🇪🇺🇵🇱🇬🇧 Economist. Assistant prof / lecturer @UCL_econ. Co-director of @UCLPolicyLab Member of @napokolenia.

How to get URL link on X (Twitter) App

Two striking macro facts over the last half century:

Two striking macro facts over the last half century:

https://twitter.com/gazetapl_news/status/1528678559887331329stopy na lokatach z opóźnieniem reagują na ruchy RPP przez nadpłynność; ani rząd ani opozycja nie oferują rozwiązań, a przerzucanie się inflacyjnymi obelgami jest płytkie i tendencyjne.

https://twitter.com/kuhnmo/status/15009377658145177742/20 Just let that sink in: *2 weeks* into this war, German policymakers had on their desks a concise, lucid and detailed study of the economic effects of a policy tool (energy ban) that could actually make a difference in this war.

MYTH 1:We are not financing Putin’s war (b/c of sanctions, he cannot use the billions of euros/dollars we send him anyway).

MYTH 1:We are not financing Putin’s war (b/c of sanctions, he cannot use the billions of euros/dollars we send him anyway).

https://twitter.com/MonikaSchnitzer/status/1502961087217606658Gut feelings: "huge" economic impact. I don't deny there'll be a cost, perhaps significant. But w/o evidence or analysis, this is scaremongering.

https://twitter.com/ben_moll/status/1502372887109459971clutching on to a plastic bag with what's left of their life's possessions.

