Engineer, father, and investor. Sharing my investment journey and thoughts. Constantly learning and curious.

Only opinions here.

5 subscribers

How to get URL link on X (Twitter) App

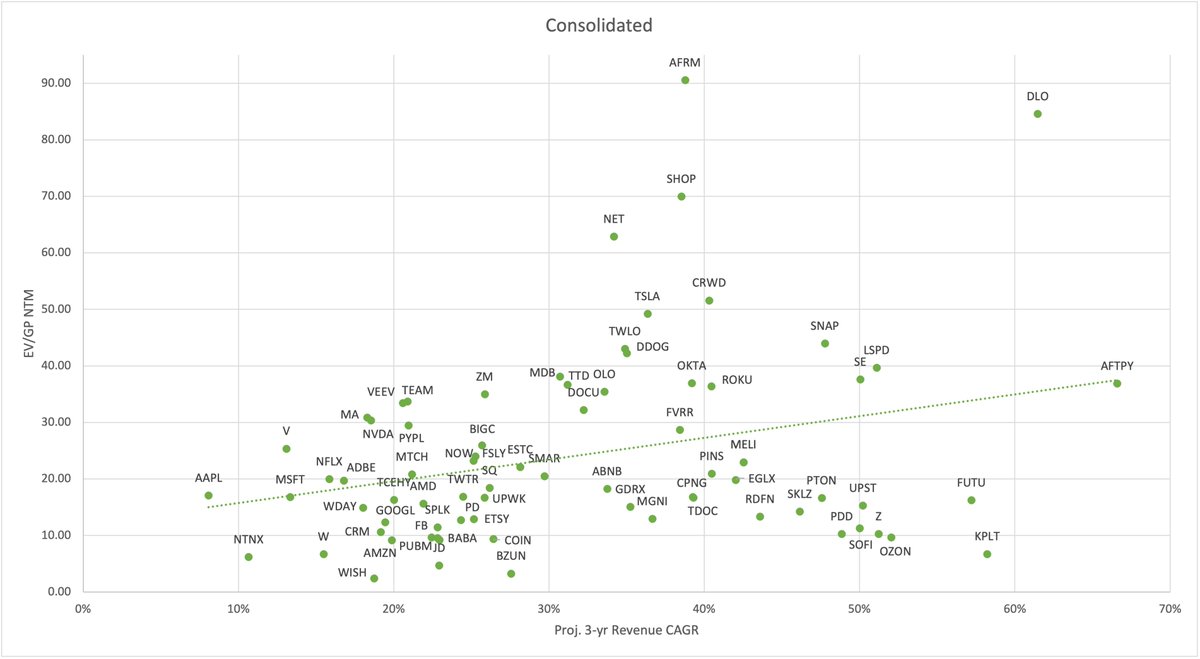

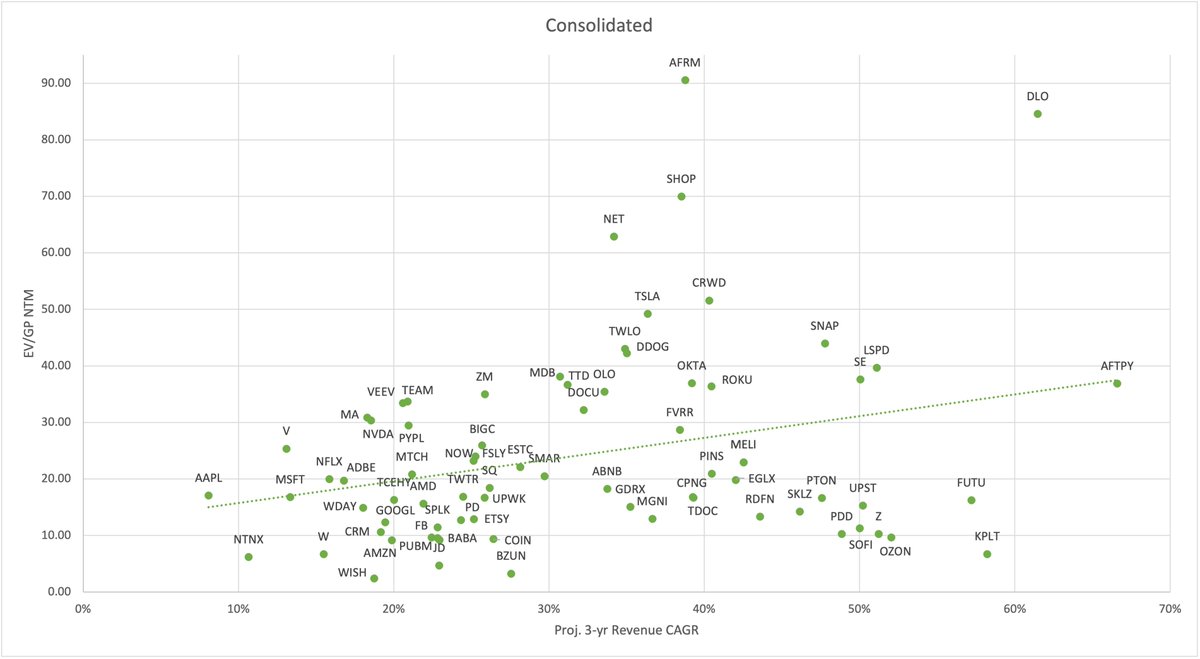

Next, we see the comparison based on a P/E NTM basis vs 3-yr Revenue Growth for all companies.

Next, we see the comparison based on a P/E NTM basis vs 3-yr Revenue Growth for all companies.

Below we can see where they were at the time and the evolution over the past month and a half.

Below we can see where they were at the time and the evolution over the past month and a half.https://twitter.com/Investing_Lion/status/1505210412521902084?s=20&t=DGrZVdjm93YEJ9lvcEUHQA

These companies are profitable and they are getting closer or reaching lower multiples than more mature and established non-tech companies.

These companies are profitable and they are getting closer or reaching lower multiples than more mature and established non-tech companies.

These are special companies, that have stood the test of time and delivered high returns to shareholders.

These are special companies, that have stood the test of time and delivered high returns to shareholders.

