Technical/Fundamental analyst, CPA, Owner of https://t.co/hO3l50hhRd, Investing in the Second Wave of AI, Join 17,000 other investors 👇

2 subscribers

How to get URL link on X (Twitter) App

2. UiPath | $PATH

2. UiPath | $PATH

2. Constellation Energy Corp | $CEG

2. Constellation Energy Corp | $CEG

2. FinTech

2. FinTech

2. Novo Nordisk | $NVO

2. Novo Nordisk | $NVO

2. Warren Buffett | Berkshire Hathaway

2. Warren Buffett | Berkshire Hathaway

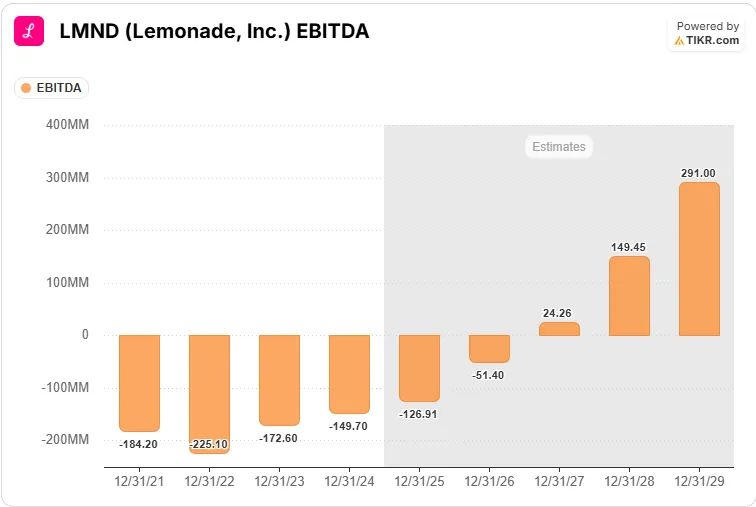

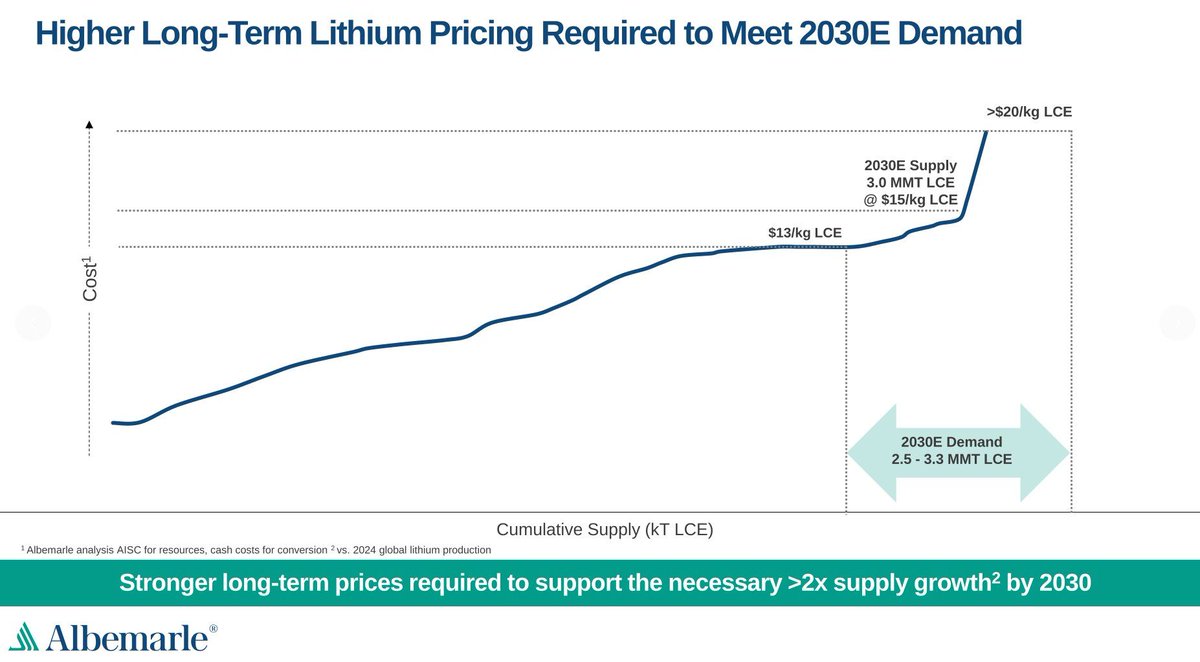

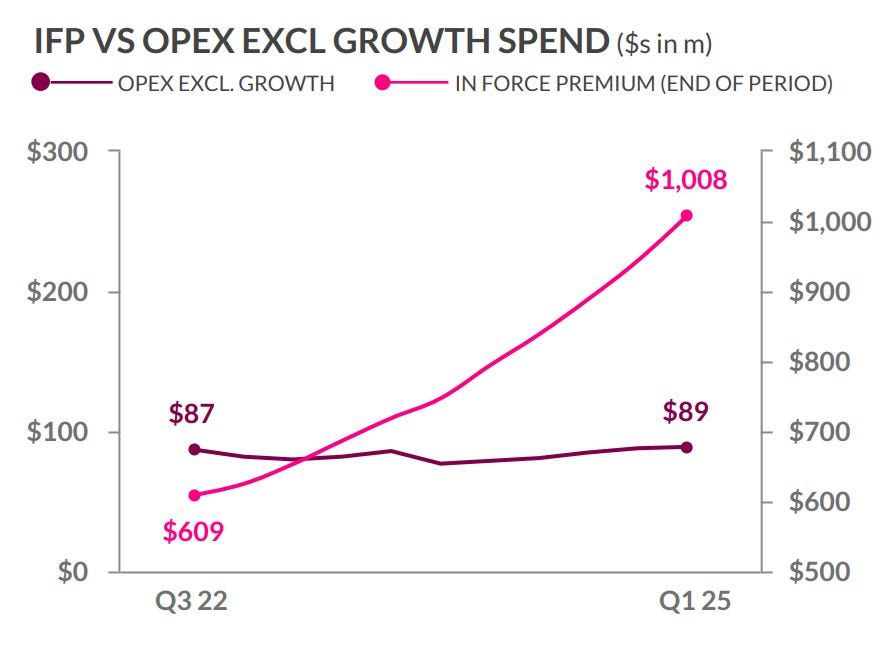

1/ What does $LMND do 👇

1/ What does $LMND do 👇

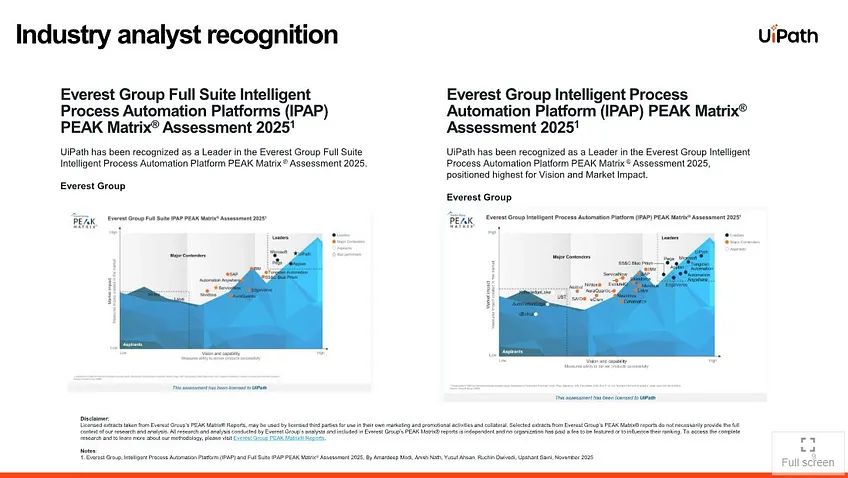

1. What does $ZETA do?

1. What does $ZETA do?

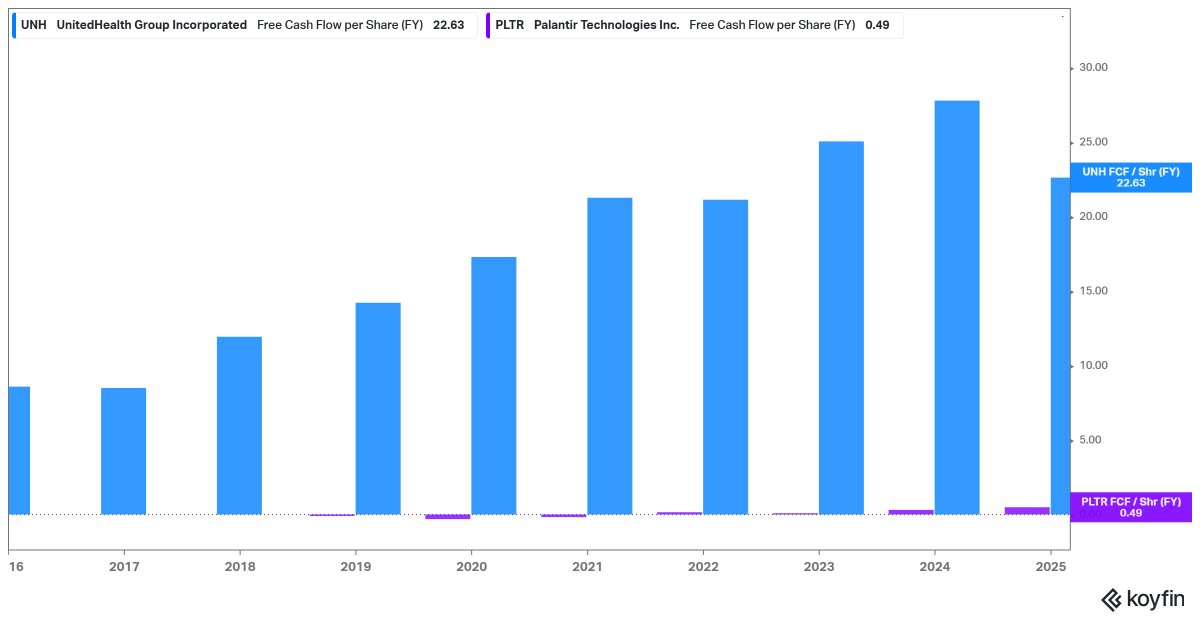

2. $GOOGL having a multiple 1/3rd of $NFLX

2. $GOOGL having a multiple 1/3rd of $NFLX