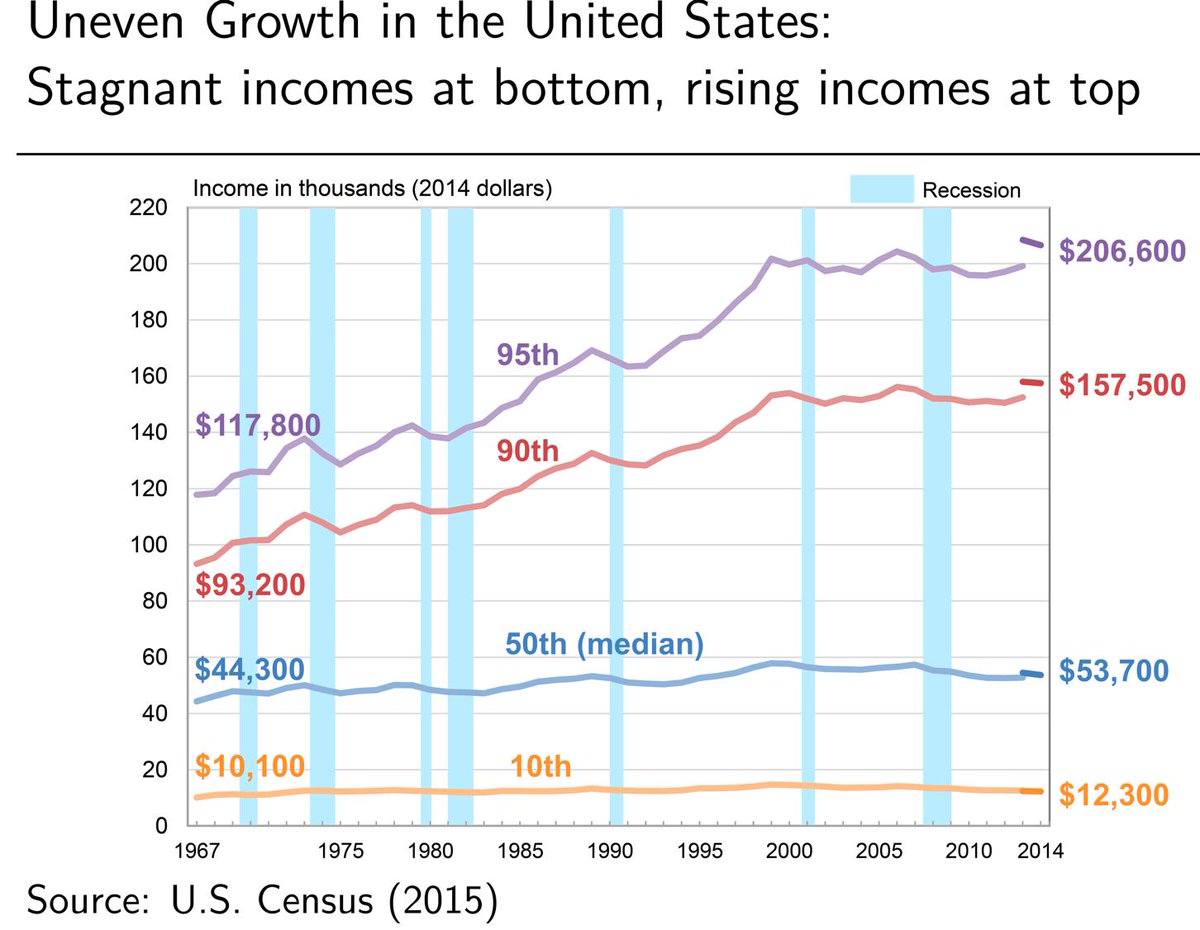

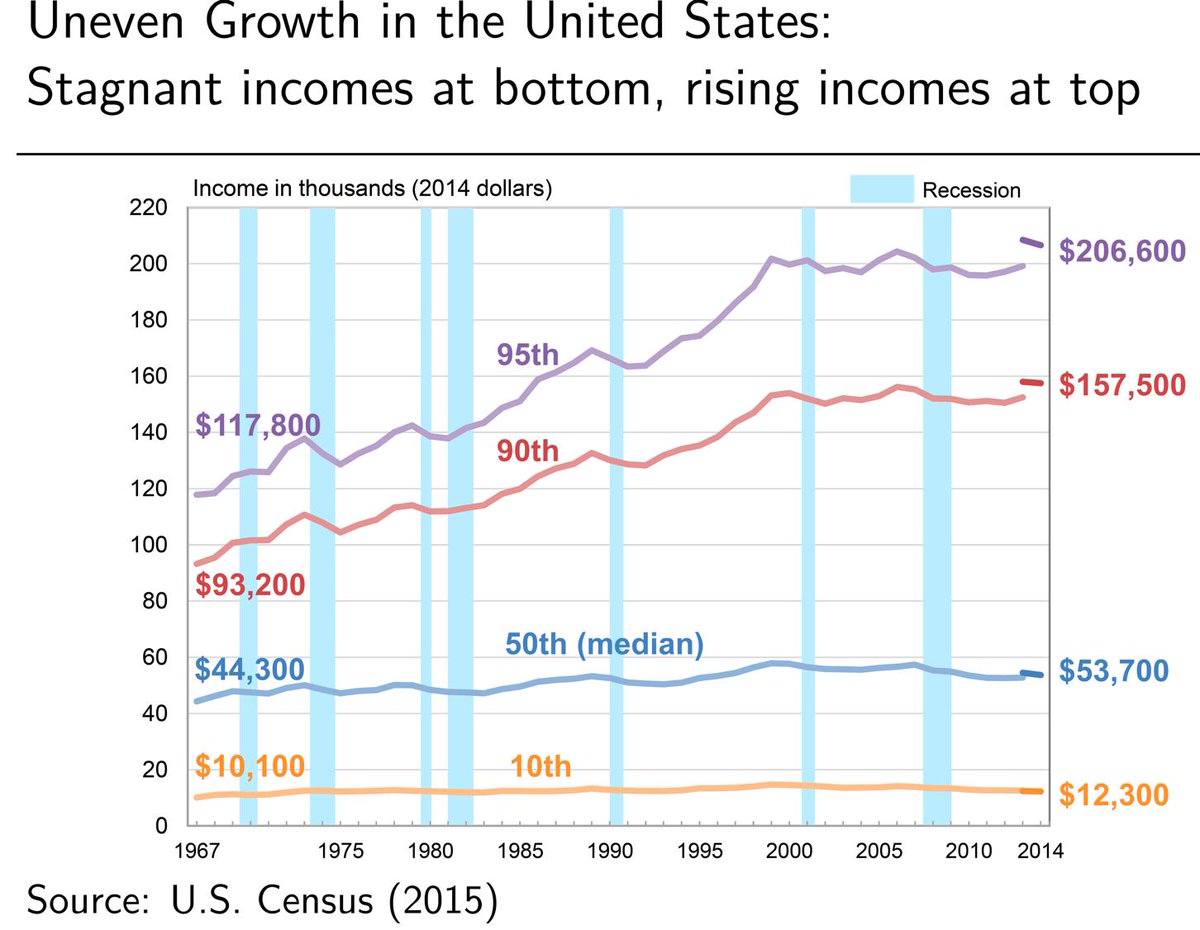

What are the distributional consequences of shifts in technology? Who wins and who loses, and why?

What are the distributional consequences of shifts in technology? Who wins and who loses, and why?

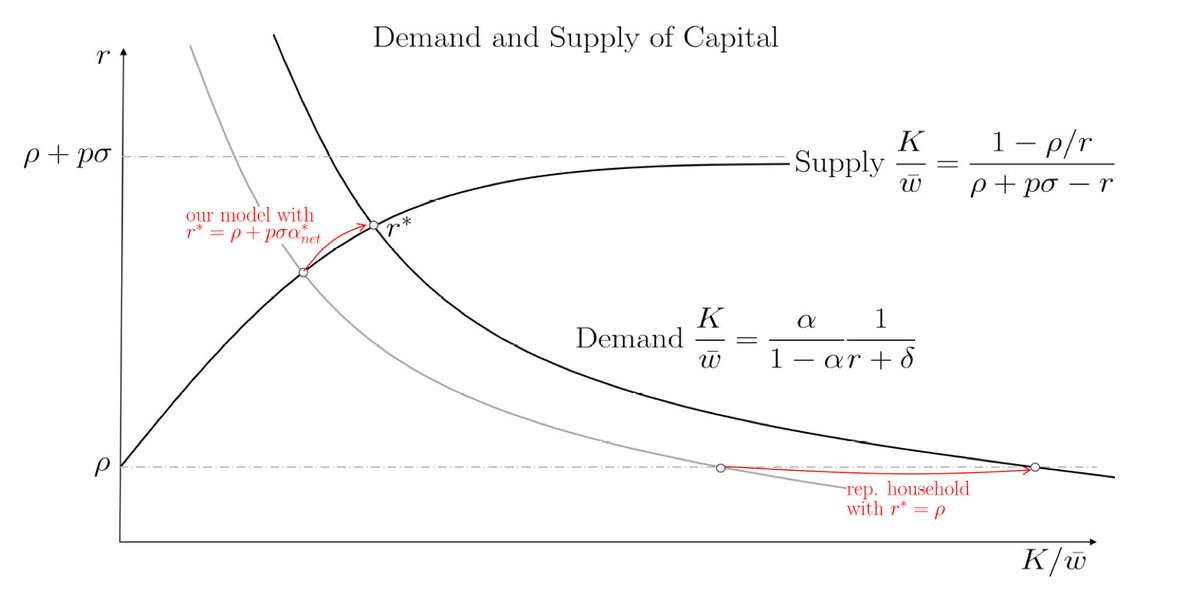

The key feature of our theory is that technology permanently affects rates of return. By raising return to capital automation results in rapid individual wealth accumulation and thus higher wealth inequality. This is related to @PikettyLeMonde 'r-g’ argument. 2/7

The key feature of our theory is that technology permanently affects rates of return. By raising return to capital automation results in rapid individual wealth accumulation and thus higher wealth inequality. This is related to @PikettyLeMonde 'r-g’ argument. 2/7