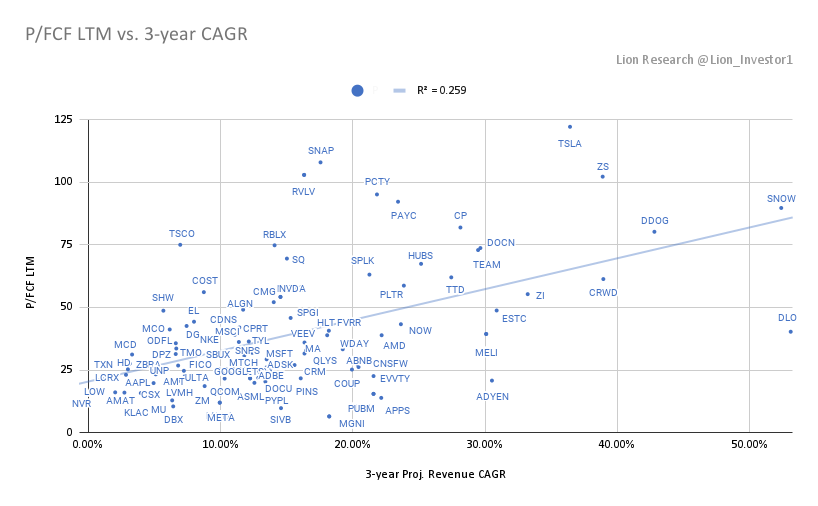

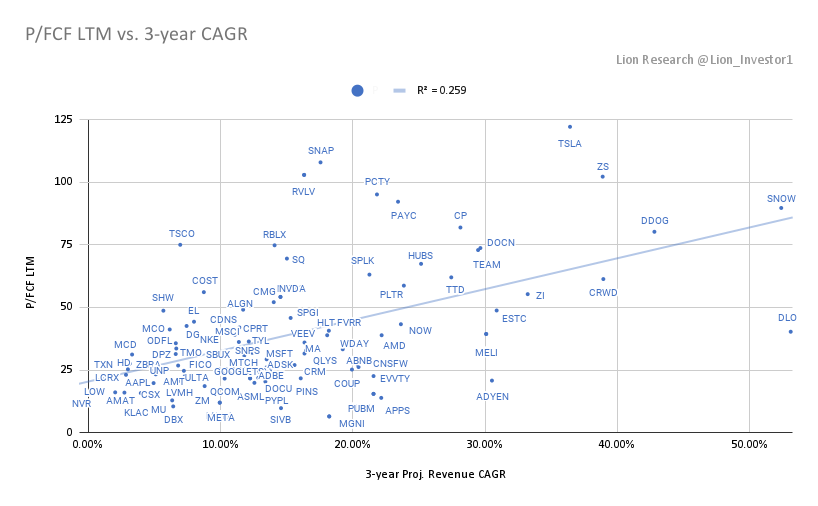

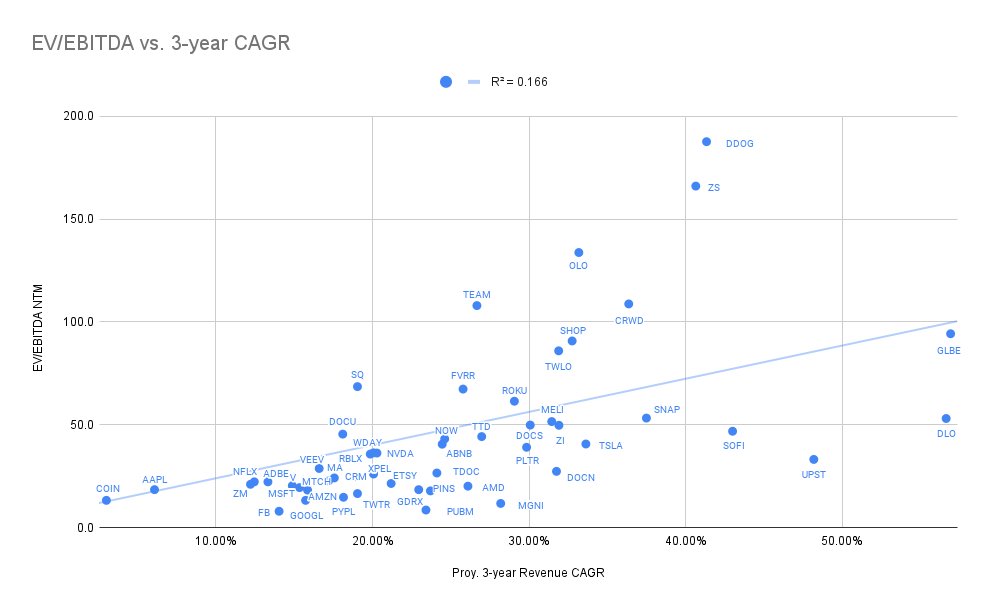

Based on the business characteristics and financials, sometimes valuations between free cash flow multiples and EBITDA multiples vary widely.

Based on the business characteristics and financials, sometimes valuations between free cash flow multiples and EBITDA multiples vary widely.

