Private Equity, Small Business Acquisition, Search Funds, ETA; Combat & Large Cap PE Veteran Co-Founder || Managing Partner - The Brydon Group

How to get URL link on X (Twitter) App

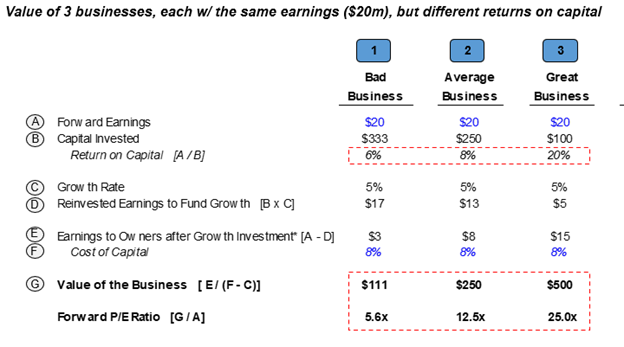

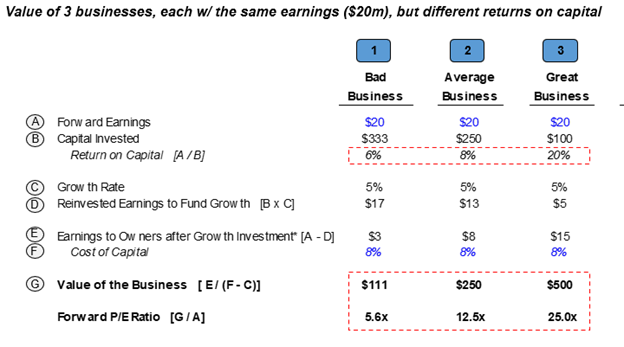

2. Here are three businesses, each with the same:

2. Here are three businesses, each with the same: