Co-founder, CEO, and Head of Analysis at PAICE. Economist, "Money Doctor" - Everything data and AI

Foredrag: https://t.co/a0zTZm2MDV

How to get URL link on X (Twitter) App

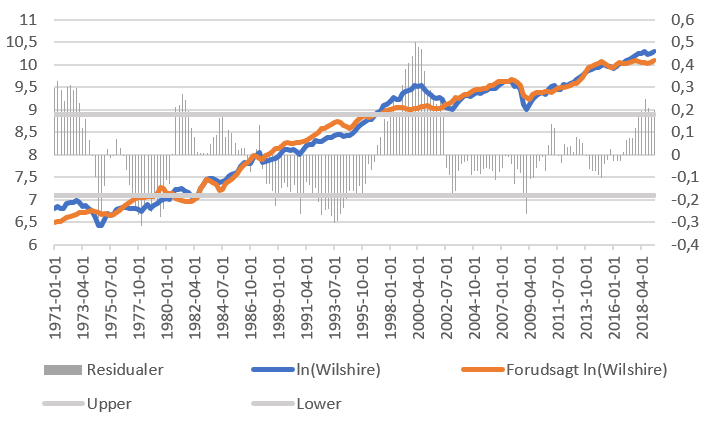

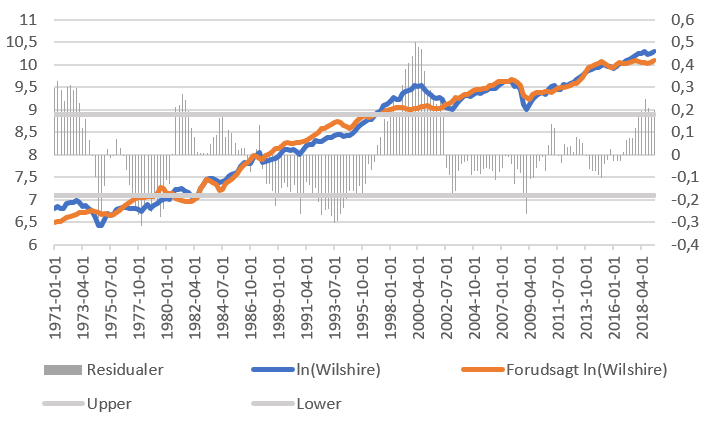

2/n I estimated Wilshire 5000 as a function of potential US NGDP, corp bond yields (Baa rated and 5-year ruling variance in US industrial production.

2/n I estimated Wilshire 5000 as a function of potential US NGDP, corp bond yields (Baa rated and 5-year ruling variance in US industrial production.