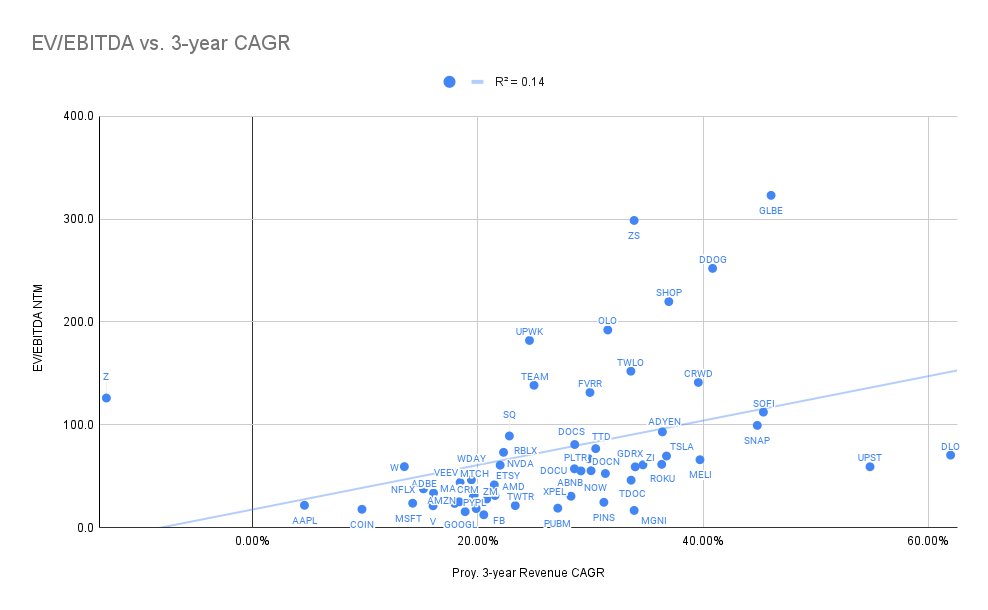

In the current lower liquidity environment, valuation has become more important. Many investors prefer companies that are profitable on an EBITDA and Free Cash Flow basis.

In the current lower liquidity environment, valuation has become more important. Many investors prefer companies that are profitable on an EBITDA and Free Cash Flow basis.

Of the 82 companies analyzed, 62 have positive NTM EBITDA and 49 are FCF LTM profitable.

Of the 82 companies analyzed, 62 have positive NTM EBITDA and 49 are FCF LTM profitable.

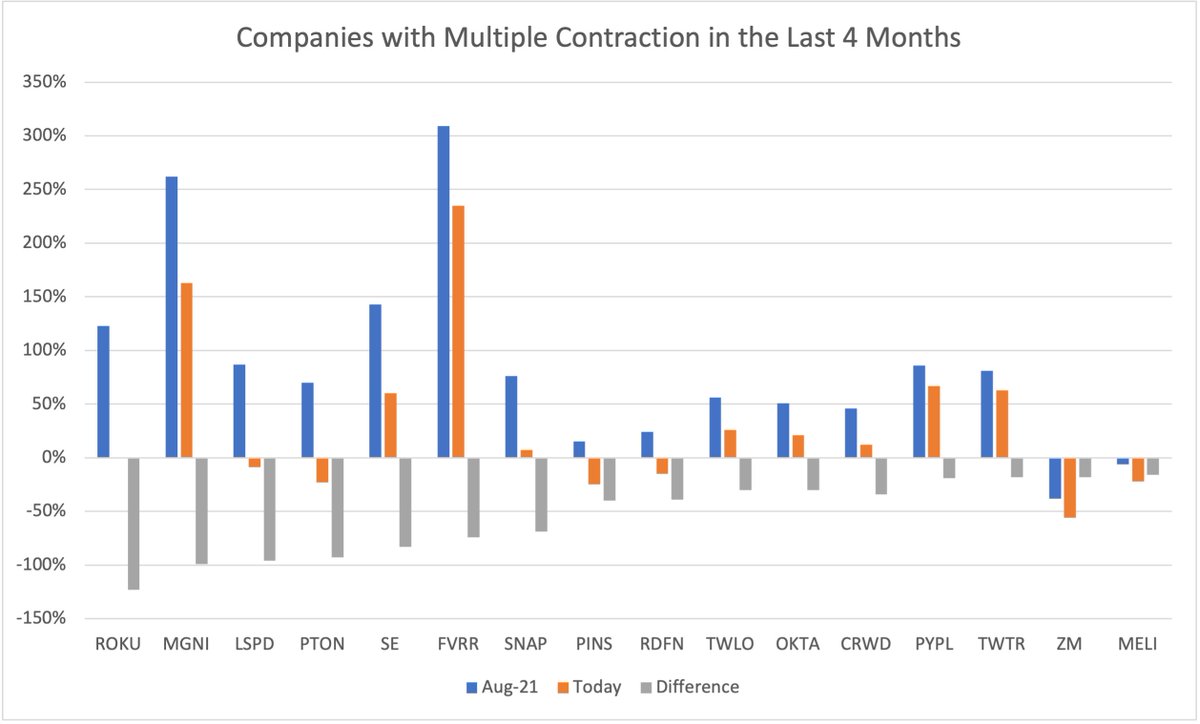

The majority of these companies are seeing multiples contracting. These are some of the most severe in the past 4 months:

