Koyfin is a financial data and analytics platform for researching global stocks, ETFs, Mutual Funds, macro trends, and portfolios. Sign up for free.

7 subscribers

How to get URL link on X (Twitter) App

1) The weight of the Magnificent Seven* more than 30% of the S&P 500, about level with prior peaks in mid-2024 and early-2025.

1) The weight of the Magnificent Seven* more than 30% of the S&P 500, about level with prior peaks in mid-2024 and early-2025.

1) $UBER Uber

1) $UBER Uber

https://x.com/KoyfinCharts/status/1957864407083675820

2/ $PTON Peloton

2/ $PTON Peloton

1) Drawdowns are the norm, not the exception.

1) Drawdowns are the norm, not the exception.

1) Today's largest companies are built different.

1) Today's largest companies are built different.

1. The 80/20 rule:

1. The 80/20 rule:

1) These charts are sometimes called 'Fair Value' chart lines, where you plot a range of constant valuation multiples to visualise where the company trades in relation to those bands.

1) These charts are sometimes called 'Fair Value' chart lines, where you plot a range of constant valuation multiples to visualise where the company trades in relation to those bands.

1/ Most investors misprice extreme outcomes - markets often overpay for "lottery" stocks (low probability, high payoff) and underprice extreme downside risks.

1/ Most investors misprice extreme outcomes - markets often overpay for "lottery" stocks (low probability, high payoff) and underprice extreme downside risks.

2) The 10 largest companies in the S&P 500 accounted for nearly 40% of total market capitalization and nearly 60% of total index returns in 2024

2) The 10 largest companies in the S&P 500 accounted for nearly 40% of total market capitalization and nearly 60% of total index returns in 2024

Here is how you would set up the screen in Koyfin, which yields 122 results across the US, Canadian, and European markets (you can include other continents or countries).

Here is how you would set up the screen in Koyfin, which yields 122 results across the US, Canadian, and European markets (you can include other continents or countries).

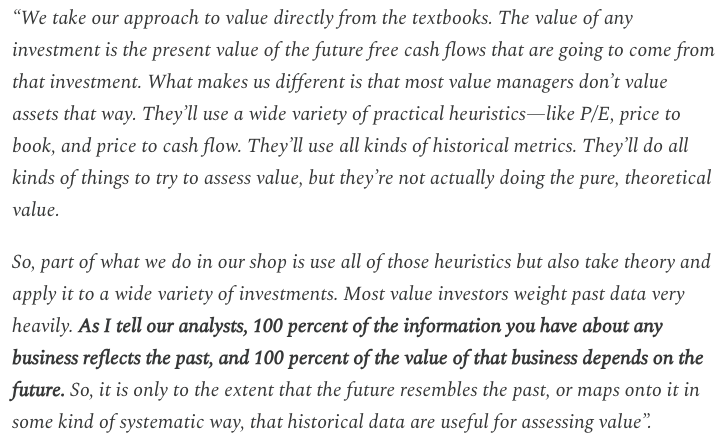

1/ What is a compounder?

1/ What is a compounder?

1. Things that have never happened before occur with some regularity

1. Things that have never happened before occur with some regularity

2/ Value traps, and how to avoid them

2/ Value traps, and how to avoid them

2) $WMT Walmart

2) $WMT Walmart

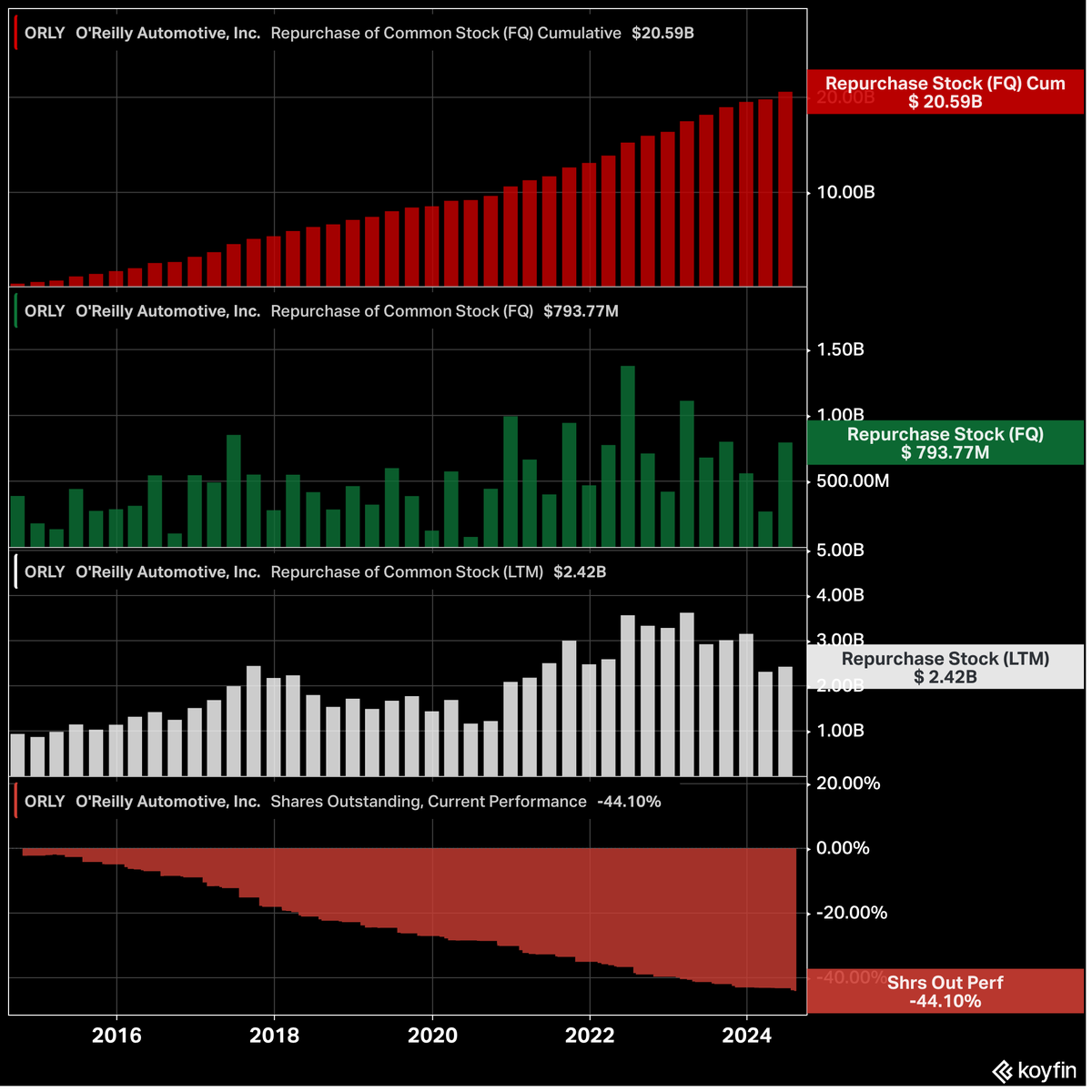

2) $ORLY O'Reilly Automotive

2) $ORLY O'Reilly Automotive