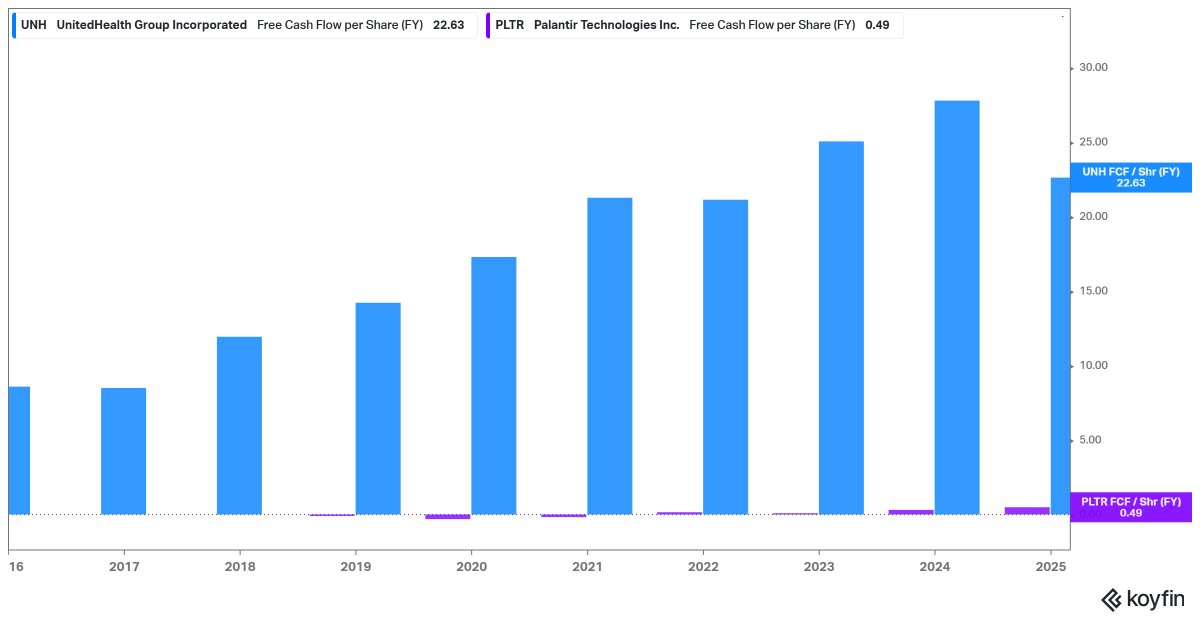

2. Albermarle Corporation | $ALB

2. Albermarle Corporation | $ALB

1. $ZETA is an AI powered marketing tech platform with one of the highest proprietary databases out of all peers allowing them to generate highly targeted engagement.

1. $ZETA is an AI powered marketing tech platform with one of the highest proprietary databases out of all peers allowing them to generate highly targeted engagement.