The majority of these companies are seeing multiples contracting. These are some of the most severe in the past 4 months:

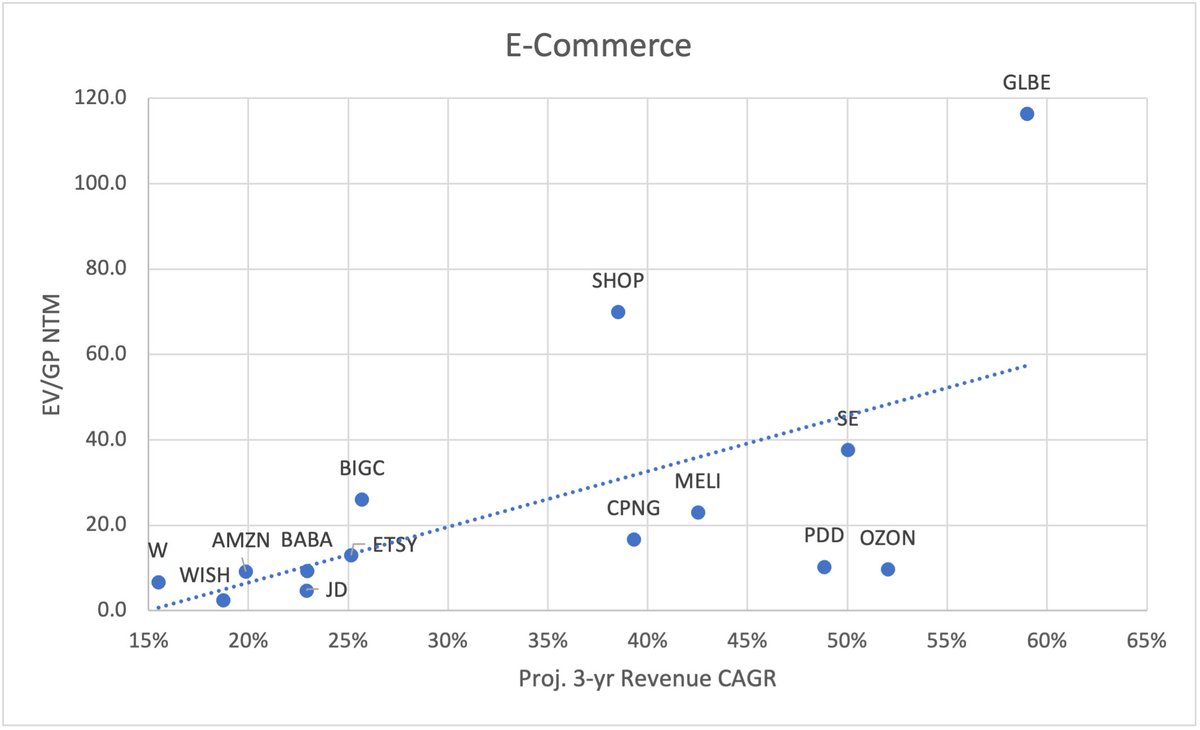

E-Commerce

E-Commerce

E-Commerce

E-Commerce

In this other one, I included some companies that I had to exclude in the first graph:

In this other one, I included some companies that I had to exclude in the first graph:

To calculate the multiple expansion of each company, I compared the average multiple of every quarter from 2018-2019 vs today, using the following metrics:

To calculate the multiple expansion of each company, I compared the average multiple of every quarter from 2018-2019 vs today, using the following metrics:

1.E-Commerce

1.E-Commerce

E-Commerce

E-Commerce