How to get URL link on X (Twitter) App

1/ Get your weekly alpha here: m6labs.co/p/high-hopium-…

1/ Get your weekly alpha here: m6labs.co/p/high-hopium-…

1/ 📊 Market Dashboard

1/ 📊 Market Dashboard

1/ 📊 Market Dashboard

1/ 📊 Market Dashboard

1/ The trust has roughly 850,000 retail investors who have been “harmed by Grayscale’s shareholder-unfriendly actions,” says Fir Tree.

1/ The trust has roughly 850,000 retail investors who have been “harmed by Grayscale’s shareholder-unfriendly actions,” says Fir Tree.

1/ Crypto proponents constantly point to the transparency of the blockchain as one of its golden features, however as the previous year has highlighted, we still seem to have no idea what players in the space are doing or a picture of their real financial health.

1/ Crypto proponents constantly point to the transparency of the blockchain as one of its golden features, however as the previous year has highlighted, we still seem to have no idea what players in the space are doing or a picture of their real financial health.

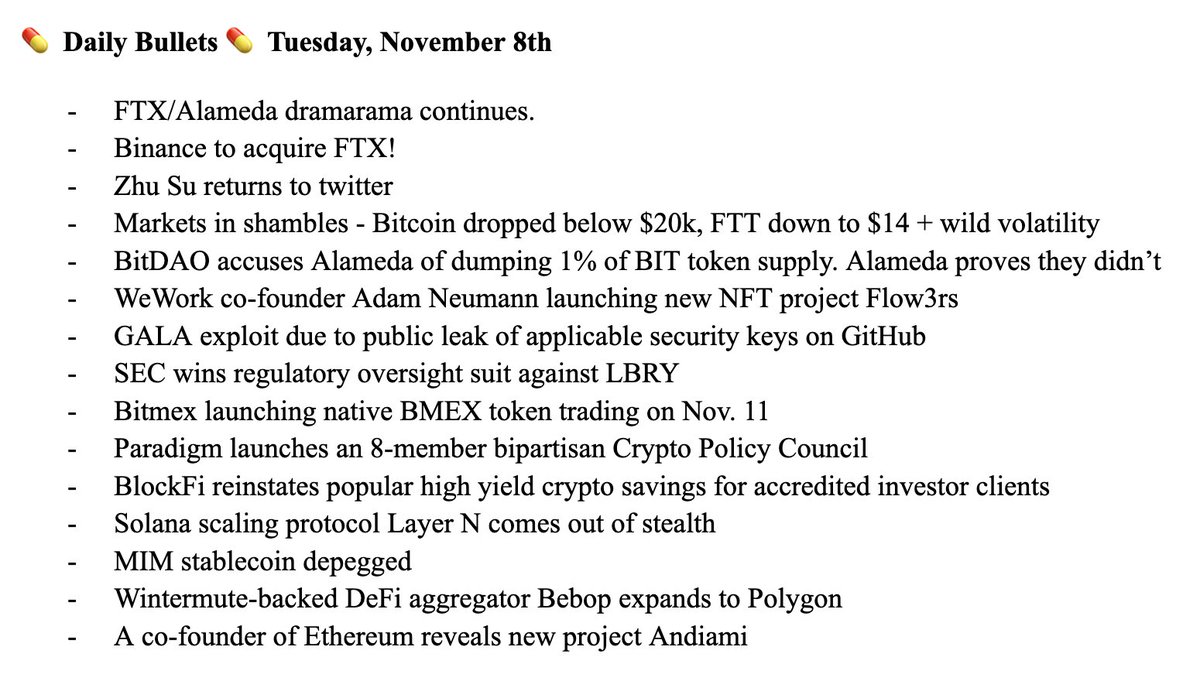

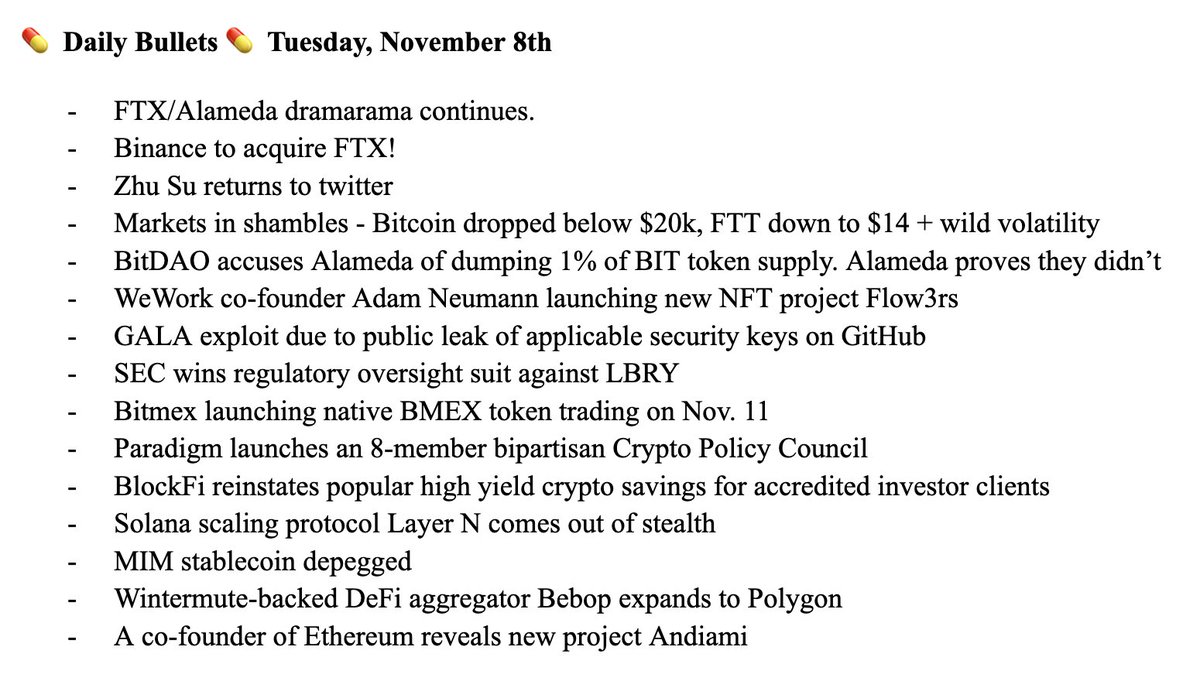

1/ This is surprising as FTX was making such large moves and acquisitions, it didn’t seem likely they were in such financial straits. Earlier, FTT and SOL were in the crosshairs.

1/ This is surprising as FTX was making such large moves and acquisitions, it didn’t seem likely they were in such financial straits. Earlier, FTT and SOL were in the crosshairs.

1/ Amid concerns over FTX’s liquidity and other issues, Binance CEO, CZ announced their plan to sell off his platform’s entire stash of FTT with Alamade’s CEO countering that they’d be glad to buy their position at $22.

1/ Amid concerns over FTX’s liquidity and other issues, Binance CEO, CZ announced their plan to sell off his platform’s entire stash of FTT with Alamade’s CEO countering that they’d be glad to buy their position at $22.

1/ Stocks were doing just fine at the start of 2020, but there were initial signs of a crisis

1/ Stocks were doing just fine at the start of 2020, but there were initial signs of a crisis