CIO at MJK Investments. Tweets are for educational purpose only. Find us on Instagram: https://t.co/cQFdhHNNS4

17 subscribers

How to get URL link on X (Twitter) App

Market Opportunity and Growth Potential:

Market Opportunity and Growth Potential:

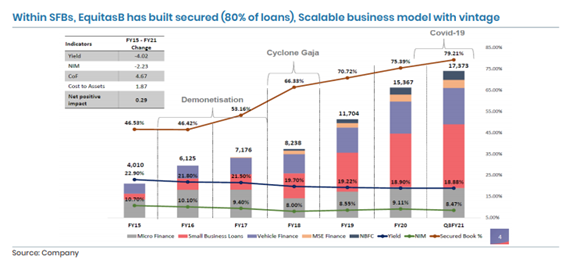

Select focussed HFC players have been posting healthy growth at over 30% CAGR over the last 5 years (33%/37%/45% CAGR over FY17-22 for Aavas, Aptus and Homefirst respectively).

Select focussed HFC players have been posting healthy growth at over 30% CAGR over the last 5 years (33%/37%/45% CAGR over FY17-22 for Aavas, Aptus and Homefirst respectively).

Performance Highlights,

Performance Highlights,

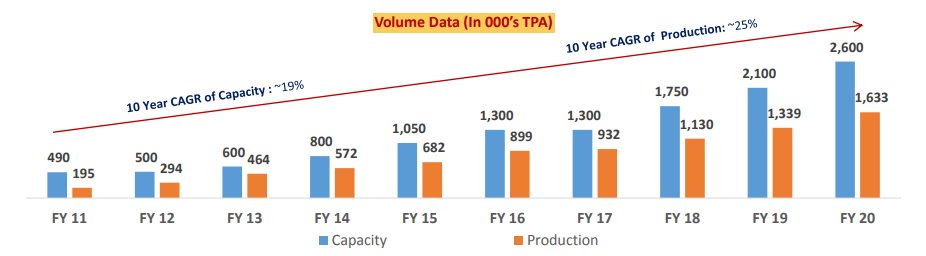

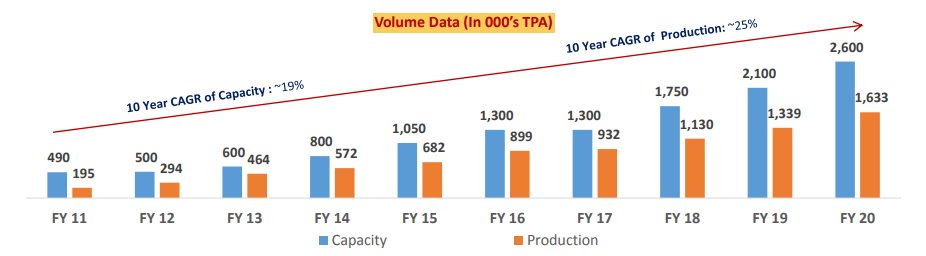

Although FY13-17 saw a 15.7% CAGR increase in tax incidence, tax revenues grew by a mere 4.7% CAGR. However, in a relatively stable tax regime (Apr18- Jan20), tax revenues grew by 10.2%.

Although FY13-17 saw a 15.7% CAGR increase in tax incidence, tax revenues grew by a mere 4.7% CAGR. However, in a relatively stable tax regime (Apr18- Jan20), tax revenues grew by 10.2%.