Ex-City of London banker. Now based in New York. BTC since 2016. XRP since $0.18 | Allocating into the next monetary regime.

How to get URL link on X (Twitter) App

2/🧵 The official report stated:

2/🧵 The official report stated:

2/🧵 The official ECB release (Nov 2018) said:

2/🧵 The official ECB release (Nov 2018) said:

2/🧵 The European Commission itself said (Jan 2018):

2/🧵 The European Commission itself said (Jan 2018):

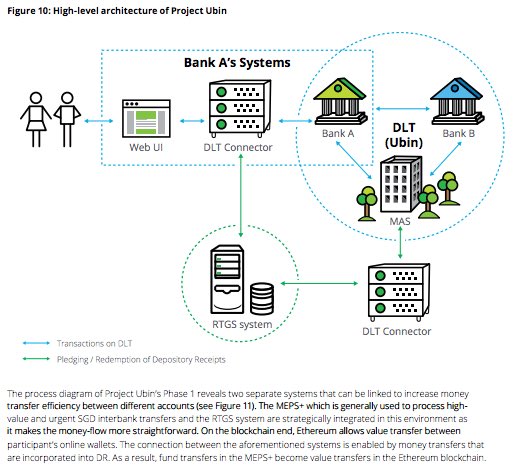

2/ Ubin’s public mandate (MAS):

2/ Ubin’s public mandate (MAS):

2/🧵 My first exposure came in 2015.

2/🧵 My first exposure came in 2015.

2/🧵

2/🧵

2/🧵 The Collapse of Banco Espírito Santo (BES):

2/🧵 The Collapse of Banco Espírito Santo (BES):

2/🧵 The Cyprus bail-in proved a painful truth:

2/🧵 The Cyprus bail-in proved a painful truth:

2/🧵 On the surface:

2/🧵 On the surface:

2/🧵 For context:

2/🧵 For context:

2/🧵 Purpose of the Agreement (excerpt):

2/🧵 Purpose of the Agreement (excerpt):

2/🧵 How the cartel worked:

2/🧵 How the cartel worked:

2/🧵 I was working closely with some of the biggest banking executives in London at the time.

2/🧵 I was working closely with some of the biggest banking executives in London at the time.

2/🧵 This isn’t about “crypto.”

2/🧵 This isn’t about “crypto.”

2/🧵 These weren’t speculative “crypto bros.”

2/🧵 These weren’t speculative “crypto bros.”

2/🧵April 2020, COVID had the markets in chaos.

2/🧵April 2020, COVID had the markets in chaos.