Christian, Husband, Father, Golfer || Helping businesses maximize cash & profit at @bisoncfo || Writing about SMB finances weekly: https://t.co/u6oqRYobKp

46 subscribers

How to get URL link on X (Twitter) App

June 29, 2007: Apple releases the iPhone

June 29, 2007: Apple releases the iPhone

First, I’d go to the Income Statement.

First, I’d go to the Income Statement.

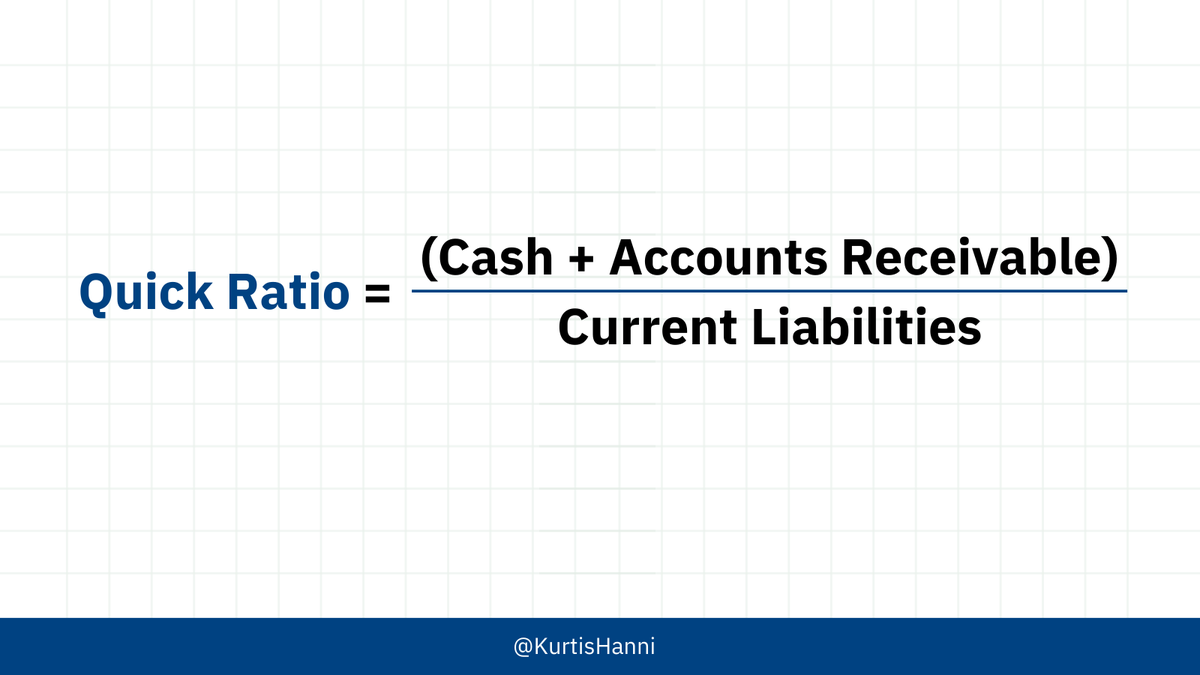

• Quick Ratio

• Quick Ratio

https://twitter.com/KurtisHanni/status/1679846163757891584

Steve Jobs returned to Apple in 1997, at a time when the company was struggling.

Steve Jobs returned to Apple in 1997, at a time when the company was struggling.

1. Two Pizza Team Rule

1. Two Pizza Team Rule

Mark Rober experimented on 50,000 of his YouTube followers.

Mark Rober experimented on 50,000 of his YouTube followers.