How to get URL link on X (Twitter) App

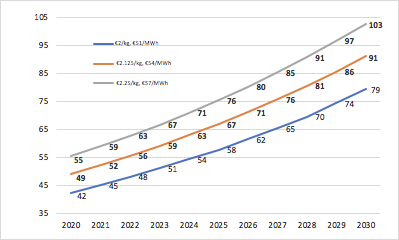

https://twitter.com/CarbonPulse/status/1487077669950922758Self-evidently, this means that EUA prices are not yet high enough to drive structural decarbonization. Against this backdrop, how should the market and policymakers be thinking about the pricing framework for EUAs from here?

https://twitter.com/LeoDiCaprio/status/14747745663669698582/12 Hamlet is the heir to the Danish throne whose father, the King, has been murdered by Hamlet's uncle (the King's brother). Not content with fratricide, the uncle then marries the King's widow (Hamlet's mother) and usurps the throne.

https://twitter.com/Sustainable2050/status/13876964159467274262/12: At its heart, the Court's ruling is about freedom: specifically, the freedom (@Luisamneubauer, #FridaysForFuture, and others) from disproportionately large – and hence excessively freedom-restricting – emissions reductions after 2030. Per the ruling: bundesverfassungsgericht.de/SharedDocs/Pre…