2. Zeta Global Holdings | $ZETA

2. Zeta Global Holdings | $ZETA

1. Howard Marks

1. Howard Marks

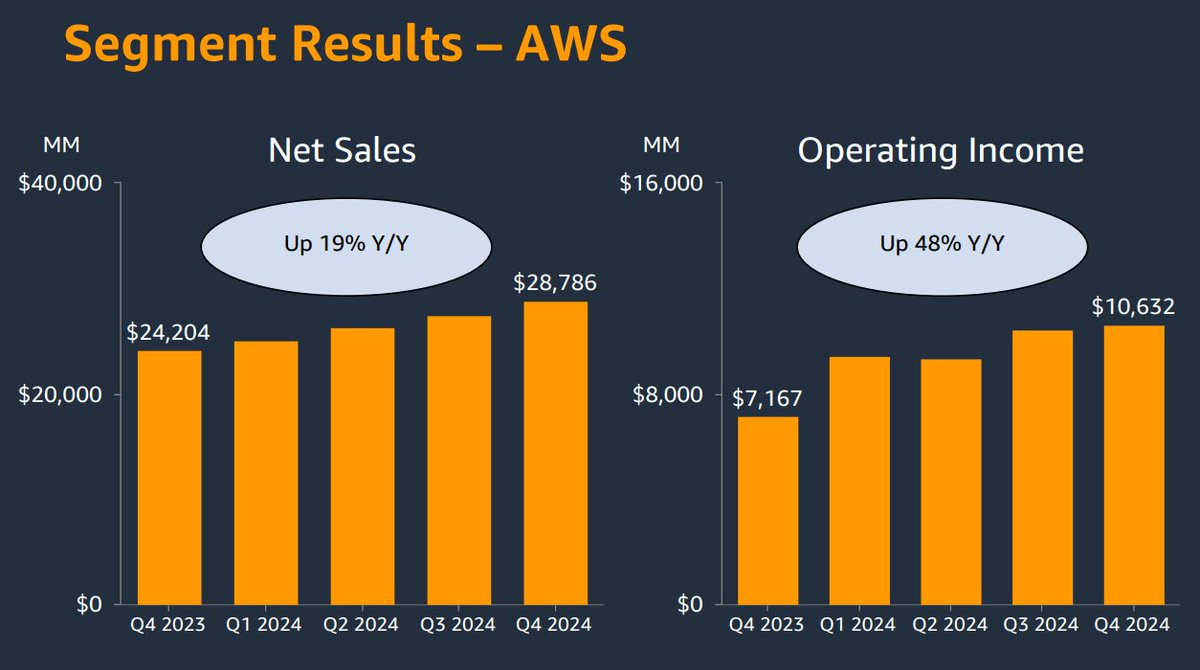

2. Amazon | $AMZN

2. Amazon | $AMZN

2. Nvidia | $NVDA

2. Nvidia | $NVDAhttps://x.com/cleoabram/status/1884676086149026022/video/1

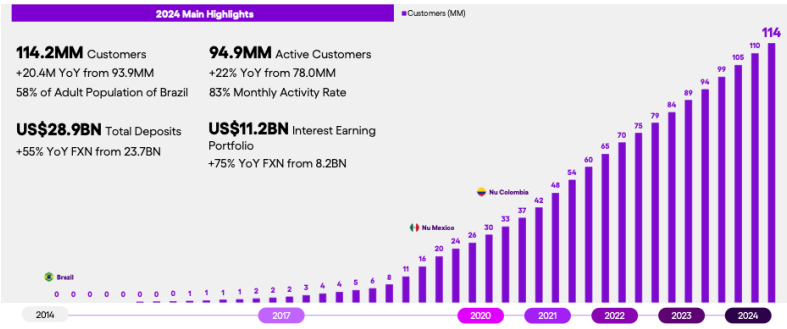

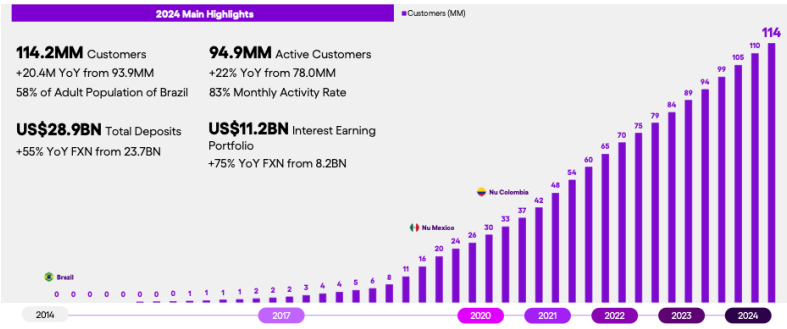

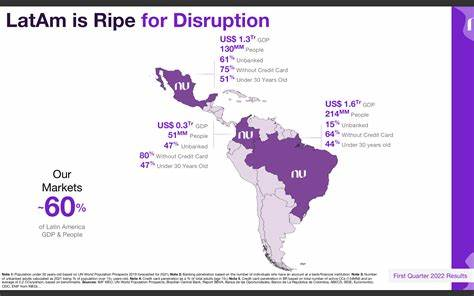

1. $NU Operate in the Perfect Market For Long Term Disruption:

1. $NU Operate in the Perfect Market For Long Term Disruption:

1. $GOOG leads in many high growth areas:

1. $GOOG leads in many high growth areas:

1/

1/ https://twitter.com/mmmtwealth/status/1886013948098457875