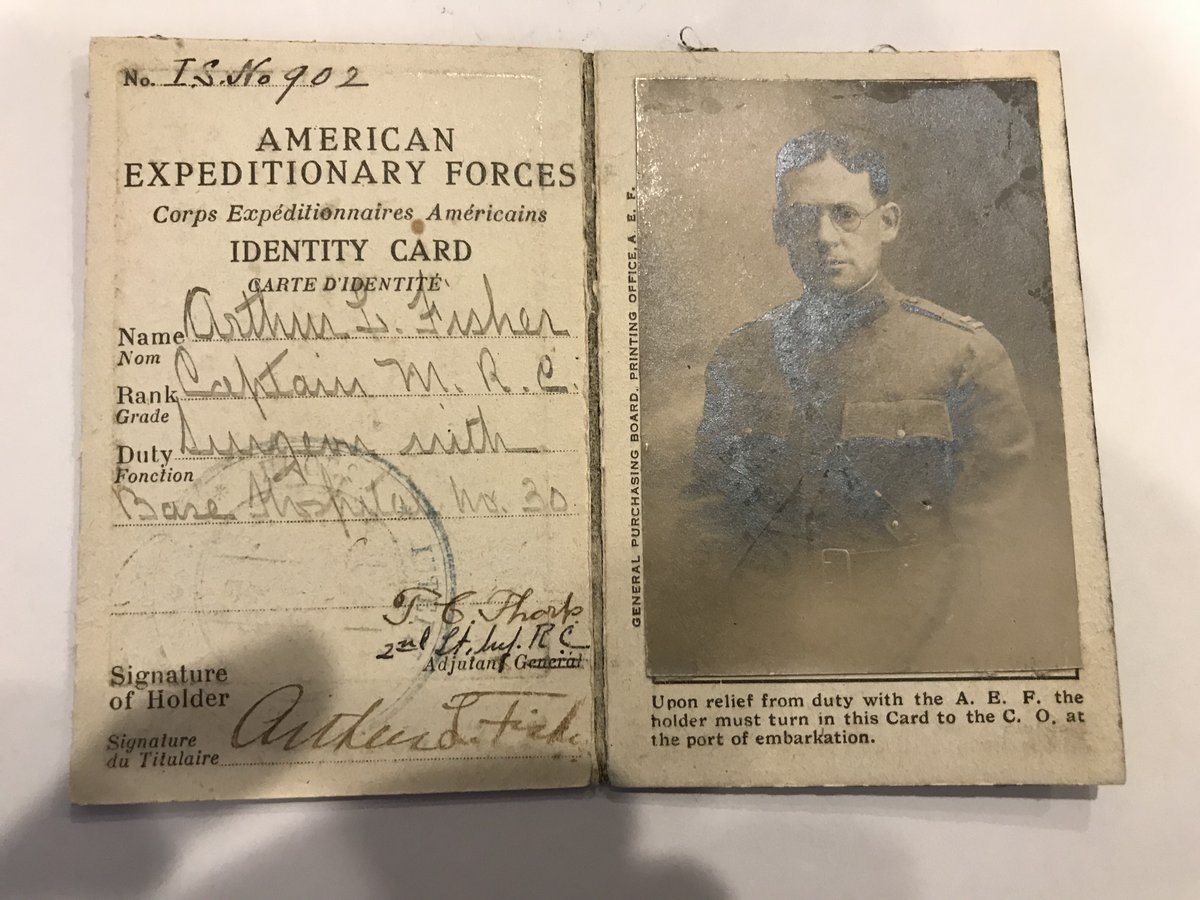

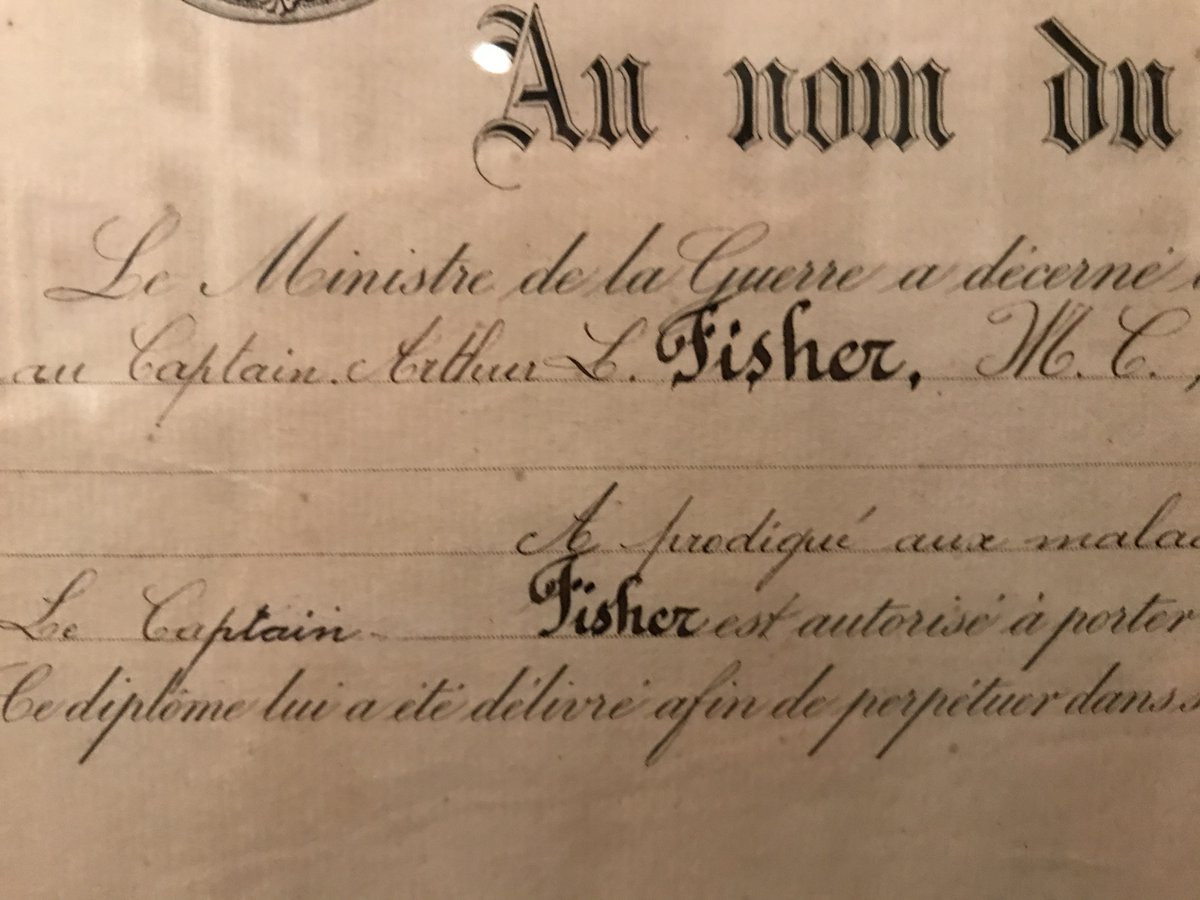

My grandpa's identity card showing rank etc. and where he served. The group he went with were exceptional. Born in 1875 he was over 40, didn't have to do this. These people were brave.

My grandpa's identity card showing rank etc. and where he served. The group he went with were exceptional. Born in 1875 he was over 40, didn't have to do this. These people were brave.