How to get URL link on X (Twitter) App

https://twitter.com/lettieridc/status/1922704137088577873

Here’s a great example of a sincere but mistaken way to think about wage trends. Talmon is treating the guy in 1979 as the same guy 36 years later in 2015 to claim that male workers are frustrated because they haven’t see meaningful wage growth over that entire period. But wait…

Here’s a great example of a sincere but mistaken way to think about wage trends. Talmon is treating the guy in 1979 as the same guy 36 years later in 2015 to claim that male workers are frustrated because they haven’t see meaningful wage growth over that entire period. But wait… https://twitter.com/talmonsmith/status/1922734770267603403

https://twitter.com/LettieriDC/status/1920131600487944348The modern hyperglobalization era began in 1994 with NAFTA, which created the largest free trade zone in the world. Decades later, NAFTA is often blamed for destroying jobs, closing factories, and harming the working class.

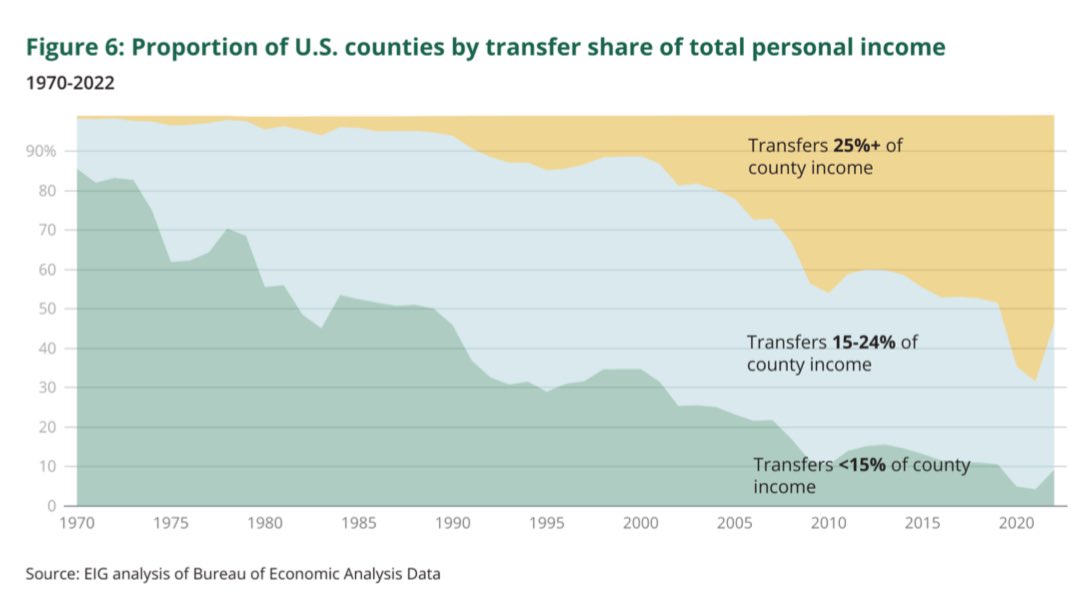

What is the Great Transfer-mation?

What is the Great Transfer-mation?

This analysis looks at counties that experienced less than half the national pace of population and median household income growth from 2000 to 2016.

This analysis looks at counties that experienced less than half the national pace of population and median household income growth from 2000 to 2016.

The General Social Survey finds 87% of workers are very or moderately satisfied.

The General Social Survey finds 87% of workers are very or moderately satisfied.

https://twitter.com/doug_rand/status/1362597288644907011Mayors were some of the first to embrace the idea—leaders like @nanwhaley, @QuentinHart, and @AkronOhioMayor were vocal right out of the gates: eig.org/news/economic-… 2/

https://twitter.com/LettieriDC/status/1245376540868739073Let’s say a business let go of half its staff in March, received the PPP loan in April, rehired back to pre-COVID levels in June. Under the statute, the entire loan amount could be forgiven. Sounds good, right?

If we look at the 25 most distressed districts nationwide, it's clear this isn't simply a Democratic or Republican issue. The most distressed district in the country is held by the GOP. In total, the GOP holds a roughly proportional 11 of the 25 most distressed districts.

If we look at the 25 most distressed districts nationwide, it's clear this isn't simply a Democratic or Republican issue. The most distressed district in the country is held by the GOP. In total, the GOP holds a roughly proportional 11 of the 25 most distressed districts.