I write about high-quality stocks with 10x return potential. Learn about the best small cap stocks you’ve never heard of at https://t.co/A7VVr0NuzS

How to get URL link on X (Twitter) App

With those very simple filters, we’re down to 12 companies that have 100x’d over the last 20 years.

With those very simple filters, we’re down to 12 companies that have 100x’d over the last 20 years.

https://twitter.com/tyler/status/13406945150746910772/ $TSLA and other real companies might put 1%... or 5% of a balance sheet in at a maximum. The key is MIGHT.

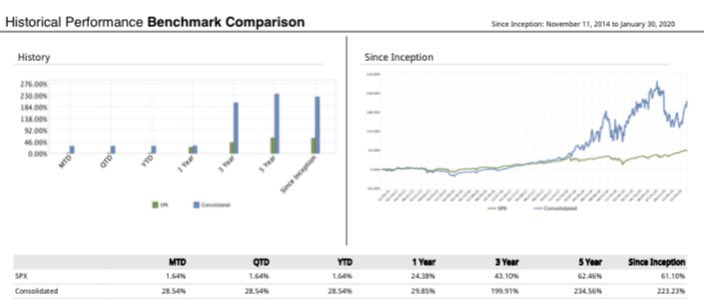

2/ Top 5 holdings = 61%. This concentration can be risky, so plz don’t just follow. These 5 will drive most my portfolio performance.

2/ Top 5 holdings = 61%. This concentration can be risky, so plz don’t just follow. These 5 will drive most my portfolio performance.